Understanding the Benefits of Trusts for Homeowners

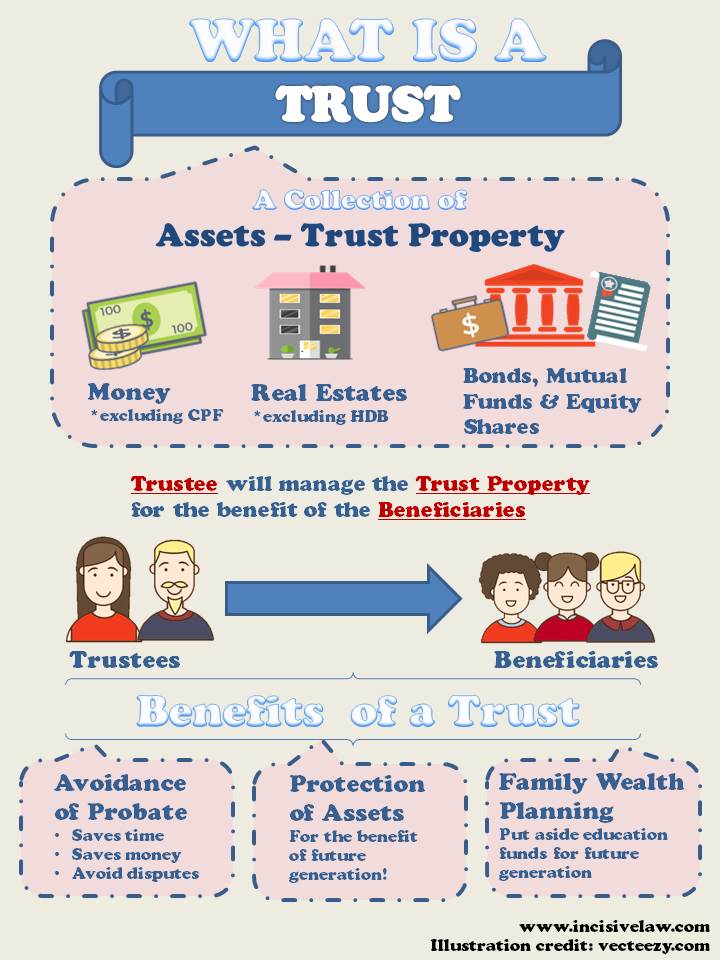

For many homeowners, the decision to put their house in a trust can be a daunting one. However, understanding the benefits of trusts can help alleviate concerns and provide peace of mind. A trust is a legal arrangement that allows a third party, known as the trustee, to hold and manage assets on behalf of the homeowner. This can include real estate, investments, and other valuable assets.

One of the primary benefits of putting a house in a trust is asset protection. By transferring ownership of the property to the trust, homeowners can shield their assets from creditors and lawsuits. This can be especially important for individuals with significant assets or those who are at risk of being sued.

In addition to asset protection, trusts can also provide tax savings. Depending on the type of trust and the homeowner’s individual circumstances, a trust can help minimize estate taxes and other tax liabilities. For example, a revocable trust can help avoid probate, which can save thousands of dollars in court fees and taxes.

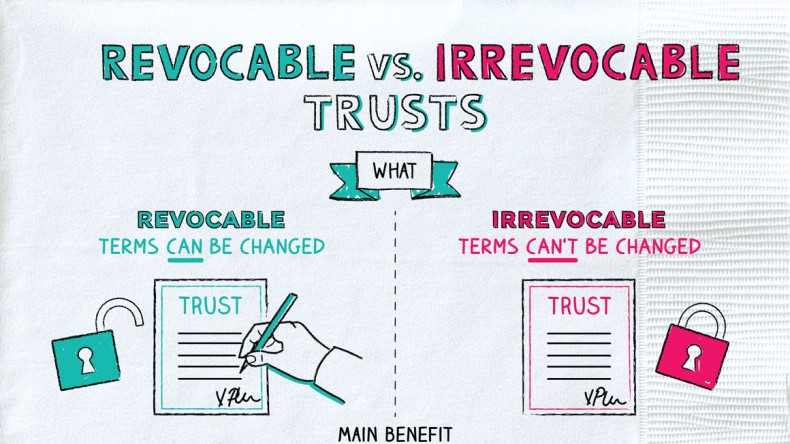

There are several types of trusts that homeowners can consider, including revocable and irrevocable trusts. A revocable trust is a flexible trust that can be changed or terminated at any time. This type of trust is often used for estate planning and can help avoid probate. An irrevocable trust, on the other hand, is a more permanent trust that cannot be changed once it is established. This type of trust is often used for tax planning and can provide significant tax savings.

When deciding whether to put a house in a trust, homeowners should consider their individual circumstances and goals. For example, if a homeowner has a large estate or is at risk of being sued, a trust may be a good option. On the other hand, if a homeowner has a small estate or is not concerned about asset protection, a trust may not be necessary.

Ultimately, the decision to put a house in a trust should be based on careful consideration and consultation with a qualified attorney or financial advisor. By understanding the benefits and drawbacks of trusts, homeowners can make an informed decision that is right for their unique situation.

How to Determine if a Trust is Right for Your Home

Deciding whether to put your house in a trust can be a complex decision, and it’s essential to consider several factors before making a decision. To help you determine if a trust is right for your home, consider the following checklist:

1. Value of your home: If your home is your most valuable asset, a trust may be a good option to protect it from creditors and lawsuits. However, if your home is not a significant portion of your overall assets, a trust may not be necessary.

2. Age and health: If you’re older or have health concerns, a trust can help ensure that your assets are distributed according to your wishes after you pass away. A trust can also provide a smooth transition of ownership and management of your assets.

3. Family dynamics: If you have a complex family situation, such as blended families, second marriages, or children with special needs, a trust can help ensure that your assets are distributed fairly and according to your wishes.

4. Asset protection: If you’re at risk of being sued or have significant assets that you want to protect, a trust can help shield your assets from creditors and lawsuits.

5. Tax implications: Depending on the type of trust and your individual circumstances, a trust can help minimize estate taxes and other tax liabilities.

It’s essential to consult with an attorney or financial advisor to determine if a trust is right for your home and legacy. They can help you evaluate your individual circumstances and goals, and provide guidance on the best course of action.

When consulting with an attorney or financial advisor, be sure to ask questions such as:

* What are the benefits and drawbacks of putting my house in a trust?

* What type of trust is best for my individual circumstances and goals?

* How will a trust affect my tax liabilities and estate planning?

By carefully considering these factors and consulting with a qualified professional, you can make an informed decision about whether a trust is right for your home and legacy.

The Pros and Cons of Putting Your House in a Trust

When considering whether to put your house in a trust, it’s essential to weigh the advantages and disadvantages of this decision. A trust can provide numerous benefits, including asset protection, tax savings, and avoiding probate. However, it also involves costs and complexity that should be carefully considered.

Pros of putting your house in a trust:

* Asset protection: A trust can shield your assets from creditors and lawsuits, providing a layer of protection for your home and other assets.

* Tax savings: Depending on the type of trust and your individual circumstances, a trust can help minimize estate taxes and other tax liabilities.

* Avoiding probate: A trust can help avoid the probate process, which can save time, money, and stress for your loved ones.

Cons of putting your house in a trust:

* Costs: Setting up and maintaining a trust can involve significant costs, including attorney fees, trustee fees, and other expenses.

* Complexity: Trusts can be complex and require ongoing management, which can be time-consuming and overwhelming.

* Lack of control: Once you put your house in a trust, you may have limited control over the property and the trust’s assets.

Ultimately, the decision to put your house in a trust should be based on your individual circumstances and goals. If you’re considering this option, it’s essential to consult with an attorney or financial advisor to determine if a trust is right for you.

When evaluating the pros and cons of putting your house in a trust, consider the following questions:

* What are my goals for putting my house in a trust?

* What are the potential benefits and drawbacks of a trust for my individual circumstances?

* How will a trust affect my tax liabilities and estate planning?

By carefully considering these questions and weighing the pros and cons of putting your house in a trust, you can make an informed decision that’s right for you.

How to Set Up a Trust for Your Home

Setting up a trust for your home can be a complex process, but it can provide numerous benefits, including asset protection, tax savings, and avoiding probate. To set up a trust for your home, follow these steps:

Step 1: Choose a Trustee

A trustee is the person or entity responsible for managing the trust and making decisions about the trust’s assets. When choosing a trustee, consider the following factors:

* Trustworthiness: The trustee should be someone you trust to make decisions about your home and other assets.

* Expertise: The trustee should have experience managing trusts and making financial decisions.

* Availability: The trustee should be available to manage the trust and make decisions as needed.

Step 2: Fund the Trust

To fund the trust, you will need to transfer ownership of your home and other assets to the trust. This can be done by:

* Deeding the property: You will need to deed the property to the trust, which will transfer ownership of the property to the trust.

* Transferring assets: You will need to transfer other assets, such as bank accounts and investments, to the trust.

Step 3: Transfer Ownership of the Property

Once the trust is funded, you will need to transfer ownership of the property to the trust. This can be done by:

* Recording the deed: The deed will need to be recorded with the county recorder’s office to transfer ownership of the property to the trust.

* Updating the property records: The property records will need to be updated to reflect the trust as the new owner of the property.

It’s essential to work with an attorney or trust expert to ensure that the trust is set up correctly and that all necessary steps are taken to transfer ownership of the property to the trust.

When setting up a trust for your home, consider the following tips:

* Seek professional advice: Work with an attorney or trust expert to ensure that the trust is set up correctly and that all necessary steps are taken.

* Choose the right trustee: Choose a trustee who is trustworthy, experienced, and available to manage the trust.

* Fund the trust correctly: Ensure that the trust is funded correctly by transferring ownership of your home and other assets to the trust.

Trust Options for Homeowners: Revocable vs. Irrevocable Trusts

When it comes to trust planning for homeowners, there are two main types of trusts to consider: revocable and irrevocable trusts. Both types of trusts have their benefits and drawbacks, and the right choice for you will depend on your individual circumstances and goals.

Revocable Trusts

A revocable trust is a trust that can be changed or terminated at any time. This type of trust is often used for estate planning and can help avoid probate. With a revocable trust, you can:

* Retain control: As the grantor of the trust, you retain control over the trust and its assets.

* Make changes: You can make changes to the trust at any time, including adding or removing assets, changing the trustee, or terminating the trust.

* Avoid probate: A revocable trust can help avoid probate, which can save time, money, and stress for your loved ones.

Irrevocable Trusts

An irrevocable trust is a trust that cannot be changed or terminated once it is established. This type of trust is often used for tax planning and can provide significant tax benefits. With an irrevocable trust, you can:

* Reduce taxes: An irrevocable trust can help reduce taxes by removing assets from your estate and reducing your tax liability.

* Protect assets: An irrevocable trust can help protect your assets from creditors and lawsuits.

* Provide for beneficiaries: An irrevocable trust can provide for your beneficiaries, such as children or grandchildren, and ensure that they receive the assets you want them to have.

When deciding between a revocable and irrevocable trust, consider the following factors:

* Flexibility: If you want to retain control over the trust and its assets, a revocable trust may be the better choice.

* Tax benefits: If you want to reduce taxes and provide for your beneficiaries, an irrevocable trust may be the better choice.

* Asset protection: If you want to protect your assets from creditors and lawsuits, an irrevocable trust may be the better choice.

Ultimately, the decision between a revocable and irrevocable trust will depend on your individual circumstances and goals. It’s essential to consult with an attorney or trust expert to determine which type of trust is right for you.

Common Mistakes to Avoid When Putting Your House in a Trust

When setting up a trust for your home, it’s essential to avoid common pitfalls that can lead to costly mistakes and unintended consequences. Here are some common mistakes to avoid:

Failing to Fund the Trust

One of the most common mistakes homeowners make when setting up a trust is failing to fund the trust. This means that the trust is not properly funded with assets, which can lead to the trust being deemed invalid or ineffective.

Not Updating the Trust

Another common mistake is not updating the trust to reflect changes in your life or circumstances. This can include changes to your family dynamics, financial situation, or goals.

Neglecting to Consider Medicaid Planning

Many homeowners neglect to consider Medicaid planning when setting up a trust. This can lead to unintended consequences, such as the loss of Medicaid benefits or the need to spend down assets to qualify for Medicaid.

Not Working with an Attorney or Trust Expert

Finally, many homeowners make the mistake of not working with an attorney or trust expert when setting up a trust. This can lead to costly mistakes and unintended consequences, as well as a lack of understanding of the trust’s terms and conditions.

To avoid these common mistakes, it’s essential to work with an attorney or trust expert who can guide you through the process of setting up a trust and ensure that it is properly funded and updated.

When setting up a trust, consider the following tips:

* Seek professional advice: Work with an attorney or trust expert to ensure that the trust is set up correctly and that all necessary steps are taken.

* Fund the trust properly: Ensure that the trust is properly funded with assets, and that all necessary documents are in place.

* Update the trust regularly: Regularly review and update the trust to reflect changes in your life or circumstances.

* Consider Medicaid planning: Consider Medicaid planning when setting up a trust, and ensure that the trust is designed to protect your assets and qualify you for Medicaid benefits.

Trust Planning for Homeowners with Complex Family Situations

For homeowners with complex family situations, trust planning can be a challenging and delicate process. Blended families, second marriages, and children with special needs can all create unique challenges when it comes to trust planning.

Blended Families

Blended families can create complex trust planning situations, particularly when it comes to distributing assets among multiple children and spouses. A trust can help ensure that each family member receives the assets they are entitled to, while also minimizing conflict and ensuring that the homeowner’s wishes are carried out.

Second Marriages

Second marriages can also create complex trust planning situations, particularly when it comes to distributing assets between spouses and children from previous marriages. A trust can help ensure that each spouse and child receives the assets they are entitled to, while also minimizing conflict and ensuring that the homeowner’s wishes are carried out.

Children with Special Needs

Children with special needs require specialized trust planning to ensure that their needs are met and that they are protected. A trust can help provide for the child’s care and well-being, while also ensuring that they do not lose access to government benefits.

When it comes to trust planning for homeowners with complex family situations, it’s essential to work with an attorney or trust expert who has experience in this area. They can help you navigate the complex laws and regulations surrounding trust planning and ensure that your wishes are carried out.

Some key considerations for trust planning in complex family situations include:

* Customized trust planning: Each family situation is unique, and a trust plan should be customized to meet the specific needs and goals of the homeowner and their family.

* Asset protection: A trust can help protect assets from creditors and lawsuits, ensuring that the homeowner’s wishes are carried out and that their family is protected.

* Tax planning: A trust can help minimize taxes and ensure that the homeowner’s assets are distributed in a tax-efficient manner.

* Medicaid planning: A trust can help ensure that the homeowner and their family are eligible for Medicaid benefits, while also protecting their assets.

Conclusion: Is a Trust Right for Your Home?

In conclusion, a trust can be a valuable tool for homeowners who want to protect their assets, minimize taxes, and ensure that their wishes are carried out after they pass away. However, whether or not a trust is right for your home depends on your individual circumstances and goals.

As we’ve discussed in this article, there are many benefits to putting your house in a trust, including asset protection, tax savings, and avoiding probate. However, there are also potential drawbacks to consider, such as the costs and complexity of setting up and maintaining a trust.

Ultimately, the decision to put your house in a trust should be based on careful consideration and consultation with an attorney or financial advisor. They can help you determine whether a trust is right for your home and legacy, and guide you through the process of setting up a trust that meets your needs and goals.

Some key takeaways from this article include:

* Trusts can provide asset protection: A trust can help protect your assets from creditors and lawsuits, ensuring that your wishes are carried out and that your family is protected.

* Trusts can minimize taxes: A trust can help minimize taxes and ensure that your assets are distributed in a tax-efficient manner.

* Trusts can avoid probate: A trust can help avoid probate, which can save time, money, and stress for your loved ones.

* Consult with an attorney or financial advisor: It’s essential to consult with an attorney or financial advisor to determine whether a trust is right for your home and legacy, and to guide you through the process of setting up a trust.

By considering these factors and consulting with an attorney or financial advisor, you can make an informed decision about whether a trust is right for your home and legacy.