Understanding the Context of a High Salary

When evaluating whether a $300,000 salary is good, it’s essential to consider the various factors that influence the perception of a high salary. Location, industry, experience, and personal financial goals all play a significant role in determining the value of a salary. For instance, a $300,000 salary in a city with a high cost of living, such as New York or San Francisco, may not be as valuable as the same salary in a city with a lower cost of living, such as Des Moines or Omaha.

Industry is another crucial factor to consider. A $300,000 salary in the tech industry, for example, may be considered average or even below average, while the same salary in the non-profit sector may be considered exceptionally high. Experience also plays a significant role, as a $300,000 salary for an entry-level position may be considered extremely high, while the same salary for a senior executive may be considered average.

Personal financial goals are also essential to consider when evaluating the value of a $300,000 salary. An individual with significant debt or financial obligations may consider a $300,000 salary to be insufficient, while someone with minimal debt and a solid financial foundation may consider the same salary to be more than adequate. Ultimately, whether a $300,000 salary is good depends on a variety of individual circumstances and factors.

In addition to these factors, it’s also important to consider the broader economic context. In times of economic uncertainty or recession, a $300,000 salary may be considered exceptionally high, while in times of economic growth and prosperity, the same salary may be considered average or even below average. As the economy continues to evolve and change, the value of a $300,000 salary will also shift and adapt.

So, is $300,000 a good salary? The answer depends on a variety of factors, including location, industry, experience, and personal financial goals. While a $300,000 salary may be considered high in some contexts, it may not be sufficient in others. By considering these factors and evaluating the value of a $300,000 salary in the context of individual circumstances, it’s possible to make a more informed decision about whether this salary is good or not.

Breaking Down the Costs of Living in Different Regions

The cost of living varies significantly across different regions, cities, and countries, which can greatly impact the purchasing power of a $300,000 salary. For example, in cities like New York or San Francisco, the cost of living is extremely high, with median home prices ranging from $1 million to $2 million. In contrast, cities like Des Moines or Omaha have a much lower cost of living, with median home prices ranging from $150,000 to $300,000.

This disparity in cost of living means that a $300,000 salary can have different purchasing powers in different locations. In a city with a high cost of living, a $300,000 salary may only be able to afford a modest lifestyle, while in a city with a lower cost of living, the same salary can afford a much more luxurious lifestyle. For instance, a $300,000 salary in New York City may only be able to afford a small one-bedroom apartment, while in Des Moines, the same salary can afford a spacious four-bedroom house.

Furthermore, the cost of living also varies significantly across different countries. For example, in countries like Switzerland or Norway, the cost of living is extremely high, with prices for food, housing, and transportation being much higher than in the United States. In contrast, countries like Mexico or Thailand have a much lower cost of living, with prices for food, housing, and transportation being much lower than in the United States.

This means that a $300,000 salary can have different purchasing powers in different countries. For instance, a $300,000 salary in Switzerland may only be able to afford a modest lifestyle, while in Mexico, the same salary can afford a much more luxurious lifestyle. Therefore, when evaluating whether a $300,000 salary is good, it’s essential to consider the cost of living in the specific region, city, or country.

In conclusion, the cost of living plays a significant role in determining the purchasing power of a $300,000 salary. By understanding the cost of living in different regions, cities, and countries, individuals can better evaluate whether a $300,000 salary is sufficient for their lifestyle and financial goals. Is $300,000 a good salary? The answer depends on the specific location and cost of living.

How to Determine if $300,000 is a Good Salary for You

Evaluating whether a $300,000 salary is sufficient for an individual’s lifestyle and financial goals requires a thorough analysis of several factors. To determine if a $300,000 salary is good for you, follow these steps:

Step 1: Calculate Your Net Income

Start by calculating your net income, which is your take-home pay after taxes. This will give you a clear understanding of how much money you have available for living expenses, savings, and debt repayment.

Step 2: Assess Your Debt

Next, assess your debt obligations, including credit card debt, student loans, and mortgages. Consider the total amount of debt, interest rates, and minimum monthly payments. This will help you determine how much of your $300,000 salary will go towards debt repayment.

Step 3: Evaluate Your Savings Goals

Consider your short-term and long-term savings goals, such as building an emergency fund, saving for a down payment on a house, or retirement. Determine how much of your $300,000 salary you can allocate towards savings each month.

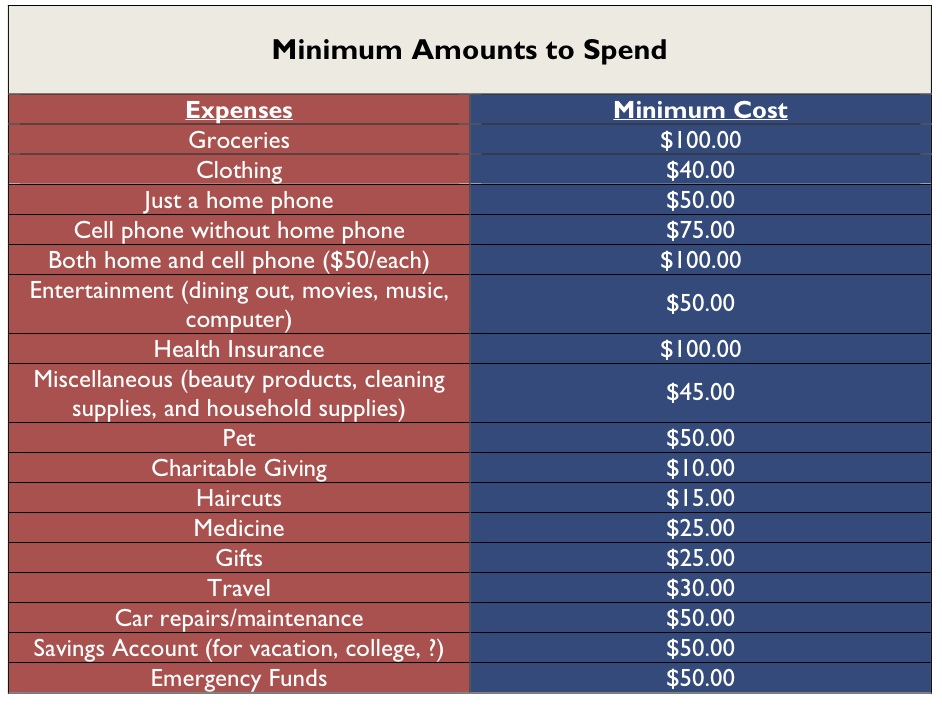

Step 4: Consider Your Lifestyle Expenses

Calculate your monthly lifestyle expenses, including housing, food, transportation, and entertainment. Consider how much of your $300,000 salary will go towards these expenses and whether you can afford to maintain your current lifestyle.

Step 5: Evaluate Your Long-Term Financial Objectives

Finally, evaluate your long-term financial objectives, such as buying a house, starting a business, or retiring early. Determine how much of your $300,000 salary you can allocate towards these objectives each month.

By following these steps, you can determine whether a $300,000 salary is sufficient for your lifestyle and financial goals. Remember to consider your individual circumstances, location, and financial goals when evaluating the value of a high salary. Is $300,000 a good salary? The answer depends on your unique situation.

The Impact of Taxes on a High Salary

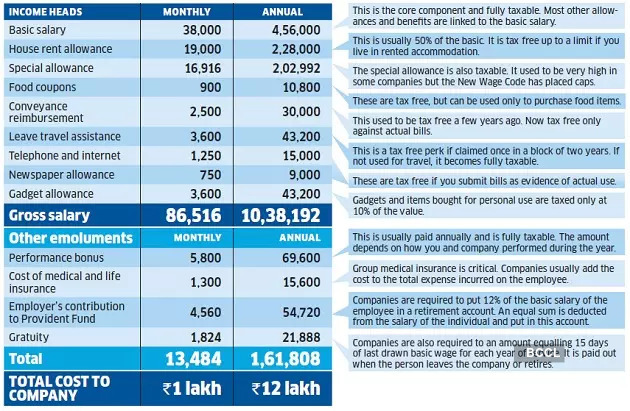

Taxes play a significant role in determining the take-home pay of a $300,000 salary. The tax implications of a high salary can vary greatly depending on the individual’s circumstances, including their location, filing status, and number of dependents.

Federal income taxes are a significant portion of the tax burden for high-income earners. The federal income tax rate for a $300,000 salary can range from 24% to 37%, depending on the individual’s tax bracket. Additionally, state and local taxes can add another 5-10% to the tax burden, depending on the location.

For example, an individual with a $300,000 salary living in California would pay approximately 13.3% in state income taxes, in addition to federal income taxes. This would reduce their take-home pay by around $40,000 per year. In contrast, an individual with the same salary living in Texas would pay no state income taxes, resulting in a higher take-home pay.

Other taxes, such as payroll taxes and property taxes, can also impact the take-home pay of a high salary. Payroll taxes, which include Social Security and Medicare taxes, can add another 7.65% to the tax burden. Property taxes, which vary by location, can also reduce the take-home pay of a high salary.

Overall, the tax implications of a $300,000 salary can significantly reduce the take-home pay and affect the overall value of the salary. When evaluating whether a $300,000 salary is good, it’s essential to consider the tax implications and how they will impact the individual’s take-home pay. Is $300,000 a good salary? The answer depends on the individual’s tax situation and how much of their salary they get to keep.

Comparing Salaries Across Different Industries

Salaries can vary significantly across different industries, and a $300,000 salary can be above or below average in different fields. For example, in the tech industry, a $300,000 salary is not uncommon for experienced software engineers or product managers. However, in the non-profit sector, a $300,000 salary is extremely rare and may be considered exceptional.

In the finance industry, a $300,000 salary is relatively common for investment bankers, hedge fund managers, and private equity professionals. However, in the education sector, a $300,000 salary is rare and may be limited to top administrators or professors at elite universities.

In the healthcare industry, a $300,000 salary is common for experienced physicians, particularly those in high-demand specialties such as orthopedic surgery or cardiology. However, in the arts and entertainment industry, a $300,000 salary is rare and may be limited to top performers or producers.

It’s essential to consider the industry standards when evaluating whether a $300,000 salary is good. A salary that is above average in one industry may be below average in another. Additionally, the cost of living, taxes, and benefits can also impact the overall value of a salary.

For instance, a $300,000 salary in the tech industry may come with a comprehensive benefits package, including stock options, health insurance, and retirement plans. In contrast, a $300,000 salary in the non-profit sector may come with limited benefits and a higher tax burden.

When evaluating whether a $300,000 salary is good, it’s crucial to consider the industry standards, cost of living, taxes, and benefits. Is $300,000 a good salary? The answer depends on the industry, location, and individual circumstances.

The Value of Benefits and Perks in Addition to Salary

When evaluating the value of a $300,000 salary, it’s essential to consider the benefits and perks that come with the job. Benefits and perks can significantly impact the overall value of a compensation package and can make a big difference in an individual’s quality of life.

Health insurance is one of the most valuable benefits that can come with a job. A good health insurance plan can provide peace of mind and financial protection in the event of a medical emergency. Additionally, many employers offer retirement plans, such as 401(k) or pension plans, which can help individuals save for their future.

Paid time off is another valuable benefit that can come with a job. Paid vacation days, sick leave, and holidays can provide individuals with much-needed breaks and time to recharge. Some employers also offer flexible work arrangements, such as telecommuting or flexible hours, which can improve work-life balance.

Other benefits and perks that can come with a job include education assistance, employee discounts, and wellness programs. These benefits can provide individuals with opportunities for personal and professional growth, as well as improve their overall well-being.

When evaluating the value of a $300,000 salary, it’s essential to consider the benefits and perks that come with the job. A salary that seems high on paper may not be as valuable if it doesn’t come with good benefits and perks. On the other hand, a salary that seems lower on paper may be more valuable if it comes with excellent benefits and perks.

For example, a $300,000 salary with a comprehensive benefits package, including health insurance, retirement plans, and paid time off, may be more valuable than a $350,000 salary with limited benefits. Is $300,000 a good salary? The answer depends on the benefits and perks that come with the job.

Long-Term Financial Planning with a High Salary

Having a $300,000 salary provides a unique opportunity for long-term financial planning. With a high salary, individuals can save and invest more, pay off debt faster, and achieve their financial goals sooner.

One of the most important things to consider when making a long-term financial plan is to prioritize saving and investing. A $300,000 salary can provide a significant amount of money for savings and investments, which can grow over time and provide a secure financial future.

Another important consideration is to pay off high-interest debt, such as credit card debt, as quickly as possible. With a $300,000 salary, individuals can make larger payments towards their debt and pay it off faster, saving money on interest and freeing up more money for savings and investments.

In addition to saving and paying off debt, individuals with a $300,000 salary should also consider investing in a diversified portfolio of stocks, bonds, and other assets. This can provide a steady stream of income and help to grow wealth over time.

It’s also important to consider retirement planning when making a long-term financial plan. With a $300,000 salary, individuals can contribute more to their retirement accounts, such as a 401(k) or IRA, and take advantage of employer matching contributions.

Finally, individuals with a $300,000 salary should also consider estate planning and tax planning. This can help to minimize taxes and ensure that their wealth is transferred to their heirs in the most efficient way possible.

By following these tips and making a long-term financial plan, individuals with a $300,000 salary can make the most of their high income and achieve their financial goals. Is $300,000 a good salary? With proper financial planning, it can be a great salary that provides a secure financial future.

Conclusion: Evaluating the Value of a $300,000 Salary

In conclusion, evaluating whether a $300,000 salary is good requires careful consideration of individual circumstances, location, and financial goals. While a $300,000 salary may seem high on paper, it’s essential to consider the cost of living, taxes, and benefits that come with the job.

As we’ve discussed, the cost of living varies significantly across different regions, cities, and countries. A $300,000 salary can have different purchasing powers in different locations, and it’s essential to consider this when evaluating the value of the salary.

Taxes also play a significant role in determining the take-home pay of a $300,000 salary. Federal, state, and local taxes can reduce the take-home pay and affect the overall value of the salary.

Additionally, benefits and perks, such as health insurance, retirement plans, and paid time off, can significantly impact the overall value of a compensation package. It’s essential to consider these benefits when evaluating the value of a $300,000 salary.

Finally, long-term financial planning is crucial when making a high salary. Saving, investing, and paying off debt are essential strategies for making the most of a $300,000 salary and achieving long-term financial goals.

In summary, whether a $300,000 salary is good depends on individual circumstances, location, and financial goals. By considering these factors and evaluating the value of the salary, individuals can make informed decisions about their financial future. Is $300,000 a good salary? The answer depends on the individual’s unique situation.