What is Travel Insurance and Why Do You Need It

Travel insurance is a type of insurance that provides financial protection to travelers in case of unexpected events or emergencies that may occur during their trip. It is designed to help mitigate the risks associated with traveling, such as trip cancellations, medical emergencies, and lost luggage. With the increasing number of travelers and the rising costs of medical care, travel insurance has become an essential component of any travel plan.

So, how does travel insurance work? In essence, it provides a financial safety net that helps travelers recover from unexpected events that may disrupt their trip. Whether it’s a sudden illness, a natural disaster, or a travel delay, travel insurance can help alleviate the financial burden of these events. By purchasing travel insurance, travelers can ensure that they are protected against unforeseen circumstances that may arise during their trip.

Travel insurance typically covers a range of risks, including trip cancellations, medical emergencies, travel delays, and lost or stolen luggage. It may also provide additional benefits, such as emergency medical evacuation, travel assistance, and concierge services. With the right travel insurance policy, travelers can enjoy their trip with peace of mind, knowing that they are protected against unexpected events.

Despite its importance, many travelers still do not purchase travel insurance, often due to a lack of understanding about how it works or a misconception that it is too expensive. However, the cost of travel insurance is relatively low compared to the potential costs of not having it. In fact, the average cost of travel insurance is around 5-10% of the total trip cost.

In conclusion, travel insurance is an essential component of any travel plan. It provides financial protection against unexpected events and emergencies, and can help alleviate the financial burden of these events. By understanding how travel insurance works and what it covers, travelers can make informed decisions about their travel plans and ensure that they are protected against unforeseen circumstances.

How Travel Insurance Works: A Step-by-Step Guide

Purchasing travel insurance can seem like a daunting task, but understanding the process can help make it easier. To start, it’s essential to know how travel insurance works. In this section, we’ll break down the step-by-step process of purchasing travel insurance, including how to choose the right policy, what to look for in a policy, and how to file a claim.

Step 1: Determine Your Travel Insurance Needs

Before purchasing travel insurance, it’s crucial to determine what type of coverage you need. Consider the length of your trip, your destination, and the activities you plan to do. This will help you decide what type of policy is best for you. For example, if you’re planning a trip to a high-risk country, you may want to consider a policy that includes emergency medical evacuation coverage.

Step 2: Choose a Travel Insurance Provider

Once you’ve determined your travel insurance needs, it’s time to choose a provider. Research different companies and compare their policies, prices, and customer reviews. Look for a provider that offers a range of coverage options and has a good reputation for paying claims.

Step 3: Read and Understand the Policy

Before purchasing a policy, make sure you read and understand the fine print. Look for a policy that clearly outlines what is covered and what is not. Pay attention to the policy’s exclusions, limitations, and deductibles. It’s also essential to understand the claims process and what documentation is required to file a claim.

Step 4: Purchase the Policy

Once you’ve chosen a provider and read the policy, it’s time to purchase. Make sure you purchase the policy before your trip, as most policies require you to purchase coverage before your trip begins.

Step 5: File a Claim (If Necessary)

If you need to file a claim, make sure you have all the necessary documentation. This may include receipts, medical records, and police reports. Follow the claims process outlined in your policy, and be patient, as the claims process can take time.

By following these steps, you can ensure that you have the right travel insurance coverage for your trip. Remember, travel insurance is designed to protect you against unexpected events, so make sure you understand how it works and what is covered.

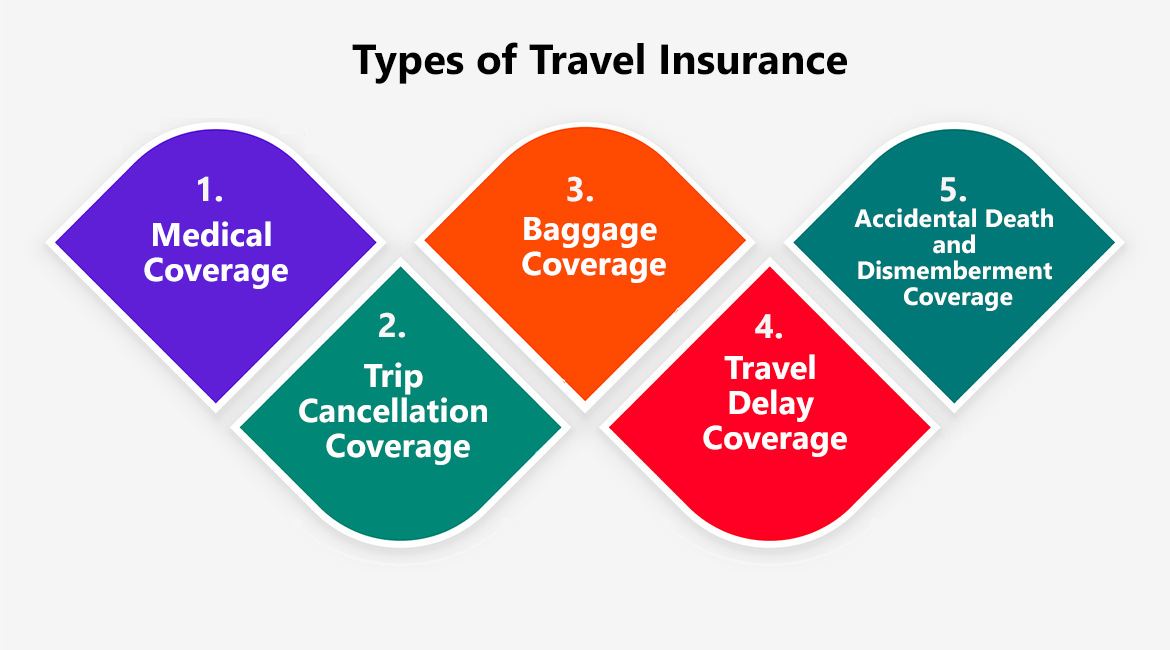

Types of Travel Insurance: Which One is Right for You

When it comes to travel insurance, there are several types of policies to choose from, each with its own benefits and drawbacks. Understanding the different types of travel insurance can help you make an informed decision about which policy is right for you.

Single-Trip Travel Insurance

A single-trip travel insurance policy provides coverage for a single trip or vacation. This type of policy is ideal for travelers who only take one or two trips per year. Single-trip policies typically offer a range of coverage options, including trip cancellations, medical emergencies, and travel delays.

Multi-Trip Travel Insurance

A multi-trip travel insurance policy provides coverage for multiple trips within a specified period, usually a year. This type of policy is ideal for frequent travelers who take multiple trips throughout the year. Multi-trip policies often offer more comprehensive coverage than single-trip policies and may include additional benefits such as travel assistance and concierge services.

Annual Travel Insurance

An annual travel insurance policy provides coverage for an entire year

Types of Travel Insurance: Which One is Right for You

When it comes to travel insurance, there are several types of policies to choose from, each with its own benefits and drawbacks. Understanding the different types of travel insurance can help you make an informed decision about which policy is right for you.

Single-Trip Travel Insurance

A single-trip travel insurance policy provides coverage for a single trip or vacation. This type of policy is ideal for travelers who only take one or two trips per year. Single-trip policies typically offer a range of coverage options, including trip cancellations, medical emergencies, and travel delays.

Multi-Trip Travel Insurance

A multi-trip travel insurance policy provides coverage for multiple trips within a specified period, usually a year. This type of policy is ideal for frequent travelers who take multiple trips throughout the year. Multi-trip policies often offer more comprehensive coverage than single-trip policies and may include additional benefits such as travel assistance and concierge services.

Annual Travel Insurance

An annual travel insurance policy provides coverage for an entire year, regardless of the number of trips taken. This type of policy is ideal for frequent travelers who take multiple trips throughout the year and want to ensure they have continuous coverage. Annual policies often offer the most comprehensive coverage and may include additional benefits such as travel assistance and concierge services.

Group Travel Insurance

A group travel insurance policy provides coverage for a group of people traveling together, such as a family or a group of friends. This type of policy is ideal for groups who want to ensure they have comprehensive coverage in case of an emergency. Group policies often offer more comprehensive coverage than individual policies and may include additional benefits such as travel assistance and concierge services.

Specialized Travel Insurance

Specialized travel insurance policies provide coverage for specific types of travel, such as adventure travel or cruise travel. These policies often offer more comprehensive coverage than standard travel insurance policies and may include additional benefits such as travel assistance and

Types of Travel Insurance: Which One is Right for You

When it comes to travel insurance, there are several types of policies to choose from, each with its own benefits and drawbacks. Understanding the different types of travel insurance can help you make an informed decision about which policy is right for you.

Single-Trip Travel Insurance

A single-trip travel insurance policy provides coverage for a single trip or vacation. This type of policy is ideal for travelers who only take one or two trips per year. Single-trip policies typically offer a range of coverage options, including trip cancellations, medical emergencies, and travel delays.

Multi-Trip Travel Insurance

A multi-trip travel insurance policy provides coverage for multiple trips within a specified period, usually a year. This type of policy is ideal for frequent travelers who take multiple trips throughout the year. Multi-trip policies often offer more comprehensive coverage than single-trip policies and may include additional benefits such as travel assistance and concierge services.

Annual Travel Insurance

An annual travel insurance policy provides coverage for an entire year, regardless of the number of trips taken. This type of policy is ideal for frequent travelers who take multiple trips throughout the year and want to ensure they have continuous coverage. Annual policies often offer the most comprehensive coverage and may include additional benefits such as travel assistance and concierge services.

Group Travel Insurance

A group travel insurance policy provides coverage for a group of people traveling together, such as a family or a group of friends. This type of policy is ideal for groups who want to ensure they have comprehensive coverage in case of an emergency. Group policies often offer more comprehensive coverage than individual policies and may include additional benefits such as travel assistance and concierge services.

Specialized Travel Insurance

Specialized travel insurance policies provide coverage for specific types of travel, such as adventure travel or cruise travel. These policies often offer more comprehensive coverage than standard travel insurance policies and may include additional benefits such as travel assistance and

Types of Travel Insurance: Which One is Right for You

When it comes to travel insurance, there are several types of policies to choose from, each with its own benefits and drawbacks. Understanding the different types of travel insurance can help you make an informed decision about which policy is right for you.

Single-Trip Travel Insurance

A single-trip travel insurance policy provides coverage for a single trip or vacation. This type of policy is ideal for travelers who only take one or two trips per year. Single-trip policies typically offer a range of coverage options, including trip cancellations, medical emergencies, and travel delays.

Multi-Trip Travel Insurance

A multi-trip travel insurance policy provides coverage for multiple trips within a specified period, usually a year. This type of policy is ideal for frequent travelers who take multiple trips throughout the year. Multi-trip policies often offer more comprehensive coverage than single-trip policies and may include additional benefits such as travel assistance and concierge services.

Annual Travel Insurance

An annual travel insurance policy provides coverage for an entire year, regardless of the number of trips taken. This type of policy is ideal for frequent travelers who take multiple trips throughout the year and want to ensure they have continuous coverage. Annual policies often offer the most comprehensive coverage and may include additional benefits such as travel assistance and concierge services.

Group Travel Insurance

A group travel insurance policy provides coverage for a group of people traveling together, such as a family or a group of friends. This type of policy is ideal for groups who want to ensure they have comprehensive coverage in case of an emergency. Group policies often offer more comprehensive coverage than individual policies and may include additional benefits such as travel assistance and concierge services.

Specialized Travel Insurance

Specialized travel insurance policies provide coverage for specific types of travel, such as adventure travel or cruise travel. These policies often offer more comprehensive coverage than standard travel insurance policies and may include additional benefits such as travel assistance and

Types of Travel Insurance: Which One is Right for You

When it comes to travel insurance, there are several types of policies to choose from, each with its own benefits and drawbacks. Understanding the different types of travel insurance can help you make an informed decision about which policy is right for you.

Single-Trip Travel Insurance

A single-trip travel insurance policy provides coverage for a single trip or vacation. This type of policy is ideal for travelers who only take one or two trips per year. Single-trip policies typically offer a range of coverage options, including trip cancellations, medical emergencies, and travel delays.

Multi-Trip Travel Insurance

A multi-trip travel insurance policy provides coverage for multiple trips within a specified period, usually a year. This type of policy is ideal for frequent travelers who take multiple trips throughout the year. Multi-trip policies often offer more comprehensive coverage than single-trip policies and may include additional benefits such as travel assistance and concierge services.

Annual Travel Insurance

An annual travel insurance policy provides coverage for an entire year, regardless of the number of trips taken. This type of policy is ideal for frequent travelers who take multiple trips throughout the year and want to ensure they have continuous coverage. Annual policies often offer the most comprehensive coverage and may include additional benefits such as travel assistance and concierge services.

Group Travel Insurance

A group travel insurance policy provides coverage for a group of people traveling together, such as a family or a group of friends. This type of policy is ideal for groups who want to ensure they have comprehensive coverage in case of an emergency. Group policies often offer more comprehensive coverage than individual policies and may include additional benefits such as travel assistance and concierge services.

Specialized Travel Insurance

Specialized travel insurance policies provide coverage for specific types of travel, such as adventure travel or cruise travel. These policies often offer more comprehensive coverage than standard travel insurance policies and may include additional benefits such as travel assistance and

Types of Travel Insurance: Which One is Right for You

When it comes to travel insurance, there are several types of policies to choose from, each with its own benefits and drawbacks. Understanding the different types of travel insurance can help you make an informed decision about which policy is right for you.

Single-Trip Travel Insurance

A single-trip travel insurance policy provides coverage for a single trip or vacation. This type of policy is ideal for travelers who only take one or two trips per year. Single-trip policies typically offer a range of coverage options, including trip cancellations, medical emergencies, and travel delays.

Multi-Trip Travel Insurance

A multi-trip travel insurance policy provides coverage for multiple trips within a specified period, usually a year. This type of policy is ideal for frequent travelers who take multiple trips throughout the year. Multi-trip policies often offer more comprehensive coverage than single-trip policies and may include additional benefits such as travel assistance and concierge services.

Annual Travel Insurance

An annual travel insurance policy provides coverage for an entire year, regardless of the number of trips taken. This type of policy is ideal for frequent travelers who take multiple trips throughout the year and want to ensure they have continuous coverage. Annual policies often offer the most comprehensive coverage and may include additional benefits such as travel assistance and concierge services.

Group Travel Insurance

A group travel insurance policy provides coverage for a group of people traveling together, such as a family or a group of friends. This type of policy is ideal for groups who want to ensure they have comprehensive coverage in case of an emergency. Group policies often offer more comprehensive coverage than individual policies and may include additional benefits such as travel assistance and concierge services.

Specialized Travel Insurance

Specialized travel insurance policies provide coverage for specific types of travel, such as adventure travel or cruise travel. These policies often offer more comprehensive coverage than standard travel insurance policies and may include additional benefits such as travel assistance and