Understanding the Rental Market Trends

The rental market has experienced significant fluctuations in recent years, leaving many to wonder if rent prices will drop in the future. To answer this question, it’s essential to understand the current state of the rental market and the factors that influence rent prices. The COVID-19 pandemic has had a profound impact on the rental market, with many cities experiencing a decline in rent prices due to reduced demand. However, as the economy recovers and people return to urban areas, rent prices are likely to increase.

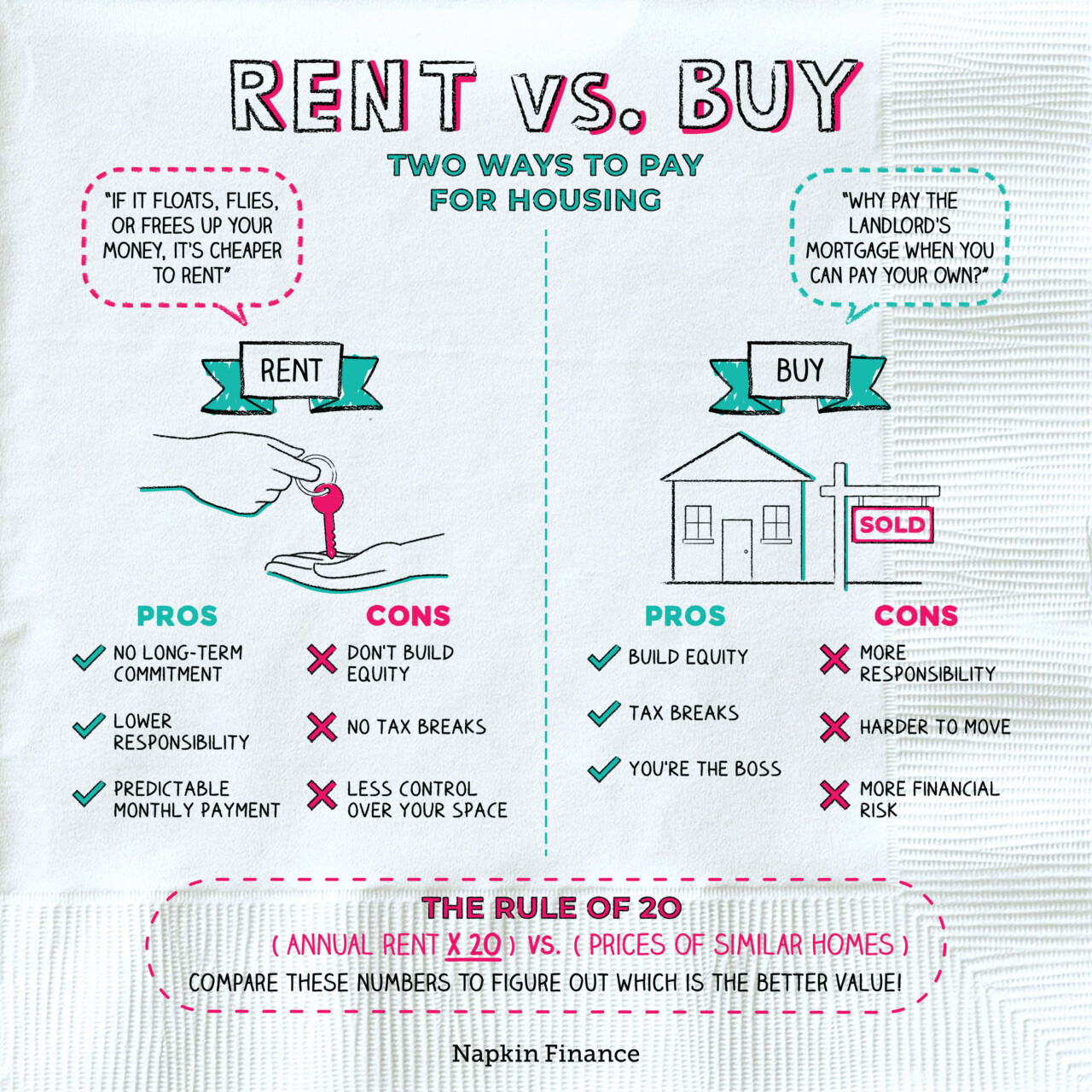

Economic trends also play a crucial role in shaping rent prices. Low interest rates, for example, can make it easier for people to buy homes, reducing demand for rentals and putting downward pressure on rent prices. On the other hand, a strong economy with low unemployment can drive up rent prices as more people are able to afford higher rents. Demographic changes, such as the growing number of millennials entering the rental market, can also impact rent prices.

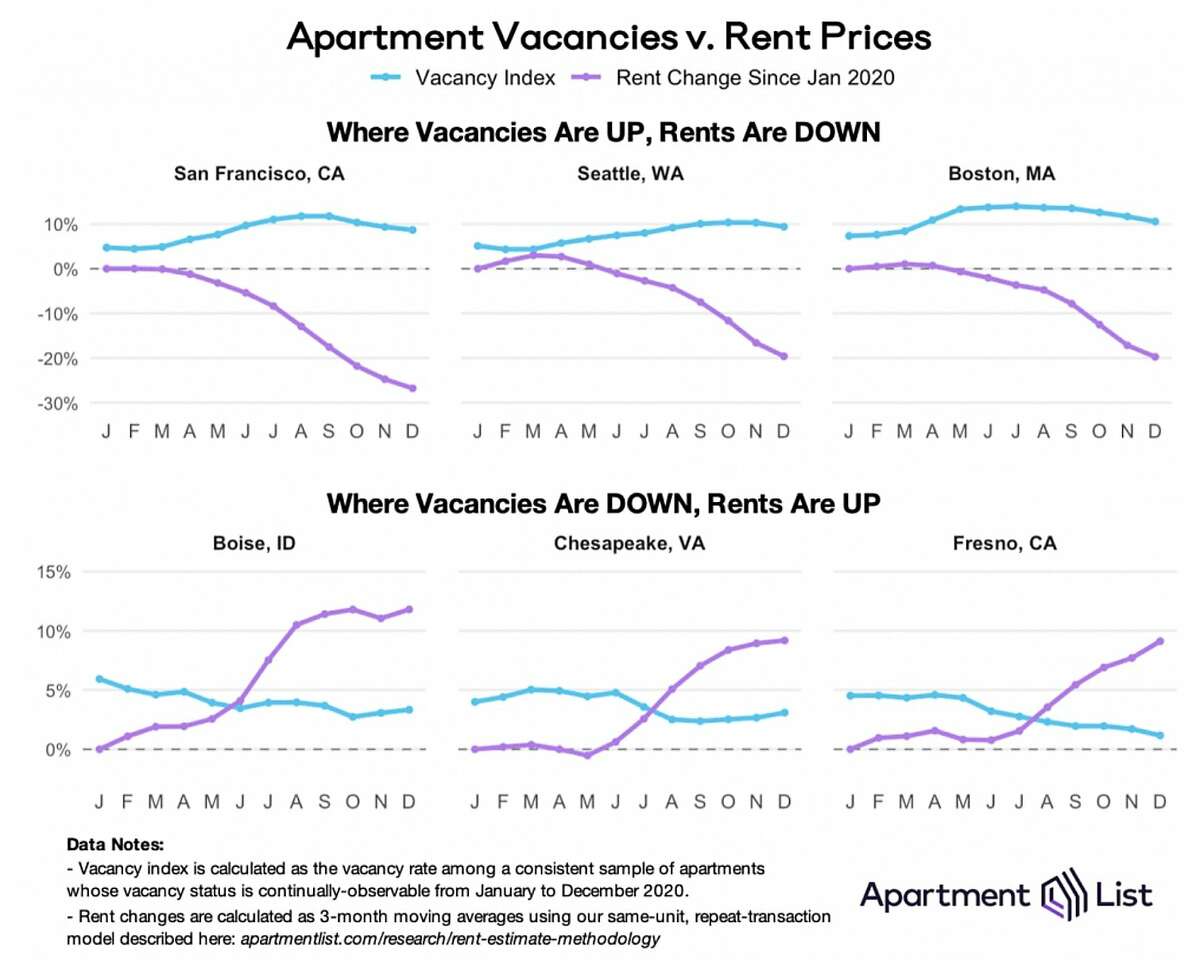

According to recent data, the rental market is expected to continue growing, with rent prices increasing by an average of 3-5% per year. However, this growth is not expected to be uniform, with some cities experiencing much higher rent increases than others. For example, cities with strong tech industries, such as San Francisco and Seattle, are likely to see significant rent increases due to high demand and limited supply.

So, is rent going to go down? While it’s difficult to predict with certainty, it’s unlikely that rent prices will drop significantly in the near future. However, there may be opportunities for renters to find better deals in certain cities or neighborhoods. By understanding the rental market trends and the factors that influence rent prices, renters and landlords can make informed decisions about their housing choices.

It’s also worth noting that the rental market is highly localized, with rent prices varying significantly from city to city and even neighborhood to neighborhood. This means that renters and landlords need to stay informed about local market trends and be prepared to adapt to changing conditions.

Factors Affecting Rent Prices: A Deep Dive

Rent prices are influenced by a complex array of factors, including supply and demand, interest rates, and government policies. Understanding these factors is crucial for predicting rent price changes and making informed decisions as a renter or landlord.

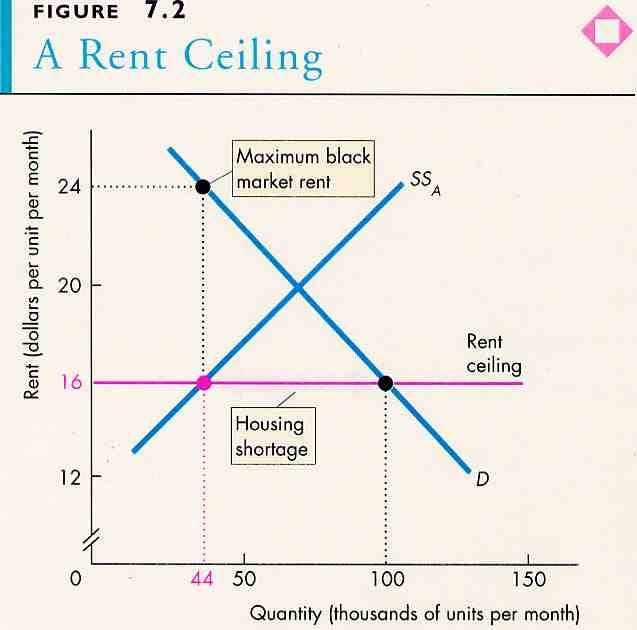

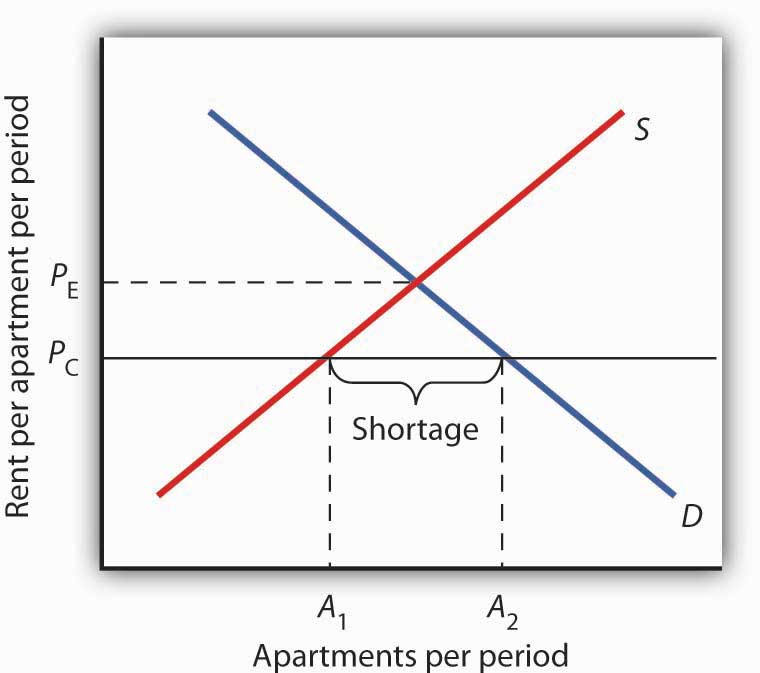

Supply and demand is a fundamental driver of rent prices. When demand for rentals is high and supply is limited, rent prices tend to increase. Conversely, when demand is low and supply is abundant, rent prices tend to decrease. For example, in cities with growing tech industries, such as San Francisco and Seattle, the demand for rentals is high, driving up rent prices. On the other hand, in cities with declining populations, such as Detroit and Cleveland, the demand for rentals is low, leading to lower rent prices.

Interest rates also play a significant role in shaping rent prices. When interest rates are low, it becomes easier for people to buy homes, reducing demand for rentals and putting downward pressure on rent prices. However, when interest rates are high, it becomes more expensive for people to buy homes, increasing demand for rentals and driving up rent prices. For instance, during the 2008 financial crisis, interest rates plummeted, leading to a surge in home buying and a subsequent decline in rent prices.

Government policies, such as rent control measures, tax policies, and subsidies, can also impact rent prices. Rent control measures, for example, can limit the amount by which landlords can increase rent prices, reducing the incentive for landlords to invest in their properties. Tax policies, such as tax credits for low-income renters, can also influence rent prices by reducing the financial burden on renters. Subsidies, such as Section 8 housing vouchers, can also impact rent prices by providing financial assistance to low-income renters.

Historical data shows that these factors have had a significant impact on rent prices in the past. For example, during the 1970s, rent prices increased rapidly due to high inflation and a shortage of affordable housing. In the 1990s, rent prices declined due to a surplus of housing and low interest rates. More recently, rent prices have increased due to a combination of factors, including low interest rates, a growing economy, and a shortage of affordable housing.

So, is rent going to go down? While it’s difficult to predict with certainty, understanding the factors that influence rent prices can provide valuable insights. By analyzing supply and demand, interest rates, and government policies, renters and landlords can make informed decisions about their housing choices and prepare for potential changes in the rental market.

How to Predict Rent Price Changes

Predicting rent price changes can be a challenging task, but there are several strategies that renters and landlords can use to make informed decisions. One key approach is to monitor local market trends, including the supply and demand of rentals, the condition of the local economy, and the impact of government policies.

Tracking economic indicators, such as GDP growth, inflation rates, and employment rates, can also provide valuable insights into rent price trends. For example, a strong economy with low unemployment and rising wages can lead to increased demand for rentals and higher rent prices. On the other hand, a weak economy with high unemployment and stagnant wages can lead to decreased demand for rentals and lower rent prices.

Analyzing demographic shifts, such as changes in population growth, age, and income, can also help predict rent price changes. For example, areas with growing populations of young professionals may experience increased demand for rentals and higher rent prices. Areas with aging populations, on the other hand, may experience decreased demand for rentals and lower rent prices.

Another important factor to consider is the impact of government policies on rent prices. For example, rent control measures can limit the amount by which landlords can increase rent prices, while tax policies can influence the affordability of rentals. Subsidies, such as Section 8 housing vouchers, can also impact rent prices by providing financial assistance to low-income renters.

By monitoring these factors and analyzing local market trends, renters and landlords can make informed decisions about their housing choices and prepare for potential changes in the rental market. For example, renters may want to consider signing a longer-term lease to lock in a lower rent price, while landlords may want to consider investing in renovations or upgrades to increase the value of their properties.

So, is rent going to go down? While it’s difficult to predict with certainty, by monitoring local market trends, tracking economic indicators, and analyzing demographic shifts, renters and landlords can gain valuable insights into rent price trends and make informed decisions about their housing choices.

Some specific tools and resources that renters and landlords can use to predict rent price changes include online rental market platforms, such as Zillow or Redfin, which provide data on local market trends and rent prices. Additionally, government websites, such as the Bureau of Labor Statistics or the Census Bureau, provide data on economic indicators and demographic shifts.

The Impact of Government Policies on Rent Prices

Government policies play a significant role in shaping rent prices, and understanding their impact is crucial for renters and landlords. Rent control measures, tax policies, and subsidies are some of the key policies that can influence rent prices.

Rent control measures, for example, can limit the amount by which landlords can increase rent prices. While these measures can provide relief to renters, they can also have unintended consequences, such as reducing the incentive for landlords to invest in their properties. In cities like New York and San Francisco, rent control measures have been implemented to slow down the rapid increase in rent prices. However, these measures have also led to a shortage of affordable housing, as landlords are less likely to rent out their properties at below-market rates.

Tax policies can also impact rent prices. For example, tax credits for low-income renters can help make housing more affordable. However, these credits can also create a disincentive for landlords to rent out their properties at below-market rates. In addition, tax policies can influence the affordability of housing by affecting the cost of construction and maintenance.

Subsidies, such as Section 8 housing vouchers, can also impact rent prices. These vouchers provide financial assistance to low-income renters, allowing them to afford housing that they might not otherwise be able to afford. However, these subsidies can also create a disincentive for landlords to rent out their properties at below-market rates.

The impact of government policies on rent prices can vary depending on the specific policy and the local market conditions. For example, in cities with a high demand for housing, rent control measures may be more effective in slowing down rent price increases. In cities with a low demand for housing, however, rent control measures may have little impact on rent prices.

So, is rent going to go down? While government policies can influence rent prices, they are just one of many factors that contribute to rent price fluctuations. By understanding the impact of government policies on rent prices, renters and landlords can make informed decisions about their housing choices and prepare for potential changes in the rental market.

It’s also worth noting that government policies can have different impacts on different stakeholders. For example, rent control measures may benefit renters by slowing down rent price increases, but they can also harm landlords by reducing their revenue. Tax policies, on the other hand, may benefit landlords by reducing their tax burden, but they can also harm renters by increasing the cost of housing.

Will Rent Prices Drop in San Francisco?

San Francisco is one of the most expensive cities in the United States, with rent prices that are significantly higher than the national average. However, the city’s rental market has been experiencing a slowdown in recent years, with rent prices decreasing by as much as 10% in some areas.

So, is rent going to go down in San Francisco? While it’s difficult to predict with certainty, there are several factors that suggest rent prices may continue to decrease in the city. One major factor is the impact of the pandemic on the local economy. Many tech companies, which are a major driver of the city’s economy, have been forced to adopt remote work policies, leading to a decrease in demand for housing.

Another factor is the increase in housing supply. San Francisco has been experiencing a surge in new construction, with many new apartments and condos being built in the city. This increase in supply has put downward pressure on rent prices, making it more affordable for renters to find housing.

Additionally, the city’s government has implemented several policies aimed at making housing more affordable. For example, the city’s rent control ordinance limits the amount by which landlords can increase rent prices, providing relief to renters. The city has also implemented a number of programs aimed at increasing the supply of affordable housing, such as the inclusionary zoning ordinance.

Despite these factors, there are still many uncertainties in the San Francisco rental market. The city’s economy is highly dependent on the tech industry, and any downturn in the industry could lead to a decrease in demand for housing. Additionally, the city’s housing market is highly competitive, with many renters competing for a limited number of apartments.

Overall, while it’s difficult to predict with certainty whether rent prices will drop in San Francisco, there are several factors that suggest they may continue to decrease. Renters and landlords should keep a close eye on the local market trends and be prepared to adapt to any changes in the market.

Some specific neighborhoods in San Francisco that may experience a decrease in rent prices include the Mission District, the Castro, and the Haight-Ashbury. These neighborhoods have seen a surge in new construction and have a high demand for housing, making them more competitive and potentially leading to lower rent prices.

What Renters Can Do to Prepare for Rent Price Changes

Renters can take several steps to prepare for potential rent price changes. One key strategy is to stay informed about local market trends and economic conditions. This can involve monitoring local news and real estate websites, as well as tracking economic indicators such as employment rates and GDP growth.

Renters can also take steps to protect themselves from potential rent price increases. For example, they can consider signing a longer-term lease to lock in a lower rent price. They can also look for apartments or houses that offer rent control or other forms of rent stabilization.

In addition, renters can take steps to reduce their expenses and make their housing more affordable. For example, they can consider finding a roommate or housemate to split the rent with. They can also look for ways to reduce their utility bills and other expenses.

Renters can also consider exploring different neighborhoods or areas that may offer more affordable housing options. This can involve researching local schools, transportation options, and other amenities to find a neighborhood that meets their needs and budget.

So, is rent going to go down? While it’s difficult to predict with certainty, renters can take steps to prepare for potential rent price changes and make their housing more affordable. By staying informed, protecting themselves from potential rent price increases, reducing their expenses, and exploring different neighborhoods, renters can make informed decisions about their housing choices and achieve their financial goals.

Some specific tips for renters include:

- Monitor local market trends and economic conditions to stay informed about potential rent price changes.

- Consider signing a longer-term lease to lock in a lower rent price.

- Look for apartments or houses that offer rent control or other forms of rent stabilization.

- Find a roommate or housemate to split the rent with.

- Explore different neighborhoods or areas that may offer more affordable housing options.

By following these tips, renters can take control of their housing costs and make informed decisions about their housing choices.