Why Part-Time Employees Need Medical Insurance

As a part-time employee, having medical insurance is crucial for protecting your health and financial well-being. Without coverage, you may be exposed to significant medical expenses, which can lead to financial hardship and even bankruptcy. In fact, a single unexpected medical bill can be devastating, with the average cost of a hospital stay exceeding $10,000. Medical insurance for part-time employees provides a safety net, ensuring that you can access necessary medical care without breaking the bank.

Moreover, medical insurance is essential for maintaining good health. Regular check-ups, screenings, and preventive care can help identify health issues early on, reducing the risk of complications and improving treatment outcomes. By having medical insurance, you can take control of your health, reduce the risk of chronic diseases, and improve your overall quality of life.

Unfortunately, many part-time employees assume that they are not eligible for medical insurance or that it is too expensive. However, this is not necessarily the case. With the Affordable Care Act (ACA) and other options available, part-time employees can access affordable medical insurance plans that meet their needs and budget.

In addition to the financial benefits, medical insurance can also provide peace of mind. Knowing that you have coverage in case of an emergency or unexpected medical expense can reduce stress and anxiety, allowing you to focus on your work and personal life.

Overall, medical insurance is a vital component of a part-time employee’s benefits package. It provides financial protection, access to necessary medical care, and peace of mind. By understanding the importance of medical insurance, part-time employees can take the first step towards protecting their health and financial well-being.

Understanding Your Options: A Breakdown of Medical Insurance Plans for Part-Time Employees

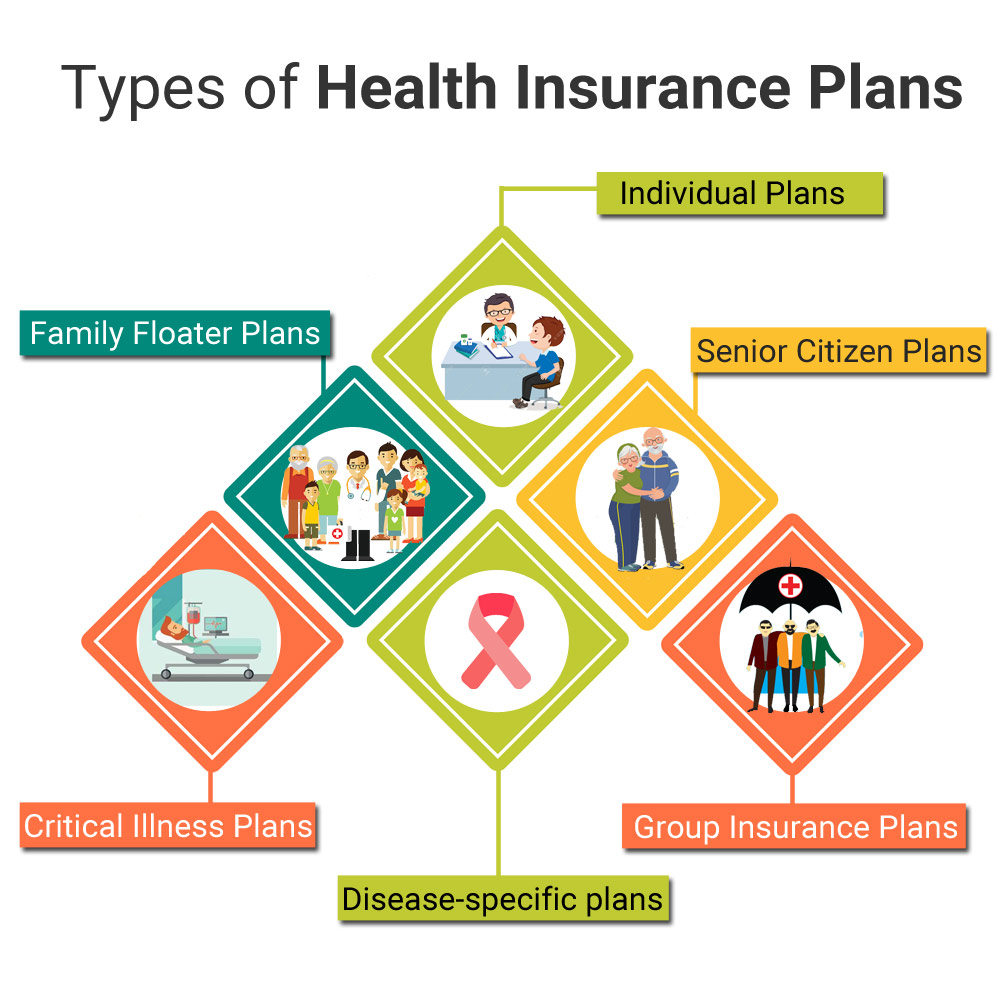

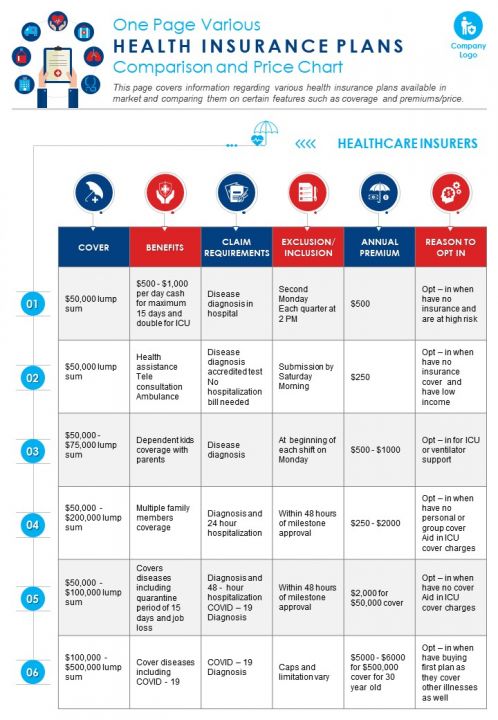

As a part-time employee, navigating the world of medical insurance can be overwhelming. With various options available, it’s essential to understand the different types of plans and their characteristics. In this section, we’ll break down the most common medical insurance plans for part-time employees, including individual plans, group plans, and short-term plans.

Individual plans are a popular option for part-time employees who don’t have access to group coverage. These plans are purchased directly from an insurance company and offer a range of benefits, including doctor visits, hospital stays, and prescription medication. Individual plans can be more expensive than group plans, but they offer flexibility and customization options.

Group plans, on the other hand, are offered by employers to their part-time employees. These plans are often more affordable than individual plans and provide a range of benefits, including preventive care, specialist visits, and hospital stays. However, group plans may have limited provider networks and higher deductibles.

Short-term plans are a temporary solution for part-time employees who need coverage for a short period. These plans typically last up to 12 months and offer limited benefits, including doctor visits and hospital stays. Short-term plans are often less expensive than individual or group plans but may not provide adequate coverage for ongoing medical needs.

When evaluating medical insurance plans for part-time employees, it’s essential to consider the pros and cons of each option. Individual plans offer flexibility and customization, but may be more expensive. Group plans provide affordability and comprehensive coverage, but may have limited provider networks. Short-term plans offer temporary coverage, but may not provide adequate benefits.

Ultimately, the best medical insurance plan for part-time employees will depend on their individual needs and circumstances. By understanding the different types of plans available, part-time employees can make informed decisions about their medical insurance coverage.

Some popular medical insurance providers for part-time employees include UnitedHealthcare, Blue Cross Blue Shield, and Aetna. These providers offer a range of plans, including individual, group, and short-term options. When selecting a provider, part-time employees should consider factors such as network providers, deductibles, copays, and maximum out-of-pocket costs.

How to Choose the Right Medical Insurance Plan for Your Needs

Choosing the right medical insurance plan can be a daunting task, especially for part-time employees who have limited options. However, by considering a few key factors, you can make an informed decision that meets your needs and budget.

First, evaluate the network providers. Check if your primary care physician and specialists are part of the plan’s network. Also, consider the plan’s coverage area, especially if you travel frequently. A plan with a large network of providers can provide greater flexibility and convenience.

Next, consider the deductibles, copays, and maximum out-of-pocket costs. These costs can add up quickly, so it’s essential to choose a plan that balances affordability with adequate coverage. Look for plans with lower deductibles and copays, but be aware that these plans may have higher premiums.

Another crucial factor is the maximum out-of-pocket cost. This is the maximum amount you’ll pay for medical expenses in a calendar year. Choose a plan with a lower maximum out-of-pocket cost to avoid financial surprises.

Additionally, consider the plan’s coverage for essential health benefits, such as preventive care, hospital stays, and prescription medication. Ensure that the plan covers the services you need, and check if there are any limitations or exclusions.

Finally, evaluate the plan’s customer service and reputation. Look for plans with high customer satisfaction ratings and a reputation for prompt claims processing. A plan with excellent customer service can provide peace of mind and reduce stress.

When selecting a medical insurance plan, part-time employees should also consider their lifestyle and health needs. For example, if you have a chronic condition, choose a plan that covers ongoing treatment and medication. If you’re relatively healthy, a plan with lower premiums and higher deductibles may be more suitable.

Ultimately, choosing the right medical insurance plan requires careful consideration of your needs and budget. By evaluating network providers, deductibles, copays, maximum out-of-pocket costs, coverage, and customer service, you can make an informed decision that protects your health and financial well-being.

Affordable Care Act (ACA) Options for Part-Time Employees

The Affordable Care Act (ACA) has expanded health insurance options for part-time employees, providing access to affordable coverage. Under the ACA, part-time employees may be eligible for subsidized plans or Medicaid expansion, depending on their income level and state of residence.

Subsidized plans are available to part-time employees who earn between 100% and 400% of the federal poverty level (FPL). These plans offer lower premiums and out-of-pocket costs, making them more affordable for part-time employees. To be eligible for subsidized plans, part-time employees must enroll in a plan through the Health Insurance Marketplace.

Medicaid expansion is another option available to part-time employees under the ACA. Medicaid expansion provides coverage to individuals who earn up to 138% of the FPL. Part-time employees who are eligible for Medicaid expansion can enroll in a Medicaid plan, which offers comprehensive coverage with little to no out-of-pocket costs.

To be eligible for ACA options, part-time employees must meet certain requirements. They must be a U.S. citizen or national, be a resident of the state where they are applying for coverage, and not be incarcerated. Additionally, part-time employees must not have access to affordable coverage through their employer or a family member‘s plan.

The application process for ACA options is straightforward. Part-time employees can enroll in a plan through the Health Insurance Marketplace during the annual open enrollment period or during a special enrollment period if they experience a qualifying life event. To apply, part-time employees will need to provide documentation of their income, residency, and citizenship status.

Once enrolled in an ACA plan, part-time employees can access a range of benefits, including preventive care, hospital stays, and prescription medication. ACA plans also offer essential health benefits, such as maternity care, mental health services, and substance abuse treatment.

Overall, the ACA has expanded health insurance options for part-time employees, providing access to affordable coverage. By understanding the eligibility requirements and application process, part-time employees can take advantage of these options and protect their health and financial well-being.

Private Insurance Options for Part-Time Employees: A Review of Top Providers

Private insurance providers offer a range of medical insurance plans for part-time employees, each with its own features, pricing, and customer reviews. In this section, we’ll review and compare three top private insurance providers: UnitedHealthcare, Blue Cross Blue Shield, and Aetna.

UnitedHealthcare is one of the largest health insurance companies in the United States, offering a range of plans for part-time employees. Their plans include individual and family coverage, as well as group plans for small businesses. UnitedHealthcare’s plans are known for their comprehensive coverage, including preventive care, hospital stays, and prescription medication.

Blue Cross Blue Shield is another top private insurance provider, offering plans in over 40 states. Their plans include individual and family coverage, as well as group plans for small businesses. Blue Cross Blue Shield’s plans are known for their flexibility, with a range of deductible and copay options.

Aetna is a well-established private insurance provider, offering plans in over 20 states. Their plans include individual and family coverage, as well as group plans for small businesses. Aetna’s plans are known for their affordability, with lower premiums and out-of-pocket costs.

When comparing private insurance providers, part-time employees should consider several factors, including plan features, pricing, and customer reviews. Plan features to consider include coverage for preventive care, hospital stays, and prescription medication. Pricing should also be a consideration, with part-time employees looking for plans with affordable premiums and out-of-pocket costs.

Customer reviews can also provide valuable insights into the quality of a private insurance provider. Part-time employees should look for providers with high customer satisfaction ratings and a reputation for prompt claims processing.

Ultimately, the best private insurance provider for part-time employees will depend on their individual needs and circumstances. By researching and comparing top providers, part-time employees can find a plan that meets their needs and budget.

In addition to the providers mentioned above, other top private insurance providers for part-time employees include Cigna, Humana, and Kaiser Permanente. These providers offer a range of plans, including individual and group coverage, and are known for their comprehensive coverage and affordability.

Group Insurance Options for Part-Time Employees: What to Expect

Group insurance plans are a common option for part-time employees, offering a range of benefits and coverage options. In this section, we’ll explain how group insurance plans work for part-time employees, including the role of the employer, plan options, and costs.

Employers play a significant role in group insurance plans, as they are responsible for selecting and offering the plan to their part-time employees. Employers may choose to offer a single plan or multiple plans, depending on their business needs and budget. Part-time employees who are eligible for group coverage may be required to contribute to the premium costs, although the employer typically pays a significant portion of the costs.

Group insurance plans offer a range of benefits, including comprehensive coverage for medical expenses, prescription medication, and preventive care. Part-time employees who enroll in a group plan may also have access to additional benefits, such as dental and vision coverage.

However, group insurance plans also have some drawbacks. For example, part-time employees may be required to work a certain number of hours per week to be eligible for coverage. Additionally, group plans may have limited provider networks, which can limit access to care.

Despite these limitations, group insurance plans can be a valuable option for part-time employees. By understanding how group plans work and what to expect, part-time employees can make informed decisions about their health insurance coverage.

Some common types of group insurance plans for part-time employees include:

- Preferred Provider Organization (PPO) plans: These plans offer a network of providers who have agreed to provide care at a discounted rate.

- Health Maintenance Organization (HMO) plans: These plans require part-time employees to receive care from a specific network of providers.

- Exclusive Provider Organization (EPO) plans: These plans offer a network of providers who have agreed to provide care at a discounted rate, but may not cover care received from out-of-network providers.

Part-time employees who are considering a group insurance plan should carefully review the plan’s benefits, costs, and limitations before enrolling. By doing so, they can ensure that they have the coverage they need to protect their health and financial well-being.

Tax Benefits and Credits for Part-Time Employees with Medical Insurance

Part-time employees with medical insurance may be eligible for tax benefits and credits that can help reduce their tax liability. In this section, we’ll discuss the tax benefits and credits available to part-time employees with medical insurance, including the Premium Tax Credit and the Health Coverage Tax Credit.

The Premium Tax Credit is a refundable tax credit that helps eligible individuals and families with low to moderate incomes pay for health insurance premiums. Part-time employees who purchase health insurance through the Health Insurance Marketplace may be eligible for the Premium Tax Credit, which can help reduce their monthly premium payments.

To be eligible for the Premium Tax Credit, part-time employees must meet certain income and family size requirements. They must also purchase health insurance through the Health Insurance Marketplace and not be eligible for other forms of health insurance, such as employer-sponsored coverage or Medicare.

The Health Coverage Tax Credit is a non-refundable tax credit that helps eligible individuals and families pay for health insurance premiums. Part-time employees who are receiving Trade Adjustment Assistance (TAA) benefits or are eligible for the Alternative TAA (ATAA) program may be eligible for the Health Coverage Tax Credit.

To claim the Premium Tax Credit or the Health Coverage Tax Credit, part-time employees must file Form 8962 with their tax return. They will need to provide documentation of their health insurance premiums and income to support their claim.

In addition to the Premium Tax Credit and the Health Coverage Tax Credit, part-time employees with medical insurance may also be eligible for other tax benefits, such as the medical expense deduction. This deduction allows individuals to deduct medical expenses that exceed 10% of their adjusted gross income.

Part-time employees with medical insurance should consult with a tax professional to determine which tax benefits and credits they are eligible for and how to claim them. By taking advantage of these tax benefits, part-time employees can reduce their tax liability and keep more of their hard-earned money.

Next Steps: Enrolling in a Medical Insurance Plan as a Part-Time Employee

Now that you’ve learned about the different types of medical insurance plans available to part-time employees, it’s time to take the next step and enroll in a plan. In this section, we’ll provide a step-by-step guide to help you research options, apply for coverage, and understand the enrollment process.

Step 1: Research Your Options

Start by researching the different types of medical insurance plans available to part-time employees. Consider your budget, health needs, and lifestyle when evaluating plans. You can use online resources, such as the Health Insurance Marketplace or private insurance provider websites, to compare plans and prices.

Step 2: Determine Your Eligibility

Next, determine your eligibility for medical insurance coverage. Check if you’re eligible for employer-sponsored coverage, Medicaid, or other government programs. You can also use the Health Insurance Marketplace’s eligibility tool to determine if you’re eligible for subsidized coverage.

Step 3: Apply for Coverage

Once you’ve determined your eligibility, apply for coverage through the Health Insurance Marketplace or a private insurance provider. You’ll need to provide personal and financial information, such as your income, family size, and health history.

Step 4: Understand the Enrollment Process

After applying for coverage, understand the enrollment process. This includes learning about the plan’s benefits, costs, and network providers. You’ll also need to understand the plan’s deductible, copays, and maximum out-of-pocket costs.

Step 5: Review and Compare Plans

Finally, review and compare plans to ensure you’re getting the best coverage for your needs and budget. Consider factors such as network providers, deductibles, copays, and maximum out-of-pocket costs.

By following these steps, part-time employees can enroll in a medical insurance plan that meets their needs and budget. Remember to carefully review and compare plans to ensure you’re getting the best coverage for your health and financial well-being.