Understanding the Pause on Student Loan Payments

The COVID-19 pandemic has brought about unprecedented challenges for individuals and economies worldwide. In response to the crisis, the US government implemented a pause on student loan payments, providing relief to millions of borrowers. This pause, which began in March 2020, has been extended several times, with the latest extension set to expire in the near future. As a result, many borrowers are left wondering when student loan repayment will start again.

The pause on student loan payments has had a significant impact on borrowers and the economy. For many, it has provided a much-needed reprieve from the financial burden of loan payments, allowing them to focus on other essential expenses. However, the pause has also raised concerns about the long-term effects on borrowers’ credit scores and the potential for increased debt when payments resume.

Despite the uncertainty surrounding the resumption of student loan payments, one thing is clear: borrowers must be prepared for the eventual restart of payments. This includes understanding the terms of their loans, creating a budget, and exploring income-driven repayment plans. By taking proactive steps, borrowers can ensure a smoother transition when payments resume and avoid potential financial pitfalls.

As the pause on student loan payments comes to an end, borrowers are left wondering when they will need to start making payments again. The answer to this question is crucial, as it will impact borrowers’ financial planning and budgeting. While the exact date for the resumption of payments has not been announced, borrowers can stay informed by monitoring government websites and loan servicer communications.

In the meantime, borrowers can take advantage of the pause to review their loan terms, explore income-driven repayment plans, and make adjustments to their budget. By being proactive and informed, borrowers can ensure a successful transition when student loan repayment starts again.

How to Prepare for the Resumption of Student Loan Payments

As the pause on student loan payments comes to an end, borrowers must prepare for the resumption of payments. To ensure a smooth transition, it’s essential to review loan terms, create a budget, and explore income-driven repayment plans. By taking proactive steps, borrowers can avoid potential financial pitfalls and make informed decisions about their loan repayment.

Reviewing loan terms is a crucial step in preparing for the resumption of payments. Borrowers should check their loan statements to understand the interest rate, payment amount, and due date. This information will help borrowers create a budget that accounts for their loan payments. Additionally, borrowers should review their loan servicer’s website for any updates on the resumption of payments.

Creating a budget is essential for managing loan payments. Borrowers should start by tracking their income and expenses to understand where their money is going. Then, they can allocate a portion of their income towards loan payments. It’s also important to prioritize needs over wants and make adjustments as necessary. By creating a budget, borrowers can ensure they have enough money set aside for loan payments when they resume.

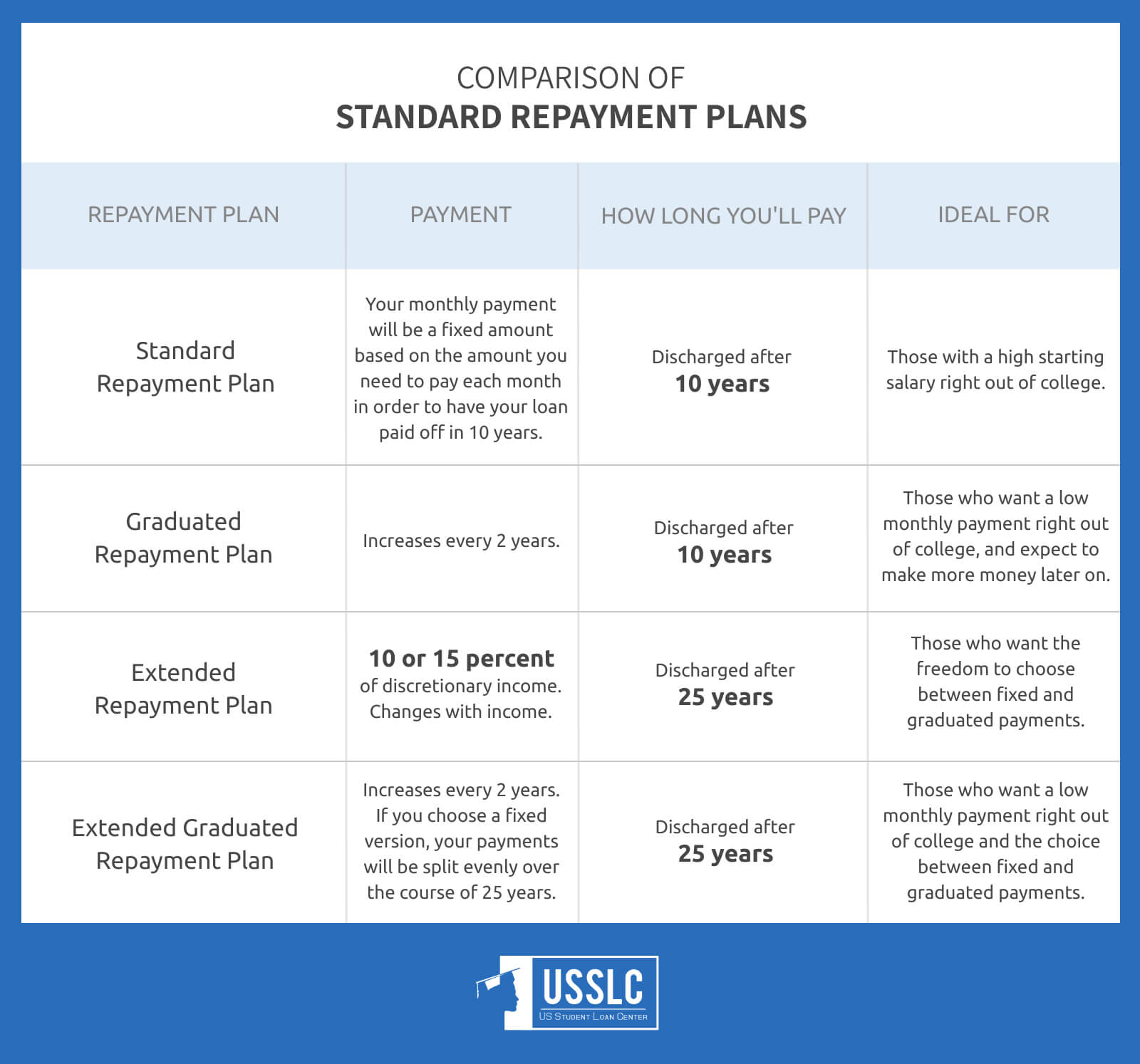

Income-driven repayment plans can also help borrowers manage their loan payments. These plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), can lower monthly payments based on income and family size. Borrowers should explore these options to determine if they are eligible and if it’s the right choice for their financial situation.

When does student loan repayment start again? While the exact date has not been announced, borrowers can stay informed by monitoring government websites and loan servicer communications. By being proactive and prepared, borrowers can ensure a successful transition when payments resume. It’s also essential to remember that loan payments will be due again, and borrowers should plan accordingly to avoid late fees and negative credit reporting.

By reviewing loan terms, creating a budget, and exploring income-driven repayment plans, borrowers can prepare for the resumption of student loan payments. It’s essential to stay informed and take proactive steps to ensure a smooth transition when payments start again.

When Can Borrowers Expect Student Loan Repayment to Start Again?

The current timeline for the resumption of student loan payments is uncertain, but borrowers can expect payments to start again in the near future. The US Department of Education has announced that the pause on student loan payments will be extended until a specific date, but this date is subject to change. Borrowers should stay informed about changes to this timeline by monitoring government websites and loan servicer communications.

To stay up-to-date on the resumption of student loan payments, borrowers can check the US Department of Education’s website for updates on the pause. Additionally, borrowers can sign up for email notifications from their loan servicer to receive updates on their loan status. By staying informed, borrowers can plan accordingly and avoid any potential disruptions to their finances.

When does student loan repayment start again? While the exact date has not been announced, borrowers can expect payments to start again soon. It’s essential to review loan terms, create a budget, and explore income-driven repayment plans to ensure a smooth transition when payments resume. Borrowers who are behind on their payments should also take steps to address their delinquency, such as rehabilitation or consolidation.

The resumption of student loan payments will likely be announced in advance, giving borrowers time to prepare. However, it’s crucial to stay informed and plan ahead to avoid any potential financial pitfalls. By understanding the current timeline and staying up-to-date on changes, borrowers can ensure a successful transition when payments start again.

In the meantime, borrowers can take proactive steps to prepare for the resumption of payments. This includes reviewing loan terms, creating a budget, and exploring income-driven repayment plans. By being prepared, borrowers can ensure a smooth transition when payments start again and avoid any potential disruptions to their finances.

What Happens to Borrowers Who Are Behind on Payments?

Borrowers who are behind on their payments, including those who were in default or delinquency before the pause, may be wondering what options are available to them. Fortunately, there are several alternatives that can help borrowers get back on track with their payments. Rehabilitation and consolidation are two options that can help borrowers recover from delinquency and default.

Rehabilitation is a process that allows borrowers to make a series of on-time payments to demonstrate their ability to make regular payments. This can help borrowers recover from delinquency and default, and can also help to remove negative marks from their credit reports. Consolidation, on the other hand, involves combining multiple loans into a single loan with a lower monthly payment. This can help borrowers simplify their payments and make them more manageable.

Borrowers who are behind on their payments should also be aware of the potential consequences of defaulting on their student loans. Defaulting on a student loan can result in serious financial consequences, including damage to credit scores, wage garnishment, and even tax refund offset. However, by taking proactive steps to address delinquency and default, borrowers can avoid these consequences and get back on track with their payments.

When does student loan repayment start again? For borrowers who are behind on their payments, it’s essential to take steps to address delinquency and default before payments resume. By exploring options like rehabilitation and consolidation, borrowers can get back on track with their payments and avoid serious financial consequences. By staying informed and taking proactive steps, borrowers can ensure a successful transition when payments start again.

In addition to rehabilitation and consolidation, borrowers who are behind on their payments may also want to consider other options, such as deferment or forbearance. These options can provide temporary relief from payments, but borrowers should be aware of the potential consequences of using these options, including the accrual of interest and the potential impact on credit scores.

How to Take Advantage of Income-Driven Repayment Plans

Income-driven repayment plans are a valuable tool for borrowers who are struggling to make their student loan payments. These plans, which include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), can help borrowers manage their payments by capping their monthly payments at a percentage of their income.

To be eligible for an income-driven repayment plan, borrowers must meet certain requirements, such as having a partial financial hardship and being enrolled in a qualifying repayment plan. Borrowers can apply for an income-driven repayment plan through their loan servicer or by completing an application on the Federal Student Aid website.

One of the benefits of income-driven repayment plans is that they can help borrowers lower their monthly payments. For example, under the IBR plan, borrowers’ monthly payments are capped at 10% of their discretionary income. This can be especially helpful for borrowers who are struggling to make their payments due to financial hardship.

In addition to lowering monthly payments, income-driven repayment plans can also provide borrowers with forgiveness benefits. For example, under the PAYE plan, borrowers may be eligible for forgiveness after 20 years of qualifying payments. This can be a valuable benefit for borrowers who are struggling to pay off their loans.

When does student loan repayment start again? For borrowers who are enrolled in an income-driven repayment plan, payments will resume when the pause on student loan payments ends. Borrowers should review their loan terms and budget to ensure they are prepared for the resumption of payments.

Income-driven repayment plans can be a valuable tool for borrowers who are struggling to make their student loan payments. By capping monthly payments at a percentage of income and providing forgiveness benefits, these plans can help borrowers manage their debt and achieve financial stability.

Strategies for Paying Off Student Loans Quickly

Paying off student loans quickly requires a strategic approach. Borrowers can consider several options to accelerate their payments and become debt-free sooner. One strategy is to make extra payments, which can be applied directly to the principal balance of the loan. This can help reduce the total interest paid over the life of the loan and pay off the loan faster.

Refinancing is another option for borrowers who want to pay off their student loans quickly. Refinancing involves replacing an existing loan with a new loan that has a lower interest rate and/or a shorter repayment term. This can help borrowers save money on interest and pay off their loans faster. However, refinancing may not be the best option for borrowers who are enrolled in income-driven repayment plans or who are pursuing Public Service Loan Forgiveness (PSLF).

Using tax deductions is another strategy for paying off student loans quickly. Borrowers may be eligible for tax deductions on the interest paid on their student loans, which can help reduce their taxable income and lower their tax liability. This can provide borrowers with more money in their budget to apply towards their student loan payments.

When does student loan repayment start again? For borrowers who are trying to pay off their loans quickly, it’s essential to stay on track with their payments and make extra payments whenever possible. By using strategies like refinancing, making extra payments, and using tax deductions, borrowers can pay off their loans faster and become debt-free sooner.

It’s also important for borrowers to consider the pros and cons of each strategy before making a decision. For example, refinancing may require borrowers to give up certain benefits, such as income-driven repayment plans or PSLF. Similarly, making extra payments may require borrowers to adjust their budget and make sacrifices in other areas.

By understanding the options available and making a plan, borrowers can pay off their student loans quickly and achieve financial freedom. Whether it’s through refinancing, making extra payments, or using tax deductions, there are several strategies that can help borrowers accelerate their payments and become debt-free sooner.

What to Do If You’re Struggling to Make Payments

If you’re struggling to make your student loan payments, there are several options available to help you get back on track. Deferment and forbearance are two options that can provide temporary relief from payments. Deferment allows borrowers to temporarily stop making payments due to financial hardship, while forbearance allows borrowers to temporarily reduce or suspend payments.

Loan forgiveness is another option for borrowers who are struggling to make payments. Public Service Loan Forgiveness (PSLF) is a program that forgives the remaining balance on a borrower’s loan after 120 qualifying payments. Borrowers who work in public service, such as teachers, nurses, and government employees, may be eligible for PSLF.

However, defaulting on student loans can have serious consequences, including damage to credit scores, wage garnishment, and tax refund offset. Borrowers who are struggling to make payments should seek help as soon as possible to avoid these consequences.

When does student loan repayment start again? For borrowers who are struggling to make payments, it’s essential to stay informed about the resumption of payments and to seek help if needed. By understanding the options available and taking proactive steps, borrowers can avoid default and get back on track with their payments.

Borrowers who are struggling to make payments should also consider reaching out to their loan servicer or a financial advisor for guidance. These professionals can help borrowers understand their options and develop a plan to get back on track with their payments.

In addition to deferment, forbearance, and loan forgiveness, borrowers may also want to consider income-driven repayment plans. These plans can help borrowers manage their payments by capping their monthly payments at a percentage of their income.

Staying on Top of Your Student Loan Repayment

Staying organized and informed about student loan repayment is crucial for borrowers who want to manage their debt effectively. Tracking payments, monitoring credit reports, and seeking help when needed are essential steps to ensure that borrowers stay on top of their repayment.

Borrowers can track their payments by logging into their loan servicer’s website or by using a payment tracking tool. This will help them stay on top of their payments and ensure that they are making timely payments.

Monitoring credit reports is also important for borrowers who want to ensure that their credit score is not affected by their student loan debt. Borrowers can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year.

Seeking help when needed is also crucial for borrowers who are struggling to make payments. Borrowers can reach out to their loan servicer or a financial advisor for guidance on managing their debt. There are also many resources available online, such as the Federal Student Aid website, that provide information and guidance on student loan repayment.

When does student loan repayment start again? For borrowers who are staying on top of their repayment, it’s essential to stay informed about the resumption of payments and to continue making timely payments. By tracking payments, monitoring credit reports, and seeking help when needed, borrowers can ensure that they are managing their debt effectively and avoiding any potential consequences.

By staying organized and informed, borrowers can take control of their student loan debt and ensure that they are on the path to financial freedom. Whether it’s through tracking payments, monitoring credit reports, or seeking help when needed, there are many resources available to help borrowers manage their debt and achieve their financial goals.