What is a Money Order and Why Do You Need One

A money order is a secure payment method that allows individuals to send or receive funds without the need for a bank account or credit card. It is a prepaid payment instrument that can be purchased at various locations, such as post offices, grocery stores, and pharmacies. Money orders are often used for transactions that require a guaranteed payment, such as paying bills, sending money to someone without a bank account, or making a purchase from a retailer that doesn’t accept personal checks or credit cards.

One of the primary benefits of using a money order is that it provides a secure way to make payments. Unlike personal checks, money orders cannot be cancelled or stopped, ensuring that the recipient receives the funds. Additionally, money orders are less susceptible to fraud and identity theft, as they require the purchaser to provide identification and proof of payment.

There are several scenarios where a money order may be required. For example, some landlords or property managers may only accept money orders as payment for rent. Similarly, some retailers may require a money order for purchases above a certain amount. In these cases, obtaining a money order is a straightforward process that can be completed at a variety of locations.

When considering how to get a money order, it’s essential to understand the benefits and requirements of this payment method. By using a money order, individuals can ensure that their payments are secure, guaranteed, and less susceptible to fraud. In the next section, we will provide a step-by-step guide on how to obtain a money order, including where to buy one and what you need to bring.

How to Get a Money Order: Step-by-Step Guide

Obtaining a money order is a relatively straightforward process that can be completed in a few simple steps. To get a money order, follow these steps:

Step 1: Determine the Amount and Payee

Before purchasing a money order, determine the exact amount you need to pay and the name of the payee. This information will be required to fill out the money order correctly.

Step 2: Choose a Location to Buy a Money Order

Money orders can be purchased at various locations, including post offices, grocery stores, pharmacies, and check cashing stores. Choose a location that is convenient for you and has the necessary services.

Step 3: Bring the Required Documents and Funds

To purchase a money order, you will need to bring a valid government-issued ID, the exact amount of cash to cover the purchase, and any additional fees. Some locations may also require a debit card or other payment method.

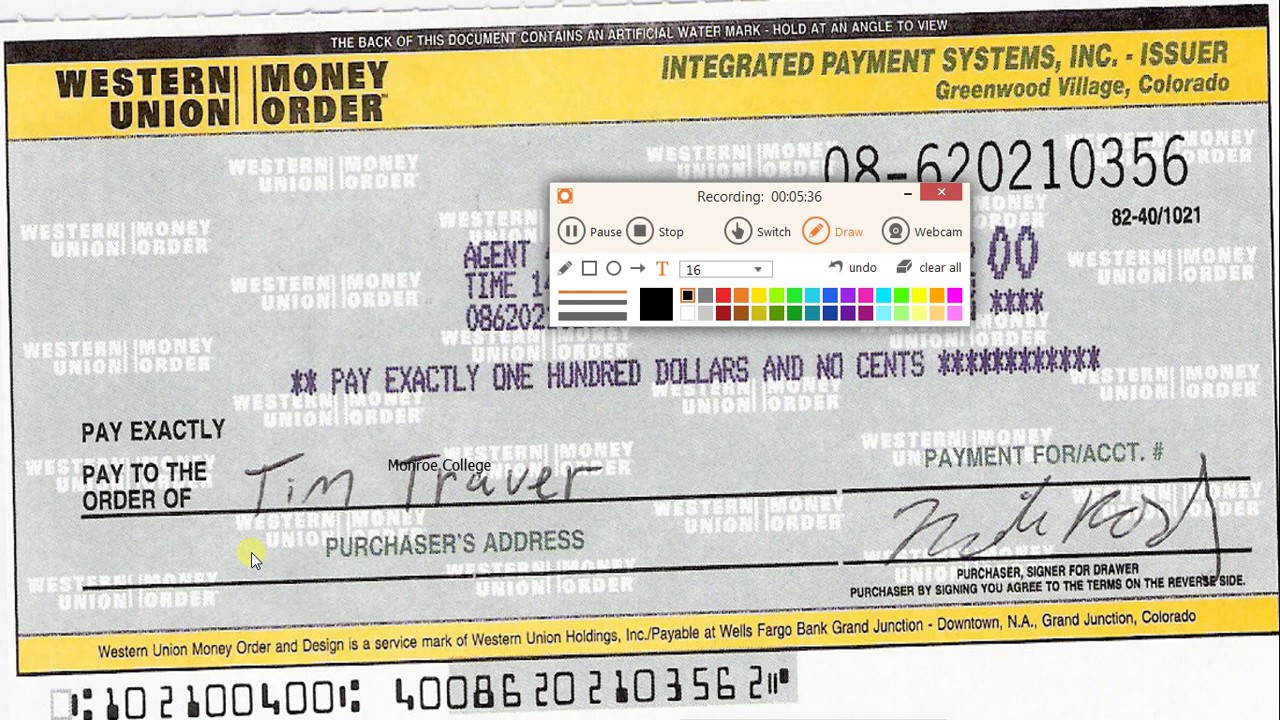

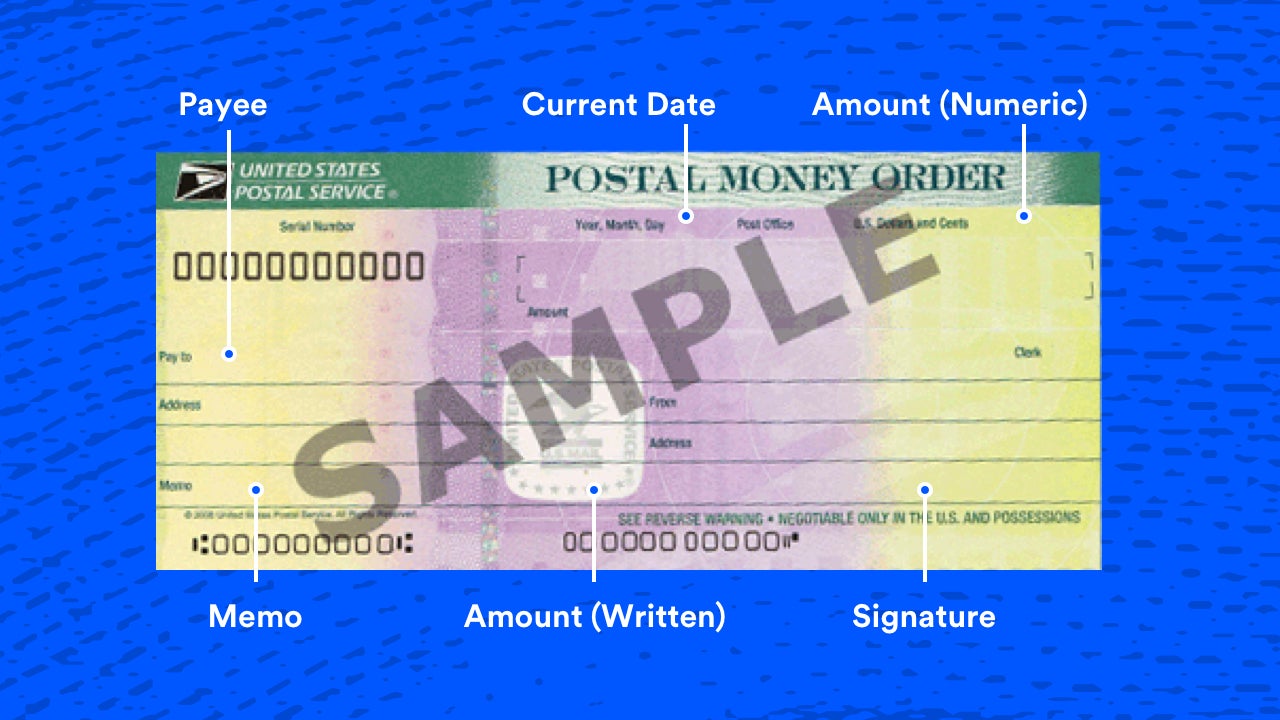

Step 4: Fill Out the Money Order

Once you have purchased the money order, fill it out carefully and accurately. Make sure to include the payee’s name, the amount, and your signature. Some money orders may also require additional information, such as the payee’s address.

Step 5: Review and Verify the Money Order

Before handing over the money order, review it carefully to ensure that all the information is correct. Verify the payee’s name, the amount, and your signature to avoid any potential issues.

By following these simple steps, you can obtain a money order quickly and easily. If you’re wondering “how can I get a money order,” the answer is simple: just follow these steps and you’ll have a secure and convenient way to make a payment.

Additional Tips:

When purchasing a money order, make sure to keep the receipt as proof of purchase. This can be helpful in case the money order is lost or stolen. Additionally, be aware of any fees associated with purchasing a money order, as these can vary depending on the location and type of money order.

By understanding how to get a money order, you can take advantage of this secure and convenient payment method. Whether you need to pay a bill, send money to someone without a bank account, or make a purchase from a retailer that doesn’t accept personal checks or credit cards, a money order is a reliable option.

Where to Buy a Money Order: Convenient Locations Near You

Money orders can be purchased at a variety of locations, making it easy to get one when you need it. Whether you’re looking for a convenient location near your home or office, there are several options to choose from.

Post Offices

The United States Postal Service (USPS) is one of the most popular places to buy a money order. With over 40,000 locations across the country, you’re likely to find a post office near you. USPS money orders are a secure and reliable way to make payments, and they can be cashed at any post office or participating location.

Grocery Stores

Many grocery stores, such as Walmart, Kroger, and Safeway, offer money order services. These stores often have extended hours of operation, making it easy to buy a money order at a time that’s convenient for you. Some grocery stores may also offer online money order services, allowing you to purchase a money order from the comfort of your own home.

Pharmacies

Pharmacies like CVS, Walgreens, and Rite Aid often offer money order services. These locations are typically open late or 24 hours, making it easy to buy a money order at a time that fits your schedule.

Check Cashing Stores

Check cashing stores, such as MoneyGram or Western Union, specialize in financial services, including money orders. These stores often have extended hours of operation and may offer additional services, such as bill payment and prepaid debit cards.

Convenience Stores

Some convenience stores, such as 7-Eleven or Circle K, may also offer money order services. These locations are often open 24 hours and may be a convenient option if you need to buy a money order outside of regular business hours.

Online Options

If you prefer to buy a money order online, there are several options available. Some online services, such as MoneyGram or Western Union, allow you to purchase a money order online and have it sent to the recipient or made available for pickup at a participating location.

When searching for a location to buy a money order, you can use online directories or search engines to find options near you. Simply type in “where can I buy a money order near me” or “money order locations near me” to find a list of nearby locations. You can also check the website of the specific location you’re interested in to confirm their hours of operation and money order services.

Money Order Fees and Limits: What You Need to Know

When purchasing a money order, it’s essential to understand the fees associated with this service. The cost of a money order can vary depending on the location, amount, and type of money order. Here’s a breakdown of the typical fees and limits you can expect:

Money Order Fees

The fee for a money order can range from $0.50 to $5.00, depending on the location and amount. For example, the United States Postal Service (USPS) charges a fee of $1.25 for money orders up to $500, while MoneyGram charges a fee of $1.50 for money orders up to $1,000.

Additional Fees

Some money order providers may charge additional fees for services like expedited shipping, tracking, or same-day delivery. These fees can range from $5.00 to $20.00, depending on the service and provider.

Maximum Amount Limits

Most money order providers have maximum amount limits, which vary depending on the provider and type of money order. For example, USPS money orders have a maximum limit of $1,000, while MoneyGram money orders have a maximum limit of $10,000.

Minimum Amount Limits

Some money order providers may have minimum amount limits, which can range from $1.00 to $10.00, depending on the provider and type of money order.

Other Fees to Consider

In addition to the fees mentioned above, you may also need to consider other costs, such as:

- Replacement fees: If you lose or damage a money order, you may need to pay a replacement fee to obtain a new one.

- Cancellation fees: If you need to cancel a money order, you may need to pay a cancellation fee.

- Refund fees: If you need to refund a money order, you may need to pay a refund fee.

Understanding the fees and limits associated with money orders can help you make informed decisions when using this service. By knowing what to expect, you can avoid unexpected costs and ensure a smooth transaction.

When searching for a money order provider, be sure to compare fees and limits to find the best option for your needs. You can also check the provider’s website or visit a physical location to confirm their fees and limits.

Alternatives to Money Orders: Digital Payment Options

While money orders are a secure and convenient way to make payments, there are also digital payment alternatives that offer similar benefits. In this section, we’ll explore some of the most popular digital payment options that can be used as alternatives to money orders.

Online Payment Services

Online payment services like PayPal, Google Pay, and Apple Pay allow users to send and receive money electronically. These services are often faster and more convenient than money orders, and can be used to make payments online or in-person.

Mobile Wallets

Mobile wallets like Venmo, Cash App, and Zelle allow users to store their payment information on their mobile devices and make payments with a few taps. These services are often more convenient than money orders, and can be used to make payments online or in-person.

Prepaid Debit Cards

Prepaid debit cards like Green Dot and NetSpend allow users to load funds onto a card and use it to make payments online or in-person. These cards can be used as an alternative to money orders, and offer the added benefit of being able to track spending and manage funds online.

Digital Payment Apps

Digital payment apps like Square Cash and Facebook Pay allow users to send and receive money electronically. These apps are often more convenient than money orders, and can be used to make payments online or in-person.

Benefits of Digital Payment Options

Digital payment options offer several benefits over traditional money orders, including:

- Convenience: Digital payment options are often faster and more convenient than money orders, and can be used to make payments online or in-person.

- Speed: Digital payment options are often faster than money orders, with funds available in real-time or within a few hours.

- Security: Digital payment options are often more secure than money orders, with advanced security measures like encryption and two-factor authentication.

- Tracking: Digital payment options often allow users to track spending and manage funds online, making it easier to stay on top of finances.

When to Use Digital Payment Options

Digital payment options are a great alternative to money orders in many situations, including:

- Online purchases: Digital payment options are often more convenient and secure than money orders for online purchases.

- Person-to-person payments: Digital payment options are often more convenient and secure than money orders for person-to-person payments.

- Business payments: Digital payment options are often more convenient and secure than money orders for business payments.

In conclusion, digital payment options are a convenient and secure alternative to money orders. By understanding the benefits and uses of digital payment options, individuals and businesses can make informed decisions about how to make payments and manage finances.

Money Order Scams and Safety Precautions

While money orders are a secure way to make payments, there are still some potential scams and safety concerns to be aware of. In this section, we’ll discuss some common money order scams and provide tips on how to protect yourself.

Common Money Order Scams

Here are some common money order scams to watch out for:

- Phony money orders: Scammers may create fake money orders that appear to be legitimate, but are actually worthless.

- Stolen money orders: Thieves may steal money orders and attempt to cash them or use them to make purchases.

- Money order scams via email or phone: Scammers may contact you via email or phone and ask you to purchase a money order to pay for a fake service or product.

Tips for Protecting Yourself

To avoid falling victim to a money order scam, follow these tips:

- Verify the authenticity of the money order: Make sure the money order is legitimate and has not been tampered with.

- Be cautious of unsolicited requests: Be wary of requests to purchase a money order from someone you don’t know, especially if they contact you via email or phone.

- Use a secure location: When purchasing a money order, use a secure location such as a post office or a reputable retailer.

- Keep your money order safe: Keep your money order in a safe place and do not leave it unattended.

What to Do If You’re a Victim of a Money Order Scam

If you believe you’ve been a victim of a money order scam, follow these steps:

- Contact the issuer: Reach out to the issuer of the money order (e.g. the post office or retailer) and report the scam.

- Contact your bank: If you’ve already cashed the money order, contact your bank and report the scam.

- File a complaint: File a complaint with the Federal Trade Commission (FTC) or your local consumer protection agency.

Conclusion

While money order scams can be a concern, there are steps you can take to protect yourself. By being aware of the potential scams and taking the necessary precautions, you can ensure a safe and secure transaction. Remember to always verify the authenticity of the money order, be cautious of unsolicited requests, and use a secure location when purchasing a money order.

Tracking and Cashing a Money Order: What to Expect

Once you’ve purchased a money order, you may need to track it or cash it. In this section, we’ll explain the process of tracking a money order and what to expect when cashing one.

Tracking a Money Order

Most money order issuers provide a tracking number that allows you to track the status of your money order. You can usually find the tracking number on the receipt or on the money order itself. To track your money order, follow these steps:

- Visit the issuer’s website: Go to the website of the money order issuer (e.g. Western Union or MoneyGram) and click on the “Track” or “Status” tab.

- Enter the tracking number: Enter the tracking number provided on the receipt or money order.

- View the status: The website will display the current status of your money order, including whether it has been cashed or not.

Cashing a Money Order

To cash a money order, you’ll need to take it to a location that accepts money orders. Here are the steps to follow:

- Find a location: Look for a location that accepts money orders, such as a bank, credit union, or check cashing store.

- Present the money order: Take the money order to the location and present it to the cashier or teller.

- Verify the money order: The cashier or teller will verify the money order to ensure it is legitimate and has not been tampered with.

- Receive the cash: Once the money order is verified, you’ll receive the cash equivalent of the money order.

Potential Issues or Delays

While cashing a money order is usually a straightforward process, there may be some potential issues or delays to be aware of:

- Verification issues: If the money order is not verified correctly, it may be delayed or rejected.

- Insufficient funds: If the money order is not funded correctly, it may be delayed or rejected.

- Location issues: If the location you choose to cash the money order does not accept money orders, you may need to find an alternative location.

Conclusion

Tracking and cashing a money order is a relatively straightforward process. By understanding the steps involved and being aware of potential issues or delays, you can ensure a smooth and secure transaction.

Conclusion: Getting a Money Order Made Easy

Obtaining a money order is a straightforward process that can be completed with ease. By understanding the benefits and uses of money orders, as well as the various places where they can be purchased, you can make informed decisions about how to use this secure and convenient payment method.

In this article, we’ve covered the basics of money orders, including what they are, why you might need one, and how to get one. We’ve also discussed the fees and limits associated with money orders, as well as digital payment alternatives and common scams to watch out for.

Whether you’re paying bills, sending money to someone without a bank account, or making a purchase from a retailer that doesn’t accept personal checks or credit cards, a money order can be a reliable and secure option. By following the steps outlined in this article, you can obtain a money order with confidence and complete your transaction with ease.

Remember, money orders are a widely accepted form of payment, and they can be used in a variety of situations. By understanding how to get a money order and how to use it, you can take advantage of this convenient and secure payment method.

In conclusion, getting a money order is a simple and straightforward process that can be completed with ease. By following the steps outlined in this article and being aware of the benefits and uses of money orders, you can make informed decisions about how to use this secure and convenient payment method.