What is a Money Order and How Does it Work?

A money order is a payment order for a specific amount of money, typically issued by a financial institution or a retail store. It is a secure and convenient way to make payments, especially for individuals who do not have access to traditional banking services or prefer not to use credit cards. When you purchase a money order, you pay the face value of the order plus a small fee, which varies depending on the issuer and the amount. The money order is then given to the recipient, who can cash it at a participating location.

The process of purchasing a money order is relatively straightforward. You can buy a money order from a variety of locations, including post offices, banks, and retail stores. To purchase a money order, you will need to provide the face value of the order plus the fee, which can be paid in cash or by debit card. Some issuers may also offer the option to purchase a money order online or by phone.

One of the benefits of using a money order is that it provides a secure way to make payments. Unlike personal checks, money orders are prepaid, which means that the recipient is guaranteed to receive the funds. Additionally, money orders are often preferred by recipients because they do not have to worry about the payment bouncing or being cancelled.

However, before purchasing a money order, it is essential to understand the costs involved. The cost of a money order can vary significantly depending on the issuer, location, and amount. In the next section, we will explore the factors that affect the cost of a money order and provide a detailed breakdown of the typical costs associated with purchasing a money order.

Factors Affecting the Cost of a Money Order

The cost of a money order can vary significantly depending on several factors. One of the primary factors that influence the cost of a money order is the issuer. Different issuers, such as Western Union, MoneyGram, and the United States Postal Service (USPS), charge varying fees for their money order services. For example, Western Union may charge a higher fee for a money order compared to the USPS.

Another factor that affects the cost of a money order is the location where it is purchased. Money orders purchased at a bank or credit union may have different fees compared to those purchased at a retail store or post office. Additionally, some issuers may charge higher fees for money orders purchased online or by phone.

The amount of the money order is also a significant factor in determining the cost. Generally, the larger the amount of the money order, the higher the fee. Some issuers may also have tiered pricing, where the fee increases as the amount of the money order increases.

Other factors that can impact the cost of a money order include the payment method used to purchase the order and any additional services requested, such as expedited delivery or tracking. It is essential to understand these factors to determine how much is money order and make informed decisions when using this payment method.

By understanding the factors that affect the cost of a money order, individuals can better navigate the process of purchasing a money order and avoid unexpected fees. In the next section, we will provide a detailed breakdown of the typical costs associated with purchasing a money order, including fees and charges from well-known issuers.

How Much Does a Money Order Cost?

The cost of a money order can vary depending on the issuer, location, and amount. Here is a breakdown of the typical costs associated with purchasing a money order from well-known issuers:

Western Union: The fee for a Western Union money order can range from $1.50 to $15.00, depending on the amount. For example, a money order for $100 would cost $5.00, while a money order for $1,000 would cost $15.00.

MoneyGram: The fee for a MoneyGram money order can range from $1.50 to $10.00, depending on the amount. For example, a money order for $100 would cost $3.00, while a money order for $1,000 would cost $10.00.

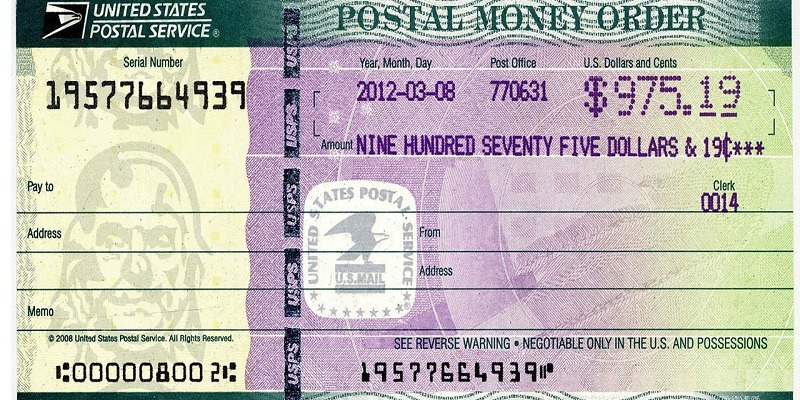

United States Postal Service (USPS): The fee for a USPS money order can range from $1.25 to $5.00, depending on the amount. For example, a money order for $100 would cost $1.25, while a money order for $1,000 would cost $5.00.

Bank of America: The fee for a Bank of America money order can range from $5.00 to $15.00, depending on the amount. For example, a money order for $100 would cost $5.00, while a money order for $1,000 would cost $15.00.

It’s essential to note that these fees are subject to change and may vary depending on the location and other factors. When determining how much is money order, it’s crucial to check with the issuer for the most up-to-date pricing information.

In addition to the fees mentioned above, some issuers may also charge additional fees for services such as expedited delivery or tracking. These fees can range from $1.00 to $10.00, depending on the issuer and the service.

By understanding the typical costs associated with purchasing a money order, individuals can make informed decisions when using this payment method. In the next section, we will compare the fees and charges of different money order issuers, including banks, post offices, and retail stores.

Comparing Money Order Fees: Issuers and Locations

When it comes to purchasing a money order, the fees and charges can vary significantly depending on the issuer and location. In this section, we will compare the fees and charges of different money order issuers, including banks, post offices, and retail stores.

Banks: Banks typically charge higher fees for money orders compared to other issuers. For example, Bank of America charges a fee of $5.00 to $15.00 for a money order, depending on the amount. Wells Fargo charges a fee of $5.00 to $10.00, while Chase Bank charges a fee of $5.00 to $12.00.

Post Offices: The United States Postal Service (USPS) charges a fee of $1.25 to $5.00 for a money order, depending on the amount. This is generally lower than the fees charged by banks.

Retail Stores: Retail stores such as Walmart and CVS typically charge lower fees for money orders compared to banks. For example, Walmart charges a fee of $1.00 to $3.00, while CVS charges a fee of $1.00 to $2.00.

Location: The location where you purchase a money order can also impact the cost. For example, purchasing a money order at a bank branch may result in a higher fee compared to purchasing one at a retail store.

It’s essential to compare the fees and charges of different issuers and locations to determine how much is money order and make informed decisions when using this payment method. By doing so, you can save money and avoid unnecessary fees.

In addition to comparing fees and charges, it’s also important to consider other factors such as convenience, security, and customer service when choosing a money order issuer. In the next section, we will provide tips and advice on how to save money when purchasing a money order.

Maximizing Value: Tips for Saving on Money Orders

When purchasing a money order, there are several ways to save money and maximize value. Here are some tips to consider:

Buy in bulk: If you need to purchase multiple money orders, consider buying them in bulk. Many issuers offer discounts for bulk purchases, which can help you save money.

Use discounts: Some issuers offer discounts for certain types of customers, such as students or military personnel. Be sure to ask about any available discounts when purchasing a money order.

Avoid unnecessary fees: Some issuers charge extra fees for services such as expedited delivery or tracking. If you don’t need these services, be sure to opt out to avoid unnecessary fees.

Compare prices: Before purchasing a money order, compare prices among different issuers to ensure you’re getting the best deal.

Consider alternative payment methods: Depending on your needs, alternative payment methods such as cashier’s checks or digital payments may be more cost-effective than a money order.

Keep receipts: Be sure to keep receipts for your money order purchases, as these can be useful for tracking and record-keeping purposes.

By following these tips, you can save money and maximize value when purchasing a money order. Remember to always compare prices and consider alternative payment methods to ensure you’re getting the best deal.

In addition to saving money, it’s also important to consider the benefits and drawbacks of different payment methods. In the next section, we will discuss alternative payment methods and weigh the pros and cons of each option.

Alternatives to Money Orders: Weighing the Options

While money orders can be a convenient and secure way to make payments, there are alternative payment methods that may be more suitable for certain situations. Here are some alternatives to money orders and their pros and cons:

Cashier’s Checks: A cashier’s check is a type of check that is guaranteed by the bank and can be used to make payments. The pros of using a cashier’s check include the fact that it is guaranteed by the bank, making it a secure form of payment. However, the cons include the fact that it may take several days to clear and may require a bank account.

Personal Checks: A personal check is a type of check that is drawn from an individual’s bank account. The pros of using a personal check include the fact that it is a convenient and widely accepted form of payment. However, the cons include the fact that it may take several days to clear and may be subject to bounced check fees.

Digital Payments: Digital payments, such as online banking and mobile payments, are becoming increasingly popular. The pros of using digital payments include the fact that they are fast, convenient, and secure. However, the cons include the fact that they may require a bank account and may be subject to fees.

When deciding whether to use a money order or an alternative payment method, it’s essential to consider the pros and cons of each option. For example, if you need to make a payment quickly and securely, a money order may be the best option. However, if you need to make a payment to someone who does not have a bank account, a cashier’s check or personal check may be a better option.

Ultimately, the choice of payment method will depend on your specific needs and circumstances. By understanding the pros and cons of each option, you can make an informed decision and choose the best payment method for your needs.

In the next section, we will discuss common mistakes to avoid when buying a money order and provide advice on how to avoid these mistakes.

Common Mistakes to Avoid When Buying a Money Order

When buying a money order, there are several common mistakes that people make. Here are some of the most common mistakes to avoid:

Not checking the issuer’s fees: Before buying a money order, it’s essential to check the issuer’s fees. Different issuers charge different fees, and some may be more expensive than others.

Not keeping receipts: It’s crucial to keep receipts for your money order purchases. This will help you track your spending and ensure that you have a record of your transactions.

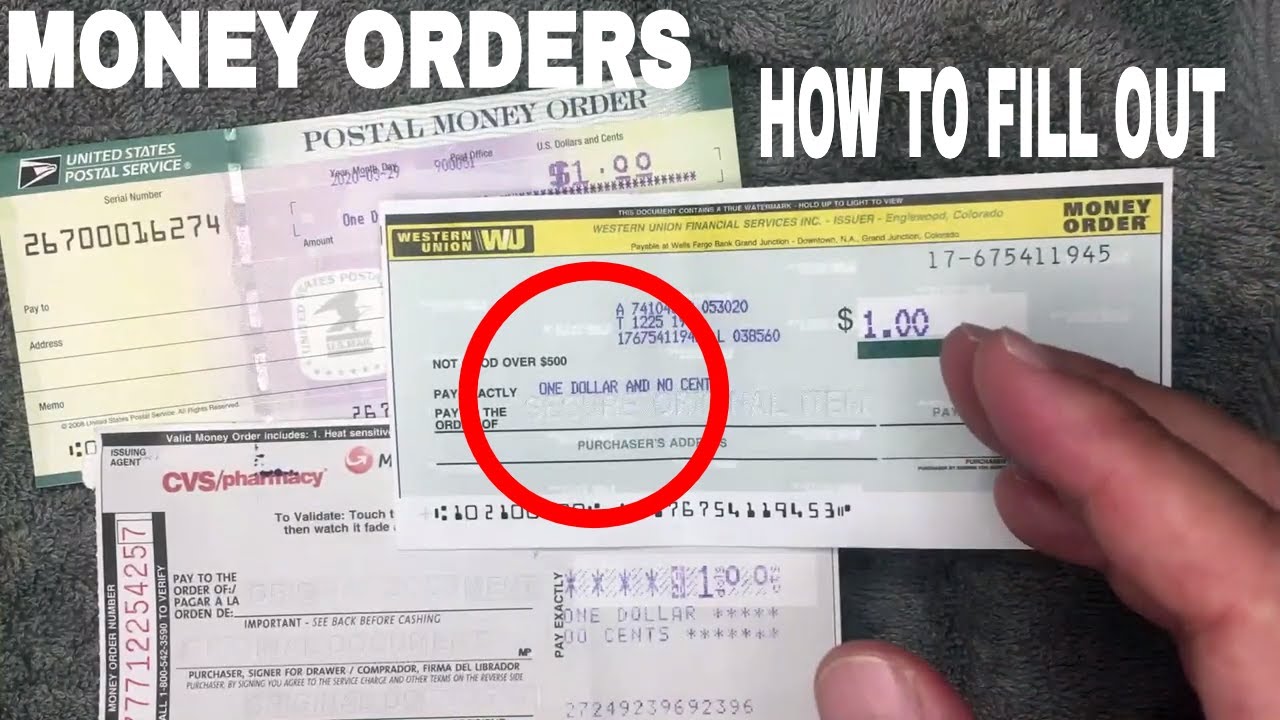

Not verifying the recipient’s information: Before sending a money order, make sure to verify the recipient’s information. This includes their name, address, and any other relevant details.

Not using a secure payment method: When buying a money order, make sure to use a secure payment method. This includes using a credit or debit card, or paying with cash.

Not checking the expiration date: Some money orders have an expiration date. Make sure to check the expiration date before buying a money order to ensure that it will be valid when you need it.

By avoiding these common mistakes, you can ensure that your money order purchase is smooth and hassle-free. Remember to always check the issuer’s fees, keep receipts, verify the recipient’s information, use a secure payment method, and check the expiration date.

In the next section, we will summarize the key points of the article and emphasize the importance of understanding the costs and benefits of money orders.

Conclusion: Making Informed Decisions About Money Orders

In conclusion, understanding the cost of money orders is crucial for making informed decisions about your financial needs. By considering the factors that influence the cost of a money order, such as the issuer, location, and amount, you can make smart choices about when to use a money order and how to minimize costs.

Additionally, being aware of the common mistakes people make when purchasing a money order can help you avoid unnecessary fees and ensure a smooth transaction. By following the tips and advice outlined in this article, you can maximize the value of your money order and make the most of this convenient payment method.

Remember, a money order can be a secure and convenient way to make payments, but it’s essential to understand the costs and benefits involved. By doing so, you can make informed decisions about your financial needs and avoid unnecessary expenses.

By now, you should have a clear understanding of how much is money order and how to use this payment method effectively. Whether you’re sending money to a friend or family member, or making a payment to a business, a money order can be a reliable and secure option.

We hope this article has provided you with valuable insights and information about money orders. By making informed decisions about your financial needs, you can achieve your goals and secure your financial future.

/MoneyOrderFilledOut-582cf3b75f9b58d5b15bfef3.jpg)