Understanding the Benefits of Certificates of Deposit

Certificates of deposit (CDs) are a type of savings account offered by banks and credit unions that provide a fixed interest rate for a specific period of time. CDs are known for their low risk and stable returns, making them an attractive option for investors seeking to grow their savings over time. One of the primary benefits of CDs is the fixed interest rate, which is typically higher than traditional savings accounts. This means that investors can earn a guaranteed return on their investment, without the risk of market fluctuations.

In addition to fixed interest rates, CDs also offer the security of FDIC insurance, which protects deposits up to $250,000. This provides investors with peace of mind, knowing that their investment is insured against bank failure. CDs can be a valuable addition to a diversified investment portfolio, providing a stable source of returns and reducing overall risk.

When considering a CD, it’s essential to evaluate the interest rate and term length to ensure it aligns with your financial goals. CDs with longer term lengths typically offer higher interest rates, but may require investors to keep their money locked in the account for an extended period. Understanding the benefits and trade-offs of CDs can help investors make informed decisions about their savings strategy.

Bank certificate of deposit rates can vary significantly depending on the institution and market conditions. Investors should research and compare rates from different banks and credit unions to find the best option for their needs. By doing so, they can maximize their returns and achieve their long-term financial objectives.

How to Choose the Best CD Rates for Your Needs

When selecting a certificate of deposit (CD), it’s essential to consider several factors to ensure you’re getting the best CD rates for your needs. One of the most critical factors is the interest rate, which can vary significantly depending on the bank, credit union, and market conditions. Investors should research and compare rates from different institutions to find the best option for their financial goals.

In addition to interest rates, investors should also consider the term length of the CD. CDs with longer term lengths typically offer higher interest rates, but may require investors to keep their money locked in the account for an extended period. Understanding the trade-offs between interest rates and term lengths can help investors make informed decisions about their savings strategy.

Minimum deposit requirements are another important factor to consider when choosing a CD. Some banks and credit unions may require a minimum deposit to open a CD, which can range from a few hundred to several thousand dollars. Investors should ensure they have enough funds to meet the minimum deposit requirements and avoid any potential penalties.

Early withdrawal penalties are also a crucial consideration when selecting a CD. Investors should understand the penalties associated with withdrawing funds before maturity, as these can impact returns and potentially result in losses. By understanding the early withdrawal penalties, investors can make informed decisions about their investment strategy.

Bank certificate of deposit rates can vary significantly depending on the institution and market conditions. Investors should research and compare rates from different banks and credit unions to find the best option for their needs. By doing so, they can maximize their returns and achieve their long-term financial objectives.

Top Banks Offering Competitive CD Rates

Several top banks offer competitive CD rates, making it easier for investors to find a high-yield investment option that meets their needs. Ally Bank, for example, offers a range of CD products with competitive interest rates and flexible term lengths. Their CDs are FDIC-insured, providing investors with peace of mind and protection for their deposits.

Marcus by Goldman Sachs is another top bank offering competitive CD rates. Their CDs have no minimum deposit requirements and offer competitive interest rates, making them an attractive option for investors. Additionally, Marcus CDs are FDIC-insured, providing investors with protection for their deposits.

Discover Bank is also a top bank offering competitive CD rates. Their CDs have a range of term lengths, from 3 months to 10 years, and offer competitive interest rates. Discover Bank CDs are FDIC-insured, providing investors with protection for their deposits.

When considering a CD from one of these top banks, investors should evaluate the interest rate, term length, and minimum deposit requirements to ensure it aligns with their financial goals. By doing so, they can maximize their returns and achieve their long-term financial objectives.

Bank certificate of deposit rates can vary significantly depending on the institution and market conditions. Investors should research and compare rates from different banks and credit unions to find the best option for their needs. By doing so, they can maximize their returns and achieve their long-term financial objectives.

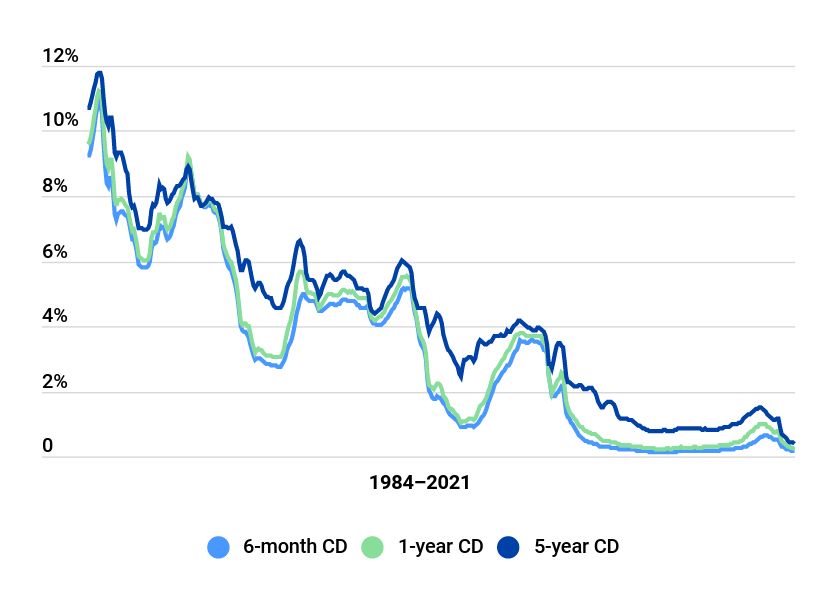

The Impact of Interest Rate Changes on CD Rates

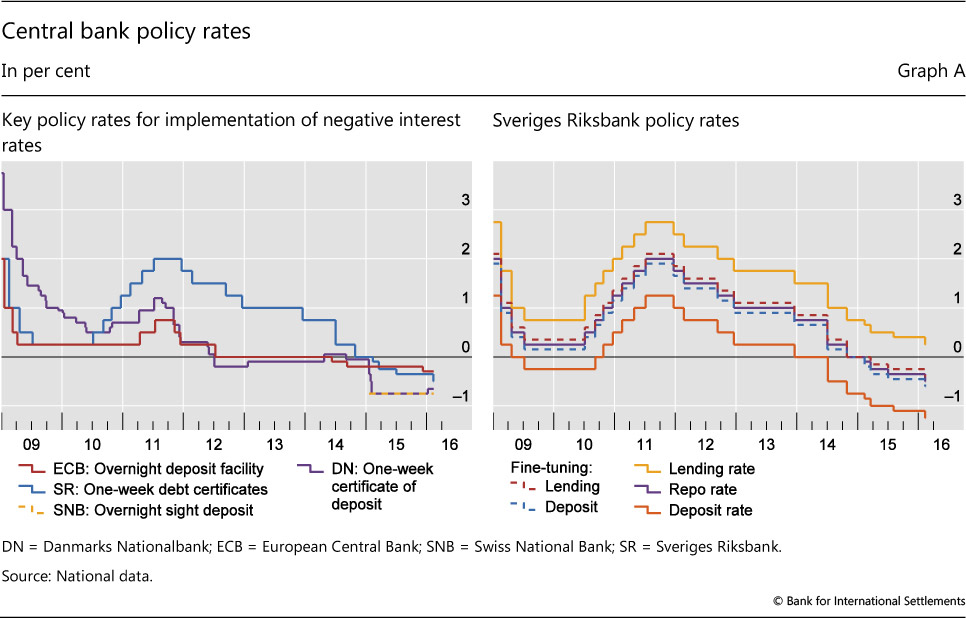

Changes in interest rates can have a significant impact on CD rates, making it essential for investors to understand how these changes can affect their investments. The Federal Reserve plays a crucial role in setting interest rates, and their decisions can influence the overall interest rate environment. When the Federal Reserve lowers interest rates, CD rates tend to decrease, making it less attractive for investors to invest in CDs. On the other hand, when the Federal Reserve raises interest rates, CD rates tend to increase, making CDs a more attractive investment option.

Investors can navigate changing interest rates by considering the interest rate environment when investing in CDs. For example, if interest rates are expected to rise, investors may consider investing in shorter-term CDs to take advantage of potentially higher interest rates in the future. Conversely, if interest rates are expected to fall, investors may consider investing in longer-term CDs to lock in higher interest rates.

Bank certificate of deposit rates can also be affected by changes in interest rates. When interest rates rise, banks may increase their CD rates to remain competitive, making CDs a more attractive investment option. However, when interest rates fall, banks may decrease their CD rates, making CDs less attractive. By understanding how changes in interest rates can affect CD rates, investors can make informed decisions about their investments.

Investors should also consider the impact of interest rate changes on their overall investment portfolio. For example, if interest rates rise, investors may consider rebalancing their portfolio to take advantage of higher interest rates. Conversely, if interest rates fall, investors may consider adjusting their portfolio to minimize losses.

By understanding the impact of interest rate changes on CD rates, investors can make informed decisions about their investments and maximize their returns.

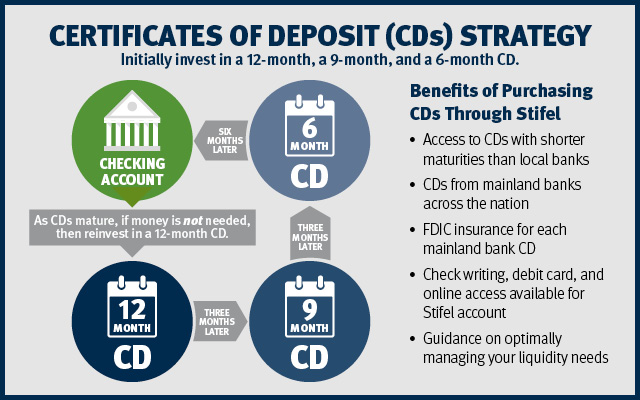

CD Laddering: A Strategy for Maximizing Returns

CD laddering is a strategy that involves investing in multiple CDs with staggered maturity dates to maximize returns and minimize risk. This strategy can help investors take advantage of higher interest rates while also providing liquidity and flexibility. By investing in multiple CDs with different maturity dates, investors can create a ladder-like structure that allows them to access their funds at different times.

For example, an investor could invest in a 1-year CD, a 2-year CD, and a 3-year CD, with each CD maturing at a different time. This would create a ladder-like structure that allows the investor to access their funds at different times, while also taking advantage of higher interest rates. By staggering the maturity dates, investors can minimize the impact of interest rate changes and maximize their returns.

CD laddering can also help investors manage risk by spreading their investments across multiple CDs with different maturity dates. This can help reduce the impact of interest rate changes and provide a more stable return on investment. By diversifying their investments across multiple CDs, investors can minimize risk and maximize their returns.

Bank certificate of deposit rates can also be affected by CD laddering. By investing in multiple CDs with different maturity dates, investors can take advantage of higher interest rates and maximize their returns. By staggering the maturity dates, investors can minimize the impact of interest rate changes and provide a more stable return on investment.

Overall, CD laddering is a strategy that can help investors maximize their returns and minimize risk. By investing in multiple CDs with staggered maturity dates, investors can take advantage of higher interest rates and provide a more stable return on investment.

Early Withdrawal Penalties: What You Need to Know

Early withdrawal penalties are a crucial aspect of certificates of deposit (CDs) that investors need to understand before investing. These penalties are fees charged by banks and credit unions when investors withdraw their funds before the CD’s maturity date. Understanding early withdrawal penalties can help investors make informed decisions about their investments and avoid potential losses.

Early withdrawal penalties can vary depending on the bank, credit union, and CD product. Some CDs may have a fixed penalty, while others may have a tiered penalty structure based on the amount withdrawn. Investors should carefully review the terms and conditions of their CD before investing to understand the early withdrawal penalties associated with it.

The impact of early withdrawal penalties on returns can be significant. For example, if an investor withdraws their funds from a 5-year CD after 2 years, they may be charged a penalty of 1-2 years’ worth of interest. This can result in a loss of principal and interest, making it essential for investors to carefully consider their investment horizon before investing in a CD.

Bank certificate of deposit rates can also be affected by early withdrawal penalties. Investors should consider the potential penalties associated with early withdrawal when evaluating CD rates. By understanding the early withdrawal penalties, investors can make informed decisions about their investments and avoid potential losses.

Overall, early withdrawal penalties are an essential aspect of CDs that investors need to understand before investing. By carefully reviewing the terms and conditions of their CD and understanding the potential penalties, investors can make informed decisions about their investments and maximize their returns.

CD Rates vs. Other Investment Options: A Comparison

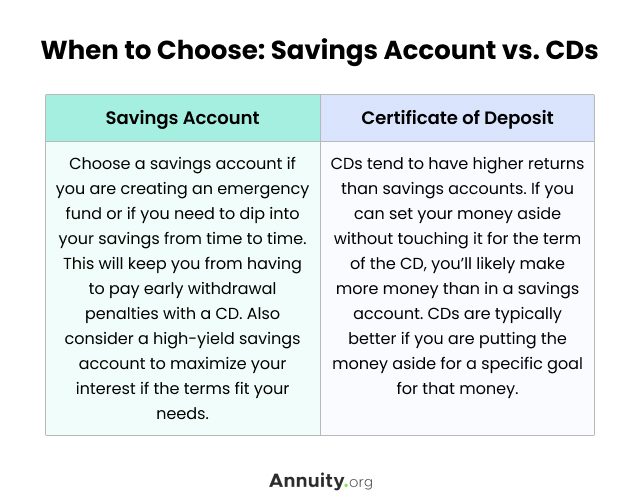

When it comes to investing, there are many options available, each with its own benefits and drawbacks. Certificates of deposit (CDs) are a popular investment option that offers a fixed interest rate and low risk. However, how do CD rates compare to other investment options, such as high-yield savings accounts, money market accounts, and Treasury bills?

High-yield savings accounts are a type of savings account that offers a higher interest rate than a traditional savings account. They are liquid, meaning that investors can access their funds at any time, and are typically FDIC-insured, providing protection for deposits up to $250,000. However, high-yield savings accounts typically offer lower interest rates than CDs, making them a less attractive option for investors seeking higher returns.

Money market accounts are another type of investment option that offers a higher interest rate than a traditional savings account. They are also liquid and typically FDIC-insured, providing protection for deposits up to $250,000. However, money market accounts often require a minimum balance and may have restrictions on withdrawals, making them less flexible than high-yield savings accounts.

Treasury bills are a type of short-term investment option that offers a fixed interest rate and low risk. They are backed by the full faith and credit of the US government, making them an extremely low-risk investment option. However, Treasury bills typically offer lower interest rates than CDs, making them a less attractive option for investors seeking higher returns.

Bank certificate of deposit rates can vary significantly depending on the institution and market conditions. Investors should research and compare rates from different banks and credit unions to find the best option for their needs. By doing so, they can maximize their returns and achieve their long-term financial objectives.

Overall, CDs offer a unique combination of fixed interest rates, low risk, and FDIC insurance, making them an attractive investment option for investors seeking stability and security. While other investment options, such as high-yield savings accounts, money market accounts, and Treasury bills, may offer some benefits, they may not offer the same level of returns and security as CDs.

Conclusion: Maximizing Your Savings with CDs

In conclusion, certificates of deposit (CDs) are a stable and secure investment option that can provide a fixed interest rate and low risk. By understanding the benefits of CDs, including fixed interest rates, low risk, and FDIC insurance, investors can make informed decisions about their investments. Additionally, by considering factors such as interest rate, term length, minimum deposit requirements, and early withdrawal penalties, investors can choose the best CD rates for their needs.

CD laddering is a strategy that can help investors maximize their returns and minimize risk. By investing in multiple CDs with staggered maturity dates, investors can take advantage of higher interest rates and reduce the impact of interest rate changes. Early withdrawal penalties are also an important consideration, and investors should understand the potential consequences of withdrawing funds before maturity.

Bank certificate of deposit rates can vary significantly depending on the institution and market conditions. Investors should research and compare rates from different banks and credit unions to find the best option for their needs. By doing so, they can maximize their returns and achieve their long-term financial objectives.

Overall, CDs can be a valuable addition to a diversified investment portfolio. By understanding the benefits and risks of CDs, investors can make informed decisions about their investments and achieve their financial goals. Whether you’re looking for a low-risk investment option or a way to maximize your returns, CDs are definitely worth considering.