Unlocking the Benefits of Long-Term CD Investments

Investing in certificates of deposit (CDs) can be a valuable addition to a diversified savings portfolio. One of the most attractive options is the 3-year CD, which offers a higher interest rate compared to shorter-term CDs. With a 3-year CD, investors can earn a fixed interest rate for a set period, providing a low-risk investment opportunity. The best 3 year CD rates can help investors maximize their returns, making it an attractive option for those seeking a stable investment.

One of the primary benefits of investing in 3-year CDs is the guaranteed returns. Unlike other investments, such as stocks or mutual funds, CDs offer a fixed interest rate, ensuring that investors will earn a predetermined return on their investment. Additionally, CDs are insured by the FDIC or NCUA, providing an added layer of security and protection for investors.

Another advantage of 3-year CDs is the low risk involved. Unlike other investments, CDs are not subject to market fluctuations, ensuring that investors will not lose principal. This makes 3-year CDs an attractive option for those seeking a low-risk investment opportunity. Furthermore, the fixed interest rate provides a predictable return, allowing investors to plan for the future with confidence.

When searching for the best 3 year CD rates, it’s essential to consider the interest rate, fees, and minimum deposit requirements. A higher interest rate can provide a higher return on investment, while lower fees can help minimize costs. Additionally, some CDs may offer more flexible terms, such as the ability to withdraw funds before maturity without incurring a penalty.

By investing in a 3-year CD, investors can earn a higher interest rate than a traditional savings account, making it an attractive option for those seeking to maximize their returns. With the best 3 year CD rates, investors can earn a fixed interest rate for a set period, providing a low-risk investment opportunity. Whether you’re saving for a specific goal or seeking to diversify your portfolio, a 3-year CD can be a valuable addition to your investment strategy.

How to Choose the Best 3-Year CD Rates for Your Needs

When searching for the best 3 year CD rates, it’s essential to consider several factors to ensure you find the right option for your savings goals. Evaluating interest rates, fees, and minimum deposit requirements can help you make an informed decision. Here are some tips to consider when selecting the best 3-year CD rates:

Interest Rate: The interest rate is a critical factor in determining the best 3-year CD rates. Look for CDs with competitive interest rates that align with your savings goals. Consider the annual percentage yield (APY) and the compounding frequency to ensure you’re getting the best rate.

Fees: Some CDs may come with fees, such as maintenance fees, overdraft fees, or early withdrawal penalties. Be sure to review the fee structure before investing in a CD. Look for CDs with low or no fees to minimize costs.

Minimum Deposit Requirements: Some CDs may require a minimum deposit to open or maintain the account. Consider the minimum deposit requirements and ensure they align with your savings goals. Look for CDs with low or no minimum deposit requirements to provide more flexibility.

Research and Compare Rates: Researching and comparing rates from different banks and credit unions can help you find the best 3-year CD rates. Use online resources, such as bank websites or financial comparison tools, to compare rates and terms. Consider working with a financial advisor or broker to help you find the best CD rates.

Reputation and Stability: Consider the reputation and stability of the bank or credit union offering the CD. Look for institutions with a strong track record of stability and a high rating from reputable rating agencies. This can provide added security and protection for your investment.

Flexibility: Consider the flexibility of the CD, including the ability to withdraw funds before maturity or add funds to the account. Look for CDs with flexible terms to provide more options for your savings goals.

By considering these factors and researching the best 3 year CD rates, you can find the right option for your savings goals. Remember to evaluate interest rates, fees, and minimum deposit requirements, and research and compare rates from different banks and credit unions. With the right CD, you can maximize your returns and achieve your savings goals.

Top 3-Year CD Rates from Reputable Banks and Credit Unions

When searching for the best 3 year CD rates, it’s essential to consider reputable banks and credit unions that offer competitive rates and terms. Here are some top 3-year CD rates from well-established institutions:

Ally Bank: Ally Bank offers a 3-year CD with a competitive interest rate of 2.50% APY and a low minimum deposit requirement of $1,000. Ally Bank is a reputable online bank with a strong track record of stability and a high rating from reputable rating agencies.

Marcus by Goldman Sachs: Marcus by Goldman Sachs offers a 3-year CD with a competitive interest rate of 2.55% APY and a low minimum deposit requirement of $500. Marcus is a well-established online bank with a strong reputation for providing competitive rates and terms.

Discover Bank: Discover Bank offers a 3-year CD with a competitive interest rate of 2.60% APY and a low minimum deposit requirement of $2,500. Discover Bank is a reputable online bank with a strong track record of stability and a high rating from reputable rating agencies.

Barclays Bank: Barclays Bank offers a 3-year CD with a competitive interest rate of 2.50% APY and a low minimum deposit requirement of $1,000. Barclays Bank is a well-established bank with a strong reputation for providing competitive rates and terms.

CIT Bank: CIT Bank offers a 3-year CD with a competitive interest rate of 2.55% APY and a low minimum deposit requirement of $1,000. CIT Bank is a reputable online bank with a strong track record of stability and a high rating from reputable rating agencies.

These are just a few examples of top 3-year CD rates from reputable banks and credit unions. When searching for the best 3 year CD rates, it’s essential to research and compare rates from different institutions to find the best option for your savings goals.

Remember to evaluate the interest rate, fees, and minimum deposit requirements when selecting a 3-year CD. Additionally, consider the reputation and stability of the institution, as well as the flexibility of the CD terms. By doing your research and comparing rates, you can find the best 3-year CD rates for your savings goals.

Understanding CD Laddering: A Strategy for Maximizing Returns

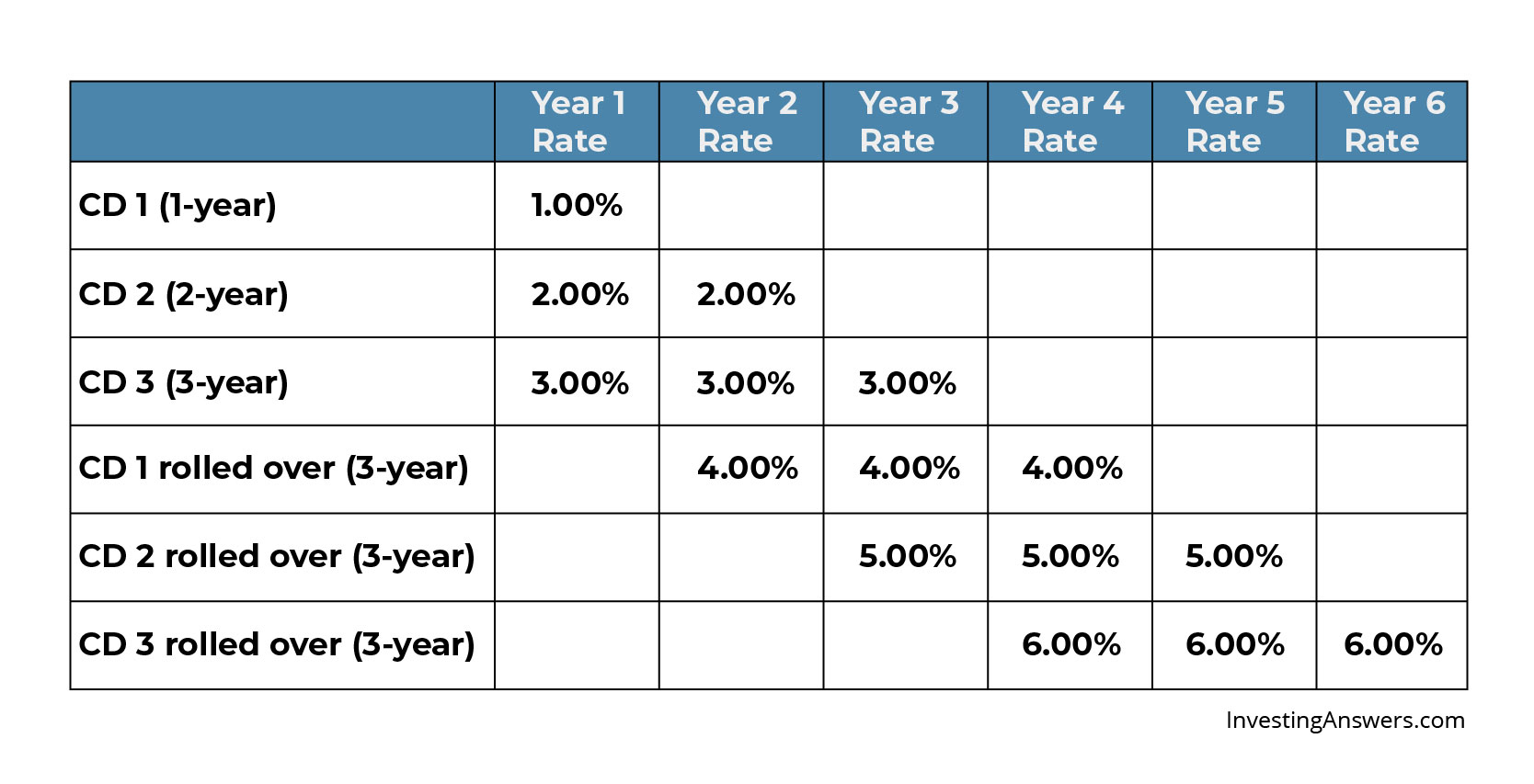

CD laddering is a strategy that involves staggering the maturities of multiple CDs to maximize returns and minimize risk. By investing in a series of CDs with different maturity dates, investors can create a ladder-like structure that provides a steady stream of income and helps to mitigate the impact of interest rate fluctuations.

Here’s an example of how to implement a CD laddering strategy with 3-year CDs:

Invest $10,000 in a 3-year CD with a competitive interest rate of 2.50% APY. At the same time, invest $5,000 in a 2-year CD with a competitive interest rate of 2.25% APY, and $5,000 in a 1-year CD with a competitive interest rate of 2.00% APY.

When the 1-year CD matures, reinvest the principal and interest in a new 3-year CD with a competitive interest rate. Repeat this process when the 2-year CD matures, and again when the original 3-year CD matures.

By staggering the maturities of the CDs, investors can create a steady stream of income and minimize the impact of interest rate fluctuations. This strategy can also help to reduce the risk of investing in a single CD, as the investor is not tied to a single interest rate for an extended period.

CD laddering can be a powerful tool for maximizing returns and minimizing risk. By understanding how to implement this strategy, investors can make the most of their CD investments and achieve their long-term financial goals.

When implementing a CD laddering strategy, it’s essential to consider the interest rates, fees, and minimum deposit requirements of each CD. Investors should also consider their individual financial goals and risk tolerance when determining the optimal CD laddering strategy.

By incorporating CD laddering into their investment strategy, investors can create a diversified portfolio that provides a steady stream of income and helps to minimize risk. This strategy can be particularly useful for investors who are seeking to maximize their returns while minimizing their risk exposure.

The Impact of Interest Rate Changes on 3-Year CD Rates

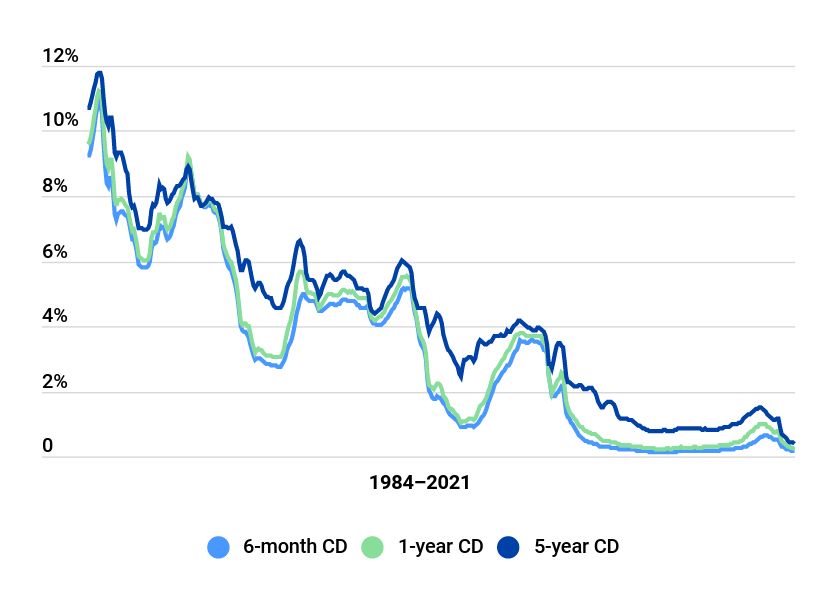

Interest rate changes can have a significant impact on 3-year CD rates and investor returns. When interest rates rise, CD rates tend to increase, providing investors with higher returns. Conversely, when interest rates fall, CD rates tend to decrease, resulting in lower returns.

The relationship between federal interest rates and CD rates is complex, but generally, CD rates tend to follow the direction of federal interest rates. When the Federal Reserve raises interest rates, CD rates tend to increase, and when the Federal Reserve lowers interest rates, CD rates tend to decrease.

However, CD rates can also be influenced by other factors, such as inflation, economic growth, and market conditions. For example, during periods of high inflation, CD rates may increase to keep pace with rising prices. Similarly, during periods of economic growth, CD rates may increase to reflect the increased demand for loans and credit.

To navigate rate fluctuations, investors can consider the following strategies:

Diversify your portfolio: By investing in a mix of short-term and long-term CDs, investors can reduce their exposure to interest rate risk.

Consider a CD ladder: By staggering the maturities of multiple CDs, investors can create a ladder-like structure that provides a steady stream of income and helps to mitigate the impact of interest rate fluctuations.

Monitor interest rates: Keep an eye on interest rate changes and adjust your investment strategy accordingly. When interest rates are rising, consider investing in shorter-term CDs to take advantage of higher rates. When interest rates are falling, consider investing in longer-term CDs to lock in higher rates.

By understanding the impact of interest rate changes on 3-year CD rates, investors can make informed decisions and maximize their returns. Remember to always research and compare rates from different banks and credit unions to find the best 3 year CD rates for your individual savings goals.

Early Withdrawal Penalties: What You Need to Know

When investing in a 3-year CD, it’s essential to understand the early withdrawal penalties associated with these accounts. Early withdrawal penalties are fees charged by banks and credit unions when an investor withdraws their money before the CD matures.

Early withdrawal penalties can be substantial, and they can eat into your returns. For example, if you withdraw your money from a 3-year CD after one year, you may be charged a penalty of 6-12 months’ interest. This can be a significant amount, especially if you’re earning a high interest rate.

However, there are ways to avoid or minimize early withdrawal penalties. Here are some tips:

Understand the penalty structure: Before investing in a 3-year CD, make sure you understand the penalty structure. Know how much you’ll be charged if you withdraw your money early, and when the penalties will be waived.

Choose a CD with a flexible withdrawal policy: Some CDs offer flexible withdrawal policies that allow you to withdraw your money without penalty. Look for CDs with these features to minimize your risk.

Consider a CD with a lower penalty: If you’re concerned about early withdrawal penalties, consider investing in a CD with a lower penalty. These CDs may offer lower interest rates, but they can provide more flexibility.

Plan ahead: Before investing in a 3-year CD, make sure you have a plan in place for your money. Consider your financial goals and whether you’ll need access to your money before the CD matures.

By understanding early withdrawal penalties and planning ahead, you can minimize your risk and maximize your returns. Remember to always research and compare rates from different banks and credit unions to find the best 3 year CD rates for your individual savings goals.

CD Rate Trends: What to Expect in the Coming Year

As we look to the coming year, it’s essential to analyze current CD rate trends and provide insights on what to expect. The CD market is influenced by various economic factors, including inflation, interest rate changes, and market conditions.

Currently, CD rates are at historic lows, and it’s uncertain whether they will rise or fall in the coming year. However, there are a few factors that could impact CD rates:

Inflation: If inflation rises, CD rates may increase to keep pace with the rising cost of living. This could be beneficial for investors who are looking for higher returns.

Interest Rate Changes: The Federal Reserve’s decisions on interest rates can significantly impact CD rates. If the Fed raises interest rates, CD rates may increase, and if they lower interest rates, CD rates may decrease.

Market Conditions: Market conditions, such as the overall state of the economy and the demand for loans, can also impact CD rates. If the economy is strong, CD rates may increase, and if the economy is weak, CD rates may decrease.

Based on these factors, here are some potential CD rate trends to expect in the coming year:

Short-term CD rates may remain low, as the Fed is likely to keep interest rates low to stimulate economic growth.

Long-term CD rates may increase, as investors seek higher returns in a low-interest-rate environment.

CD rates may become more competitive, as banks and credit unions compete for deposits in a crowded market.

By understanding these trends and factors, investors can make informed decisions about their CD investments and maximize their returns. Remember to always research and compare rates from different banks and credit unions to find the best 3 year CD rates for your individual savings goals.

Conclusion: Finding the Best 3-Year CD Rates for Your Savings Goals

In conclusion, finding the best 3-year CD rates requires careful consideration of several factors, including interest rates, fees, and minimum deposit requirements. By researching and comparing rates from different banks and credit unions, investors can maximize their returns and achieve their savings goals.

It’s essential to understand the benefits and risks associated with 3-year CDs, including the potential for higher interest rates, low risk, and guaranteed returns. Additionally, investors should be aware of the impact of interest rate changes on 3-year CD rates and the potential for early withdrawal penalties.

By incorporating CD laddering and other strategies into their investment approach, investors can maximize their returns and minimize their risk exposure. Furthermore, staying informed about current CD rate trends and economic factors can help investors make informed decisions about their CD investments.

Ultimately, the key to finding the best 3-year CD rates is to research and compare rates from different banks and credit unions. By doing so, investors can find the best 3 year CD rates for their individual savings goals and maximize their returns.

Remember, investing in 3-year CDs can be a valuable addition to a diversified savings portfolio. With the right strategy and research, investors can achieve their savings goals and maximize their returns.