How to Choose the Best Balance Transfer Credit Card for Your Needs

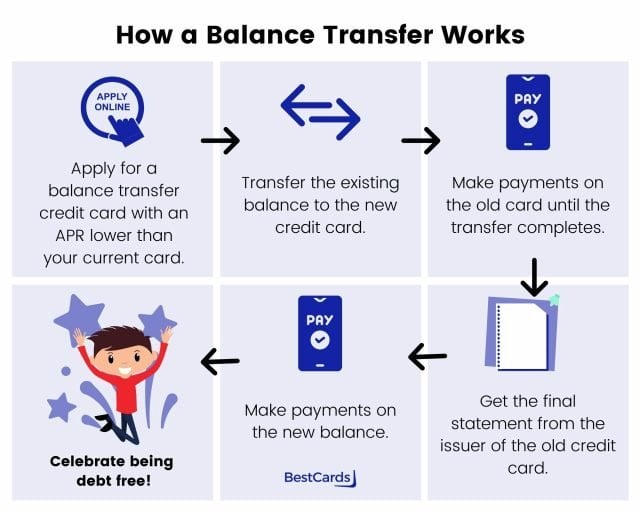

Choosing the right balance transfer credit card can be a daunting task, especially with the numerous options available in the market. However, selecting the best balance transfer credit card offer can help individuals save money on interest, pay off debt faster, and improve their overall financial health. To make an informed decision, it’s essential to consider several factors, including interest rates, fees, and credit limits.

Interest rates play a crucial role in determining the cost of borrowing. Look for balance transfer credit cards with 0% intro APR periods, which can last from 6 to 21 months, depending on the issuer. For instance, the Citi Simplicity Card offers a 0% intro APR for 21 months, making it an attractive option for those who need more time to pay off their debt. Additionally, consider the regular APR, which will apply after the intro period ends.

Fees are another critical aspect to consider when choosing a balance transfer credit card. Some cards come with balance transfer fees, which can range from 3% to 5% of the transferred amount. However, some issuers, like Discover, offer balance transfer credit cards with no balance transfer fees, such as the Discover it Balance Transfer. It’s essential to calculate the total cost of the balance transfer, including fees, to ensure you’re getting the best deal.

Credit limits also play a significant role in determining the best balance transfer credit card for your needs. If you have a large amount of debt, look for cards with high credit limits, such as the Citi Double Cash Card, which offers a credit limit of up to $25,000. However, be aware that high credit limits can also lead to overspending, so it’s essential to use the card responsibly.

By considering these factors, individuals can find the best balance transfer credit card offer that meets their needs and helps them achieve their financial goals. Whether you’re looking to pay off high-interest debt, save money on interest, or improve your credit score, there’s a balance transfer credit card that can help. With the right card, you can take control of your finances and start building a stronger financial future.

Understanding Balance Transfer Fees: What You Need to Know

When considering the best balance transfer credit card offers, it’s essential to understand the different types of balance transfer fees associated with these cards. Balance transfer fees can be a significant cost, and knowing how they work can help you make an informed decision.

There are two main types of balance transfer fees: one-time fees and ongoing fees. One-time fees are charged as a percentage of the transferred amount, typically ranging from 3% to 5%. For example, if you transfer a balance of $2,000, you may be charged a one-time fee of $60 to $100. Ongoing fees, on the other hand, are charged periodically, such as monthly or annually, and can add up over time.

Some credit cards, like the Chase Slate Edge, offer low or no balance transfer fees. The Chase Slate Edge, for instance, has a 0% intro APR for 18 months and a balance transfer fee of $0 for the first 60 days. After the intro period, the balance transfer fee is 3% of the amount transferred, with a minimum of $5. This can be a significant cost savings for those who need to transfer a large balance.

Other credit cards, like the Citi Simplicity Card, offer a balance transfer fee of 3% of the amount transferred, with a minimum of $5. However, this card also offers a 0% intro APR for 21 months, making it a competitive option for those who need more time to pay off their debt.

When evaluating balance transfer credit cards, it’s crucial to consider the total cost of the balance transfer, including fees. By understanding the different types of balance transfer fees and how they work, you can make an informed decision and choose the best balance transfer credit card offer for your needs.

In addition to considering balance transfer fees, it’s also essential to look at the regular APR, credit limits, and other features of the credit card. By taking a comprehensive approach to evaluating balance transfer credit cards, you can find the best option for your financial situation and start paying off your debt more efficiently.

The Benefits of 0% Intro APR: How to Make the Most of Your Balance Transfer

One of the most significant benefits of balance transfer credit cards is the 0% intro APR period. This feature allows cardholders to save money on interest and pay off their debt faster. When used strategically, 0% intro APR balance transfer credit cards can be a powerful tool for debt repayment.

So, how can you make the most of your balance transfer? First, look for credit cards with long 0% intro APR periods. The Bank of America Cash Rewards credit card, for example, offers a 0% intro APR for 12 billing cycles. This gives you a full year to pay off your debt without incurring interest charges.

Another key benefit of 0% intro APR balance transfer credit cards is the ability to save money on interest. By transferring your high-interest debt to a 0% intro APR credit card, you can avoid paying interest on your debt for an extended period. This can help you pay off your principal balance faster and save money on interest charges.

It’s also essential to consider the regular APR when evaluating balance transfer credit cards. While the 0% intro APR period may be attractive, the regular APR will apply after the intro period ends. Look for credit cards with competitive regular APRs to ensure you’re not stuck with a high-interest rate after the intro period ends.

In addition to saving money on interest, 0% intro APR balance transfer credit cards can also help you pay off your debt faster. By avoiding interest charges, you can focus on paying off your principal balance, which can help you become debt-free faster.

Some popular balance transfer credit cards with 0% intro APR periods include the Citi Simplicity Card, the Discover it Balance Transfer, and the Chase Slate Edge. These cards offer competitive 0% intro APR periods and can help you save money on interest and pay off your debt faster.

When using a 0% intro APR balance transfer credit card, it’s essential to make timely payments and pay off your debt before the intro period ends. This will help you avoid interest charges and make the most of your balance transfer.

Top Balance Transfer Credit Cards with No Foreign Transaction Fees

When traveling abroad or making international purchases, foreign transaction fees can add up quickly. However, some balance transfer credit cards offer no foreign transaction fees, making them an excellent choice for those who frequently travel or make international purchases.

The Capital One Quicksilver Cash Rewards Credit Card is a top balance transfer credit card with no foreign transaction fees. This card offers a 0% intro APR for 15 months, a cashback rewards program, and no foreign transaction fees. Additionally, the card has a competitive regular APR and a high credit limit, making it an excellent choice for those who need to transfer a large balance.

Another top balance transfer credit card with no foreign transaction fees is the Barclays Arrival Plus World Elite Mastercard. This card offers a 0% intro APR for 12 months, a rewards program that allows you to redeem points for travel purchases, and no foreign transaction fees. The card also has a competitive regular APR and a high credit limit, making it an excellent choice for those who need to transfer a large balance.

Other balance transfer credit cards with no foreign transaction fees include the Citi Premier Card and the Chase Sapphire Preferred Card. These cards offer competitive rewards programs, high credit limits, and no foreign transaction fees, making them excellent choices for those who frequently travel or make international purchases.

When evaluating balance transfer credit cards with no foreign transaction fees, it’s essential to consider the other features of the card, such as the intro APR period, regular APR, and credit limit. By choosing a card that meets your needs and offers no foreign transaction fees, you can save money on international purchases and make the most of your balance transfer.

In addition to considering the features of the card, it’s also essential to read the terms and conditions carefully. Some cards may have restrictions on international purchases or require a minimum purchase amount to qualify for the rewards program. By understanding the terms and conditions, you can make the most of your balance transfer and avoid any potential pitfalls.

How to Avoid Balance Transfer Traps: Common Mistakes to Watch Out For

While balance transfer credit cards can be a powerful tool for paying off debt, there are common mistakes to avoid when using these cards. By understanding these potential pitfalls, you can make the most of your balance transfer and avoid costly mistakes.

One of the most significant mistakes to avoid is not paying off the balance before the intro APR period ends. Many balance transfer credit cards offer 0% intro APR periods, but these periods are limited. If you don’t pay off the balance before the intro period ends, you’ll be charged the regular APR, which can be much higher. To avoid this trap, make sure to pay off the balance in full before the intro period ends.

Another common mistake is not considering the regular APR. While the intro APR period may be attractive, the regular APR will apply after the intro period ends. Make sure to consider the regular APR when evaluating balance transfer credit cards, and choose a card with a competitive regular APR.

Additionally, be aware of balance transfer fees. While some credit cards offer low or no balance transfer fees, others may charge high fees. Make sure to understand the balance transfer fees associated with your credit card, and factor these fees into your decision.

Finally, be aware of the credit limit. While a high credit limit may be attractive, it can also lead to overspending. Make sure to use your credit card responsibly, and avoid overspending to avoid accumulating more debt.

By avoiding these common mistakes, you can make the most of your balance transfer and pay off your debt more efficiently. Remember to always read the terms and conditions carefully, and understand the features of your credit card before making a decision.

Some popular balance transfer credit cards that can help you avoid these traps include the Citi Simplicity Card, the Discover it Balance Transfer, and the Chase Slate Edge. These cards offer competitive intro APR periods, low balance transfer fees, and high credit limits, making them excellent choices for those who want to pay off their debt efficiently.

Balance Transfer Credit Cards with Rewards: Are They Worth It?

When considering the best balance transfer credit card offers, it’s essential to think about the rewards programs associated with these cards. While rewards programs can be a great way to earn cash back, points, or other benefits, they may not always be worth the potential drawbacks.

The Citi Double Cash Card, for example, offers a rewards program that allows you to earn 2% cash back on all purchases, with no rotating categories or spending limits. However, this card also has a higher regular APR and a balance transfer fee, which may offset the benefits of the rewards program.

The Discover it Cash Back, on the other hand, offers a rewards program that allows you to earn 5% cash back on various categories throughout the year, such as gas stations, grocery stores, and restaurants. However, this card also has a lower credit limit and a higher regular APR, which may limit its usefulness for those who need to transfer a large balance.

When evaluating balance transfer credit cards with rewards programs, it’s essential to consider the pros and cons of each card. Ask yourself whether the rewards program is worth the potential drawbacks, such as higher fees or interest rates. Additionally, consider your spending habits and whether the rewards program aligns with your needs.

Some popular balance transfer credit cards with rewards programs include the Chase Freedom Unlimited, the Capital One Quicksilver Cash Rewards Credit Card, and the Bank of America Cash Rewards credit card. These cards offer competitive rewards programs, low fees, and high credit limits, making them excellent choices for those who want to earn rewards while paying off their debt.

Ultimately, whether a balance transfer credit card with a rewards program is worth it depends on your individual needs and financial situation. By carefully evaluating the pros and cons of each card and considering your spending habits, you can make an informed decision and choose the best balance transfer credit card offer for your needs.

Using Balance Transfer Credit Cards to Pay Off High-Interest Debt

High-interest debt can be overwhelming and difficult to pay off, but balance transfer credit cards can provide a solution. By transferring your high-interest debt to a balance transfer credit card with a lower interest rate, you can save money on interest and pay off your debt faster.

To use balance transfer credit cards effectively, it’s essential to prioritize your debts and create a payment plan. Start by making a list of all your debts, including the balance, interest rate, and minimum payment for each. Then, prioritize your debts by focusing on the ones with the highest interest rates first.

Next, consider applying for a balance transfer credit card with a high credit limit, such as the Wells Fargo Platinum card. This card offers a 0% intro APR for 18 months, a high credit limit, and no annual fee. By transferring your high-interest debt to this card, you can save money on interest and pay off your debt faster.

Another option is the Citi Simplicity Card, which offers a 0% intro APR for 21 months, a high credit limit, and no annual fee. This card also has no late fees, no penalty APR, and no foreign transaction fees, making it an excellent choice for those who want to pay off their debt without incurring additional fees.

When using balance transfer credit cards to pay off high-interest debt, it’s essential to make timely payments and pay off the balance in full before the intro APR period ends. This will help you avoid interest charges and make the most of your balance transfer.

Additionally, consider combining balance transfer credit cards with other debt repayment strategies, such as debt snowball and debt avalanche methods. By using a combination of these strategies, you can maximize your savings and pay off your debt more efficiently.

Some popular balance transfer credit cards for paying off high-interest debt include the Discover it Balance Transfer, the Bank of America Cash Rewards credit card, and the Capital One Quicksilver Cash Rewards Credit Card. These cards offer competitive intro APR periods, high credit limits, and low fees, making them excellent choices for those who want to pay off their debt quickly and efficiently.

Maximizing Your Savings: How to Combine Balance Transfer Credit Cards with Other Debt Repayment Strategies

When it comes to paying off debt, using a single strategy may not always be enough. By combining balance transfer credit cards with other debt repayment strategies, you can maximize your savings and pay off your debt more efficiently.

One popular debt repayment strategy is the debt snowball method. This involves paying off your debts in a specific order, starting with the smallest balance first. By using a balance transfer credit card with a 0% intro APR, you can save money on interest and pay off your debt faster.

Another debt repayment strategy is the debt avalanche method. This involves paying off your debts in a specific order, starting with the debt with the highest interest rate first. By using a balance transfer credit card with a 0% intro APR, you can save money on interest and pay off your debt faster.

For example, let’s say you have two debts: a credit card with a $2,000 balance and an 18% interest rate, and a personal loan with a $5,000 balance and a 12% interest rate. By using a balance transfer credit card with a 0% intro APR, you can transfer the credit card balance and save money on interest. Then, you can focus on paying off the personal loan, which has a lower interest rate.

Some popular balance transfer credit cards that can be used in conjunction with other debt repayment strategies include the Citi Simplicity Card, the Discover it Balance Transfer, and the Bank of America Cash Rewards credit card. These cards offer competitive intro APR periods, low fees, and high credit limits, making them excellent choices for those who want to pay off their debt quickly and efficiently.

By combining balance transfer credit cards with other debt repayment strategies, you can maximize your savings and pay off your debt more efficiently. Remember to always read the terms and conditions carefully, and understand the features of your credit card before making a decision.

In addition to using balance transfer credit cards, you can also consider other debt repayment strategies, such as debt consolidation and credit counseling. By using a combination of these strategies, you can create a personalized debt repayment plan that works for you.