How to Find Cheap Car Insurance in Texas as a Young Driver

As a young driver in Texas, finding affordable car insurance can be a daunting task. Insurance rates for young drivers are often higher due to the increased risk of accidents and claims. However, there are ways to find cheap car insurance in Texas that meets your needs and budget. In this article, we will explore the challenges of finding affordable car insurance as a young driver in Texas and provide tips on how to overcome them.

One of the main factors that affect insurance rates for young drivers is age. Statistically, young drivers are more likely to be involved in accidents, which increases the risk for insurance companies. Additionally, driving experience and location also play a significant role in determining insurance rates. For example, driving in urban areas like Houston or Dallas can be more expensive than driving in rural areas.

Another challenge for young drivers is finding insurance companies that offer affordable rates. Many insurance companies offer discounts and programs specifically designed for young drivers, but these can be difficult to find. Some insurance companies, such as Geico and State Farm, offer good student discounts, driver’s education courses, and low-mileage discounts. However, these discounts may not be available to all young drivers, and the eligibility criteria can be strict.

Despite these challenges, there are ways to find cheap car insurance in Texas as a young driver. By understanding the factors that affect insurance rates and taking advantage of discounts and programs, young drivers can find affordable insurance that meets their needs. In the next section, we will discuss the minimum car insurance requirements in Texas and how these requirements impact insurance rates for young drivers.

Understanding Texas Car Insurance Requirements for Young Drivers

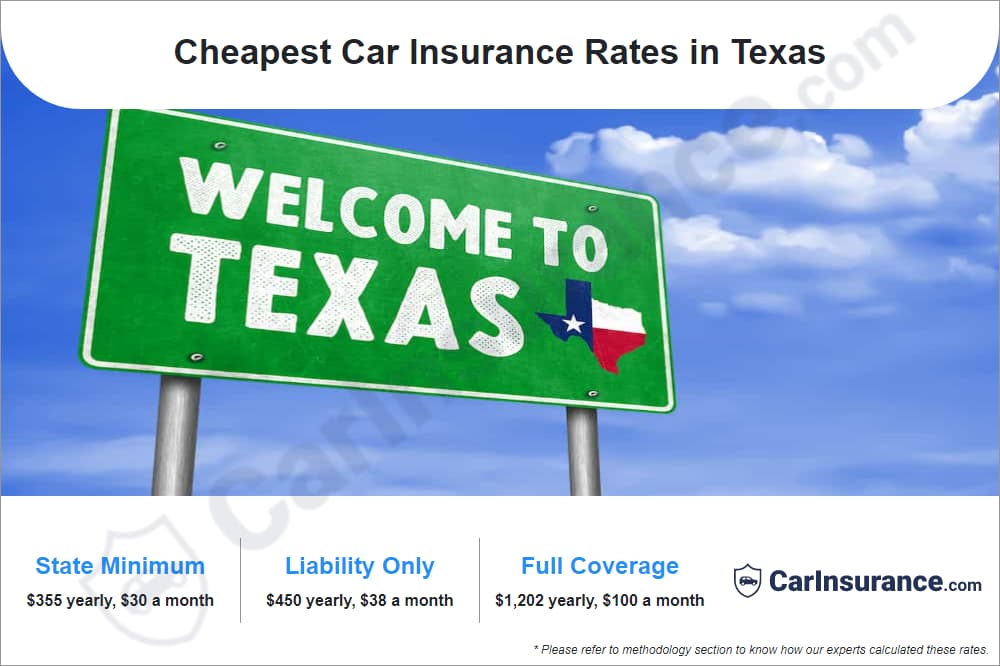

In Texas, all drivers, including young drivers, are required to have a minimum level of car insurance coverage. The Texas Department of Insurance requires drivers to have liability coverage, personal injury protection, and uninsured/underinsured motorist coverage. Liability coverage pays for damages to other people or property in the event of an accident, while personal injury protection covers medical expenses for the driver and passengers. Uninsured/underinsured motorist coverage protects drivers in the event of an accident with someone who does not have insurance or does not have enough insurance.

For young drivers, these requirements can impact insurance rates. Liability coverage, for example, can be more expensive for young drivers due to their higher risk of accidents. Personal injury protection and uninsured/underinsured motorist coverage can also be more expensive for young drivers, especially if they have a history of accidents or claims. However, having these coverages is essential for protecting young drivers and their passengers in the event of an accident.

In addition to these requirements, young drivers in Texas may also want to consider additional coverage options, such as comprehensive and collision coverage. Comprehensive coverage pays for damages to the vehicle that are not related to an accident, such as theft or vandalism. Collision coverage pays for damages to the vehicle in the event of an accident, regardless of who is at fault. These coverages can provide additional protection for young drivers, but they can also increase insurance rates.

When shopping for car insurance in Texas, young drivers should carefully consider their coverage options and ensure they meet the state’s minimum requirements. By understanding the requirements and options available, young drivers can find the cheapest car insurance in Texas that meets their needs and budget. In the next section, we will review and compare the rates and coverage options of top car insurance companies in Texas, including Geico, State Farm, and Progressive.

Top Cheap Car Insurance Companies in Texas for Young Drivers

When searching for the cheapest car insurance in Texas for young drivers, it’s essential to compare rates and coverage options from top insurance companies. Here’s a review of the top car insurance companies in Texas, including their rates, discounts, and programs specifically designed for young drivers.

1. Geico: Geico is one of the most popular car insurance companies in Texas, offering competitive rates for young drivers. They offer a variety of discounts, including a good student discount of up to 15% and a driver’s education discount of up to 10%. Geico’s average annual premium for young drivers in Texas is around $2,300.

2. State Farm: State Farm is another top car insurance company in Texas, offering a range of coverage options and discounts for young drivers. They offer a Steer Clear program, which provides a discount of up to 15% for young drivers who complete a driver’s education course. State Farm’s average annual premium for young drivers in Texas is around $2,500.

3. Progressive: Progressive is a popular car insurance company in Texas, known for its innovative usage-based insurance program, Snapshot. They offer a variety of discounts for young drivers, including a good student discount of up to 10% and a driver’s education discount of up to 5%. Progressive’s average annual premium for young drivers in Texas is around $2,800.

4. USAA: USAA is a top car insurance company in Texas, offering competitive rates and coverage options for young drivers who are members of the military or have a military affiliation. They offer a variety of discounts, including a good student discount of up to 10% and a driver’s education discount of up to 5%. USAA’s average annual premium for young drivers in Texas is around $2,200.

5. Esurance: Esurance is a popular car insurance company in Texas, offering a range of coverage options and discounts for young drivers. They offer a good student discount of up to 10% and a driver’s education discount of up to 5%. Esurance’s average annual premium for young drivers in Texas is around $2,600.

When comparing car insurance rates and coverage options, it’s essential to consider the cheapest car insurance in Texas for young drivers that meets your needs and budget. Be sure to research and compare rates from multiple insurance companies to find the best option for you.

Discounts and Incentives for Young Drivers in Texas

As a young driver in Texas, it’s essential to take advantage of discounts and incentives that can help lower your car insurance rates. Insurance companies offer various discounts to encourage safe driving habits, academic achievement, and other positive behaviors. Here are some discounts and incentives available to young drivers in Texas:

Good Student Discount: Many insurance companies offer a good student discount to young drivers who maintain a good grade point average (GPA). This discount can range from 5% to 15% off the annual premium. To qualify, students typically need to have a GPA of 3.0 or higher and be enrolled in a high school or college.

Driver’s Education Course Discount: Completing a driver’s education course can also lead to a discount on car insurance. This course teaches young drivers safe driving habits and techniques, which can reduce the risk of accidents. Insurance companies may offer a discount of up to 10% for young drivers who complete a driver’s education course.

Low-Mileage Discount: If you drive fewer miles than average, you may be eligible for a low-mileage discount. This discount can range from 5% to 10% off the annual premium. To qualify, you typically need to drive less than 7,500 miles per year.

Defensive Driving Course Discount: Taking a defensive driving course can also lead to a discount on car insurance. This course teaches young drivers how to anticipate and respond to potential hazards on the road. Insurance companies may offer a discount of up to 5% for young drivers who complete a defensive driving course.

Multi-Car Discount: If you have multiple cars in your household, you may be eligible for a multi-car discount. This discount can range from 5% to 10% off the annual premium. To qualify, you typically need to have multiple cars insured with the same insurance company.

Bundle Discount: Bundling your car insurance with other insurance policies, such as home or renters insurance, can also lead to a discount. This discount can range from 5% to 10% off the annual premium. To qualify, you typically need to have multiple policies with the same insurance company.

When shopping for the cheapest car insurance in Texas for young drivers, be sure to ask about these discounts and incentives. By taking advantage of these discounts, you can lower your car insurance rates and save money on your premium.

Factors That Affect Car Insurance Rates for Young Drivers in Texas

As a young driver in Texas, it’s essential to understand the factors that affect car insurance rates. Insurance companies use various factors to determine the level of risk associated with insuring a young driver, and these factors can significantly impact insurance rates. Here are some of the key factors that affect car insurance rates for young drivers in Texas:

Driving Record: A clean driving record is crucial for young drivers in Texas. Insurance companies view drivers with a history of accidents or traffic violations as higher risks, and therefore, charge higher premiums. On the other hand, a clean driving record can lead to lower premiums and discounts.

Credit Score: In Texas, insurance companies are allowed to use credit scores to determine insurance rates. Young drivers with good credit scores are viewed as lower risks and may qualify for lower premiums. However, young drivers with poor credit scores may face higher premiums.

Vehicle Type: The type of vehicle driven can also impact insurance rates for young drivers in Texas. Insurance companies view certain vehicles, such as sports cars or luxury vehicles, as higher risks and charge higher premiums. On the other hand, vehicles with good safety ratings and lower values may qualify for lower premiums.

Annual Mileage: The number of miles driven per year can also impact insurance rates for young drivers in Texas. Insurance companies view drivers who drive fewer miles as lower risks and may offer lower premiums. However, drivers who drive more miles may face higher premiums.

Location: The location where a young driver lives can also impact insurance rates. Insurance companies view certain areas, such as urban areas with high crime rates, as higher risks and charge higher premiums. On the other hand, areas with low crime rates and low traffic congestion may qualify for lower premiums.

Age and Experience: Age and experience are also significant factors that affect car insurance rates for young drivers in Texas. Insurance companies view younger drivers as higher risks and charge higher premiums. However, as young drivers gain more experience and age, their premiums may decrease.

When shopping for the cheapest car insurance in Texas for young drivers, it’s essential to consider these factors and how they may impact insurance rates. By understanding these factors, young drivers can take steps to mitigate their impact and find more affordable car insurance options.

How to Compare Car Insurance Quotes in Texas as a Young Driver

Comparing car insurance quotes is a crucial step in finding the cheapest car insurance in Texas for young drivers. With so many insurance companies and coverage options available, it can be overwhelming to navigate the process. Here’s a step-by-step guide on how to compare car insurance quotes in Texas:

Step 1: Determine Your Coverage Needs: Before comparing quotes, it’s essential to determine your coverage needs. Consider the minimum car insurance requirements in Texas, as well as any additional coverage options you may need, such as comprehensive or collision coverage.

Step 2: Gather Information: To compare quotes, you’ll need to provide some personal and vehicle information, including:

- Age and driving experience

- Vehicle make, model, and year

- Annual mileage

- Credit score

- Driving record

Step 3: Use Online Quote Tools: Many insurance companies offer online quote tools that allow you to compare quotes quickly and easily. Some popular online quote tools include:

- Geico’s online quote tool

- State Farm’s online quote tool

- Progressive’s online quote tool

Step 4: Evaluate Coverage Options: Once you have your quotes, it’s essential to evaluate the coverage options and pricing. Consider the following factors:

- Liability coverage limits

- Comprehensive and collision coverage deductibles

- Uninsured/underinsured motorist coverage

- Personal injury protection

Step 5: Compare Quotes: Finally, compare the quotes from different insurance companies, taking into account the coverage options and pricing. Consider the following factors:

- Premium cost

- Coverage limits

- Deductibles

- Discounts and incentives

By following these steps, you can compare car insurance quotes in Texas and find the cheapest car insurance that meets your needs and budget.

Additional Tips for Finding Affordable Car Insurance in Texas

As a young driver in Texas, finding affordable car insurance can be a challenge. However, there are several additional tips and strategies that can help you find the cheapest car insurance in Texas for young drivers. Here are some additional tips to consider:

Bundle Policies: Bundling your car insurance with other insurance policies, such as home or renters insurance, can help you save money on your premiums. Many insurance companies offer discounts for bundling policies, so it’s worth exploring this option.

Increase Deductibles: Increasing your deductibles can help lower your premiums, but it’s essential to make sure you can afford to pay the deductible amount in the event of a claim. Consider increasing your deductibles for comprehensive and collision coverage to lower your premiums.

Drop Unnecessary Coverage: If you have an older vehicle, you may not need comprehensive and collision coverage. Dropping these coverage options can help lower your premiums, but make sure you understand the risks involved.

Consider a Usage-Based Insurance Program: Usage-based insurance programs, such as Progressive’s Snapshot program, can help you save money on your premiums based on your driving habits. These programs use a device to track your driving habits and reward safe driving with lower premiums.

Shop Around: Shopping around and comparing quotes from different insurance companies is essential to finding the cheapest car insurance in Texas for young drivers. Consider working with an independent insurance agent who can help you compare quotes and find the best coverage options for your needs and budget.

Take Advantage of Low-Mileage Discounts: If you drive fewer than 7,500 miles per year, you may be eligible for a low-mileage discount. Many insurance companies offer this discount, so it’s worth exploring this option.

By following these additional tips and strategies, you can find affordable car insurance in Texas as a young driver. Remember to always shop around, compare quotes, and consider your coverage options carefully to find the best cheap car insurance that meets your needs and budget.

Conclusion: Finding the Best Cheap Car Insurance in Texas for Young Drivers

As a young driver in Texas, finding affordable car insurance can be a challenge. However, by understanding the factors that affect insurance rates, taking advantage of discounts and incentives, and comparing quotes from top insurance companies, you can find the cheapest car insurance in Texas that meets your needs and budget.

In this comprehensive guide, we’ve provided you with the information and tools you need to find affordable car insurance in Texas. From understanding the minimum car insurance requirements to comparing quotes and taking advantage of discounts, we’ve covered it all.

Here’s a final checklist to help you find the best cheap car insurance in Texas for young drivers:

- Understand the minimum car insurance requirements in Texas

- Compare quotes from top insurance companies, including Geico, State Farm, and Progressive

- Take advantage of discounts and incentives, such as good student discounts and driver’s education courses

- Consider bundling policies, increasing deductibles, and dropping unnecessary coverage

- Use online quote tools to compare quotes and find the best coverage options

By following these steps and considering your coverage options carefully, you can find the cheapest car insurance in Texas that meets your needs and budget. Remember to always shop around, compare quotes, and take advantage of discounts and incentives to find the best cheap car insurance in Texas for young drivers.