Understanding the Key Characteristics of a Profitable Business

When it comes to identifying the most profitable business, it’s essential to understand the key characteristics that contribute to a company’s success. Scalability, market demand, and competitive advantage are three crucial factors that can make or break a business. A scalable business model allows companies to increase revenue without a proportional increase in costs, making it an attractive trait for investors and entrepreneurs alike. Market demand is another critical factor, as it determines the potential size of the customer base and the level of competition. A business that can meet the demands of its target market while differentiating itself from competitors is more likely to achieve long-term success.

Competitive advantage is also vital, as it enables businesses to outperform their rivals and maintain a strong market position. This can be achieved through innovative products or services, strategic partnerships, or exceptional customer service. By understanding these key characteristics, entrepreneurs and business leaders can better navigate the complexities of the market and make informed decisions about their ventures. Whether you’re looking to start a new business or invest in an existing one, knowing what makes a business profitable is crucial. So, what’s the most profitable business? The answer lies in identifying opportunities that combine scalability, market demand, and competitive advantage.

In today’s fast-paced business landscape, companies must be adaptable and responsive to changing market conditions. This requires a deep understanding of the key characteristics that drive profitability. By focusing on scalability, market demand, and competitive advantage, businesses can position themselves for long-term success and attract investors, customers, and top talent. Whether you’re a seasoned entrepreneur or just starting out, understanding the key characteristics of a profitable business is essential for achieving your goals and staying ahead of the competition.

How to Identify Emerging Trends and Opportunities

Identifying emerging trends and opportunities is crucial for entrepreneurs and business leaders who want to stay ahead of the curve and capitalize on new ventures. In today’s fast-paced and rapidly changing market, it’s essential to be proactive and adaptable to succeed. So, what’s the most profitable business to invest in? The answer lies in understanding the latest trends and opportunities.

Market research and analysis are critical components of identifying emerging trends and opportunities. By conducting thorough market research, businesses can gain valuable insights into consumer behavior, preferences, and needs. This information can be used to develop innovative products or services that meet the demands of the market. Additionally, market analysis can help businesses identify gaps in the market and capitalize on untapped opportunities.

Another key aspect of identifying emerging trends and opportunities is staying up-to-date with the latest industry news and developments. This can be achieved by attending conferences, seminars, and workshops, as well as following industry leaders and experts on social media. By staying informed, businesses can anticipate changes in the market and adapt their strategies accordingly.

Adaptability is also essential for identifying emerging trends and opportunities. Businesses that are agile and able to pivot quickly can capitalize on new opportunities as they arise. This requires a culture of innovation and experimentation, where employees are encouraged to think outside the box and develop new ideas.

Technology is also playing a significant role in identifying emerging trends and opportunities. By leveraging tools such as data analytics and artificial intelligence, businesses can gain valuable insights into consumer behavior and market trends. This information can be used to develop targeted marketing campaigns and improve overall business performance.

In terms of specific industries, some of the most profitable businesses to invest in include healthcare, technology, and e-commerce. These industries are experiencing rapid growth and innovation, and there are many opportunities for businesses to capitalize on emerging trends and opportunities. For example, the healthcare industry is experiencing a significant shift towards personalized medicine, while the technology industry is seeing a rise in demand for artificial intelligence and cybersecurity solutions.

Ultimately, identifying emerging trends and opportunities requires a combination of market research, analysis, adaptability, and innovation. By staying ahead of the curve and capitalizing on new ventures, businesses can achieve long-term success and profitability. So, what’s the most profitable business to invest in? The answer lies in understanding the latest trends and opportunities, and being proactive and adaptable in response.

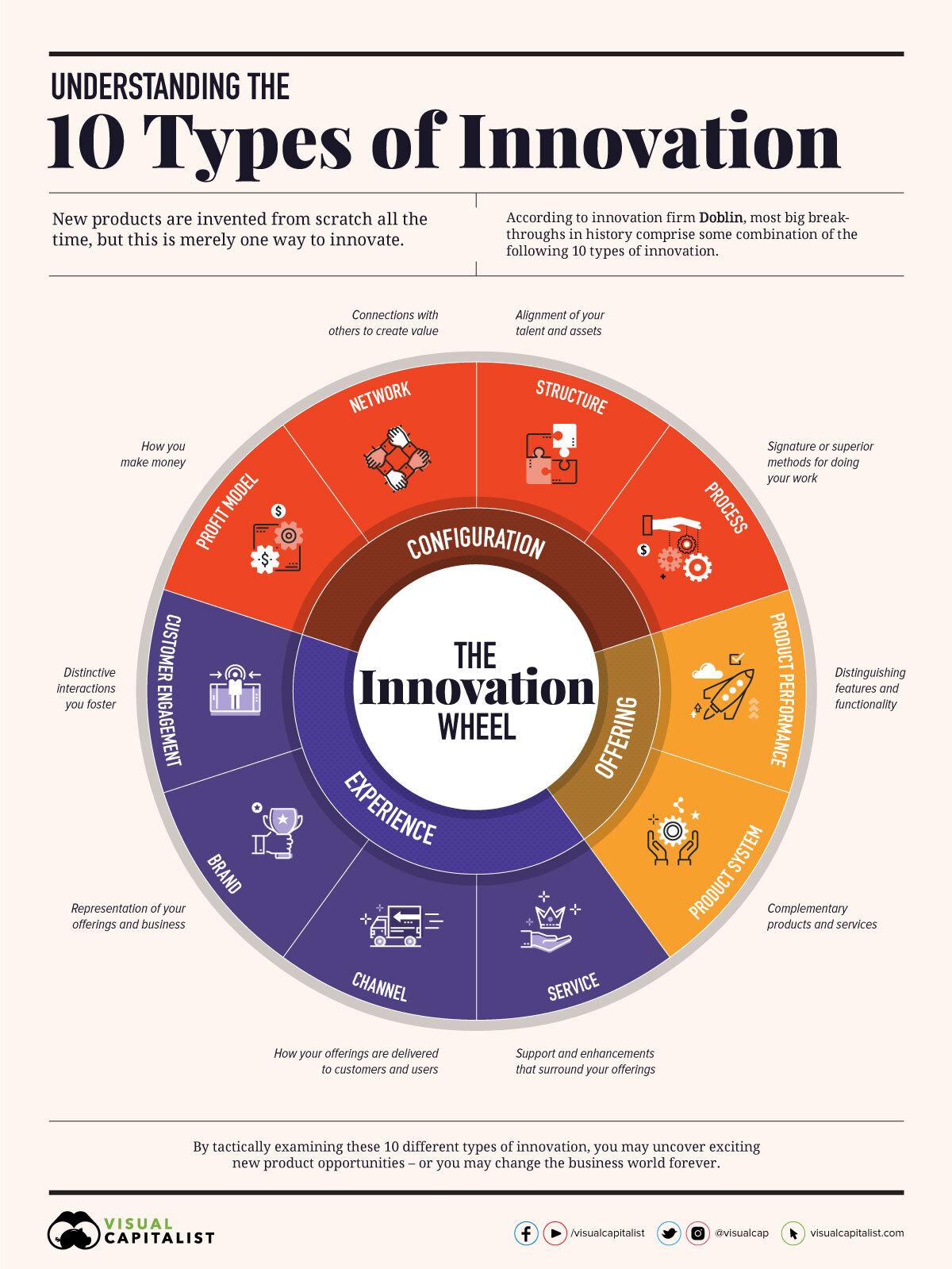

The Role of Innovation in Driving Business Success

Innovation is a crucial driver of business success, particularly in today’s fast-paced and rapidly changing market. Companies that fail to innovate risk being left behind, while those that prioritize innovation can reap significant rewards. So, what’s the most profitable business to invest in? The answer lies in understanding the role of innovation in driving business growth and profitability.

At its core, innovation involves developing new ideas, products, or services that meet the evolving needs of customers. This can be achieved through various means, including research and development, experimentation, and collaboration with external partners. By fostering a culture of innovation, companies can encourage employees to think outside the box and develop new solutions to complex problems.

One key aspect of innovation is experimentation. Companies that are willing to take calculated risks and experiment with new ideas are more likely to stumble upon breakthroughs that can drive business growth. This requires a culture that encourages experimentation, learning from failure, and continuous improvement. By embracing experimentation, companies can develop new products, services, and business models that meet the evolving needs of customers.

Technology is also playing a significant role in driving innovation. By leveraging tools such as artificial intelligence, blockchain, and the Internet of Things (IoT), companies can develop new products and services that were previously unimaginable. For example, companies like Amazon and Google are using AI to develop personalized customer experiences, while companies like Walmart and Target are using IoT to optimize their supply chains.

In addition to technology, collaboration is also essential for driving innovation. Companies that partner with external partners, including startups, academia, and other industry players, can access new ideas, expertise, and resources. This can help companies develop new products and services that meet the evolving needs of customers. For example, companies like Apple and IBM are partnering with startups to develop new products and services that leverage AI and IoT.

So, what’s the most profitable business to invest in? The answer lies in understanding the role of innovation in driving business growth and profitability. Companies that prioritize innovation, experimentation, and collaboration can reap significant rewards, including increased revenue, market share, and competitiveness. By embracing innovation, companies can stay ahead of the curve and achieve long-term business success.

In terms of specific industries, some of the most profitable businesses to invest in include technology, healthcare, and e-commerce. These industries are experiencing rapid growth and innovation, and there are many opportunities for companies to develop new products and services that meet the evolving needs of customers. For example, companies like Amazon and Google are developing new products and services that leverage AI and IoT, while companies like CVS and Walgreens are developing new healthcare services that leverage telemedicine and personalized medicine.

Ultimately, innovation is a key driver of business success, and companies that prioritize innovation can reap significant rewards. By fostering a culture of innovation, experimentation, and collaboration, companies can develop new products and services that meet the evolving needs of customers and achieve long-term business success.

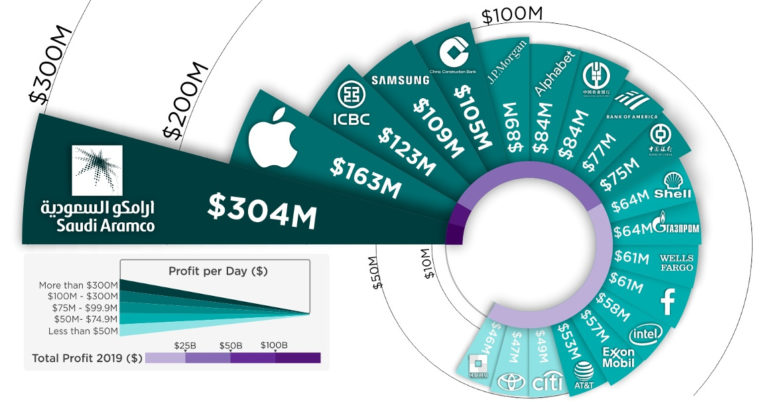

Analyzing the Most Profitable Industries and Sectors

When it comes to identifying the most profitable businesses, it’s essential to analyze various industries and sectors. Some of the most profitable industries and sectors include healthcare, technology, and e-commerce. These industries are experiencing rapid growth and innovation, and there are many opportunities for businesses to capitalize on emerging trends and opportunities.

The healthcare industry is one of the most profitable sectors, with a projected global value of over $11 trillion by 2025. This growth is driven by an aging population, increased healthcare spending, and advancements in medical technology. Key players in the healthcare industry include pharmaceutical companies, medical device manufacturers, and healthcare providers. Opportunities for growth and investment in the healthcare sector include personalized medicine, telemedicine, and healthcare IT.

The technology industry is another highly profitable sector, with a projected global value of over $5 trillion by 2025. This growth is driven by the increasing demand for digital transformation, cloud computing, and artificial intelligence. Key players in the technology industry include software companies, hardware manufacturers, and IT service providers. Opportunities for growth and investment in the technology sector include AI, blockchain, and the Internet of Things (IoT).

E-commerce is also a highly profitable industry, with a projected global value of over $4 trillion by 2025. This growth is driven by the increasing demand for online shopping, digital payments, and social media marketing. Key players in the e-commerce industry include online retailers, digital payment providers, and social media platforms. Opportunities for growth and investment in the e-commerce sector include mobile commerce, social commerce, and influencer marketing.

Other profitable industries and sectors include finance, real estate, and renewable energy. The finance industry is driven by the increasing demand for digital banking, mobile payments, and investment services. The real estate industry is driven by the increasing demand for housing, commercial property, and property management services. The renewable energy industry is driven by the increasing demand for solar energy, wind energy, and energy efficiency solutions.

So, what’s the most profitable business to invest in? The answer lies in understanding the key trends and opportunities in various industries and sectors. By analyzing the most profitable industries and sectors, businesses can identify opportunities for growth and investment, and make informed decisions about where to allocate their resources.

In terms of specific companies, some of the most profitable businesses include Amazon, Google, Microsoft, and Facebook. These companies are leaders in their respective industries and have a strong track record of innovation and growth. Other profitable companies include Johnson & Johnson, Procter & Gamble, and Coca-Cola. These companies have a strong brand presence and a diversified portfolio of products and services.

Ultimately, the most profitable business to invest in is one that has a strong track record of innovation, growth, and profitability. By analyzing the most profitable industries and sectors, businesses can identify opportunities for growth and investment, and make informed decisions about where to allocate their resources.

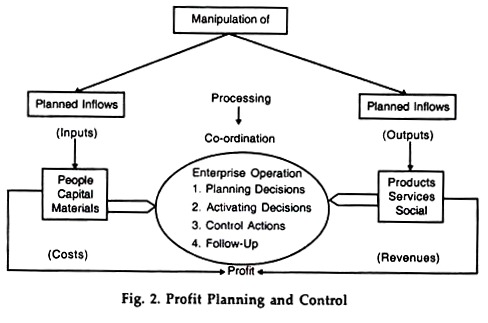

The Importance of Financial Management and Planning

Financial management and planning are crucial components of a profitable business. Effective financial management enables companies to make informed decisions, optimize resources, and achieve long-term success. So, what’s the most profitable business to invest in? The answer lies in understanding the importance of financial management and planning.

Budgeting is a critical aspect of financial management. A well-crafted budget helps companies allocate resources efficiently, prioritize spending, and achieve financial goals. By creating a comprehensive budget, companies can identify areas of cost savings, optimize resource allocation, and make informed decisions about investments and expenses.

Forecasting is another essential component of financial management. By analyzing market trends, industry developments, and economic indicators, companies can anticipate future financial performance and make informed decisions about investments, pricing, and resource allocation. Accurate forecasting enables companies to stay ahead of the competition, capitalize on emerging trends, and mitigate potential risks.

Cash flow management is also vital for business success. Companies must manage cash flow effectively to ensure liquidity, meet financial obligations, and invest in growth opportunities. By monitoring cash flow, companies can identify areas of improvement, optimize working capital, and make informed decisions about investments and financing.

Financial planning is also critical for business success. By developing a comprehensive financial plan, companies can define financial goals, identify key performance indicators (KPIs), and establish a roadmap for achieving financial success. A well-crafted financial plan enables companies to make informed decisions about investments, resource allocation, and risk management.

In addition to budgeting, forecasting, cash flow management, and financial planning, companies must also prioritize financial reporting and analysis. By providing transparent and accurate financial reporting, companies can build trust with stakeholders, identify areas of improvement, and make informed decisions about investments and resource allocation.

So, what’s the most profitable business to invest in? The answer lies in understanding the importance of financial management and planning. By prioritizing financial management and planning, companies can achieve long-term success, optimize resources, and make informed decisions about investments and growth opportunities.

In terms of specific industries, some of the most profitable businesses to invest in include finance, technology, and healthcare. These industries are experiencing rapid growth and innovation, and there are many opportunities for companies to capitalize on emerging trends and opportunities. By prioritizing financial management and planning, companies in these industries can achieve long-term success and optimize resources.

Ultimately, financial management and planning are critical components of a profitable business. By prioritizing financial management and planning, companies can achieve long-term success, optimize resources, and make informed decisions about investments and growth opportunities.

Building a Strong Team and Leadership Structure

A strong team and leadership structure are essential components of a profitable business. A well-built team can drive business growth, improve productivity, and enhance overall performance. So, what’s the most profitable business to invest in? The answer lies in understanding the importance of building a strong team and leadership structure.

Attracting top talent is crucial for building a strong team. Companies must develop a competitive recruitment strategy that includes offering attractive salaries, benefits, and perks. Additionally, companies must create a positive work culture that fosters collaboration, innovation, and growth. By attracting top talent, companies can drive business growth, improve productivity, and enhance overall performance.

Retaining top talent is also critical for building a strong team. Companies must develop a retention strategy that includes providing opportunities for growth and development, offering competitive salaries and benefits, and fostering a positive work culture. By retaining top talent, companies can reduce turnover rates, improve productivity, and enhance overall performance.

Motivating top talent is also essential for building a strong team. Companies must develop a motivation strategy that includes providing recognition and rewards, offering opportunities for growth and development, and fostering a positive work culture. By motivating top talent, companies can drive business growth, improve productivity, and enhance overall performance.

Effective communication is also critical for building a strong team and leadership structure. Companies must develop a communication strategy that includes providing regular updates, fostering open communication, and encouraging feedback. By communicating effectively, companies can drive business growth, improve productivity, and enhance overall performance.

Decision-making is also essential for building a strong team and leadership structure. Companies must develop a decision-making strategy that includes providing clear direction, fostering collaboration, and encouraging innovation. By making informed decisions, companies can drive business growth, improve productivity, and enhance overall performance.

In terms of specific industries, some of the most profitable businesses to invest in include technology, healthcare, and finance. These industries are experiencing rapid growth and innovation, and there are many opportunities for companies to build strong teams and leadership structures. By prioritizing team building and leadership development, companies in these industries can drive business growth, improve productivity, and enhance overall performance.

Ultimately, building a strong team and leadership structure is critical for business success. By attracting, retaining, and motivating top talent, companies can drive business growth, improve productivity, and enhance overall performance. By prioritizing team building and leadership development, companies can achieve long-term success and become the most profitable business in their industry.

Measuring and Optimizing Business Performance

Measuring and optimizing business performance is crucial for achieving long-term success and profitability. By tracking key performance indicators (KPIs), metrics, and benchmarks, companies can identify areas of improvement, optimize resources, and make informed decisions. So, what’s the most profitable business to invest in? The answer lies in understanding the importance of measuring and optimizing business performance.

Key performance indicators (KPIs) are quantifiable measures that track a company’s progress towards its goals. Examples of KPIs include revenue growth, customer acquisition, and retention rates. By tracking KPIs, companies can identify areas of improvement, optimize resources, and make informed decisions.

Metrics are another important aspect of measuring business performance. Metrics provide a detailed analysis of a company’s performance, including financial metrics, customer metrics, and operational metrics. By analyzing metrics, companies can identify trends, patterns, and areas of improvement.

Benchmarks are also essential for measuring business performance. Benchmarks provide a comparison of a company’s performance to industry averages, competitors, or best practices. By benchmarking, companies can identify areas of improvement, optimize resources, and make informed decisions.

Data-driven decision-making is critical for optimizing business performance. By analyzing data, companies can identify trends, patterns, and areas of improvement. Data-driven decision-making enables companies to make informed decisions, optimize resources, and drive business growth.

Continuous improvement is also essential for optimizing business performance. By continuously monitoring and evaluating business performance, companies can identify areas of improvement, optimize resources, and make informed decisions. Continuous improvement enables companies to stay ahead of the competition, drive business growth, and achieve long-term success.

In terms of specific industries, some of the most profitable businesses to invest in include technology, healthcare, and finance. These industries are experiencing rapid growth and innovation, and there are many opportunities for companies to measure and optimize business performance. By prioritizing data-driven decision-making and continuous improvement, companies in these industries can drive business growth, optimize resources, and achieve long-term success.

Ultimately, measuring and optimizing business performance is critical for achieving long-term success and profitability. By tracking KPIs, metrics, and benchmarks, companies can identify areas of improvement, optimize resources, and make informed decisions. By prioritizing data-driven decision-making and continuous improvement, companies can drive business growth, optimize resources, and achieve long-term success.

Staying Adaptable and Resilient in a Changing Market

Staying adaptable and resilient is crucial for businesses to navigate the rapidly changing market landscape. With technological advancements, shifting consumer behaviors, and increasing competition, companies must be agile and flexible to stay ahead of the curve. So, what’s the most profitable business to invest in? The answer lies in understanding the importance of adaptability and resilience.

Agility is essential for businesses to respond quickly to changing market conditions. By being agile, companies can pivot their strategies, adjust their products or services, and capitalize on emerging trends and opportunities. Agility enables companies to stay ahead of the competition, drive business growth, and achieve long-term success.

Flexibility is also critical for businesses to navigate uncertainty and change. By being flexible, companies can adapt to new market conditions, adjust their business models, and respond to changing consumer needs. Flexibility enables companies to stay resilient, drive business growth, and achieve long-term success.

Risk management is also essential for businesses to navigate uncertainty and change. By identifying and mitigating potential risks, companies can minimize losses, optimize resources, and make informed decisions. Risk management enables companies to stay resilient, drive business growth, and achieve long-term success.

In terms of specific industries, some of the most profitable businesses to invest in include technology, healthcare, and finance. These industries are experiencing rapid growth and innovation, and there are many opportunities for companies to stay adaptable and resilient. By prioritizing agility, flexibility, and risk management, companies in these industries can drive business growth, optimize resources, and achieve long-term success.

Ultimately, staying adaptable and resilient is critical for businesses to navigate the rapidly changing market landscape. By being agile, flexible, and proactive in managing risk, companies can drive business growth, optimize resources, and achieve long-term success. By prioritizing adaptability and resilience, companies can stay ahead of the competition and become the most profitable business in their industry.

In today’s fast-paced and rapidly changing market, companies must be prepared to adapt and evolve to stay ahead of the curve. By staying adaptable and resilient, companies can drive business growth, optimize resources, and achieve long-term success. Whether you’re a startup or an established business, prioritizing adaptability and resilience is crucial for achieving success and becoming the most profitable business in your industry.