How to Turn Currency Exchange into a Lucrative Opportunity

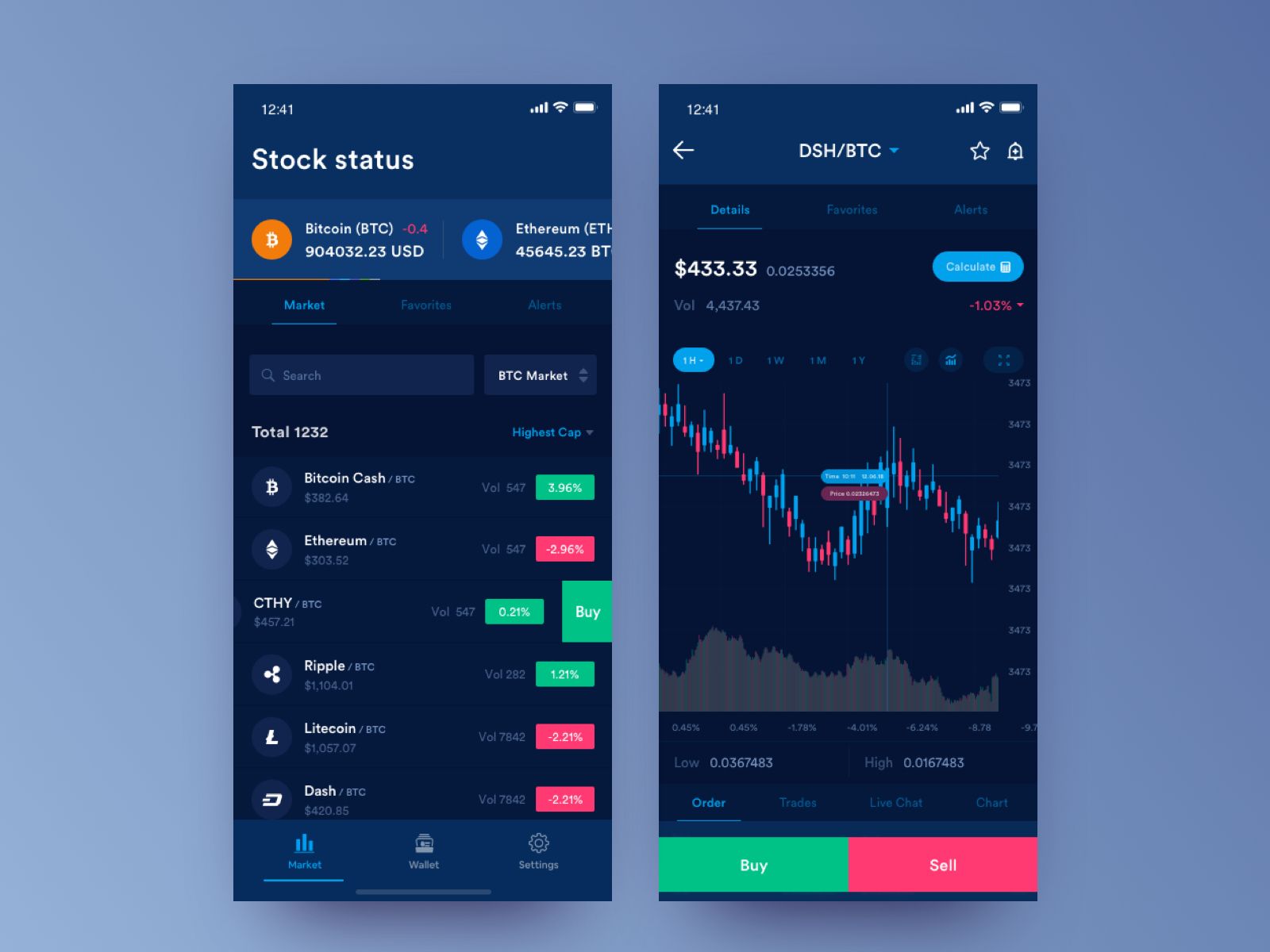

The foreign exchange market is a vast and complex system that offers numerous opportunities for individuals to earn extra income. With the advent of currency exchange apps, it has become easier for people to participate in this market and make money. A currency exchange app to make money is a platform that allows users to buy and sell currencies at the click of a button.

These apps have revolutionized the way people think about currency exchange, making it faster, cheaper, and more convenient than ever before. However, with so many apps on the market, it can be difficult to know where to start. Choosing the right currency exchange app is crucial, as it can make a significant difference in the user’s experience and potential earnings.

When selecting a currency exchange app, it is essential to consider several factors, including the app’s features, fees, and user experience. Some popular currency exchange apps, such as TransferWise, Revolut, and PayPal, offer competitive exchange rates, low fees, and user-friendly interfaces. However, each app has its strengths and weaknesses, and it is crucial to research and compare them before making a decision.

Understanding the market is also vital when using a currency exchange app to make money. The foreign exchange market is influenced by various factors, including economic indicators, political events, and market trends. Staying informed about these factors can help users make informed decisions and maximize their earnings.

By using a currency exchange app to make money, individuals can tap into a global market that is worth trillions of dollars. With the right app and a solid understanding of the market, users can take advantage of the numerous opportunities available and earn extra income.

Top Currency Exchange Apps for Making Money: A Review

When it comes to using a currency exchange app to make money, choosing the right platform is crucial. With so many options available, it can be difficult to know where to start. In this review, we’ll take a closer look at some of the top currency exchange apps on the market, including TransferWise, Revolut, and PayPal.

TransferWise is a popular choice among currency exchange app users. This app offers competitive exchange rates, low fees, and a user-friendly interface. TransferWise also provides a borderless account, which allows users to hold and manage multiple currencies in one place.

Revolut is another top contender in the currency exchange app market. This app offers a range of features, including real-time exchange rates, low fees, and a debit card that can be used to make purchases abroad. Revolut also provides a cryptocurrency exchange feature, which allows users to buy and sell cryptocurrencies such as Bitcoin and Ethereum.

PayPal is a well-established player in the digital payments market, and its currency exchange app is a popular choice among users. PayPal offers competitive exchange rates, low fees, and a user-friendly interface. This app also provides a range of features, including the ability to send and receive payments in multiple currencies.

When choosing a currency exchange app, it’s essential to consider several factors, including the app’s features, fees, and user experience. Each of the apps mentioned above has its strengths and weaknesses, and it’s crucial to research and compare them before making a decision.

In addition to the apps mentioned above, there are many other currency exchange apps available on the market. Some other popular options include WorldFirst, Currencies Direct, and OFX. Each of these apps offers a range of features and benefits, and it’s worth doing your research to find the one that best suits your needs.

By using a currency exchange app to make money, individuals can take advantage of the numerous opportunities available in the foreign exchange market. Whether you’re a seasoned investor or just starting out, there’s a currency exchange app out there that can help you achieve your financial goals.

Understanding Currency Exchange Rates and Market Trends

Currency exchange rates are a crucial aspect of the foreign exchange market, and understanding how they work is essential for anyone looking to use a currency exchange app to make money. In this section, we’ll take a closer look at the basics of currency exchange rates and market trends.

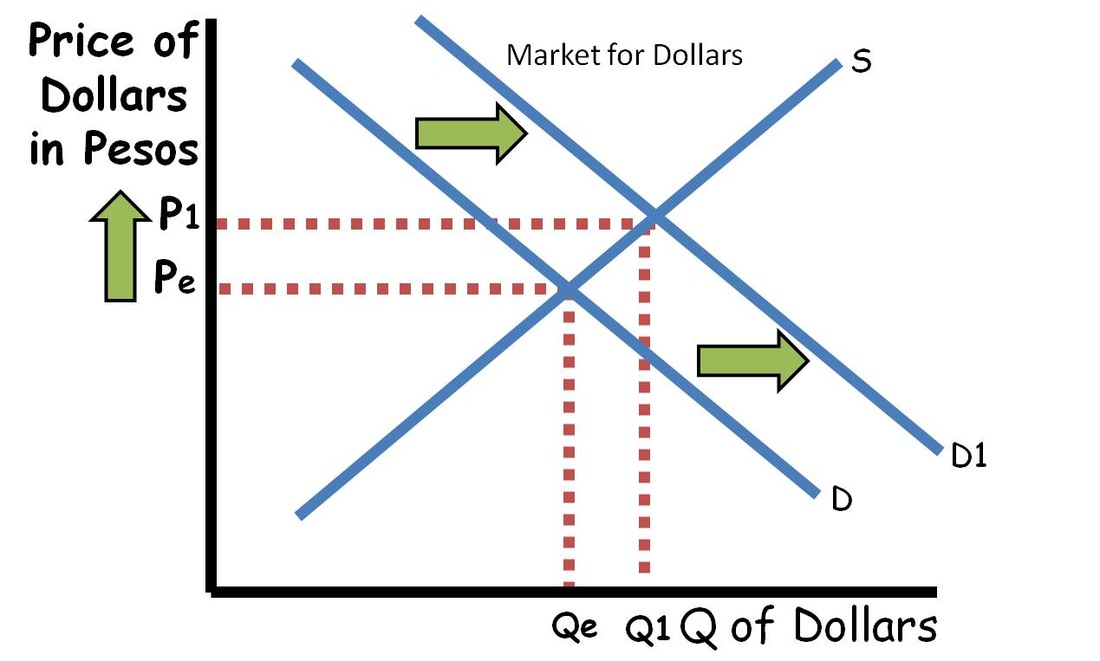

Currency exchange rates are determined by supply and demand in the foreign exchange market. When the demand for a particular currency is high, its value tends to increase, and when the demand is low, its value tends to decrease. This is why currency exchange rates can fluctuate rapidly, and why it’s essential to stay informed about changes in the market.

There are several factors that can influence currency exchange rates, including economic indicators, political events, and market trends. Economic indicators such as GDP, inflation, and interest rates can all impact currency exchange rates, as can political events such as elections and trade agreements. Market trends, such as changes in investor sentiment and market volatility, can also influence currency exchange rates.

Staying informed about changes in the foreign exchange market is crucial for anyone looking to use a currency exchange app to make money. This can be done by following financial news and market analysis, as well as by using technical indicators and charting tools to analyze market trends.

Some popular technical indicators used in currency exchange rate analysis include moving averages, relative strength index (RSI), and Bollinger Bands. These indicators can help identify trends and patterns in the market, and can be used to make informed decisions about buying and selling currencies.

In addition to technical indicators, it’s also essential to stay informed about fundamental analysis, which involves analyzing economic and financial data to make informed decisions about currency exchange rates. This can include analyzing economic indicators, such as GDP and inflation, as well as analyzing company financials and industry trends.

By understanding currency exchange rates and market trends, individuals can make informed decisions about using a currency exchange app to make money. Whether you’re a seasoned investor or just starting out, staying informed about changes in the market is crucial for success.

Strategies for Making Money with Currency Exchange Apps

Using a currency exchange app to make money requires a combination of knowledge, strategy, and timing. In this section, we’ll explore some effective strategies for making money with currency exchange apps.

One of the most popular strategies for making money with currency exchange apps is to buy and sell currencies at the right time. This involves analyzing market trends and identifying opportunities to buy low and sell high. By using technical indicators and charting tools, you can identify trends and patterns in the market and make informed decisions about when to buy and sell.

Another effective strategy is to use limit orders. A limit order is an instruction to buy or sell a currency at a specific price. By setting a limit order, you can ensure that you buy or sell a currency at the price you want, rather than at the current market price. This can be particularly useful in volatile markets, where prices can fluctuate rapidly.

Taking advantage of price fluctuations is another strategy for making money with currency exchange apps. By analyzing market trends and identifying opportunities to buy low and sell high, you can profit from price fluctuations. This can be done by using technical indicators and charting tools to identify trends and patterns in the market.

Arbitrage is another strategy for making money with currency exchange apps. Arbitrage involves buying a currency at a low price in one market and selling it at a higher price in another market. By taking advantage of price differences between markets, you can profit from arbitrage opportunities.

Finally, it’s essential to stay informed about changes in the foreign exchange market. By following financial news and market analysis, you can stay up-to-date with the latest market trends and make informed decisions about buying and selling currencies.

By using these strategies, you can increase your chances of making money with a currency exchange app. Remember to always do your research, stay informed, and use effective risk management techniques to minimize your losses.

Managing Risk and Minimizing Losses

Using a currency exchange app to make money involves risk, and it’s essential to manage that risk to minimize losses. In this section, we’ll discuss the importance of risk management and provide tips on how to set stop-loss orders, diversify your portfolio, and avoid common pitfalls.

Risk management is critical when using a currency exchange app to make money. The foreign exchange market can be volatile, and prices can fluctuate rapidly. If you’re not careful, you can lose money quickly. To manage risk, it’s essential to set stop-loss orders, which are instructions to sell a currency when it reaches a certain price.

Stop-loss orders can help limit your losses if the market moves against you. For example, if you buy a currency at $100 and set a stop-loss order at $90, the currency will be sold automatically if it falls to $90. This can help prevent significant losses if the market moves against you.

Diversifying your portfolio is another way to manage risk when using a currency exchange app to make money. By spreading your investments across multiple currencies, you can reduce your exposure to any one currency. This can help minimize losses if one currency performs poorly.

Avoiding common pitfalls is also essential when using a currency exchange app to make money. One common pitfall is over-leveraging, which involves using too much leverage to make trades. This can increase your potential losses if the market moves against you.

Another common pitfall is failing to stay informed about market trends and news. The foreign exchange market is constantly changing, and it’s essential to stay up-to-date with the latest news and trends to make informed decisions.

By managing risk and minimizing losses, you can increase your chances of success when using a currency exchange app to make money. Remember to always set stop-loss orders, diversify your portfolio, and stay informed about market trends and news.

Security and Safety Features of Currency Exchange Apps

When using a currency exchange app to make money, security and safety are top priorities. In this section, we’ll evaluate the security and safety features of popular currency exchange apps, including encryption, two-factor authentication, and regulatory compliance.

Encryption is a critical security feature that protects user data and transactions. Look for currency exchange apps that use end-to-end encryption, which ensures that all data transmitted between the user’s device and the app’s servers is encrypted and secure.

Two-factor authentication is another essential security feature that adds an extra layer of protection to user accounts. This feature requires users to provide a second form of verification, such as a fingerprint or a code sent to their phone, in addition to their password.

Regulatory compliance is also crucial when it comes to security and safety. Look for currency exchange apps that are regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US.

TransferWise, for example, is a popular currency exchange app that prioritizes security and safety. The app uses end-to-end encryption and two-factor authentication to protect user data and transactions. Additionally, TransferWise is regulated by the FCA in the UK and is compliant with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Revolut is another currency exchange app that takes security and safety seriously. The app uses encryption and two-factor authentication to protect user data and transactions. Additionally, Revolut is regulated by the FCA in the UK and is compliant with AML and KYC regulations.

PayPal is also a secure and safe currency exchange app that uses encryption and two-factor authentication to protect user data and transactions. The app is regulated by the SEC in the US and is compliant with AML and KYC regulations.

By prioritizing security and safety, currency exchange apps can provide users with a secure and trustworthy platform for making money. When choosing a currency exchange app, look for features such as encryption, two-factor authentication, and regulatory compliance to ensure that your transactions are secure and safe.

Real-Life Examples of Successful Currency Exchange App Users

Using a currency exchange app to make money is not just a theoretical concept, but a reality for many individuals around the world. In this section, we’ll share real-life examples of individuals who have successfully used currency exchange apps to make money, highlighting their strategies and experiences.

One example is a freelance writer who uses TransferWise to exchange currencies and make payments to clients around the world. By using TransferWise, the writer is able to save money on transaction fees and exchange rates, and make more money from their writing services.

Another example is a small business owner who uses Revolut to manage their company’s finances and make international payments. By using Revolut, the business owner is able to save time and money on transaction fees, and make more informed decisions about their company’s finances.

A third example is a traveler who uses PayPal to exchange currencies and make payments while abroad. By using PayPal, the traveler is able to avoid high transaction fees and exchange rates, and make more money from their travels.

These examples demonstrate that using a currency exchange app to make money is a real and achievable goal for individuals and businesses around the world. By choosing the right app and understanding the market, individuals can make more money and achieve their financial goals.

It’s worth noting that these examples are not isolated incidents, but rather a representation of the many individuals and businesses that have successfully used currency exchange apps to make money. By following their strategies and experiences, you can also achieve success and make more money using a currency exchange app.

Getting Started with Currency Exchange Apps: A Step-by-Step Guide

Getting started with currency exchange apps is easier than you think. In this section, we’ll provide a step-by-step guide on how to sign up, deposit funds, and start making trades with a currency exchange app.

Step 1: Choose a Currency Exchange App

The first step is to choose a currency exchange app that meets your needs. Consider factors such as fees, exchange rates, and user experience. Some popular currency exchange apps include TransferWise, Revolut, and PayPal.

Step 2: Sign Up for an Account

Once you’ve chosen a currency exchange app, sign up for an account. This typically involves providing some personal and financial information, such as your name, address, and bank account details.

Step 3: Deposit Funds

After signing up for an account, deposit funds into your account. This can be done using a variety of payment methods, such as bank transfer, credit card, or debit card.

Step 4: Set Up Your Account

Once your funds are deposited, set up your account by adding your payment methods, setting up your security settings, and familiarizing yourself with the app’s interface.

Step 5: Start Making Trades

Now that your account is set up, start making trades. This involves buying and selling currencies at the right time, using limit orders, and taking advantage of price fluctuations.

Step 6: Monitor Your Trades

After making a trade, monitor your trades to ensure that they are executing as planned. This involves tracking the exchange rates, monitoring your account balance, and adjusting your trades as needed.

By following these steps, you can get started with currency exchange apps and start making money. Remember to always do your research, stay informed, and use effective risk management techniques to minimize your losses.