Understanding Walmart’s Health Insurance Options

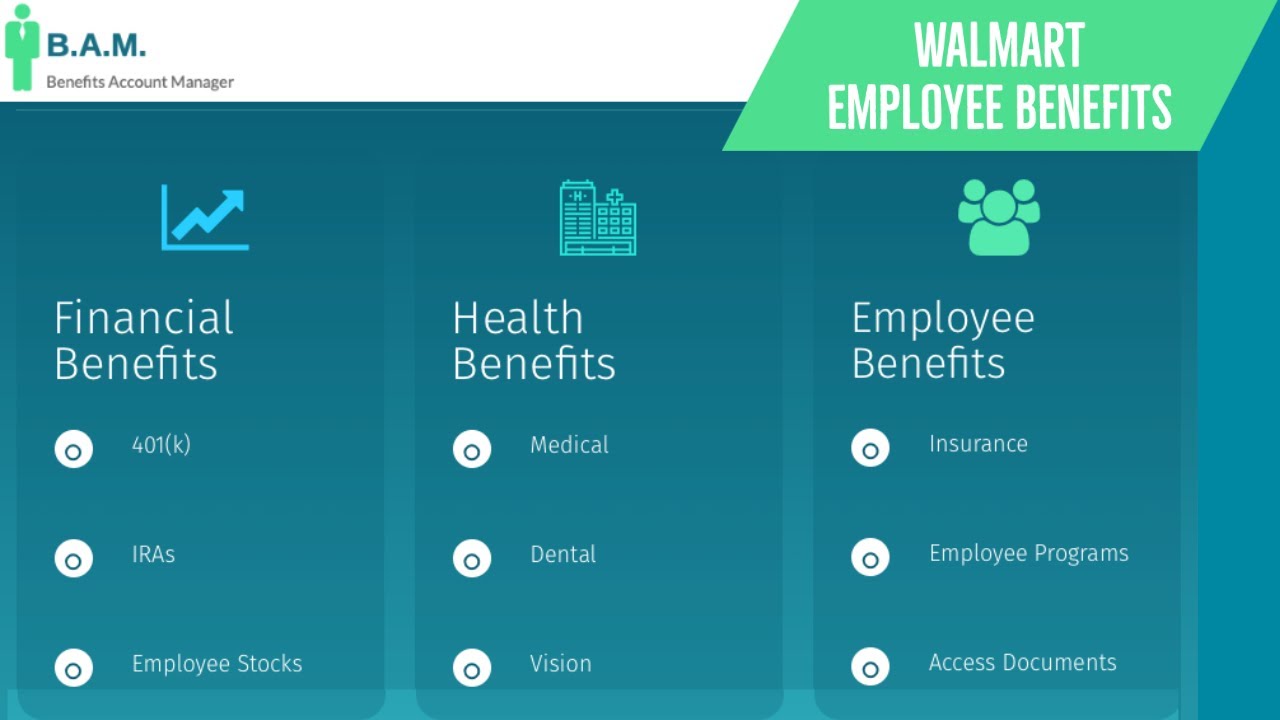

As a part-time employee, having access to health insurance is crucial for maintaining overall well-being and financial stability. Walmart, one of the largest retailers in the world, offers a range of benefits to its part-time employees, including health insurance. But does Walmart offer health insurance to part-time employees? The answer is yes, and in this article, we will delve into the details of Walmart’s health insurance options and how they compare to other retailers.

Walmart’s health insurance program is designed to provide part-time employees with access to quality healthcare at an affordable cost. The program offers a range of coverage options, including medical, dental, and vision insurance. Part-time employees can choose from various plans, including a catastrophic plan, a bronze plan, and a silver plan, each with different levels of coverage and premium costs.

One of the key benefits of Walmart’s health insurance program is its affordability. The company offers competitive premium rates, making it easier for part-time employees to access quality healthcare. Additionally, Walmart’s health insurance program is designed to be flexible, allowing part-time employees to choose the coverage that best suits their needs and budget.

But how does Walmart’s health insurance program compare to other retailers? According to a recent survey, Walmart’s health insurance program is one of the most comprehensive and affordable in the retail industry. The program offers a range of benefits, including preventive care, hospitalization, and prescription medication coverage, making it an attractive option for part-time employees.

In addition to its health insurance program, Walmart also offers other benefits to its part-time employees, including 401(k) matching, employee discounts, and paid time off. These benefits can enhance the overall compensation package for part-time employees, making Walmart a more attractive employer in the retail industry.

Overall, Walmart’s health insurance program is a valuable benefit for part-time employees, providing access to quality healthcare at an affordable cost. With its range of coverage options, competitive premium rates, and flexibility, Walmart’s health insurance program is an attractive option for part-time employees looking for a comprehensive benefits package.

How to Navigate Walmart’s Health Insurance Enrollment Process

Enrolling in Walmart’s health insurance program can seem daunting, but with the right guidance, part-time employees can easily navigate the process. To start, part-time employees must meet the eligibility requirements, which typically include working a minimum number of hours per week and being in good standing with the company.

Once eligible, part-time employees can enroll in Walmart’s health insurance program during the designated enrollment periods, which usually occur annually or during special enrollment events. To enroll, part-time employees will need to provide necessary documentation, such as proof of identity, social security number, and dependent information.

The enrollment process can be completed online through Walmart’s benefits portal or in-person with a benefits representative. Part-time employees can also contact Walmart’s benefits hotline for assistance with the enrollment process.

It’s essential for part-time employees to carefully review their coverage options and premium costs before enrolling in Walmart’s health insurance program. This will help ensure they choose the best plan for their needs and budget. Additionally, part-time employees should take advantage of Walmart’s online resources and tools, such as the benefits calculator, to help them make informed decisions about their health insurance coverage.

For part-time employees who are new to Walmart’s health insurance program, it’s recommended to start by reviewing the program’s overview and eligibility requirements. This will provide a solid understanding of the program’s structure and what to expect during the enrollment process.

Furthermore, part-time employees can also seek guidance from Walmart’s benefits representatives, who are available to answer questions and provide support throughout the enrollment process. By taking the time to understand the enrollment process and seeking guidance when needed, part-time employees can ensure a smooth and successful enrollment experience.

Does Walmart offer health insurance to part-time employees? Yes, and with the right guidance, part-time employees can easily navigate the enrollment process and take advantage of the program’s benefits. By following these steps and seeking support when needed, part-time employees can ensure they have the health insurance coverage they need to maintain their overall well-being.

Walmart’s Health Insurance Plans: A Breakdown of Coverage and Costs

Walmart offers a range of health insurance plans to its part-time employees, each with varying levels of coverage and costs. The plans are designed to provide affordable and comprehensive healthcare options for part-time employees and their families.

The most basic plan, known as the “Catastrophic Plan,” provides limited coverage for emergency medical services, hospitalization, and prescription medication. This plan is ideal for part-time employees who are looking for a low-cost option and are willing to pay out-of-pocket for most medical expenses.

The next level of coverage is the “Bronze Plan,” which provides more comprehensive coverage for medical services, including doctor visits, hospitalization, and prescription medication. This plan also includes a higher deductible and out-of-pocket expenses compared to the Catastrophic Plan.

The “Silver Plan” is the most popular option among part-time employees, offering a balance of coverage and affordability. This plan provides comprehensive coverage for medical services, including doctor visits, hospitalization, and prescription medication, with a moderate deductible and out-of-pocket expenses.

Walmart also offers a “Gold Plan” and a “Platinum Plan,” which provide more comprehensive coverage and higher levels of benefits, but at a higher cost. These plans are ideal for part-time employees who want the best possible coverage and are willing to pay a premium for it.

In comparison to other health insurance providers, Walmart’s plans are competitive in terms of coverage and costs. However, the costs of the plans can vary depending on the location, age, and health status of the part-time employee.

Does Walmart offer health insurance to part-time employees? Yes, and with a range of plans to choose from, part-time employees can select the one that best fits their needs and budget. By understanding the coverage options and costs of each plan, part-time employees can make informed decisions about their health insurance coverage.

It’s essential for part-time employees to carefully review the details of each plan, including the deductible, out-of-pocket expenses, and coverage options, before making a decision. This will help ensure they choose the best plan for their needs and budget.

Additional Benefits for Part-Time Employees: Beyond Health Insurance

While health insurance is a crucial benefit for part-time employees, Walmart offers a range of additional benefits that can enhance their overall compensation package. These benefits include dental and vision insurance, 401(k) matching, and employee discounts.

Walmart’s dental insurance plan provides coverage for routine cleanings, fillings, and other dental procedures. This plan is designed to help part-time employees maintain good oral health and prevent costly dental problems down the line.

The vision insurance plan, on the other hand, provides coverage for eye exams, glasses, and contact lenses. This plan is designed to help part-time employees maintain good eye health and correct any vision problems that may be affecting their daily lives.

In addition to these insurance plans, Walmart also offers a 401(k) matching program to help part-time employees save for retirement. This program allows part-time employees to contribute a portion of their paycheck to a 401(k) account, and Walmart will match a certain percentage of those contributions.

Employee discounts are another benefit that Walmart offers to its part-time employees. These discounts can be used on a wide range of products and services, including groceries, electronics, and clothing. This benefit can help part-time employees save money on everyday items and stretch their budget further.

These additional benefits can have a significant impact on a part-time employee’s overall compensation package. By offering a range of benefits beyond health insurance, Walmart is able to attract and retain top talent in the retail industry.

Does Walmart offer health insurance to part-time employees? Yes, and as we’ve seen, the company also offers a range of additional benefits that can enhance their overall compensation package. By taking advantage of these benefits, part-time employees can improve their overall well-being and job satisfaction.

It’s worth noting that these benefits can vary depending on the location and type of job. Part-time employees should check with their HR representative to see what benefits are available to them.

Real-Life Scenarios: How Walmart’s Health Insurance Impacts Part-Time Employees

Walmart’s health insurance program has had a positive impact on the lives and careers of many part-time employees. Here are a few real-life examples of how the program has made a difference:

Meet Sarah, a part-time sales associate at a Walmart store in Texas. Sarah has been working at Walmart for three years and has been enrolled in the company’s health insurance program for two years. She has a chronic medical condition that requires regular doctor visits and medication. Thanks to Walmart’s health insurance program, Sarah has been able to manage her condition and stay healthy.

“I was hesitant to enroll in the health insurance program at first, but I’m so glad I did,” Sarah said. “The program has been a lifesaver for me. I’ve been able to get the medical care I need without breaking the bank.”

Another example is John, a part-time stocker at a Walmart store in California. John has been working at Walmart for five years and has been enrolled in the company’s health insurance program for three years. He has a family of four and was struggling to make ends meet before enrolling in the program.

“Walmart’s health insurance program has been a game-changer for my family and me,” John said. “We were able to get the medical care we needed without going into debt. The program has given us peace of mind and allowed us to focus on our health and well-being.”

These are just a few examples of how Walmart’s health insurance program has positively impacted the lives and careers of part-time employees. The program has provided many employees with access to affordable healthcare, which has improved their overall well-being and job satisfaction.

Does Walmart offer health insurance to part-time employees? Yes, and as these examples show, the program has made a significant difference in the lives of many employees. By offering a comprehensive health insurance program, Walmart is able to attract and retain top talent in the retail industry.

Common Questions and Concerns: Addressing Part-Time Employees’ Health Insurance Queries

As a part-time employee at Walmart, you may have questions and concerns about the company’s health insurance program. Here are some frequently asked questions and concerns that part-time employees may have about Walmart’s health insurance program:

Q: Am I eligible for Walmart’s health insurance program as a part-time employee?

A: Yes, part-time employees who work at least 30 hours per week are eligible for Walmart’s health insurance program.

Q: What are the different types of health insurance plans offered by Walmart?

A: Walmart offers a range of health insurance plans, including catastrophic, bronze, silver, and gold plans. Each plan has different levels of coverage and costs.

Q: How much does Walmart’s health insurance program cost?

A: The cost of Walmart’s health insurance program varies depending on the plan you choose and your individual circumstances. However, Walmart offers competitive pricing and a range of options to fit different budgets.

Q: Can I add my family members to my health insurance plan?

A: Yes, part-time employees can add their family members to their health insurance plan. However, the cost of the plan may increase depending on the number of family members added.

Q: What is the enrollment process for Walmart’s health insurance program?

A: The enrollment process for Walmart’s health insurance program typically occurs during the annual open enrollment period. However, part-time employees can also enroll in the program during special enrollment periods or when they experience a qualifying life event.

Q: Can I change my health insurance plan during the year?

A: Yes, part-time employees can change their health insurance plan during the year if they experience a qualifying life event or during the annual open enrollment period.

Does Walmart offer health insurance to part-time employees? Yes, and as we’ve seen, the program offers a range of benefits and options to fit different needs and budgets. By understanding the answers to these frequently asked questions, part-time employees can make informed decisions about their health insurance coverage.

Maximizing Your Benefits: Tips for Part-Time Employees

As a part-time employee at Walmart, it’s essential to understand how to maximize your benefits to get the most out of your compensation package. Here are some tips to help you make the most of your benefits:

Take advantage of preventive care: Walmart’s health insurance program covers preventive care services, such as annual physicals, vaccinations, and screenings. By taking advantage of these services, you can stay healthy and avoid costly medical bills.

Utilize employee assistance programs: Walmart offers employee assistance programs (EAPs) to help part-time employees manage stress, anxiety, and other mental health issues. EAPs can provide confidential counseling services, stress management techniques, and other resources to help you manage your mental health.

Understand your coverage options: Walmart’s health insurance program offers a range of coverage options, including catastrophic, bronze, silver, and gold plans. By understanding your coverage options, you can choose the plan that best fits your needs and budget.

Take advantage of employee discounts: Walmart offers employee discounts on store merchandise, including groceries, electronics, and clothing. By taking advantage of these discounts, you can save money on everyday items and stretch your budget further.

Participate in wellness programs: Walmart offers wellness programs, such as fitness classes and healthy eating initiatives, to help part-time employees stay healthy and active. By participating in these programs, you can improve your overall health and well-being.

Does Walmart offer health insurance to part-time employees? Yes, and by following these tips, you can maximize your benefits and get the most out of your compensation package. By taking advantage of preventive care, utilizing employee assistance programs, and understanding your coverage options, you can stay healthy, save money, and improve your overall well-being.

Conclusion: Why Walmart’s Health Insurance Matters for Part-Time Employees

Walmart’s health insurance program is a vital component of the company’s benefits package for part-time employees. By offering a range of coverage options and competitive premium costs, Walmart demonstrates its commitment to supporting the overall well-being and job satisfaction of its part-time workforce. As a part-time employee, understanding the ins and outs of Walmart’s health insurance program can help you make informed decisions about your benefits and take advantage of the resources available to you.

Does Walmart offer health insurance to part-time employees? The answer is yes, and it’s an important aspect of the company’s benefits package. By providing health insurance options to part-time employees, Walmart helps to level the playing field and ensure that all employees have access to quality healthcare, regardless of their work schedule. This, in turn, can lead to improved health outcomes, increased productivity, and enhanced job satisfaction.

In conclusion, Walmart’s health insurance program is a valuable resource for part-time employees. By taking the time to understand the program’s details, including coverage options, premium costs, and enrollment requirements, part-time employees can make informed decisions about their benefits and take advantage of the resources available to them. Whether you’re a seasoned part-time employee or just starting out, Walmart’s health insurance program is an important aspect of your overall compensation package and can have a significant impact on your well-being and job satisfaction.

As a part-time employee, it’s essential to remember that you have access to a range of benefits beyond health insurance, including dental and vision insurance, 401(k) matching, and employee discounts. By taking advantage of these benefits, you can enhance your overall compensation package and improve your quality of life. So, take the time to explore your benefits options and make the most of Walmart’s health insurance program – your health and well-being depend on it.