Why Building Wealth Requires a Strategic Mindset

Building wealth is not just about making a lot of money; it’s about having a clear understanding of what it takes to achieve financial freedom. To make a million dollars a year, individuals need to adopt a strategic mindset that encompasses financial literacy, calculated risk-taking, and a long-term perspective. This mindset is essential for navigating the complexities of wealth creation and avoiding common pitfalls that can derail even the best-laid plans.

A strategic mindset begins with a deep understanding of personal finance and investing. This includes knowledge of financial instruments, such as stocks, bonds, and real estate, as well as the ability to analyze market trends and make informed investment decisions. It also involves developing a risk management strategy that balances potential returns with potential losses.

In addition to financial knowledge, a strategic mindset requires a willingness to take calculated risks. This means being open to new opportunities and willing to invest time and resources in pursuit of long-term goals. It also involves being adaptable and resilient in the face of uncertainty and setbacks.

Finally, a strategic mindset requires a long-term perspective. Building wealth is not a get-rich-quick scheme; it’s a marathon, not a sprint. It requires patience, discipline, and a commitment to staying the course, even when the going gets tough.

By adopting a strategic mindset, individuals can set themselves up for success and increase their chances of making a million dollars a year. It’s not a guarantee, but it’s a critical first step on the path to financial freedom.

Identifying Lucrative Opportunities: How to Spot High-Growth Industries

Identifying high-growth industries and opportunities is crucial for individuals looking to make a million dollars a year. These industries have the potential to generate significant revenue and provide a strong foundation for building wealth. So, how can you spot these lucrative opportunities?

One approach is to look at industries that have historically produced high earners. For example, the tech industry has been a breeding ground for millionaires and billionaires in recent years, with companies like Google, Amazon, and Facebook leading the way. Other industries, such as healthcare, finance, and renewable energy, also have a strong track record of producing high-growth opportunities.

Another approach is to look at emerging trends and technologies that have the potential to disrupt traditional industries. For example, the rise of artificial intelligence, blockchain, and the Internet of Things (IoT) is creating new opportunities for entrepreneurs and investors. By identifying these trends early, individuals can position themselves for success and potentially make a million dollars a year.

It’s also important to consider the job market and the skills that are in high demand. For example, data scientists, software engineers, and digital marketers are in high demand and can command high salaries. By developing skills in these areas, individuals can increase their earning potential and potentially make a million dollars a year.

Finally, it’s essential to stay informed and up-to-date on the latest industry trends and news. This can be done by reading industry publications, attending conferences and events, and networking with other professionals in the field. By staying informed, individuals can identify lucrative opportunities and make informed decisions about their investments and career choices.

By following these strategies, individuals can increase their chances of identifying high-growth industries and opportunities that can help them make a million dollars a year. Remember, building wealth takes time, effort, and a willingness to take calculated risks. But with the right mindset and strategy, it is possible to achieve financial freedom and success.

Developing a Valuable Skillset: Investing in Your Personal Growth

Developing a valuable skillset is essential for individuals looking to make a million dollars a year. In today’s competitive job market, having a unique set of skills that are in high demand can significantly increase earning potential. So, what skills are highly valued in the job market, and how can individuals develop them?

One of the most in-demand skills in the job market is data science. With the increasing amount of data being generated every day, companies are looking for professionals who can collect, analyze, and interpret data to make informed business decisions. Other highly valued skills include software engineering, digital marketing, and cloud computing.

To develop these skills, individuals can invest in online courses, attend workshops and conferences, and read industry publications. It’s also essential to stay up-to-date with the latest industry trends and technologies. For example, individuals can learn programming languages such as Python, Java, and JavaScript, which are highly valued in the job market.

In addition to technical skills, individuals can also develop soft skills such as communication, leadership, and problem-solving. These skills are essential for success in any industry and can significantly increase earning potential. For example, individuals can learn how to effectively communicate with colleagues and clients, lead teams, and solve complex problems.

Investing in personal growth and developing a valuable skillset takes time and effort. However, it’s essential for individuals looking to make a million dollars a year. By developing a unique set of skills that are in high demand, individuals can increase their earning potential and achieve financial freedom.

Some of the most successful individuals in the world have developed valuable skillsets that are in high demand. For example, entrepreneurs like Elon Musk and Steve Jobs have developed skills in software engineering, design, and innovation. By developing these skills, they were able to create successful companies and achieve financial freedom.

In conclusion, developing a valuable skillset is essential for individuals looking to make a million dollars a year. By investing in personal growth and developing skills that are in high demand, individuals can increase their earning potential and achieve financial freedom.

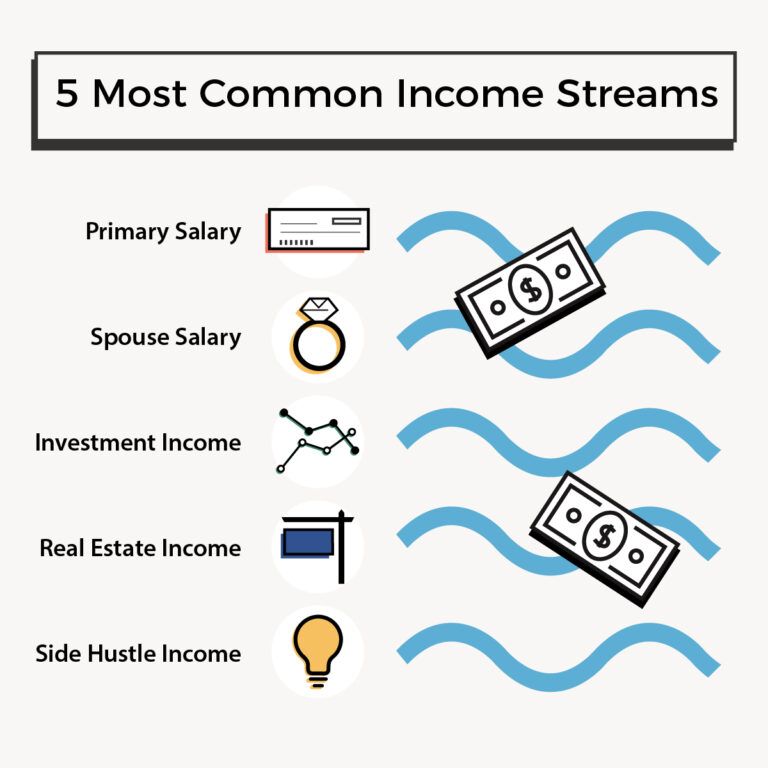

Building Multiple Income Streams: Diversifying Your Revenue

Building multiple income streams is a crucial step in achieving financial freedom and making a million dollars a year. By diversifying your revenue streams, you can reduce financial risk and increase your earning potential. So, what are some examples of different types of income streams that you can build?

One of the most popular income streams is real estate investing. By investing in rental properties or real estate investment trusts (REITs), you can generate passive income and build wealth over time. Another example is dividend-paying stocks, which can provide a regular stream of income and help you build wealth through compounding.

Online businesses are also a great way to build multiple income streams. By creating a website or blog, you can generate income through advertising, affiliate marketing, and selling digital products. Additionally, you can create and sell online courses, ebooks, and other digital products to generate passive income.

Other examples of income streams include freelancing, consulting, and coaching. By offering your skills and expertise to clients, you can generate income and build a reputation as an expert in your field. You can also create and sell an online course or ebook to teach others your skills and generate passive income.

Building multiple income streams requires a strategic mindset and a willingness to take calculated risks. It’s essential to diversify your revenue streams to reduce financial risk and increase your earning potential. By building multiple income streams, you can achieve financial freedom and make a million dollars a year.

Some of the most successful entrepreneurs and investors have built multiple income streams to achieve financial freedom. For example, Warren Buffett has built a vast fortune through his investments in stocks, real estate, and businesses. By diversifying his revenue streams, he has reduced financial risk and increased his earning potential.

In conclusion, building multiple income streams is essential for achieving financial freedom and making a million dollars a year. By diversifying your revenue streams, you can reduce financial risk and increase your earning potential. By building multiple income streams, you can achieve financial freedom and live the life you want.

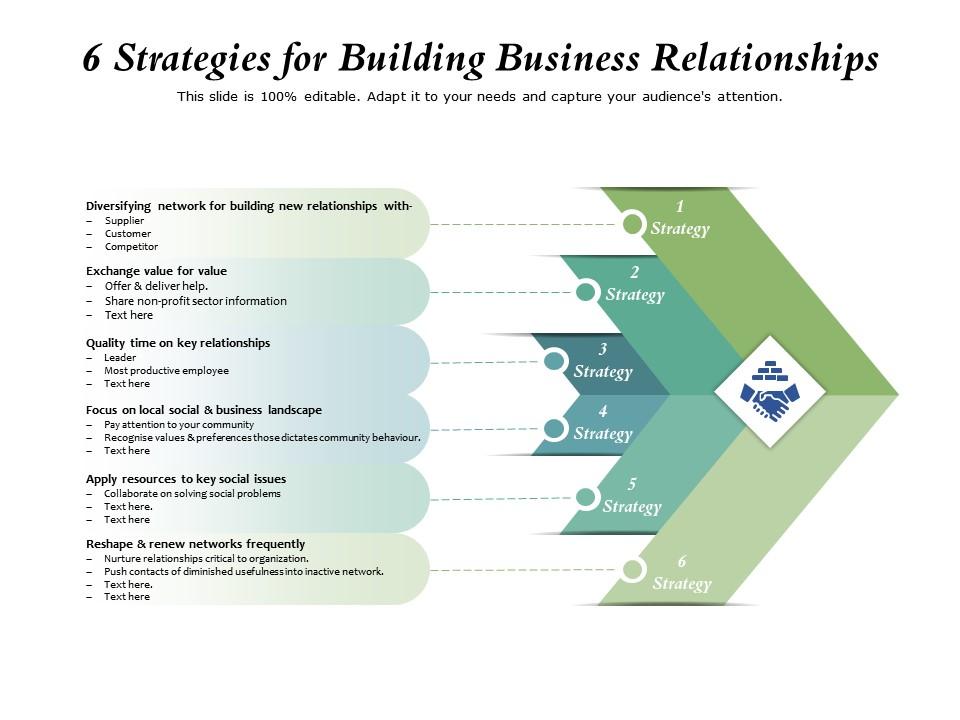

Networking and Building Relationships: The Power of Strategic Partnerships

Building strategic partnerships and networking with high-net-worth individuals is a crucial step in achieving financial freedom and making a million dollars a year. By building relationships with successful entrepreneurs, investors, and business leaders, you can gain access to new opportunities, learn from their experiences, and increase your earning potential.

One of the most effective ways to build strategic partnerships is to attend industry conferences, networking events, and seminars. These events provide a platform for meeting successful entrepreneurs and investors who can offer valuable advice, mentorship, and business opportunities. Additionally, you can join online communities, forums, and social media groups to connect with like-minded individuals and build relationships.

Another way to build strategic partnerships is to offer value to others. By providing valuable services, products, or advice, you can build trust and credibility with potential partners. This can lead to new business opportunities, joint ventures, and strategic partnerships that can help you achieve your financial goals.

Some of the most successful entrepreneurs and investors have built their wealth through strategic partnerships. For example, Bill Gates and Warren Buffett have built a vast fortune through their partnerships and investments. By building relationships with successful entrepreneurs and investors, you can gain access to new opportunities and increase your earning potential.

Building strategic partnerships requires a strategic mindset and a willingness to take calculated risks. It’s essential to identify potential partners who share your values, goals, and vision. By building relationships with the right people, you can increase your earning potential and achieve financial freedom.

In addition to building strategic partnerships, it’s also essential to build a strong network of contacts. This can include friends, family, colleagues, and acquaintances who can provide support, advice, and business opportunities. By building a strong network, you can increase your earning potential and achieve financial freedom.

By building strategic partnerships and networking with high-net-worth individuals, you can gain access to new opportunities, learn from their experiences, and increase your earning potential. This can help you achieve financial freedom and make a million dollars a year.

Managing Your Finances: How to Make Smart Investment Decisions

Managing your finances effectively is crucial for achieving financial freedom and making a million dollars a year. One of the most important aspects of financial management is making smart investment decisions. By investing your money wisely, you can minimize taxes, maximize returns, and achieve your long-term financial goals.

One of the most effective ways to manage your finances is to create a diversified investment portfolio. This can include a mix of low-risk investments, such as bonds and CDs, and higher-risk investments, such as stocks and real estate. By diversifying your portfolio, you can reduce your risk and increase your potential returns.

Another important aspect of financial management is tax planning. By minimizing your taxes, you can keep more of your hard-earned money and achieve your financial goals faster. This can include strategies such as tax-loss harvesting, charitable donations, and retirement account contributions.

In addition to tax planning, it’s also essential to manage your cash flow effectively. This can include creating a budget, tracking your expenses, and building an emergency fund. By managing your cash flow, you can reduce your financial stress and achieve your long-term financial goals.

Some of the most successful investors and entrepreneurs have achieved their financial success through smart investment decisions and effective financial management. For example, Warren Buffett has built a vast fortune through his value investing strategy and tax planning. By following in their footsteps, you can achieve financial freedom and make a million dollars a year.

When it comes to making smart investment decisions, it’s essential to do your research and stay informed. This can include reading financial news, attending seminars, and consulting with financial advisors. By staying informed and doing your research, you can make informed investment decisions and achieve your financial goals.

In conclusion, managing your finances effectively is crucial for achieving financial freedom and making a million dollars a year. By creating a diversified investment portfolio, minimizing taxes, and managing your cash flow, you can achieve your long-term financial goals and live the life you want.

Staying Motivated and Focused: Overcoming Obstacles to Success

Staying motivated and focused is crucial for achieving financial freedom and making a million dollars a year. However, it’s easy to get sidetracked and lose momentum, especially when faced with obstacles and setbacks. So, how can you stay motivated and focused on your long-term goals?

One of the most effective ways to stay motivated is to set clear and specific goals. By setting goals that are aligned with your values and vision, you can create a sense of purpose and direction. Additionally, breaking down your goals into smaller, manageable tasks can help you stay focused and motivated.

Another important aspect of staying motivated is to create a positive and supportive environment. This can include surrounding yourself with positive and like-minded individuals, reading inspiring books and articles, and engaging in activities that bring you joy and fulfillment.

It’s also essential to develop a growth mindset and be open to learning and growth. By embracing challenges and viewing failures as opportunities for growth, you can stay motivated and focused on your long-term goals.

Some of the most successful entrepreneurs and investors have achieved their financial success through sheer determination and perseverance. For example, Thomas Edison is famously quoted as saying, “I have not failed. I’ve just found 10,000 ways that won’t work.” By staying motivated and focused, you can overcome obstacles and achieve your financial goals.

In addition to staying motivated, it’s also essential to stay organized and manage your time effectively. By prioritizing your tasks and managing your time wisely, you can stay focused on your goals and achieve financial freedom.

By staying motivated and focused, you can overcome obstacles and achieve your financial goals. Remember, making a million dollars a year requires dedication, hard work, and perseverance. By staying committed to your goals and vision, you can achieve financial freedom and live the life you want.

Putting it All Together: Creating a Personalized Plan for Success

Creating a personalized plan for success is crucial for achieving financial freedom and making a million dollars a year. By combining the strategies and concepts discussed in this article, you can create a comprehensive plan that aligns with your goals and vision.

Start by identifying your strengths and weaknesses, and determining what skills and knowledge you need to acquire to achieve your goals. Develop a valuable skillset that is in high demand, and invest in your personal growth and development.

Next, identify high-growth industries and opportunities that have the potential to generate significant revenue. Build multiple income streams to reduce financial risk and increase earning potential, and diversify your revenue streams to minimize dependence on a single source of income.

Build strategic partnerships and network with high-net-worth individuals who can provide guidance, support, and access to new opportunities. Manage your finances effectively, making smart investment decisions, minimizing taxes, and maximizing returns.

Stay motivated and focused on your long-term goals, even in the face of obstacles and setbacks. Develop a growth mindset and be open to learning and growth, and prioritize your tasks and manage your time wisely to stay on track.

By following these steps and creating a personalized plan for success, you can achieve financial freedom and make a million dollars a year. Remember, making a million dollars a year requires dedication, hard work, and perseverance. By staying committed to your goals and vision, you can achieve financial freedom and live the life you want.

Take action today and start building your wealth. Create a personalized plan for success, and start working towards your financial goals. With the right mindset, strategy, and support, you can achieve financial freedom and make a million dollars a year.