Understanding the Math Behind Part-Time Income

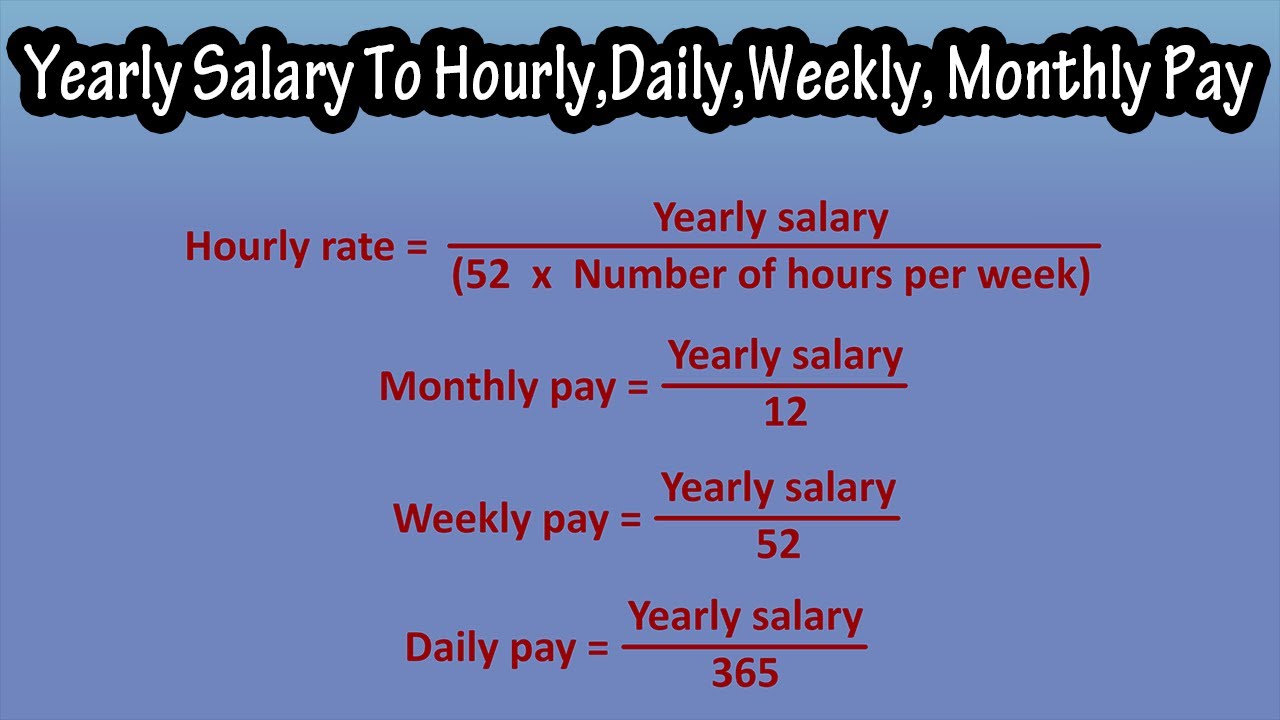

To calculate annual income from a part-time job, it’s essential to understand the math behind it. The formula is straightforward: hourly wage multiplied by the number of working hours per week, multiplied by the number of weeks worked per year. For a part-time job paying $15 an hour, the calculation would be: $15/hour x 20 hours/week x 52 weeks/year = $15,600 per year. However, this is a simplified example and does not take into account factors like taxes, benefits, and overtime pay.

For a more accurate calculation, consider the following example: if you work 25 hours a week at $15 an hour, your weekly income would be $375. Assuming you work 50 weeks a year (accounting for holidays and time off), your annual income would be $18,750. This is a more realistic estimate, but keep in mind that actual take-home pay may vary depending on individual circumstances.

When calculating annual income for a $15 an hour part-time job, it’s crucial to consider the number of hours worked per week and the number of weeks worked per year. This will give you a more accurate estimate of your potential earnings. Additionally, factors like taxes, benefits, and overtime pay can impact your actual take-home pay. By understanding the math behind part-time income, you can make informed decisions about your job and finances.

How to Turn a $15 an Hour Part-Time Job into a Lucrative Opportunity

While a $15 an hour part-time job may not seem like a lucrative opportunity at first, there are several ways to increase your earnings potential. One strategy is to take on additional shifts or work overtime. This can significantly boost your annual income, especially if you’re able to work extra hours during peak periods. For example, if you work 20 hours a week at $15 an hour, your weekly income would be $300. However, if you’re able to take on an additional 10 hours of overtime per week, your weekly income would increase to $450.

Another way to increase your earnings potential is to negotiate a raise. If you’ve been working in your part-time job for a while and have consistently delivered high-quality work, you may be able to negotiate a higher hourly wage. This could be especially effective if you’re able to demonstrate the value you’ve added to the company or organization. For instance, if you’re able to negotiate a $2 an hour raise, your annual income would increase by $4,000.

Pursuing side hustles or freelance work is another way to increase your earnings potential. This could include anything from writing or designing to pet-sitting or house-sitting. By leveraging your skills and interests, you can create additional income streams that can help supplement your part-time income. For example, if you’re able to earn an additional $500 per month through freelance work, your annual income would increase by $6,000.

The Impact of Part-Time Work on Annual Salary: A Closer Look

Part-time work can have a significant impact on annual salary, and it’s essential to understand the pros and cons of part-time employment. According to the Bureau of Labor Statistics, part-time workers earn an average of $24,000 per year, compared to $51,000 per year for full-time workers. However, part-time work can also provide flexibility and work-life balance, which can be invaluable for many individuals.

One of the primary benefits of part-time work is the ability to balance work and personal responsibilities. Many part-time workers are able to pursue other interests, care for family members, or attend school while still earning a steady income. Additionally, part-time work can provide opportunities for skill development and career advancement, which can lead to higher earning potential in the long run.

However, part-time work can also have its drawbacks. Part-time workers may not have access to the same benefits as full-time workers, such as health insurance, retirement plans, or paid time off. Additionally, part-time work can be unpredictable, with variable schedules and uncertain income. According to a survey by the Pew Research Center, 63% of part-time workers report that they would prefer to work full-time, but are unable to do so due to lack of opportunities or other circumstances.

Despite these challenges, many part-time workers are able to earn a good income and achieve financial stability. For example, a part-time worker earning $15 an hour and working 20 hours per week could earn an annual income of $15,600. While this may not be as high as the average full-time salary, it can still provide a decent standard of living and opportunities for advancement.

Real-Life Examples of Part-Time Jobs that Pay $15 an Hour or More

While it may seem challenging to find part-time jobs that pay $15 an hour or more, there are several industries and job titles that offer competitive wages. Here are some real-life examples of part-time jobs that pay $15 an hour or more:

Tutoring or teaching is one example of a part-time job that can pay $15 an hour or more. Many educational institutions and private companies hire part-time tutors or teachers to work with students. For example, a part-time tutor working 20 hours per week at $20 an hour could earn an annual income of $20,800.

Another example is freelance writing or editing. Many companies and websites hire freelance writers or editors to create content or edit existing content. For example, a freelance writer working 20 hours per week at $25 an hour could earn an annual income of $26,000.

Part-time jobs in the healthcare industry can also pay $15 an hour or more. For example, a part-time nurse working 20 hours per week at $30 an hour could earn an annual income of $31,200.

Additionally, part-time jobs in the technology industry can also pay competitive wages. For example, a part-time software developer working 20 hours per week at $35 an hour could earn an annual income of $36,400.

These are just a few examples of part-time jobs that can pay $15 an hour or more. By exploring different industries and job titles, individuals can find part-time work that offers a good income and opportunities for advancement.

Maximizing Your Part-Time Income: Strategies for Success

To maximize your part-time income, it’s essential to have a solid understanding of your finances and a plan in place to manage your money effectively. One of the most critical strategies for success is creating a budget that accounts for all of your income and expenses. By doing so, you can identify areas where you can cut back on unnecessary expenses and allocate more funds towards saving and investing.

Another key strategy is saving for taxes. As a part-time worker, you may be responsible for paying self-employment taxes, which can be a significant expense. By setting aside a portion of your income each month, you can avoid a large tax bill at the end of the year and ensure that you’re in compliance with all tax laws and regulations.

Investing in personal development is also crucial for maximizing your part-time income. By acquiring new skills and knowledge, you can increase your earning potential and open up new opportunities for advancement. This can include taking courses or attending workshops, reading industry publications, or seeking out mentorship from experienced professionals.

Additionally, it’s essential to take advantage of any benefits or perks that your employer may offer. This can include health insurance, retirement plans, or paid time off. By utilizing these benefits, you can reduce your expenses and increase your overall compensation package.

Finally, it’s crucial to stay organized and keep track of your finances. This can include using a spreadsheet or accounting software to track your income and expenses, or setting reminders to ensure that you’re meeting all of your financial obligations. By staying on top of your finances, you can avoid costly mistakes and ensure that you’re maximizing your part-time income.

The Benefits of Part-Time Work: Why It’s a Great Option for Many

Part-time work offers a range of benefits that make it an attractive option for many individuals. One of the most significant advantages of part-time work is flexibility. Part-time jobs often have more flexible schedules than full-time jobs, which can be ideal for individuals who need to balance work with other responsibilities, such as family or education.

Another benefit of part-time work is work-life balance. Part-time jobs can provide a better balance between work and personal life, allowing individuals to pursue other interests and activities outside of work. This can lead to improved overall well-being and a greater sense of fulfillment.

Part-time work can also provide opportunities for skill development and career advancement. Many part-time jobs offer training and development programs, which can help individuals build new skills and advance their careers. Additionally, part-time work can provide a foot in the door with a company, leading to potential full-time opportunities in the future.

Furthermore, part-time work can be a great option for individuals who are looking to transition into a new career or industry. Part-time jobs can provide a low-risk way to test the waters and gain experience in a new field, without making a long-term commitment.

Finally, part-time work can be a great way to earn extra income and achieve financial stability. With the rise of the gig economy, there are many part-time job opportunities available that can provide a steady income stream and help individuals achieve their financial goals.

Common Mistakes to Avoid When Calculating Part-Time Income

When calculating part-time income, there are several common mistakes to avoid. One of the most significant errors is neglecting to account for taxes. Part-time workers are often responsible for paying self-employment taxes, which can be a significant expense. Failing to account for these taxes can lead to a lower annual income than expected.

Another mistake is neglecting to account for benefits. Some part-time jobs may offer benefits, such as health insurance or retirement plans, which can impact annual income. Failing to account for these benefits can lead to an inaccurate calculation of part-time income.

Additionally, part-time workers may make the mistake of assuming that their hourly wage is the same as their annual income. However, this is not always the case. Part-time workers may work varying hours each week, which can impact their annual income. Failing to account for these variations can lead to an inaccurate calculation of part-time income.

Furthermore, part-time workers may neglect to account for overtime pay or bonuses. These can significantly impact annual income, and failing to account for them can lead to an inaccurate calculation.

Finally, part-time workers may make the mistake of assuming that their part-time income is not subject to the same financial planning and budgeting as full-time income. However, this is not the case. Part-time workers should still create a budget and plan for their finances, taking into account their part-time income and expenses.

Conclusion: Turning Part-Time Work into a Full-Time Opportunity

In conclusion, part-time work can be a great way to earn extra income and achieve financial stability. By understanding the math behind part-time income, increasing earnings potential, and avoiding common mistakes, individuals can maximize their part-time income and turn it into a full-time opportunity.

Remember, part-time work is not just a temporary solution, but a viable career path that can lead to long-term success. By taking the right steps and making informed decisions, individuals can turn their part-time job into a lucrative opportunity that provides financial stability and personal fulfillment.

So, if you’re looking to maximize your part-time income and turn it into a full-time opportunity, start by taking action today. Calculate your annual income, increase your earnings potential, and avoid common mistakes. With the right mindset and strategies, you can achieve financial stability and success through part-time work.

Don’t let part-time work hold you back from achieving your financial goals. Take control of your finances and turn your part-time job into a full-time opportunity. With the right approach, you can earn a good annual income for $15 an hour part-time and achieve financial stability.