What Does $15 an Hour Really Mean?

Understanding the value of $15 an hour is crucial in today’s fast-paced economy. This hourly wage can have a significant impact on one’s lifestyle, financial stability, and career choices. For many individuals, $15 an hour is a benchmark for a decent standard of living, but is it really enough? In this article, we will delve into the world of $15 an hour and explore its implications on various aspects of life.

When searching for answers to “how much is $15 an hour,” it’s essential to consider the broader context. $15 an hour translates to an annual salary of around $31,200, assuming a 40-hour workweek and 52 weeks per year. While this may seem like a decent income, it’s crucial to factor in the cost of living, taxes, and benefits to get a clear picture of the actual take-home pay.

The significance of understanding the value of $15 an hour lies in its potential to influence career choices and financial decisions. For instance, an individual earning $15 an hour may need to consider taking on a side job or freelancing to supplement their income. On the other hand, someone earning a higher hourly wage may have more flexibility to pursue their passions and interests.

As we explore the world of $15 an hour, we will examine the various factors that impact its value. From the cost of living and taxes to benefits and industry standards, we will provide a comprehensive overview of what it means to earn $15 an hour. Whether you’re a job seeker, employer, or simply curious about the value of your time, this article aims to provide valuable insights and information to help you make informed decisions.

Calculating the Annual Salary: How Much is $15 an Hour Really Worth?

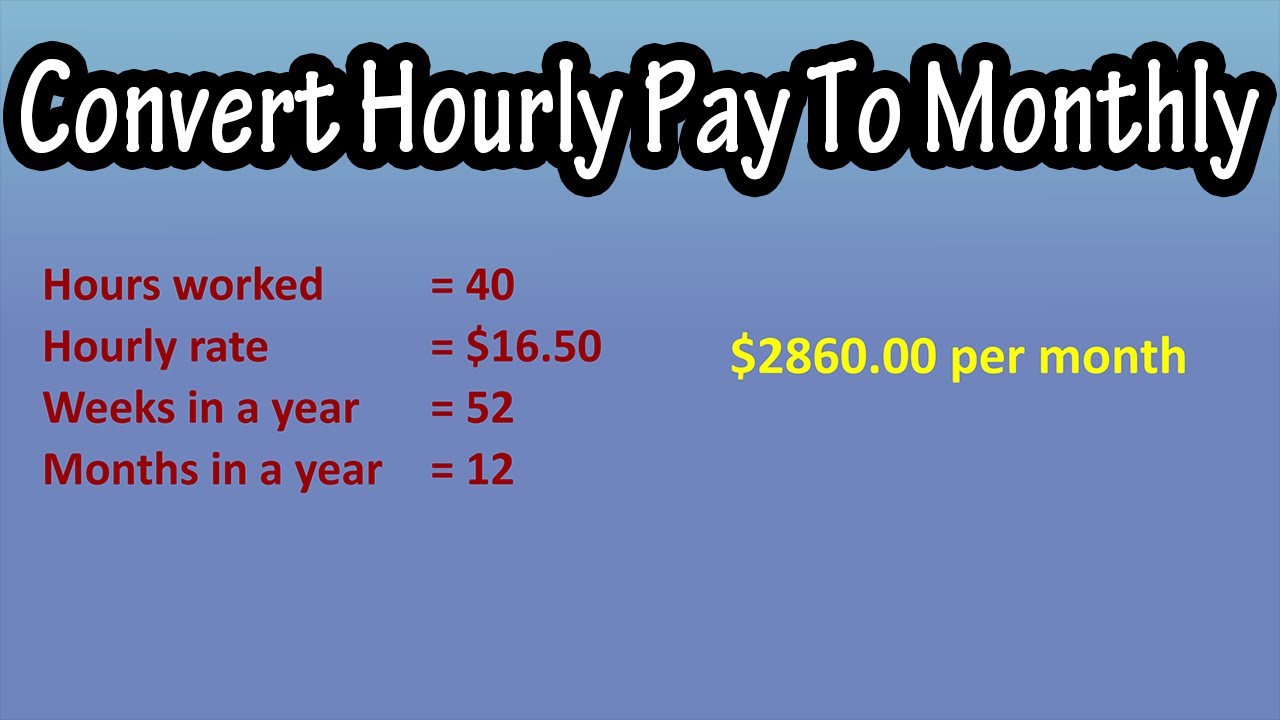

When searching for answers to “how much is $15 an hour,” it’s essential to consider the annual salary implications. Calculating the annual salary based on a $15 an hour wage can be a straightforward process, but it’s crucial to factor in the number of hours worked per week and the number of weeks worked per year.

For a full-time employee working 40 hours a week and 52 weeks a year, the annual salary would be:

$15/hour x 40 hours/week = $600/week

$600/week x 52 weeks/year = $31,200/year

However, this calculation assumes a full-time schedule, which may not be the case for part-time or freelance workers. For part-time workers, the annual salary would be lower, depending on the number of hours worked per week. For example:

$15/hour x 20 hours/week = $300/week

$300/week x 52 weeks/year = $15,600/year

Freelance workers, on the other hand, may have a more variable income, depending on the number of clients and projects they take on. To calculate their annual salary, they would need to estimate their average hourly earnings and multiply it by the number of hours worked per year.

Understanding how to calculate the annual salary based on a $15 an hour wage can help individuals make informed decisions about their career choices and financial planning. Whether you’re a full-time employee, part-time worker, or freelancer, knowing the value of your time is essential for achieving financial stability and success.

The Cost of Living: How Far Does $15 an Hour Stretch?

The cost of living in different cities and states can significantly impact the value of $15 an hour. In areas with a high cost of living, such as New York City or San Francisco, $15 an hour may not be enough to cover basic necessities like housing, food, and transportation. On the other hand, in areas with a lower cost of living, such as rural towns or cities in the Midwest, $15 an hour may be sufficient to maintain a comfortable lifestyle.

For example, in New York City, the median rent for a one-bedroom apartment is over $2,000 per month. Assuming a 40-hour workweek and 52 weeks per year, $15 an hour would translate to an annual salary of $31,200. However, after deducting rent, utilities, and other expenses, the take-home pay would be significantly lower, making it challenging to afford basic necessities.

In contrast, in a city like Des Moines, Iowa, the median rent for a one-bedroom apartment is around $700 per month. With the same annual salary of $31,200, the take-home pay would be higher, allowing for a more comfortable lifestyle.

When searching for answers to “how much is $15 an hour,” it’s essential to consider the cost of living in the area. A $15 an hour wage may be sufficient in some areas, but it may not be enough in others. Understanding the cost of living can help individuals make informed decisions about their career choices and financial planning.

Some of the expenses that can impact the value of $15 an hour include:

Housing: rent or mortgage, utilities, and maintenance

Food: groceries, dining out, and takeout

Transportation: car payment, insurance, gas, and maintenance

Healthcare: medical expenses, insurance, and prescriptions

Entertainment: hobbies, travel, and leisure activities

Understanding these expenses can help individuals create a budget and make the most of their $15 an hour wage.

Comparing $15 an Hour to the Minimum Wage: Is it a Living Wage?

The current minimum wage in the United States is $7.25 per hour, which has been in place since 2009. In recent years, there has been a growing movement to increase the minimum wage to a living wage, which is defined as the amount of money needed to meet the basic needs of an individual or family. $15 an hour is often cited as a potential living wage, but is it enough?

When searching for answers to “how much is $15 an hour,” it’s essential to consider the pros and cons of a higher minimum wage. On the one hand, a higher minimum wage could help low-income workers afford basic necessities like housing, food, and healthcare. On the other hand, it could also lead to higher prices for goods and services, as well as potential job losses.

Some of the arguments in favor of a $15 an hour minimum wage include:

Increased purchasing power: A higher minimum wage would give low-income workers more money to spend on goods and services, which could boost economic growth.

Reduced poverty: A living wage could help lift millions of Americans out of poverty, reducing the need for government assistance programs.

Improved health and well-being: A higher minimum wage could lead to better health outcomes, as low-income workers would have more money to spend on healthcare and healthy food.

However, there are also arguments against a $15 an hour minimum wage, including:

Job losses: A higher minimum wage could lead to job losses, as some employers may not be able to afford the increased labor costs.

Higher prices: A higher minimum wage could lead to higher prices for goods and services, as employers pass on the increased labor costs to consumers.

Economic uncertainty: A higher minimum wage could lead to economic uncertainty, as some employers may be forced to reduce hours or lay off workers to offset the increased labor costs.

Ultimately, whether $15 an hour is a good salary depends on a variety of factors, including the cost of living, industry standards, and individual circumstances. While a higher minimum wage could have benefits, it’s essential to consider the potential drawbacks and find a solution that works for everyone.

Industry Standards: How Does $15 an Hour Compare to Average Salaries?

When searching for answers to “how much is $15 an hour,” it’s essential to consider industry standards and average salaries. $15 an hour may be a good salary in some industries, but it may not be enough in others. In this section, we’ll explore average salaries in various industries and compare them to $15 an hour.

According to the Bureau of Labor Statistics (BLS), the average hourly earnings for all occupations in the United States was $25.72 in May 2020. However, average salaries can vary significantly depending on the industry, location, and level of experience.

Here are some examples of average salaries in various industries:

Healthcare: $34.62 per hour (registered nurses), $25.14 per hour (dental hygienists)

Technology: $43.62 per hour (software developers), $31.42 per hour (web developers)

Finance: $35.62 per hour (financial analysts), $28.14 per hour (accountants)

Education: $29.62 per hour (postsecondary teachers), $25.14 per hour (elementary school teachers)

As you can see, $15 an hour is below the average salary in many industries. However, it’s essential to consider the specific job requirements, location, and level of experience when evaluating the value of $15 an hour.

For job seekers, understanding industry standards and average salaries can help them negotiate better pay and benefits. For employers, offering competitive salaries and benefits can help attract and retain top talent.

In conclusion, $15 an hour may be a good salary in some industries, but it’s essential to consider the specific job requirements, location, and level of experience when evaluating its value. By understanding industry standards and average salaries, job seekers and employers can make informed decisions about pay and benefits.

Tax Implications: How Much of Your $15 an Hour Goes to Taxes?

When searching for answers to “how much is $15 an hour,” it’s essential to consider the tax implications of earning this wage. Taxes can significantly impact the take-home pay, and understanding the tax implications can help individuals make informed decisions about their finances.

Federal income taxes are a significant portion of the taxes paid on $15 an hour. The federal income tax rate for single individuals earning between $9,875 and $40,125 is 12%. This means that for every $15 earned, $1.80 goes towards federal income taxes.

State and local taxes can also impact the take-home pay. The state income tax rate varies from state to state, ranging from 0% to 13.3%. Local taxes, such as city or county taxes, can also be applied. For example, in New York City, the local income tax rate is 3.648%.

In addition to income taxes, other taxes such as Social Security taxes and Medicare taxes may also be applied. Social Security taxes are 6.2% of earnings, and Medicare taxes are 1.45% of earnings.

To minimize tax liability, individuals can consider the following strategies:

Take advantage of tax deductions: Itemize deductions, such as charitable donations or mortgage interest, can help reduce taxable income.

Utilize tax credits: Tax credits, such as the Earned Income Tax Credit (EITC), can provide a refund or reduce tax liability.

Contribute to a retirement account: Contributions to a 401(k) or IRA can reduce taxable income and provide tax benefits in retirement.

Consult a tax professional: A tax professional can help individuals navigate the tax implications of $15 an hour and provide personalized advice on minimizing tax liability.

By understanding the tax implications of $15 an hour, individuals can make informed decisions about their finances and minimize their tax liability.

Benefits and Perks: What Else Can You Expect with a $15 an Hour Job?

When searching for answers to “how much is $15 an hour,” it’s essential to consider the benefits and perks that come with a job. Benefits and perks can significantly impact the overall value of a job, and $15 an hour is no exception.

Some common benefits and perks that may come with a $15 an hour job include:

Health insurance: Many employers offer health insurance as a benefit to their employees. This can be a significant perk, especially for those who may not be able to afford health insurance on their own.

Retirement plans: Some employers offer retirement plans, such as 401(k) or pension plans, to help employees save for their future.

Paid time off: Paid time off, including vacation days and sick leave, can be a valuable perk for employees who need to take time off for personal or family reasons.

Other benefits and perks may include:

Dental and vision insurance

Life insurance

Disability insurance

Employee assistance programs (EAPs)

Wellness programs

Flexible work arrangements

Professional development opportunities

When evaluating the value of a $15 an hour job, it’s essential to consider the benefits and perks that come with it. These can add significant value to the job and impact the overall quality of life for the employee.

In addition to benefits and perks, some employers may also offer other forms of compensation, such as:

Bonuses

Stock options

Profit-sharing plans

These forms of compensation can add significant value to the job and impact the overall earnings of the employee.

By considering the benefits and perks that come with a $15 an hour job, individuals can make informed decisions about their career choices and financial stability.

Conclusion: Is $15 an Hour a Good Salary?

In conclusion, the value of $15 an hour depends on various factors, including the cost of living, industry standards, and individual circumstances. While $15 an hour may be a good salary in some areas, it may not be enough in others.

When searching for answers to “how much is $15 an hour,” it’s essential to consider the pros and cons of this wage. On the one hand, $15 an hour can provide a decent standard of living, especially in areas with a low cost of living. On the other hand, it may not be enough to cover basic necessities in areas with a high cost of living.

Ultimately, whether $15 an hour is a good salary depends on individual circumstances. It’s essential to consider factors such as the cost of living, industry standards, and individual financial goals when evaluating the value of $15 an hour.

In this article, we’ve examined the various factors that impact the value of $15 an hour, including the cost of living, industry standards, tax implications, and benefits and perks. By considering these factors, individuals can make informed decisions about their career choices and financial stability.

While $15 an hour may not be a living wage in all areas, it can still provide a decent standard of living in many parts of the country. By understanding the value of $15 an hour, individuals can make informed decisions about their financial future and take steps to achieve their goals.

In the end, the value of $15 an hour depends on individual circumstances and priorities. By considering the various factors that impact the value of this wage, individuals can make informed decisions about their career choices and financial stability.