What is a Good Salary for a 15 Dollar an Hour Job?

A salary for 15 an hour is considered a good wage for many individuals, offering a decent standard of living and financial security. In the United States, for example, a $15 an hour salary translates to an annual income of around $31,200, assuming a 40-hour workweek and 52 weeks of work per year. This amount is higher than the federal minimum wage and is often considered a benchmark for a living wage in many cities.

Having a good understanding of the value of a $15 an hour salary is essential for individuals seeking to improve their financial situation. A higher wage can provide numerous benefits, including increased financial security, improved standard of living, and better job prospects. Moreover, a $15 an hour salary can also offer a sense of stability and predictability, allowing individuals to plan for the future and make informed financial decisions.

For many workers, a $15 an hour salary is a significant improvement over lower-paying jobs. It can provide a sense of dignity and self-worth, as well as a better quality of life. Furthermore, a higher wage can also lead to increased productivity and job satisfaction, as individuals feel more valued and appreciated for their work.

In addition to the financial benefits, a $15 an hour salary can also offer a range of non-monetary benefits, including better working conditions, more comprehensive benefits packages, and greater opportunities for career advancement. These benefits can be particularly important for individuals seeking to build a long-term career or improve their overall well-being.

Overall, a salary for 15 an hour is considered a good wage for many individuals, offering a range of financial and non-monetary benefits. By understanding the value of this salary, individuals can make informed decisions about their career and financial goals, and work towards achieving a better standard of living.

How to Calculate Your Annual Salary Based on Hourly Wage

Calculating your annual salary based on your hourly wage is a simple yet essential step in understanding your earning potential. To calculate your annual salary, you need to know your hourly wage and the number of hours you work per week and per year.

Assuming a standard full-time schedule of 40 hours per week and 52 weeks per year, you can calculate your annual salary as follows:

Hourly Wage x Number of Hours Worked per Week x Number of Weeks Worked per Year

For example, if you earn a salary for 15 an hour and work 40 hours per week, your weekly earnings would be:

$15/hour x 40 hours/week = $600/week

To calculate your annual salary, multiply your weekly earnings by the number of weeks you work per year:

$600/week x 52 weeks/year = $31,200/year

This calculation assumes a standard full-time schedule, but your actual annual salary may vary depending on your specific work arrangement, including part-time or seasonal work.

Understanding how to calculate your annual salary based on your hourly wage can help you make informed decisions about your career and financial goals. By knowing your earning potential, you can better plan for the future, make smart financial decisions, and negotiate for better pay.

In addition to calculating your annual salary, it’s also essential to consider other factors that can impact your take-home pay, including taxes, benefits, and deductions. By taking these factors into account, you can get a more accurate picture of your earning potential and make informed decisions about your career and financial future.

Jobs That Pay $15 an Hour: Exploring Your Career Options

There are numerous job opportunities that offer a salary for 15 an hour, spanning various industries and sectors. Here are some examples of jobs that pay around $15 an hour, along with the required skills and qualifications:

1. Retail Management: Many retail stores and chains offer management positions that pay around $15 an hour. These roles typically require a high school diploma, excellent communication skills, and previous retail experience.

2. Customer Service Representatives: Companies in various industries, including finance, healthcare, and technology, hire customer service representatives to handle customer inquiries and concerns. A high school diploma, excellent communication skills, and basic computer knowledge are often required for these roles.

3. Data Entry Clerks: Data entry clerks are responsible for accurately and efficiently entering information into computer systems. A high school diploma, basic computer skills, and attention to detail are typically required for these positions.

4. Warehouse Workers: Warehouse workers are responsible for receiving, storing, and shipping products. A high school diploma, physical stamina, and basic math skills are often required for these roles.

5. Food Service Managers: Food service managers oversee the daily operations of restaurants, cafes, and other food establishments. A high school diploma, excellent communication skills, and previous food service experience are typically required for these positions.

6. Administrative Assistants: Administrative assistants provide administrative support to executives, managers, and other professionals. A high school diploma, excellent communication skills, and basic computer knowledge are often required for these roles.

7. Sales Representatives: Sales representatives work with customers to understand their needs and provide solutions. A high school diploma, excellent communication skills, and previous sales experience are typically required for these positions.

These are just a few examples of jobs that pay around $15 an hour. Remember to research the specific requirements and qualifications for each job and industry to ensure the best fit for your skills and interests.

When exploring career options, it’s essential to consider factors such as job satisfaction, growth opportunities, and work-life balance. By understanding the various job opportunities available, you can make informed decisions about your career and increase your earning potential.

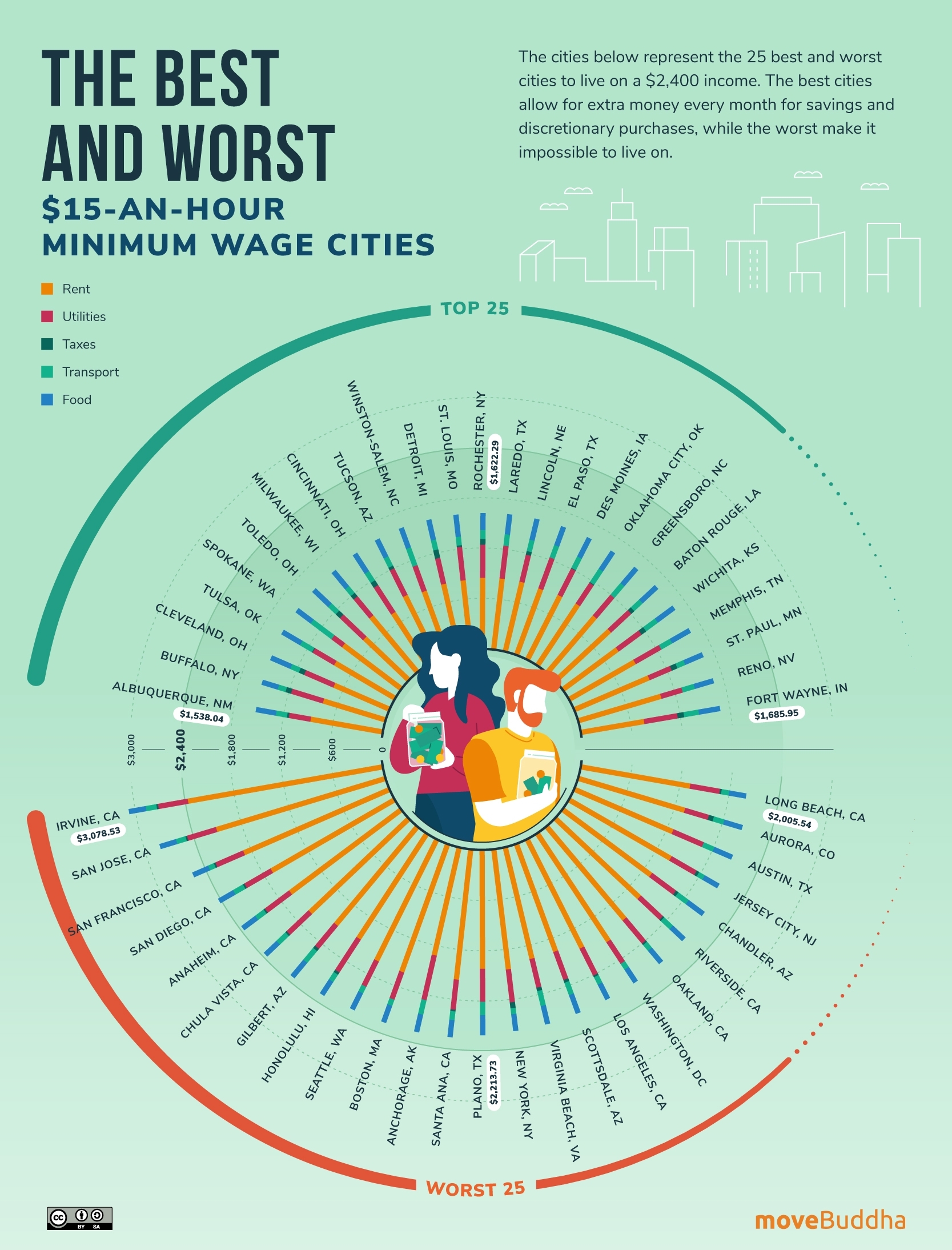

The Impact of Location on Your $15 an Hour Salary

When considering a salary for 15 an hour, it’s essential to factor in the impact of location on your purchasing power. The cost of living, taxes, and regional variations in wages can significantly affect the value of your salary.

For example, a $15 an hour salary in a city with a high cost of living, such as New York or San Francisco, may not go as far as the same salary in a city with a lower cost of living, such as Des Moines or Omaha. This is because the cost of living in these cities is significantly higher, with expenses such as housing, food, and transportation being more expensive.

Taxes also play a significant role in the value of your salary. Different states and cities have varying tax rates, which can affect the amount of take-home pay you receive. For instance, a $15 an hour salary in a state with high taxes, such as California or New York, may result in a lower take-home pay compared to the same salary in a state with lower taxes, such as Texas or Florida.

Regional variations in wages can also impact the value of your salary. Certain industries, such as technology or finance, may offer higher salaries in specific regions, such as the West Coast or New York City. However, these salaries may not be as competitive in other regions, such as the Midwest or South.

To give you a better idea of how location affects the purchasing power of a $15 an hour salary, here are some examples of cities with varying costs of living:

* New York City, NY: $15 an hour salary = $31,200 per year (high cost of living)

* Des Moines, IA: $15 an hour salary = $31,200 per year (lower cost of living)

* San Francisco, CA: $15 an hour salary = $31,200 per year (high cost of living)

* Omaha, NE: $15 an hour salary = $31,200 per year (lower cost of living)

As you can see, the same salary can have different values depending on the location. It’s crucial to consider these factors when evaluating job opportunities and negotiating your salary.

By understanding the impact of location on your salary, you can make informed decisions about your career and financial goals. Remember to research the cost of living, taxes, and regional variations in wages to determine the true value of your salary.

Negotiating a Higher Salary: Tips and Strategies

Negotiating a higher salary is a crucial step in maximizing your earning potential with a $15 an hour salary. By being prepared, confident, and effective in your communication, you can secure better pay and improve your overall compensation package.

Before entering into salary negotiations, it’s essential to research the market value of your role and industry. This will give you a solid understanding of the average salary range for your position and help you make a strong case for why you deserve a higher salary.

Here are some tips and strategies to help you negotiate a higher salary:

1. Know your worth: Be confident in your skills and experience, and be prepared to articulate your value to your employer.

2. Do your research: Use online resources such as Glassdoor or Payscale to determine the average salary range for your role and industry.

3. Set a target salary range: Based on your research, set a realistic target salary range that you feel comfortable with.

4. Be prepared to negotiate: Anticipate that your employer may not be willing to meet your target salary range, and be prepared to negotiate and compromise.

5. Focus on benefits: In addition to salary, consider negotiating benefits such as health insurance, paid time off, or retirement plans.

6. Be confident but respectful: Approach the negotiation with confidence and respect, and avoid being pushy or aggressive.

7. Be open to creative solutions: Think outside the box and consider alternative compensation arrangements, such as a signing bonus or additional vacation time.

By following these tips and strategies, you can effectively negotiate a higher salary and maximize your earning potential with a $15 an hour salary.

Remember, negotiation is a conversation, not a confrontation. By being prepared, confident, and respectful, you can achieve a mutually beneficial outcome that meets your needs and exceeds your expectations.

Benefits and Perks: What to Expect with a $15 an Hour Job

A $15 an hour salary can provide a range of benefits and perks that enhance the overall compensation package. While the specific benefits may vary depending on the employer, industry, and location, here are some common advantages that often come with a $15 an hour job.

Health insurance is a common benefit offered by many employers, and a $15 an hour salary may qualify employees for comprehensive coverage, including medical, dental, and vision care. This can be a significant advantage, especially for individuals who may not have access to affordable health insurance otherwise.

Paid time off (PTO) is another benefit that may be included in a $15 an hour job. This can include vacation days, sick leave, and holidays, providing employees with a better work-life balance and time to recharge. The amount of PTO may vary depending on the employer and the employee’s length of service.

Retirement plans, such as 401(k) or pension plans, may also be offered by employers as part of a $15 an hour salary package. These plans can help employees save for their future and provide a sense of financial security. Some employers may even offer matching contributions to encourage employees to contribute to their retirement accounts.

In addition to these benefits, some employers may offer other perks, such as flexible scheduling, employee discounts, or professional development opportunities. These can enhance the overall value of the $15 an hour salary and provide employees with a more rewarding work experience.

When evaluating a $15 an hour job, it’s essential to consider the total compensation package, including benefits and perks. This can help employees understand the true value of their salary and make informed decisions about their career. By taking into account the various benefits and perks that come with a $15 an hour salary, employees can maximize their earning potential and achieve a better quality of life.

Career Advancement Opportunities with a $15 an Hour Salary

A $15 an hour salary can provide a solid foundation for career advancement and professional growth. With a stable income, individuals can focus on developing their skills, gaining experience, and pursuing opportunities for promotion and education.

Many industries offer opportunities for advancement with a $15 an hour salary. For example, in the retail industry, employees can move from sales associate to assistant manager or store manager with experience and additional training. In the healthcare industry, medical assistants can advance to become nurses or healthcare administrators with further education and certification.

Some employers also offer training and development programs to help employees advance in their careers. These programs may include workshops, mentorship, and tuition reimbursement. By taking advantage of these opportunities, employees can enhance their skills and knowledge, making them more competitive for promotions and higher-paying jobs.

In addition to industry-specific opportunities, a $15 an hour salary can also provide a foundation for pursuing higher education. With a stable income, individuals can pursue certifications, associate’s degrees, or bachelor’s degrees in their field, leading to greater career advancement opportunities and higher earning potential.

Furthermore, a $15 an hour salary can also provide opportunities for entrepreneurship and small business ownership. With a stable income, individuals can pursue their passions and start their own businesses, creating jobs and wealth for themselves and others.

When evaluating career advancement opportunities with a $15 an hour salary, it’s essential to consider the following factors:

- Industry growth and demand

- Required skills and education

- Opportunities for promotion and advancement

- Availability of training and development programs

- Potential for entrepreneurship and small business ownership

By understanding these factors and taking advantage of opportunities for career advancement, individuals with a $15 an hour salary can unlock their earning potential and achieve greater financial security and success.

Conclusion: Maximizing Your Earning Potential with a $15 an Hour Salary

In conclusion, a $15 an hour salary can provide a solid foundation for financial stability and career growth. By understanding the value of this salary, individuals can make informed decisions about their career goals and take steps to maximize their earning potential.

Throughout this guide, we have explored the significance of a $15 an hour salary, including its benefits, job opportunities, and impact on location. We have also discussed the importance of negotiating a higher salary, benefits and perks, and career advancement opportunities.

To maximize your earning potential with a $15 an hour salary, it is essential to:

- Understand the value of your salary and its impact on your standard of living

- Explore job opportunities that offer a $15 an hour salary and align with your career goals

- Negotiate a higher salary and benefits package

- Take advantage of career advancement opportunities, including training and education

- Consider the impact of location on your salary and make informed decisions about your career

By following these steps and staying focused on your career goals, you can unlock your earning potential and achieve financial stability and success with a $15 an hour salary.

Remember, a $15 an hour salary is not just a number; it’s a starting point for building a better future. With the right mindset, skills, and knowledge, you can turn this salary into a stepping stone for greater success and prosperity.

Take control of your career and start maximizing your earning potential today. With a $15 an hour salary, the possibilities are endless, and the future is bright.