Diversifying Your Investment Portfolio: An Overview

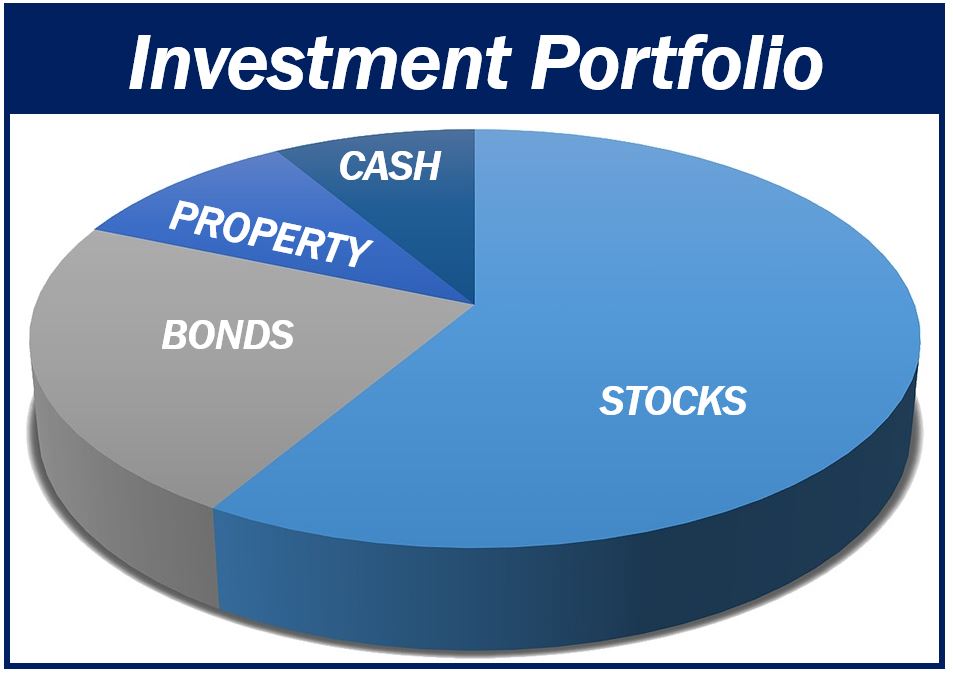

Investment diversification is a crucial strategy for achieving long-term financial stability and growth. By allocating financial resources across various investment vehicles, such as stocks, bonds, real estate, and mutual funds, investors can mitigate risks and maximize returns. The concept of “where to invest money” becomes more nuanced when considering the different investment options available and their respective benefits and drawbacks.

Diversification helps to spread the risk associated with any single investment. By investing in a variety of assets, investors can protect themselves from market volatility and potential losses. For instance, if the stock market experiences a downturn, an investor with a diversified portfolio may still have positive returns from their bond or real estate investments. This strategy is particularly important for those looking to build wealth over time, as it helps to ensure a stable and sustainable financial future.

One of the primary benefits of diversification is the potential for higher risk-adjusted returns. By balancing high-risk investments with lower-risk ones, investors can achieve a more stable return profile. This is because high-risk investments often have the potential for higher returns, while lower-risk investments provide a more predictable return. By combining these two types of investments, investors can potentially earn higher returns while still maintaining a level of security.

Another advantage of diversification is the ability to access a wider range of investment opportunities. By investing in various asset classes, investors can take advantage of different market conditions and economic cycles. For example, while stocks may perform well during periods of economic growth, bonds may be more attractive during times of economic uncertainty. By having a diversified portfolio, investors can participate in various market opportunities, potentially increasing their overall returns.

In summary, diversification is a key strategy for those asking “where to invest money” in order to achieve long-term financial stability and growth. By allocating financial resources across various investment vehicles, investors can mitigate risks, maximize returns, and access a wider range of investment opportunities. In the following sections, we will explore the different investment options available and their respective benefits and drawbacks, providing a comprehensive guide for those looking to build a diversified investment portfolio.

Stocks: Investing in Equities for Growth Potential

Stocks, also known as equities, represent ownership in a company and offer investors the potential for significant long-term growth. When considering “where to invest money,” stocks are often a popular choice due to their potential for high returns. However, it’s important to understand that stocks also come with a higher level of risk compared to other investment vehicles.

When investing in stocks, there are two main types to consider: common and preferred shares. Common shares give investors ownership in a company and the right to vote on important matters, such as the election of board members. However, common shareholders are last in line to receive payment in the event of a company’s liquidation. Preferred shares, on the other hand, do not come with voting rights but offer a higher claim on a company’s assets and earnings. Preferred shareholders are paid before common shareholders in the event of a liquidation.

Both common and preferred shares have their own advantages and disadvantages. Common shares often have a higher potential for long-term growth, but they also come with a higher level of risk. Preferred shares, on the other hand, offer a lower level of risk but also a lower potential for long-term growth. When considering which type of stock to invest in, it’s important to consider your investment goals and risk tolerance.

Another factor to consider when investing in stocks is diversification. By investing in a variety of stocks from different industries and sectors, you can spread out your risk and potentially increase your returns. This is because different industries and sectors often perform differently at different times. For example, while the technology sector may be performing well, the energy sector may be experiencing a downturn. By having a diversified portfolio, you can participate in the growth of various industries and sectors, potentially increasing your overall returns.

In summary, stocks offer investors the potential for significant long-term growth but come with a higher level of risk compared to other investment vehicles. When considering “where to invest money” in stocks, it’s important to understand the different types of stocks available and their respective advantages and disadvantages. Additionally, diversification is key to spreading out risk and potentially increasing returns. By investing in a variety of stocks from different industries and sectors, you can participate in the growth of various market segments, potentially increasing your overall returns.

Bonds: Securing Your Investment with Fixed Income

Bonds are a type of investment vehicle that offer investors a fixed income stream over a set period of time. When considering “where to invest money,” bonds can be a good option for those looking for a lower-risk investment with predictable returns. Bonds are essentially loans that investors make to borrowers, such as governments or corporations, in exchange for regular interest payments and the return of the loan amount at the end of the bond term.

Bonds play an important role in a diversified investment portfolio. They offer a lower risk compared to stocks and can help to balance out the overall risk level of a portfolio. This is because bonds tend to have a negative correlation with stocks, meaning that when stocks perform poorly, bonds often perform well, and vice versa. By investing in both stocks and bonds, investors can potentially reduce their overall risk and increase their returns through diversification.

There are several types of bonds available, including government bonds, corporate bonds, and municipal bonds. Government bonds are considered to be one of the safest types of bonds, as they are backed by the full faith and credit of the government. Corporate bonds, on the other hand, are issued by corporations and tend to offer higher interest rates than government bonds, but they also come with a higher level of risk. Municipal bonds are issued by state and local governments and offer tax-free interest payments, making them a popular choice for investors in higher tax brackets.

When investing in bonds, it’s important to consider the creditworthiness of the borrower. Creditworthiness refers to the borrower’s ability to repay the loan and make interest payments. Bonds issued by borrowers with a high credit rating are considered to be safer than those issued by borrowers with a lower credit rating. However, bonds with a lower credit rating often offer higher interest rates to compensate investors for the higher level of risk.

In summary, bonds offer investors a lower-risk investment option with predictable returns. They play an important role in a diversified investment portfolio and can help to balance out the overall risk level of a portfolio. When considering “where to invest money” in bonds, it’s important to consider the creditworthiness of the borrower and the bond’s interest rate. By investing in a variety of bonds with different credit ratings and interest rates, investors can potentially increase their returns while still maintaining a lower level of risk compared to stocks.

Real Estate: Building Wealth through Property Investments

Real estate investments have long been a popular choice for investors looking to build wealth through property ownership. When considering “where to invest money,” real estate can offer a number of potential benefits, including long-term capital appreciation and passive income. However, it’s important to understand the different types of real estate investments available and the associated risks and rewards.

Real estate investments can be divided into two main categories: residential and commercial. Residential real estate includes properties such as single-family homes, townhouses, and apartment buildings. These properties are typically used for long-term rental income or for resale at a profit. Commercial real estate, on the other hand, includes properties such as office buildings, retail centers, and industrial facilities. These properties are typically used for business purposes and can generate income through rental income or appreciation in value.

One of the main benefits of investing in real estate is the potential for long-term capital appreciation. Over time, real estate values tend to increase, particularly in areas with strong demand for housing or commercial space. By investing in real estate, investors can potentially benefit from this appreciation and see their investment grow in value over time. Additionally, real estate investments can provide a source of passive income through rental income. By renting out a property, investors can generate a steady stream of income without having to actively manage the property.

However, real estate investments also come with a number of risks. Real estate values can be volatile, particularly in areas with high demand and limited supply. Additionally, rental income can be unpredictable, particularly if tenants fail to pay rent or if the property is vacant for an extended period of time. Real estate investments also require a significant amount of upfront capital, and ongoing maintenance and repair costs can add up quickly. It’s important for investors to carefully consider these risks and weigh them against the potential benefits before investing in real estate.

When considering “where to invest money” in real estate, it’s important to do your research and work with experienced professionals. This can include real estate agents, property managers, and attorneys who can help you navigate the complex world of real estate investing. Additionally, it’s important to diversify your real estate investments and not put all your eggs in one basket. By investing in a variety of properties and locations, you can potentially reduce your risk and increase your returns over time.

In summary, real estate investments can offer a number of potential benefits, including long-term capital appreciation and passive income. However, they also come with a number of risks, including volatility in real estate values and unpredictable rental income. By doing your research, working with experienced professionals, and diversifying your investments, you can potentially build wealth through real estate investing. When considering “where to invest money,” real estate should be carefully considered as part of a diversified investment portfolio.

Mutual Funds: Diversifying Your Investments with Professional Management

When considering “where to invest money,” mutual funds can offer a convenient and cost-effective way to diversify your investment portfolio. A mutual fund is a type of investment vehicle that pools together money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. These funds are managed by professional fund managers who make investment decisions on behalf of the investors.

One of the main benefits of mutual funds is their ability to provide diversification. By investing in a mutual fund, you gain exposure to a wide range of assets, which can help to spread out risk and potentially increase returns. Additionally, mutual funds offer a level of professional management that can be beneficial for investors who do not have the time, knowledge, or resources to manage their own investments. Professional fund managers have access to extensive research and analysis tools, which can help them to make informed investment decisions.

There are two main types of mutual funds: index funds and actively managed funds. Index funds are designed to replicate the performance of a specific market index, such as the S&P 500. These funds are generally low-cost and offer broad market exposure. Actively managed funds, on the other hand, are managed by a team of professionals who make investment decisions with the goal of outperforming a specific market index. These funds can be more expensive than index funds, but they offer the potential for higher returns.

When considering “where to invest money” in mutual funds, it’s important to do your research and understand the fees associated with each fund. Mutual funds charge an annual management fee, known as the expense ratio, which covers the cost of managing the fund. Additionally, some funds may charge a sales load, which is a commission paid to the broker or financial advisor who sold you the fund. It’s important to understand these fees, as they can eat into your investment returns over time.

Another important consideration when investing in mutual funds is the investment style and strategy of the fund manager. Some fund managers focus on growth stocks, while others may focus on value stocks. Additionally, some managers may employ a passive investment strategy, while others may be more aggressive in their approach. It’s important to understand the investment style and strategy of the fund manager, as this can have a significant impact on the performance of the fund.

In summary, mutual funds can offer a convenient and cost-effective way to diversify your investment portfolio. By investing in a mutual fund, you gain exposure to a wide range of assets, which can help to spread out risk and potentially increase returns. However, it’s important to do your research and understand the fees associated with each fund, as well as the investment style and strategy of the fund manager. By carefully considering these factors, you can potentially maximize your investment returns and build a stable and sustainable financial future.

Alternative Investments: Exploring Non-Traditional Investment Opportunities

When considering “where to invest money,” alternative investments can offer unique opportunities for diversification and potentially higher returns. Alternative investments refer to non-traditional investment vehicles that fall outside of the conventional categories of stocks, bonds, and real estate. These can include hedge funds, private equity, venture capital, real estate investment trusts (REITs), and commodities.

One of the main benefits of alternative investments is their potential for higher returns compared to traditional investments. However, it’s important to note that these investments also come with unique risks and challenges. Alternative investments are often less regulated than traditional investments, which can make it more difficult to assess their true value and potential risks. Additionally, alternative investments may require a higher minimum investment and may be less liquid, meaning they may be more difficult to sell or convert to cash.

Hedge funds are a type of alternative investment that uses complex strategies to generate returns. These funds often employ a variety of tactics, such as short selling, leverage, and derivatives, to capitalize on market inefficiencies. However, hedge funds are often only accessible to accredited investors, due to their high minimum investment requirements and complex nature.

Private equity is another type of alternative investment that involves investing in private companies. Private equity firms often acquire majority stakes in these companies with the goal of improving their operations and increasing their value. Private equity investments can offer high returns, but they also come with significant risks, as many private companies fail to achieve their growth potential.

Venture capital is a type of alternative investment that focuses on investing in early-stage companies with high growth potential. These investments can offer significant returns, but they also come with a high level of risk, as many startups fail to achieve commercial success. Additionally, venture capital investments are often illiquid, meaning they may be difficult to sell or convert to cash.

Real estate investment trusts (REITs) are a type of alternative investment that allows individuals to invest in large-scale real estate projects. REITs can offer high returns and dividends, but they also come with unique risks, such as changes in real estate values and market conditions. Additionally, REITs may be less liquid than traditional stocks and bonds.

Commodities, such as gold, oil, and agricultural products, are another type of alternative investment. Commodities can offer a hedge against inflation and currency fluctuations, but they also come with unique risks, such as changes in supply and demand and geopolitical tensions.

In summary, alternative investments can offer unique opportunities for diversification and potentially higher returns compared to traditional investments. However, these investments also come with unique risks and challenges. It’s important to carefully consider your investment goals, risk tolerance, and financial situation before investing in alternative investments. By doing your research and working with a qualified financial advisor, you can potentially maximize your investment returns and build a stable and sustainable financial future.

Maximizing Your Investment Returns: Tips and Strategies

When it comes to managing your finances and growing your wealth, it’s essential to consider various investment opportunities and employ strategies that can help you maximize your returns. Here are some actionable tips and strategies to consider for where to invest money and how to optimize your investment portfolio.

1. Dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. By doing so, you’ll buy more shares when prices are low and fewer shares when prices are high, reducing the impact of market volatility on your investment portfolio. Over time, dollar-cost averaging can help you build a sizable position in your chosen investments while minimizing risks associated with market timing.

2. Tax-loss harvesting: This technique involves selling securities at a loss to offset a capital gains tax liability. By realizing losses in your portfolio, you can reduce your overall tax burden and potentially free up capital to invest in other opportunities. However, it’s crucial to be aware of the wash-sale rule, which prohibits you from repurchasing the same or substantially identical security within 30 days before or after the sale. This rule is designed to prevent investors from abusing the tax-loss harvesting strategy.

3. Portfolio rebalancing: Over time, the composition of your investment portfolio may shift due to market fluctuations or the performance of individual securities. Periodically rebalancing your portfolio ensures that it remains aligned with your target asset allocation and risk tolerance. This process involves selling positions that have become overweight and purchasing those that have become underweight, helping you maintain a well-diversified and balanced investment strategy.

4. Long-term planning and discipline: Achieving financial success requires a long-term perspective and the discipline to stick to your investment plan. Rather than attempting to time the market or chase short-term gains, focus on your investment goals and maintain a consistent approach to investing. By doing so, you’ll be better positioned to take advantage of market opportunities and avoid costly mistakes that can derail your financial progress.

In conclusion, when considering where to invest money, it’s essential to employ strategies that can help you maximize your investment returns and build wealth over time. By incorporating dollar-cost averaging, tax-loss harvesting, portfolio rebalancing, and long-term planning into your investment approach, you’ll be better equipped to navigate market volatility and achieve your financial objectives.

Assessing Your Risk Tolerance: Balancing Growth and Security

When it comes to investing, understanding your risk tolerance is crucial for making informed decisions and achieving a stable and sustainable financial future. Risk tolerance refers to the degree of volatility and uncertainty an investor is willing to accept in pursuit of their investment objectives. By assessing your risk tolerance, you can balance your desire for growth with the need for security, ensuring that your investment strategy aligns with your financial goals and comfort level.

Identifying your risk tolerance: To determine your risk tolerance, consider factors such as your investment horizon, financial situation, and emotional comfort with market fluctuations. Generally, investors with a longer time horizon and a more robust financial position can afford to take on more risk, as they have time to recover from potential losses. Conversely, those nearing retirement or facing financial constraints may prefer a more conservative approach, focusing on preserving capital and generating predictable income.

Balancing growth and security: Once you’ve identified your risk tolerance, it’s essential to balance your investment portfolio accordingly. For instance, if you have a high risk tolerance, you may allocate a larger portion of your portfolio to stocks and other growth-oriented investments, such as real estate or alternative assets. On the other hand, if your risk tolerance is low, you may focus on more conservative investments, such as bonds and other fixed-income securities, which offer lower growth potential but greater stability and predictability.

Monitoring and adjusting your risk tolerance: As you progress through life, your risk tolerance may change due to shifts in your financial situation, personal circumstances, or investment goals. Regularly reviewing and adjusting your investment strategy can help ensure that it remains aligned with your evolving risk tolerance and financial objectives. By staying attuned to your risk tolerance, you can make informed decisions about where to invest money and maintain a balanced and sustainable investment approach.

In conclusion, assessing your risk tolerance is a critical step in building a successful investment strategy. By understanding your comfort level with market volatility and balancing your investment portfolio accordingly, you can pursue your financial goals while maintaining the necessary stability and security. Regularly monitoring and adjusting your risk tolerance can help you stay on track and make informed decisions about where to invest money, ultimately leading to a more prosperous and fulfilling financial future.