Breaking Down the Barrier: Understanding the Mindset of High Earners

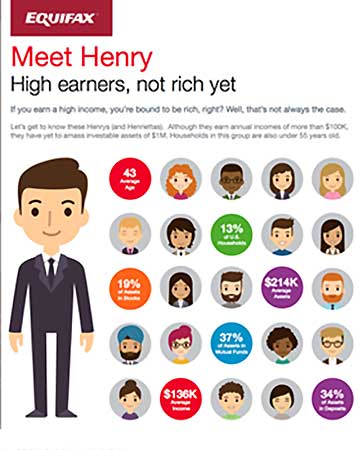

When it comes to achieving a high monthly income, such as $5000 or more, it’s essential to understand the mindset of high earners. These individuals think differently and make decisions that set them up for financial success. They possess a growth mindset, which enables them to continuously learn, adapt, and innovate. This mindset allows them to stay ahead of the curve and capitalize on new opportunities.

High earners are also willing to take calculated risks, which is a critical component of achieving financial success. They understand that playing it safe may not lead to significant financial rewards and are willing to step outside their comfort zone to pursue new ventures. This risk-taking mindset is often accompanied by a strong work ethic and a willingness to put in the time and effort required to achieve their financial goals.

In addition to a growth mindset and a willingness to take risks, high earners often possess a unique set of skills and knowledge that sets them apart from others. They may have a deep understanding of their industry or market, which enables them to identify opportunities and make informed decisions. They may also have a strong network of contacts and relationships that provide them with access to valuable resources and information.

So, how can you develop the mindset of a high earner and start earning $5000 a month or more? It begins with a willingness to learn and adapt. Continuously update your skills and knowledge to stay ahead of the curve, and be open to new opportunities and experiences. Develop a strong work ethic and be willing to put in the time and effort required to achieve your financial goals. Finally, cultivate a growth mindset and be willing to take calculated risks to pursue new ventures and opportunities.

Identifying Lucrative Opportunities: Exploring High-Paying Careers and Side Hustles

For those seeking to earn $5000 a month or more, it’s essential to identify lucrative opportunities that can generate significant income. High-paying careers and side hustles can provide a substantial boost to one’s earning potential. Here are some examples of high-paying careers and side hustles that can potentially generate a monthly income of $5000 or more:

Freelancing is a popular option for those with specialized skills, such as writing, designing, or programming. Freelance platforms like Upwork, Fiverr, and Freelancer offer a range of opportunities for freelancers to find high-paying clients. Online coaching is another lucrative option, where individuals can offer coaching services to clients remotely. Affiliate marketing is also a viable option, where individuals can earn commissions by promoting products or services of other companies.

Investing in stocks or real estate can also generate significant passive income. Investing in dividend-paying stocks or real estate investment trusts (REITs) can provide a steady stream of income. Additionally, investing in a small business or startup can also be a lucrative option, but it requires careful research and due diligence.

Other high-paying careers include consulting, software development, and data science. These careers often require specialized skills and education, but they can offer significant financial rewards. Side hustles like creating and selling online courses, ebooks, or software products can also generate significant income.

When exploring high-paying careers and side hustles, it’s essential to consider one’s skills, interests, and experience. It’s also crucial to research the market demand and competition to ensure that the chosen career or side hustle has the potential to generate significant income. By identifying lucrative opportunities and taking the necessary steps to pursue them, individuals can increase their earning potential and achieve financial freedom.

Developing In-Demand Skills: Investing in Personal and Professional Growth

To increase earning potential and achieve a high monthly income, such as $5000 a month or more, it’s essential to develop in-demand skills that are highly valued by employers and clients. Continuous learning and professional development are critical components of career success, and can help individuals stay ahead of the curve in their industry.

So, how can you identify the skills that are in demand and invest in your personal and professional growth? Start by researching industry trends and job market demands. Look at job postings and descriptions to see what skills are required for high-paying jobs. You can also network with professionals in your industry to learn more about the skills that are in demand.

Once you’ve identified the skills you need to develop, create a plan to acquire them. This may involve taking courses or getting certified in a particular area. You can also seek out mentorship or coaching to help you develop your skills. Additionally, consider attending conferences or workshops to stay up-to-date with the latest industry trends and developments.

Some of the most in-demand skills across various industries include data science, digital marketing, cloud computing, and cybersecurity. Developing skills in these areas can help you increase your earning potential and stay competitive in the job market.

Investing in personal and professional growth is an ongoing process that requires commitment and dedication. However, the payoff can be significant, and can help you achieve your long-term financial goals. By developing in-demand skills and staying ahead of the curve in your industry, you can increase your earning potential and achieve financial freedom.

Building Multiple Income Streams: Diversifying Your Revenue Sources

To achieve financial freedom and earn $5000 a month or more, it’s essential to build multiple income streams. Diversifying your revenue sources can help you reduce financial risk, increase your earning potential, and achieve long-term financial stability.

There are two types of income streams: active and passive. Active income streams require your direct involvement and time, such as a salary or freelance work. Passive income streams, on the other hand, generate income without requiring your direct involvement, such as rental properties or dividend-paying stocks.

To build multiple income streams, start by identifying your skills, interests, and resources. Consider your strengths and weaknesses, and think about how you can monetize your skills and expertise. You can also explore different business models, such as affiliate marketing, online coaching, or creating and selling digital products.

Some examples of active income streams include freelancing, consulting, and coaching. You can also create and sell online courses, ebooks, or software products. Passive income streams include investing in stocks, real estate, or peer-to-peer lending.

Having a mix of active and passive income streams can help you achieve financial stability and increase your earning potential. For example, you can create an online course or ebook that generates passive income, while also offering coaching or consulting services that generate active income.

Building multiple income streams requires planning, strategy, and execution. Start by setting clear financial goals and identifying your target market. Then, develop a business plan and create a strategy for building and diversifying your income streams.

Creating a Business Mindset: Turning Your Passion into a Profitable Venture

To achieve financial freedom and earn $5000 a month or more, it’s essential to create a business mindset and treat your income-generating activities as a business. This means thinking like an entrepreneur and making decisions that drive revenue and growth.

So, how can you create a business mindset and turn your passion into a profitable venture? Start by defining your business mission and vision. Identify your target market and create a unique value proposition that sets you apart from the competition.

Next, develop a business plan that outlines your goals, strategies, and financial projections. This will help you stay focused and motivated, and ensure that you’re making progress towards your financial goals.

It’s also essential to set financial goals and track your progress. This will help you stay accountable and motivated, and ensure that you’re on track to achieving your financial goals.

Some key financial metrics to track include revenue, expenses, and profit margins. You should also track your cash flow and ensure that you have a sufficient emergency fund in place.

Creating a business mindset requires a shift in thinking and behavior. It requires you to be proactive, strategic, and focused on driving revenue and growth. By adopting a business mindset, you can turn your passion into a profitable venture and achieve financial freedom.

Remember, earning $5000 a month or more requires hard work, dedication, and a willingness to take calculated risks. But with the right mindset and strategy, you can achieve financial freedom and live the life you’ve always wanted.

Managing Finances Effectively: Saving, Investing, and Minimizing Taxes

To achieve financial freedom and earn $5000 a month or more, it’s essential to manage your finances effectively. This includes saving, investing, and minimizing taxes. By doing so, you can maximize your earnings, reduce your expenses, and achieve your long-term financial goals.

Saving is a critical component of financial management. It’s essential to have an emergency fund in place to cover unexpected expenses and ensure that you can continue to earn a steady income. Aim to save at least 10% to 20% of your income each month, and consider setting up automatic transfers to make saving easier and less prone to being neglected.

Investing is another key aspect of financial management. By investing your money wisely, you can generate passive income and grow your wealth over time. Consider investing in a tax-advantaged retirement account, such as a 401(k) or IRA, and take advantage of any employer matching contributions.

Minimizing taxes is also crucial to achieving financial freedom. By taking advantage of tax deductions and credits, you can reduce your tax liability and keep more of your hard-earned money. Consider consulting with a tax professional to ensure that you’re taking advantage of all the tax savings available to you.

Some additional tips for managing your finances effectively include creating a budget, tracking your expenses, and avoiding debt. By following these tips and staying disciplined, you can achieve financial freedom and earn $5000 a month or more.

Remember, managing your finances effectively is an ongoing process that requires regular monitoring and adjustments. By staying on top of your finances and making smart financial decisions, you can achieve your long-term financial goals and live the life you’ve always wanted.

Staying Motivated and Focused: Overcoming Obstacles and Achieving Success

To achieve financial freedom and earn $5000 a month or more, it’s essential to stay motivated and focused on your long-term financial goals. However, overcoming obstacles and staying on track can be challenging. Here are some tips to help you stay motivated and focused:

First, set clear and specific financial goals. Break down your long-term goals into smaller, manageable tasks, and create a schedule to achieve them. Celebrate your successes along the way, and don’t be too hard on yourself when you encounter setbacks.

Second, find a supportive community or accountability partner. Surrounding yourself with like-minded individuals who share your financial goals can help you stay motivated and inspired. You can also join online communities or forums to connect with others who are working towards similar goals.

Third, track your progress and adjust your strategy as needed. Use a budgeting app or spreadsheet to track your income and expenses, and make adjustments to your spending habits or investment strategy as needed.

Fourth, stay positive and focused on your goals. Remind yourself why you’re working towards financial freedom, and visualize the benefits of achieving your goals. Use positive affirmations or visualization techniques to stay motivated and focused.

Finally, be patient and persistent. Achieving financial freedom takes time and effort, and it’s essential to stay committed to your goals even when faced with obstacles or setbacks. By staying motivated and focused, you can overcome any obstacle and achieve financial success.

Remember, earning $5000 a month or more requires hard work, dedication, and a willingness to learn and adapt. By staying motivated and focused, you can achieve your financial goals and live the life you’ve always wanted.

Sustaining Success: Continuously Improving and Adapting to Change

To sustain financial success and continue earning $5000 a month or more, it’s essential to continuously improve and adapt to change. This means staying up-to-date with industry trends, seeking feedback, and being open to new opportunities.

One way to stay ahead of the curve is to continuously learn and develop new skills. This can include attending conferences, workshops, and online courses to stay current with the latest industry trends and best practices.

Another way to sustain success is to seek feedback from others. This can include seeking feedback from clients, customers, or colleagues to identify areas for improvement and make adjustments accordingly.

Being open to new opportunities is also crucial to sustaining financial success. This can include exploring new markets, industries, or business models to stay ahead of the competition and capitalize on new opportunities.

Additionally, it’s essential to stay adaptable and flexible in the face of change. This can include being willing to pivot or adjust your business strategy in response to changes in the market or industry.

By continuously improving and adapting to change, you can sustain financial success and continue earning $5000 a month or more. Remember, financial success is a marathon, not a sprint, and it requires ongoing effort and dedication to achieve and maintain.

By following these tips and staying committed to your financial goals, you can achieve long-term financial success and live the life you’ve always wanted.