Why Small Businesses Are the Backbone of the Economy

Small businesses play a vital role in driving economic growth, innovation, and job creation. According to the Small Business Administration (SBA), small businesses account for approximately 99.7% of all businesses in the United States and employ nearly 50% of the private workforce. Starting a small business can be a fulfilling and profitable venture, offering entrepreneurs the opportunity to pursue their passions and create a lasting impact on their communities.

The most profitable small business to start often involves identifying a niche or gap in the market and developing a unique value proposition to meet the needs of customers. By doing so, small businesses can differentiate themselves from larger corporations and establish a loyal customer base. Moreover, small businesses are often more agile and adaptable, allowing them to respond quickly to changes in the market and stay ahead of the competition.

In addition to their economic benefits, small businesses also contribute to the social fabric of their communities. They often provide essential goods and services, support local causes, and foster a sense of community and connection among residents. By starting a small business, entrepreneurs can make a positive impact on their community and create a lasting legacy.

However, starting a small business can also be a challenging and daunting task. It requires careful planning, hard work, and dedication to succeed. Entrepreneurs must be prepared to wear multiple hats, from managing finances to marketing their products or services. Nevertheless, the rewards of starting a small business far outweigh the risks, offering entrepreneurs the opportunity to pursue their dreams and create a better future for themselves and their communities.

As the economy continues to evolve, it is likely that small businesses will play an increasingly important role in driving growth and innovation. By supporting and empowering small businesses, we can create a more vibrant and diverse economy that benefits everyone. Whether you are an aspiring entrepreneur or a seasoned business owner, starting a small business can be a rewarding and profitable venture that offers endless opportunities for growth and success.

Identifying the Most Profitable Industries for Small Businesses

The most profitable small business to start often depends on the industry and market trends. According to a report by IBISWorld, the top 5 most profitable industries for small businesses in the United States are e-commerce, software development, healthcare, renewable energy, and cybersecurity. These industries have shown significant growth and profitability in recent years, making them attractive options for entrepreneurs looking to start a small business.

E-commerce, for example, has experienced rapid growth in recent years, with online sales projected to reach $6.5 trillion by 2023. Starting an e-commerce business can be a lucrative venture, with opportunities to sell products through online marketplaces, social media, and company websites. Software development is another profitable industry, with the global software market expected to reach $507.2 billion by 2023. Small businesses can develop and sell software products, offer custom software development services, or provide software consulting services.

The healthcare industry is also a profitable sector for small businesses, with opportunities to provide medical services, develop healthcare software, or offer healthcare consulting services. Renewable energy is another growing industry, with opportunities to develop and install solar panels, wind turbines, and other renewable energy systems. Cybersecurity is also a lucrative industry, with opportunities to provide cybersecurity services, develop cybersecurity software, and offer cybersecurity consulting services.

When identifying the most profitable industries for small businesses, it’s essential to consider market trends, competition, and growth prospects. Entrepreneurs should also assess their skills, interests, and values to ensure they are starting a business that aligns with their strengths and passions. By doing so, small businesses can increase their chances of success and profitability in the long term.

According to a report by the Small Business Administration (SBA), small businesses in the e-commerce industry have an average annual revenue of $1.1 million, while those in the software development industry have an average annual revenue of $1.3 million. Small businesses in the healthcare industry have an average annual revenue of $1.2 million, while those in the renewable energy industry have an average annual revenue of $1.1 million. Cybersecurity small businesses have an average annual revenue of $1.4 million.

These statistics demonstrate the potential for profitability in these industries, making them attractive options for entrepreneurs looking to start a small business. However, it’s essential to remember that profitability depends on various factors, including market trends, competition, and the entrepreneur’s skills and experience.

How to Choose a Profitable Business Idea That Aligns with Your Passion

Choosing a profitable business idea that aligns with your passion is crucial for the success of your small business. When you’re passionate about your business, you’re more likely to be motivated to put in the hard work and dedication required to make it successful. Moreover, a business that aligns with your values and interests can lead to a more fulfilling and enjoyable entrepreneurial journey.

To choose a profitable business idea that aligns with your passion, start by identifying your strengths, skills, and interests. What are you good at? What do you enjoy doing? What problems do you want to solve? Answering these questions can help you narrow down your options and identify potential business ideas that align with your passion.

Next, conduct market research to validate your business idea. Look for trends, demand, and competition in your desired market. Use online tools such as Google Trends, Keyword Planner, and social media to gather data and insights. You can also talk to potential customers, attend industry events, and join online communities to gather feedback and validate your idea.

Another important factor to consider is the profitability of your business idea. Research the market size, growth potential, and revenue streams of your desired industry. Look for industries with high demand, low competition, and potential for scalability. You can also use online tools such as IBISWorld, Statista, and Bloomberg to gather data and insights on the profitability of your business idea.

Some of the most profitable small business ideas that align with popular passions include:

– E-commerce businesses that sell products related to hobbies or interests

– Software development businesses that create solutions for specific industries or problems

– Healthcare businesses that provide services or products related to wellness or fitness

– Renewable energy businesses that provide solutions for sustainable living

– Cybersecurity businesses that provide services or products related to online security

When choosing a profitable business idea that aligns with your passion, remember to stay focused on your goals and values. Don’t be afraid to pivot or adjust your idea based on market feedback and validation. With the right mindset and strategy, you can turn your passion into a successful and profitable small business.

According to a report by the Small Business Administration (SBA), small businesses that align with their owner’s passion and values are more likely to succeed and experience long-term growth. In fact, the SBA reports that small businesses that align with their owner’s passion and values have a 20% higher success rate than those that don’t.

Top 5 Most Profitable Small Business Ideas to Consider

Starting a small business can be a lucrative venture, but it’s essential to choose a profitable business idea that aligns with your skills, interests, and values. Here are the top 5 most profitable small business ideas to consider, along with real-life examples and success stories:

1. E-commerce Store Owner: Starting an e-commerce store can be a profitable venture, with the potential to earn up to $100,000 per year. With the rise of online shopping, e-commerce stores have become increasingly popular, and entrepreneurs can capitalize on this trend by selling products through online marketplaces or their own websites.

Example: Amazon FBA (Fulfillment by Amazon) sellers can earn up to $50,000 per month by selling products through Amazon’s platform.

2. Software Developer: Software development is a lucrative industry, with the potential to earn up to $200,000 per year. Entrepreneurs can develop and sell software products, offer custom software development services, or provide software consulting services.

Example: A software development company can earn up to $1 million per year by developing and selling software products to businesses and individuals.

3. Healthcare Consultant: The healthcare industry is a growing market, with the potential to earn up to $150,000 per year. Entrepreneurs can offer healthcare consulting services, develop healthcare software, or provide healthcare services to individuals and businesses.

Example: A healthcare consulting company can earn up to $500,000 per year by providing consulting services to healthcare providers and insurance companies.

4. Renewable Energy Specialist: The renewable energy industry is a growing market, with the potential to earn up to $120,000 per year. Entrepreneurs can develop and install renewable energy systems, offer renewable energy consulting services, or provide renewable energy products to individuals and businesses.

Example: A renewable energy company can earn up to $200,000 per year by developing and installing solar panels and wind turbines for homes and businesses.

5. Cybersecurity Specialist: The cybersecurity industry is a growing market, with the potential to earn up to $180,000 per year. Entrepreneurs can offer cybersecurity services, develop cybersecurity software, or provide cybersecurity consulting services to individuals and businesses.

Example: A cybersecurity company can earn up to $500,000 per year by providing cybersecurity services to businesses and individuals.

These business ideas have the potential to be highly profitable, but it’s essential to conduct thorough market research and validation to ensure success. By choosing a business idea that aligns with your skills, interests, and values, you can increase your chances of success and create a thriving small business.

Creating a Solid Business Plan to Ensure Long-Term Success

A well-crafted business plan is essential for the success of any small business. It serves as a roadmap, guiding the entrepreneur through the process of launching and growing their business. A solid business plan should include market analysis, financial projections, and marketing strategies.

Market analysis is a critical component of a business plan. It involves researching the target market, identifying competitors, and understanding the needs and preferences of potential customers. This information can be used to develop a unique value proposition and create a competitive advantage.

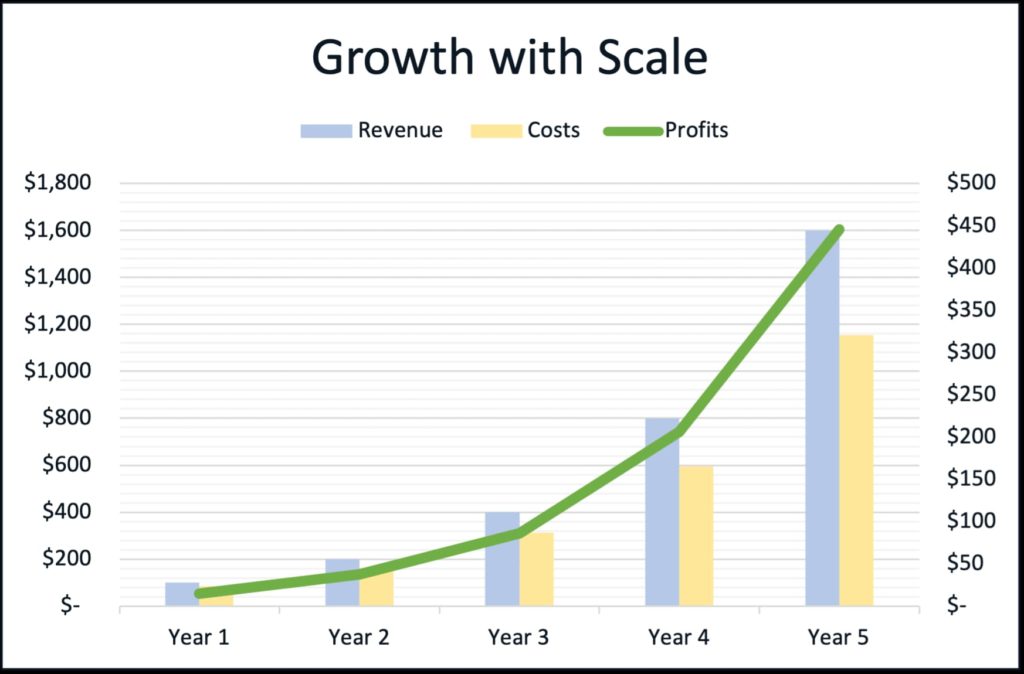

Financial projections are also a crucial part of a business plan. They involve estimating revenue, expenses, and profits over a specific period of time. This information can be used to secure funding, make informed decisions, and measure progress.

Marketing strategies are another essential component of a business plan. They involve identifying the most effective channels for reaching the target market and creating a plan for promoting the business. This can include social media marketing, content marketing, email marketing, and paid advertising.

A solid business plan should also include a section on management and organization. This should include information on the business structure, ownership, and key personnel. It should also outline the roles and responsibilities of each team member and provide a plan for recruiting and training new employees.

Finally, a solid business plan should include a section on funding and financing. This should include information on the startup costs, funding options, and financial projections. It should also outline a plan for managing cash flow and securing additional funding as needed.

By creating a solid business plan, entrepreneurs can set their business up for success and increase their chances of achieving their goals. A well-crafted business plan can also help entrepreneurs to secure funding, attract investors, and build a strong team.

According to a report by the Small Business Administration (SBA), businesses that have a solid business plan are more likely to succeed and experience long-term growth. In fact, the SBA reports that businesses with a solid business plan have a 20% higher success rate than those without one.

Some of the most profitable small businesses to start have a solid business plan in place. For example, a software development company can create a business plan that outlines their market analysis, financial projections, and marketing strategies. This can help them to secure funding, attract investors, and build a strong team.

Similarly, a healthcare consulting company can create a business plan that outlines their market analysis, financial projections, and marketing strategies. This can help them to secure funding, attract investors, and build a strong team.

Securing Funding and Managing Finances for Your Small Business

Securing funding and managing finances are crucial steps in starting and growing a small business. There are various funding options available to small businesses, including loans, grants, and investors. Each option has its own advantages and disadvantages, and entrepreneurs should carefully consider their options before making a decision.

Loans are a popular funding option for small businesses. They can be obtained from banks, credit unions, and online lenders. Loans can provide the necessary funds to start or grow a business, but they must be repaid with interest. Entrepreneurs should carefully consider the terms and conditions of a loan before signing an agreement.

Grants are another funding option for small businesses. They are typically provided by government agencies and non-profit organizations. Grants can provide the necessary funds to start or grow a business, but they are often competitive and may have specific requirements or restrictions.

Investors are also a funding option for small businesses. They can provide the necessary funds to start or grow a business in exchange for equity. Investors can provide valuable guidance and support, but entrepreneurs should carefully consider the terms and conditions of an investment before signing an agreement.

In addition to securing funding, entrepreneurs must also manage their finances effectively. This includes creating a budget, tracking expenses, and managing cash flow. Entrepreneurs should also consider hiring an accountant or bookkeeper to help with financial management.

Some of the most profitable small businesses to start require careful financial management. For example, a software development company may require significant upfront costs to develop a product, but can generate significant revenue through sales and licensing.

A healthcare consulting company may require significant upfront costs to hire staff and develop a client base, but can generate significant revenue through consulting services and product sales.

By securing funding and managing finances effectively, entrepreneurs can set their business up for success and increase their chances of achieving their goals. A well-managed financial plan can help entrepreneurs to make informed decisions, manage risk, and achieve long-term growth and profitability.

According to a report by the Small Business Administration (SBA), businesses that have a solid financial plan are more likely to succeed and experience long-term growth. In fact, the SBA reports that businesses with a solid financial plan have a 20% higher success rate than those without one.

Building a Strong Online Presence to Attract Customers and Drive Sales

In today’s digital age, having a strong online presence is crucial for small businesses to attract customers and drive sales. A professional website and social media presence can help small businesses to establish their brand, build trust with customers, and increase their online visibility.

A website is a critical component of a small business’s online presence. It provides a platform for businesses to showcase their products or services, share their story, and connect with customers. A well-designed website can help small businesses to establish their brand, build trust with customers, and increase their online visibility.

Social media is also an essential component of a small business’s online presence. It provides a platform for businesses to connect with customers, share their story, and build their brand. Social media can help small businesses to increase their online visibility, drive website traffic, and generate leads.

To build a strong online presence, small businesses should focus on creating high-quality content that resonates with their target audience. This can include blog posts, videos, social media posts, and email newsletters. Small businesses should also focus on optimizing their website and social media profiles for search engines to increase their online visibility.

Some of the most profitable small businesses to start have a strong online presence. For example, an e-commerce business can use social media to drive website traffic and generate sales. A software development company can use content marketing to establish their brand and attract customers.

A healthcare consulting company can use social media to build their brand and attract customers. By building a strong online presence, small businesses can increase their online visibility, drive website traffic, and generate leads.

According to a report by the Small Business Administration (SBA), businesses that have a strong online presence are more likely to succeed and experience long-term growth. In fact, the SBA reports that businesses with a strong online presence have a 20% higher success rate than those without one.

By building a strong online presence, small businesses can establish their brand, build trust with customers, and increase their online visibility. This can help small businesses to attract customers, drive sales, and achieve long-term growth and profitability.

https://www.youtube.com/watch?v=IjS9eTpmhgk

Scaling Your Business for Long-Term Growth and Profitability

Scaling a small business requires careful planning and execution. It involves expanding the business’s operations, increasing revenue, and improving profitability. To scale a business successfully, entrepreneurs must focus on building a strong team, outsourcing tasks, and entering new markets.

Building a strong team is essential for scaling a business. It involves hiring talented and experienced employees who can help the business grow and expand. Entrepreneurs should focus on building a team that is diverse, skilled, and motivated. They should also invest in training and development programs to help their employees grow and develop.

Outsourcing tasks is another important aspect of scaling a business. It involves delegating tasks to external partners or vendors who can help the business grow and expand. Entrepreneurs should focus on outsourcing tasks that are not core to their business, such as accounting, marketing, and IT. This can help them to free up resources and focus on high-priority tasks.

Entering new markets is also essential for scaling a business. It involves expanding the business’s operations into new geographic regions, industries, or customer segments. Entrepreneurs should focus on identifying new markets that are aligned with their business goals and objectives. They should also invest in market research and analysis to understand the needs and preferences of their target customers.

Some of the most profitable small businesses to start have successfully scaled their operations. For example, a software development company can scale its operations by hiring more developers, outsourcing tasks to external partners, and entering new markets. A healthcare consulting company can scale its operations by hiring more consultants, outsourcing tasks to external partners, and entering new markets.

By scaling their business, entrepreneurs can increase revenue, improve profitability, and achieve long-term growth and success. However, scaling a business requires careful planning and execution. Entrepreneurs must focus on building a strong team, outsourcing tasks, and entering new markets to achieve success.

According to a report by the Small Business Administration (SBA), businesses that scale their operations successfully are more likely to achieve long-term growth and profitability. In fact, the SBA reports that businesses that scale their operations successfully have a 20% higher success rate than those that do not.