Why Buying a Small Business Can Be a Savvy Move

For entrepreneurs looking to invest in a new venture, buying a small business can be a smart and strategic decision. Not only can it provide a faster return on investment compared to starting from scratch, but it also offers a lower risk profile. With an established customer base and existing operations, a small business can generate revenue from day one, allowing the new owner to focus on growth and expansion.

One of the primary benefits of buying a small business is the reduced startup costs. When starting a new business, entrepreneurs often need to invest significant amounts of money in marketing, equipment, and staffing. In contrast, buying a small business allows the new owner to leverage the existing infrastructure and customer base, reducing the need for significant upfront investments.

Another advantage of buying a small business is the potential for quick returns on investment. With an established customer base and existing operations, a small business can generate revenue from day one, allowing the new owner to see a return on their investment relatively quickly. This can be particularly attractive for entrepreneurs who are looking to generate cash flow quickly.

When searching for the best small business to buy, it’s essential to consider the potential for growth and expansion. Look for businesses with a strong market position, a loyal customer base, and a solid financial track record. Additionally, consider the industry trends and the potential for innovation and disruption.

By buying a small business, entrepreneurs can tap into the potential for long-term growth and success. With the right strategy and execution, a small business can be scaled up to achieve significant revenue and profitability. Whether you’re a seasoned entrepreneur or just starting out, buying a small business can be a savvy move that sets you up for success.

How to Identify the Most Profitable Small Business to Buy

When searching for the best small business to buy, it’s essential to identify the most profitable opportunities. This requires a combination of research, analysis, and due diligence. Here are some tips and strategies to help you identify the most profitable small business to buy:

Research industry trends: Start by researching the latest industry trends and identifying areas with high growth potential. Look for industries that are experiencing rapid expansion, such as e-commerce, healthcare, or technology. These industries often present opportunities for small businesses to capitalize on emerging trends and technologies.

Analyze financial statements: When evaluating a small business for sale, it’s crucial to analyze the financial statements carefully. Look for businesses with a strong financial track record, including increasing revenue, profitability, and cash flow. Be wary of businesses with declining financial performance or high levels of debt.

Evaluate market demand: Assess the market demand for the products or services offered by the small business. Look for businesses with a strong market position, a loyal customer base, and a competitive advantage. Evaluate the competition and assess the potential for market share growth.

Popular industries for small business investments: Some popular industries for small business investments include food trucks, e-commerce stores, and home-based services. These industries often present opportunities for entrepreneurs to capitalize on emerging trends and technologies. For example, the food truck industry has experienced rapid growth in recent years, driven by increasing demand for mobile food services.

Other industries to consider: Other industries to consider when searching for the best small business to buy include:

- Home cleaning services: With increasing demand for cleaning services, home cleaning businesses can be a profitable investment opportunity.

- Lawn care services: Lawn care businesses can be a lucrative investment, particularly in areas with high demand for landscaping services.

- Pet grooming services: With increasing demand for pet grooming services, pet grooming businesses can be a profitable investment opportunity.

By following these tips and strategies, you can identify the most profitable small business to buy and make a smart investment decision. Remember to always conduct thorough research and due diligence before making a purchase.

Top Small Business Opportunities for First-Time Buyers

For first-time buyers, finding the right small business opportunity can be a daunting task. However, there are several industries that are well-suited for new entrepreneurs. Here are some of the top small business opportunities for first-time buyers:

Home cleaning services: Home cleaning services are a popular choice for first-time buyers. This industry is relatively easy to enter, and the startup costs are low. Additionally, there is a high demand for cleaning services, making it a lucrative business opportunity.

Lawn care services: Lawn care services are another popular choice for first-time buyers. This industry requires minimal startup costs and can be operated with a small team. Additionally, lawn care services are in high demand, particularly during the spring and summer months.

Pet grooming services: Pet grooming services are a growing industry, and first-time buyers can capitalize on this trend. This business requires minimal startup costs and can be operated from a small location. Additionally, pet owners are willing to pay a premium for high-quality grooming services.

Why these businesses are attractive: These businesses are attractive for first-time buyers because they require minimal startup costs and can be operated with a small team. Additionally, they are in high demand, making it easier to generate revenue. Furthermore, these businesses can be operated from a small location, making it easier to manage and maintain.

Examples of successful companies: There are several examples of successful companies in these industries. For example, Molly Maid is a successful home cleaning services company that has been in operation for over 30 years. Similarly, Lawn Doctor is a successful lawn care services company that has been in operation for over 50 years.

What to consider: When considering these business opportunities, it’s essential to conduct thorough research and due diligence. This includes evaluating the market demand, assessing the competition, and reviewing the financial performance of similar businesses. Additionally, it’s crucial to develop a solid business plan and secure funding to support the business.

By considering these top small business opportunities, first-time buyers can make an informed decision and increase their chances of success. Remember to always conduct thorough research and due diligence before making a decision.

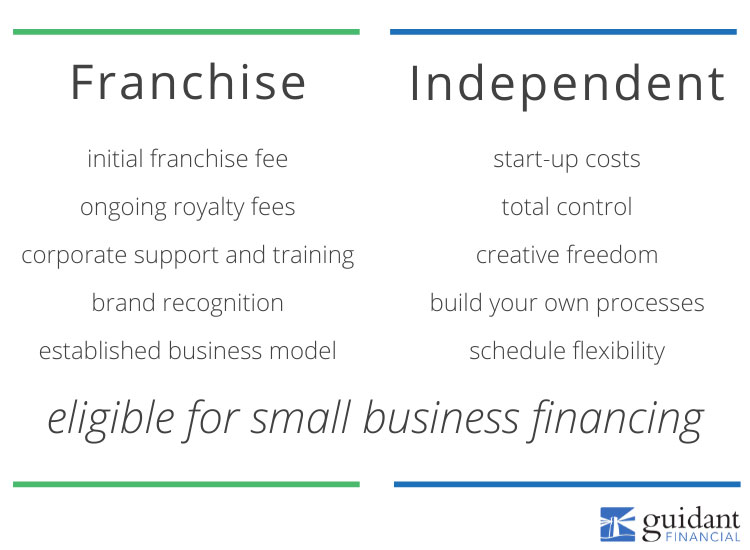

The Pros and Cons of Buying a Franchise vs. Independent Business

When considering buying a small business, entrepreneurs often face a dilemma: whether to buy a franchise or an independent business. Both options have their pros and cons, which must be carefully weighed before making a decision.

Pros of buying a franchise:

- Brand recognition: Franchises often have a well-established brand, which can attract customers and provide a competitive advantage.

- Support: Franchisors typically provide ongoing support, including training, marketing, and operational assistance.

- Proven business model: Franchises have a proven business model, which can reduce the risk of failure.

Cons of buying a franchise:

- Costs: Franchises often require significant upfront costs, including franchise fees and royalties.

- Limited control: Franchisees may have limited control over the business, as they must adhere to the franchisor’s rules and regulations.

- Contractual obligations: Franchisees are typically required to sign a contract, which can be difficult to exit if the business is not successful.

Pros of buying an independent business:

- Control: Independent business owners have complete control over the business, allowing them to make decisions and changes as they see fit.

- No royalties: Independent business owners do not have to pay royalties or franchise fees.

- Flexibility: Independent business owners can adapt to changing market conditions and customer needs without being tied to a franchisor’s rules and regulations.

Cons of buying an independent business:

- No brand recognition: Independent businesses may not have the same level of brand recognition as a franchise.

- No support: Independent business owners may not have access to the same level of support as franchisees.

- Higher risk: Independent businesses may be riskier than franchises, as they do not have a proven business model.

Examples of successful franchises and independent businesses:

McDonald’s is a successful franchise with a well-established brand and proven business model. On the other hand, companies like Amazon and Google are successful independent businesses that have achieved great success without being part of a franchise.

Ultimately, the decision to buy a franchise or an independent business depends on the individual entrepreneur’s goals, resources, and preferences. It is essential to carefully weigh the pros and cons of each option and consider factors such as brand recognition, support, and control before making a decision.

What to Look for When Evaluating a Small Business for Sale

When evaluating a small business for sale, there are several key factors to consider. These factors can help you determine whether the business is a good investment opportunity and whether it aligns with your goals and budget.

Financial performance: One of the most important factors to consider is the financial performance of the business. Review the company’s financial statements, including the balance sheet, income statement, and cash flow statement. Look for signs of financial stability, such as increasing revenue, profitability, and cash flow.

Market position: Evaluate the business’s market position, including its target market, competition, and market share. Consider whether the business has a strong brand presence and whether it is well-positioned to compete in the market.

Growth potential: Assess the business’s growth potential, including its ability to expand into new markets, increase revenue, and improve profitability

What to Look for When Evaluating a Small Business for Sale

When evaluating a small business for sale, there are several key factors to consider. These factors can help you determine whether the business is a good investment opportunity and whether it aligns with your goals and budget.

Financial performance: One of the most important factors to consider is the financial performance of the business. Review the company’s financial statements, including the balance sheet, income statement, and cash flow statement. Look for signs of financial stability, such as increasing revenue, profitability, and cash flow.

Market position: Evaluate the business’s market position, including its target market, competition, and market share. Consider whether the business has a strong brand presence and whether it is well-positioned to compete in the market.

Growth potential: Assess the business’s growth potential, including its ability to expand into new markets, increase revenue, and improve profitability

What to Look for When Evaluating a Small Business for Sale

When evaluating a small business for sale, there are several key factors to consider. These factors can help you determine whether the business is a good investment opportunity and whether it aligns with your goals and budget.

Financial performance: One of the most important factors to consider is the financial performance of the business. Review the company’s financial statements, including the balance sheet, income statement, and cash flow statement. Look for signs of financial stability, such as increasing revenue, profitability, and cash flow.

Market position: Evaluate the business’s market position, including its target market, competition, and market share. Consider whether the business has a strong brand presence and whether it is well-positioned to compete in the market.

Growth potential: Assess the business’s growth potential, including its ability to expand into new markets, increase revenue, and improve profitability

What to Look for When Evaluating a Small Business for Sale

When evaluating a small business for sale, there are several key factors to consider. These factors can help you determine whether the business is a good investment opportunity and whether it aligns with your goals and budget.

Financial performance: One of the most important factors to consider is the financial performance of the business. Review the company’s financial statements, including the balance sheet, income statement, and cash flow statement. Look for signs of financial stability, such as increasing revenue, profitability, and cash flow.

Market position: Evaluate the business’s market position, including its target market, competition, and market share. Consider whether the business has a strong brand presence and whether it is well-positioned to compete in the market.

Growth potential: Assess the business’s growth potential, including its ability to expand into new markets, increase revenue, and improve profitability