The Mindset of a Millionaire: Setting Yourself Up for Success

When it comes to making millions of dollars a year, having the right mindset is crucial. A growth mindset, resilience, and a willingness to take calculated risks are essential for achieving financial success. Individuals who have made their fortunes often possess a unique mindset that sets them apart from others. They are open to learning, adaptable, and willing to challenge conventional wisdom.

Developing a growth mindset requires a deep understanding of your strengths, weaknesses, and motivations. It involves being aware of your thoughts, emotions, and behaviors, and making conscious decisions to improve yourself. By cultivating a growth mindset, you can overcome obstacles, stay focused, and maintain a positive attitude, even in the face of adversity.

Resilience is another critical component of a millionaire’s mindset. It involves being able to bounce back from setbacks, failures, and disappointments. When faced with challenges, resilient individuals don’t give up; instead, they learn from their mistakes and use them as opportunities for growth. By developing resilience, you can navigate the ups and downs of entrepreneurship, investing, and other high-risk, high-reward pursuits.

Finally, taking calculated risks is essential for achieving financial success. This involves weighing the potential risks and rewards of a particular investment, business venture, or career move. By taking informed risks, you can capitalize on opportunities that others may miss, and position yourself for long-term financial gain.

So, how can you develop the mindset of a millionaire? Start by cultivating a growth mindset, being open to learning, and embracing challenges. Practice resilience by learning from your mistakes and staying focused on your goals. And, don’t be afraid to take calculated risks, as this is often where the greatest rewards lie. By adopting these strategies, you can set yourself up for success and increase your chances of making millions of dollars a year.

Identifying Lucrative Opportunities: Where to Focus Your Efforts

When it comes to making millions of dollars a year, identifying lucrative opportunities is crucial. Certain industries and fields have a higher potential for generating significant revenue, and understanding these areas can help you focus your efforts. In this section, we’ll explore some of the most promising industries and opportunities that can help you achieve your financial goals.

One of the most lucrative industries in recent years has been technology. The rise of smartphones, cloud computing, and artificial intelligence has created a vast array of opportunities for entrepreneurs and investors. Companies like Apple, Amazon, and Google have made their founders and investors incredibly wealthy, and there are still many opportunities for innovation and disruption in this space.

Real estate is another industry that has consistently produced millionaires. Whether it’s through investing in rental properties, flipping houses, or developing commercial real estate, there are many ways to make money in this field. Successful real estate investors like Donald Trump and Robert Kiyosaki have built their fortunes through savvy investments and strategic decision-making.

Entrepreneurship is also a key driver of wealth creation. Starting a successful business can be a challenging but rewarding experience, and many entrepreneurs have made their fortunes by identifying a need in the market and filling it with a innovative product or service. Companies like Facebook, Uber, and Airbnb have disrupted entire industries and made their founders incredibly wealthy.

Other industries that have the potential to generate significant revenue include finance, healthcare, and energy. These fields often require specialized knowledge and expertise, but for those who are willing to put in the time and effort, the rewards can be substantial.

So, how can you identify lucrative opportunities in these industries? Start by doing your research and staying up-to-date on the latest trends and developments. Network with successful entrepreneurs and investors, and learn from their experiences. Be willing to take calculated risks and invest in yourself and your ideas. By following these strategies, you can increase your chances of making millions of dollars a year and achieving your financial goals.

Building Multiple Income Streams: Diversifying Your Wealth

Having multiple income streams is crucial for achieving financial stability and security. By diversifying your income, you can reduce your reliance on a single source of income and increase your overall earning potential. In this section, we’ll explore various ways to build multiple income streams and create a more stable financial foundation.

One of the most effective ways to build multiple income streams is through investing. Investing in stocks, real estate, or other assets can provide a steady stream of passive income and help you build wealth over time. For example, investing in dividend-paying stocks can provide a regular stream of income, while investing in real estate can provide rental income and potential long-term appreciation in value.

Starting a side business is another way to build multiple income streams. Whether it’s freelancing, consulting, or starting a part-time business, having a side hustle can provide an additional source of income and help you diversify your earnings. Many successful entrepreneurs have built their fortunes by starting side businesses and eventually scaling them into full-time ventures.

Creating and selling digital products is another way to build multiple income streams. Whether it’s creating and selling ebooks, courses, or software, digital products can provide a passive stream of income and help you build wealth over time. Many successful entrepreneurs have built their fortunes by creating and selling digital products, and this trend is expected to continue in the future.

Real estate investing is another way to build multiple income streams. Whether it’s investing in rental properties, fix-and-flip projects, or real estate investment trusts (REITs), real estate can provide a steady stream of income and help you build wealth over time. Many successful real estate investors have built their fortunes by investing in real estate and creating multiple income streams.

So, how can you build multiple income streams and create a more stable financial foundation? Start by identifying your strengths and passions, and exploring ways to monetize them. Consider investing in stocks, real estate, or other assets, and start a side business or create digital products. By building multiple income streams, you can reduce your reliance on a single source of income and increase your overall earning potential, helping you to make millions of dollars a year.

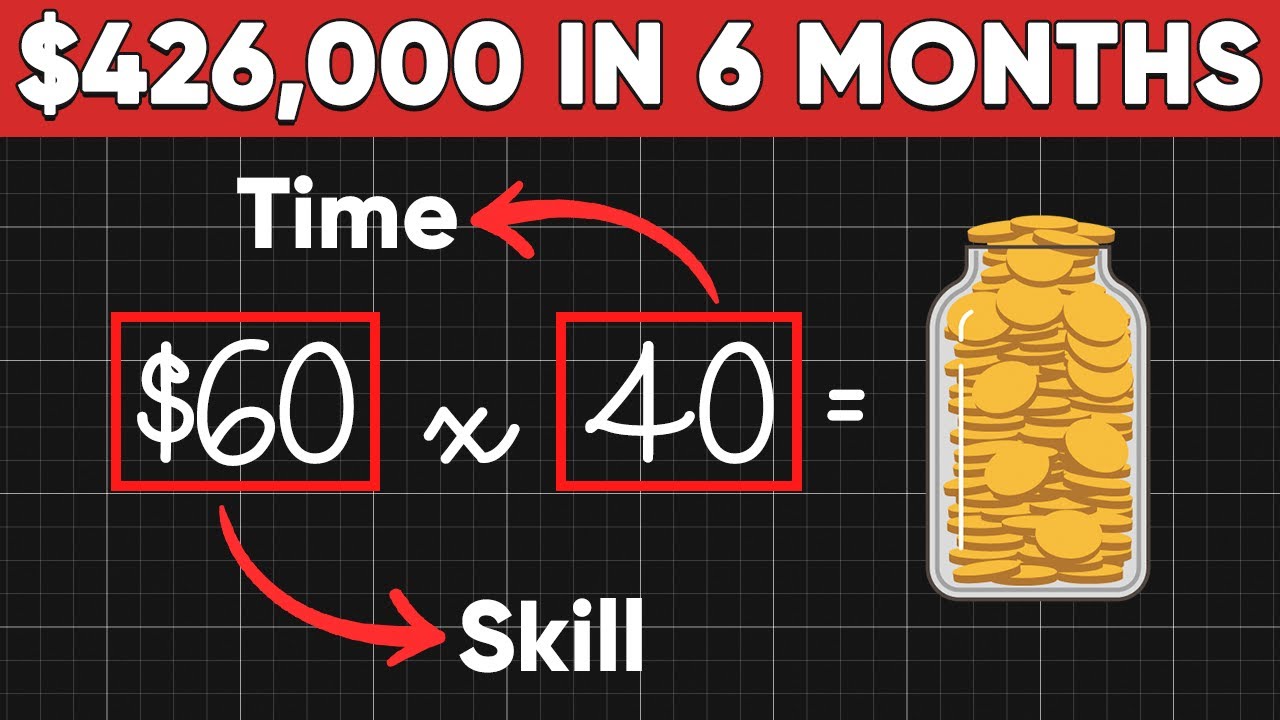

Developing a Valuable Skillset: Investing in Yourself

Having a valuable skillset is essential for increasing your earning potential and making millions of dollars a year. In today’s fast-paced and competitive job market, it’s crucial to have skills that are in high demand and can set you apart from others. In this section, we’ll explore various ways to develop a valuable skillset and increase your earning potential.

Coding is one of the most valuable skills in today’s job market. With the rise of technology and the increasing demand for digital solutions, coding skills are in high demand. Whether it’s learning to code in Python, Java, or JavaScript, having coding skills can open up a world of opportunities and increase your earning potential.

Digital marketing is another valuable skill that can increase your earning potential. With the rise of online marketing and the increasing demand for digital solutions, digital marketing skills are in high demand. Whether it’s learning about SEO, social media marketing, or PPC advertising, having digital marketing skills can help you succeed in today’s competitive job market.

Data analysis is another valuable skill that can increase your earning potential. With the increasing amount of data being generated every day, companies are looking for professionals who can analyze and interpret data to make informed decisions. Whether it’s learning about data visualization, machine learning, or statistical analysis, having data analysis skills can help you succeed in today’s data-driven world.

So, how can you develop a valuable skillset and increase your earning potential? Start by identifying the skills that are in high demand in your industry and invest in yourself by taking courses, attending workshops, and reading books. Network with professionals in your industry and learn from their experiences. By developing a valuable skillset, you can increase your earning potential and make millions of dollars a year.

Additionally, consider obtaining certifications or diplomas in your field of expertise. This can help you stand out from others and demonstrate your expertise to potential employers. Many successful professionals have obtained certifications or diplomas in their field and have seen a significant increase in their earning potential.

Finally, remember that developing a valuable skillset is a continuous process. Stay up-to-date with the latest trends and developments in your industry and continuously invest in yourself. By doing so, you can increase your earning potential and make millions of dollars a year.

Networking and Building Relationships: The Power of Connections

Building a strong network of relationships is crucial for achieving financial success and making millions of dollars a year. In today’s business world, who you know can be just as important as what you know. In this section, we’ll explore the importance of networking and building relationships, and provide tips on how to do it effectively.

Attending networking events is a great way to meet new people and build relationships. Whether it’s a conference, a trade show, or a networking meeting, these events provide a platform for you to connect with others in your industry. Make sure to bring business cards, be prepared to talk about your business or idea, and follow up with new contacts after the event.

Joining online communities is another way to build relationships and network with others. Whether it’s a LinkedIn group, a Facebook group, or a Reddit community, online communities provide a platform for you to connect with others who share similar interests and goals. Participate in discussions, offer advice and expertise, and build relationships with others in the community.

Connecting with influential people in your industry can also be a powerful way to build relationships and achieve financial success. Whether it’s a mentor, a business partner, or a potential investor, building relationships with influential people can provide access to new opportunities, resources, and networks. Make sure to research and identify key influencers in your industry, and reach out to them to build a relationship.

So, how can you build a strong network of relationships and achieve financial success? Start by identifying your goals and what you want to achieve, and then build relationships with others who can help you get there. Attend networking events, join online communities, and connect with influential people in your industry. By building a strong network of relationships, you can increase your chances of making millions of dollars a year and achieving financial success.

Additionally, make sure to be genuine and authentic in your relationships. People can spot a fake from a mile away, and building relationships based on manipulation or insincerity will not lead to long-term success. Instead, focus on building relationships based on mutual respect, trust, and a shared vision for success.

Finally, remember that building relationships takes time and effort. Don’t expect to build a strong network of relationships overnight, but instead focus on building relationships over time. By doing so, you can increase your chances of making millions of dollars a year and achieving financial success.

Creating and Selling a Product or Service: Turning Your Idea into a Million-Dollar Business

Creating and selling a product or service can be a lucrative way to make millions of dollars a year. However, it requires careful planning, execution, and marketing. In this section, we’ll explore the key steps to turn your idea into a million-dollar business.

Market research is a critical step in creating a successful product or service. It involves understanding your target audience, their needs, and preferences. Conduct surveys, gather feedback, and analyze industry trends to identify gaps in the market and opportunities for innovation.

Product development is the next step in creating a successful product or service. It involves designing, testing, and refining your product or service to meet the needs of your target audience. Use agile development methodologies, gather feedback from beta testers, and iterate on your product or service to ensure it meets the highest standards of quality.

Marketing is a crucial step in selling your product or service. It involves creating a marketing strategy that resonates with your target audience, builds brand awareness, and drives sales. Use social media, content marketing, and paid advertising to reach your target audience and build a loyal customer base.

So, how can you turn your idea into a million-dollar business? Start by conducting market research to understand your target audience and identify opportunities for innovation. Develop a product or service that meets the needs of your target audience, and iterate on it to ensure it meets the highest standards of quality. Create a marketing strategy that resonates with your target audience, builds brand awareness, and drives sales. By following these steps, you can turn your idea into a million-dollar business and achieve financial success.

Additionally, consider using lean startup methodologies to validate your idea and build a minimum viable product (MVP). This involves testing your idea with a small group of customers, gathering feedback, and iterating on your product or service to ensure it meets their needs.

Finally, remember that creating and selling a product or service requires ongoing effort and improvement. Continuously gather feedback from customers, iterate on your product or service, and stay up-to-date with industry trends to ensure your business remains competitive and profitable.

Managing Your Finances: Avoiding Common Pitfalls and Staying on Track

Managing your finances effectively is crucial for achieving financial success and making millions of dollars a year. However, many people struggle with managing their finances, and it can be a major obstacle to achieving their financial goals. In this section, we’ll explore common pitfalls to avoid and provide tips on how to stay on track.

Budgeting is a critical step in managing your finances. It involves tracking your income and expenses, and making sure that you’re not overspending. Create a budget that accounts for all of your expenses, including savings and investments. Use the 50/30/20 rule as a guideline, where 50% of your income goes towards necessities, 30% towards discretionary spending, and 20% towards saving and investing.

Saving is another important aspect of managing your finances. It involves setting aside a portion of your income each month, and using it to build wealth over time. Consider using a savings account or a certificate of deposit (CD) to earn interest on your savings. Aim to save at least 10% to 20% of your income each month.

Investing is a key step in building wealth and achieving financial success. It involves using your savings to invest in assets that have the potential to generate returns over time. Consider using a brokerage account or a robo-advisor to invest in stocks, bonds, or other assets. Aim to invest at least 10% to 20% of your income each month.

So, how can you manage your finances effectively and avoid common pitfalls? Start by creating a budget that accounts for all of your expenses, and make sure to save and invest regularly. Avoid overspending and debt, and consider using a savings account or a certificate of deposit (CD) to earn interest on your savings. By following these tips, you can stay on track and achieve your financial goals.

Additionally, consider using financial tools and apps to help you manage your finances. There are many tools available that can help you track your income and expenses, create a budget, and invest in assets. Some popular options include Mint, Personal Capital, and Robinhood.

Finally, remember that managing your finances is an ongoing process. It requires discipline, patience, and persistence. Stay focused on your financial goals, and avoid getting distracted by short-term setbacks or obstacles. By following these tips and staying committed to your financial goals, you can achieve financial success and make millions of dollars a year.

Staying Motivated and Focused: Overcoming Obstacles and Achieving Your Goals

Staying motivated and focused is crucial for achieving financial success and making millions of dollars a year. However, many people struggle with staying motivated and focused, and it can be a major obstacle to achieving their financial goals. In this section, we’ll explore the importance of staying motivated and focused, and provide tips on how to overcome obstacles and achieve your goals.

Setting clear goals is a critical step in staying motivated and focused. It involves identifying what you want to achieve, and creating a plan to achieve it. Make sure to set specific, measurable, achievable, relevant, and time-bound (SMART) goals, and break them down into smaller, manageable tasks. Use a goal-setting framework, such as the SMART goal framework, to help you set and achieve your goals.

Creating a positive mindset is another important aspect of staying motivated and focused. It involves cultivating a positive attitude, and using positive self-talk to motivate yourself. Use affirmations, visualization, and positive self-talk to create a positive mindset, and overcome negative thoughts and self-doubt.

Overcoming obstacles is a key step in achieving financial success. It involves identifying obstacles, and creating a plan to overcome them. Use problem-solving strategies, such as the SWOT analysis, to identify obstacles, and create a plan to overcome them. Stay focused on your goals, and use positive self-talk to motivate yourself to overcome obstacles.

So, how can you stay motivated and focused on your financial goals? Start by setting clear goals, and creating a plan to achieve them. Use a goal-setting framework, such as the SMART goal framework, to help you set and achieve your goals. Create a positive mindset, and use positive self-talk to motivate yourself. Overcome obstacles, and stay focused on your goals. By following these tips, you can stay motivated and focused, and achieve financial success.

Additionally, consider using accountability partners or mentors to help you stay motivated and focused. Having someone to hold you accountable, and provide guidance and support, can be a powerful way to stay motivated and focused. Use online communities, or find a mentor or accountability partner, to help you stay motivated and focused.

Finally, remember that staying motivated and focused is an ongoing process. It requires discipline, patience, and persistence. Stay focused on your financial goals, and use positive self-talk to motivate yourself. By following these tips, and staying committed to your financial goals, you can achieve financial success and make millions of dollars a year.