Breaking Down the Barriers to Entrepreneurship

Starting a business is often perceived as a daunting task, requiring a significant amount of capital and resources. However, this notion is far from the truth. With careful planning and execution, it is entirely possible to start a business with a modest investment of $10,000. In fact, many successful entrepreneurs have launched their ventures with limited startup costs, proving that it’s not the amount of money that matters, but rather the idea, passion, and dedication behind it.

One of the primary barriers to entrepreneurship is the misconception that a large amount of capital is required to get started. This can be intimidating for individuals who have limited financial resources or are hesitant to take on debt. However, with the rise of digital technologies and online platforms, it’s now possible to start a business with minimal upfront costs. For instance, entrepreneurs can leverage social media, content marketing, and e-commerce platforms to reach customers and generate revenue without breaking the bank.

Moreover, starting a business with limited capital can actually be beneficial in the long run. It forces entrepreneurs to be more resourceful, innovative, and focused on their core offerings. By bootstrapping their business, entrepreneurs can avoid the pitfalls of over-spending and maintain a lean, agile operation that is better equipped to adapt to changing market conditions.

So, if you’re considering starting a business with $10,000, don’t let the perceived barriers hold you back. With the right mindset, strategy, and support, you can turn your entrepreneurial vision into a reality. In the following sections, we’ll explore various business ideas, provide tips on creating a solid business plan, and offer guidance on managing finances, building an online presence, and scaling your business for long-term success.

Identifying Lucrative Business Opportunities with Limited Startup Costs

When it comes to starting a business with $10,000, it’s essential to identify opportunities that can generate significant revenue with minimal upfront costs. One such opportunity is e-commerce. With the rise of online shopping, entrepreneurs can start an e-commerce business with a relatively small investment. For instance, they can start by selling products on platforms like Amazon, Etsy, or eBay, and then scale up to their own website as the business grows.

Another lucrative opportunity is freelancing. With the gig economy on the rise, freelancers can offer their services to clients across the globe. Platforms like Upwork, Fiverr, and Freelancer make it easy to find clients and manage projects. Freelancers can offer services such as writing, graphic design, web development, and social media management, among others.

Service-based businesses are also an excellent option for entrepreneurs with limited startup costs. For example, they can start a consulting business, offering services such as marketing, HR, or financial consulting. They can also start a coaching or tutoring business, offering services to individuals or businesses.

Other business ideas that can be started with $10,000 or less include affiliate marketing, selling stock photos, creating and selling online courses, and starting a blog or YouTube channel. The key is to identify a niche or opportunity that has a high demand and can be monetized with minimal upfront costs.

Successful businesses that have been launched with limited startup costs include Warby Parker, which started as an online eyewear retailer with just $120,000 in seed funding, and Airbnb, which started as a small online platform for renting out air mattresses with just $7,500 in seed funding. These examples demonstrate that it’s possible to start a successful business with limited capital, as long as you have a solid business plan and a willingness to work hard.

How to Create a Solid Business Plan on a Budget

Creating a comprehensive business plan is essential for any entrepreneur, regardless of the amount of capital they have to invest. However, many entrepreneurs believe that creating a business plan requires a significant amount of money, which is not necessarily true. With a little creativity and resourcefulness, it’s possible to create a solid business plan on a budget.

The first step in creating a business plan is to define your business model. This includes identifying your target market, products or services, and revenue streams. You can use online resources such as the Small Business Administration’s (SBA) business plan tool to help you get started. This tool provides a template and guidance on how to create a business plan, and it’s free.

Next, you’ll need to conduct market research to understand your target market and competitors. You can use online tools such as Google Trends and Keyword Planner to gather data on your target market and identify trends. You can also use social media to gather feedback from potential customers and understand their needs and preferences.

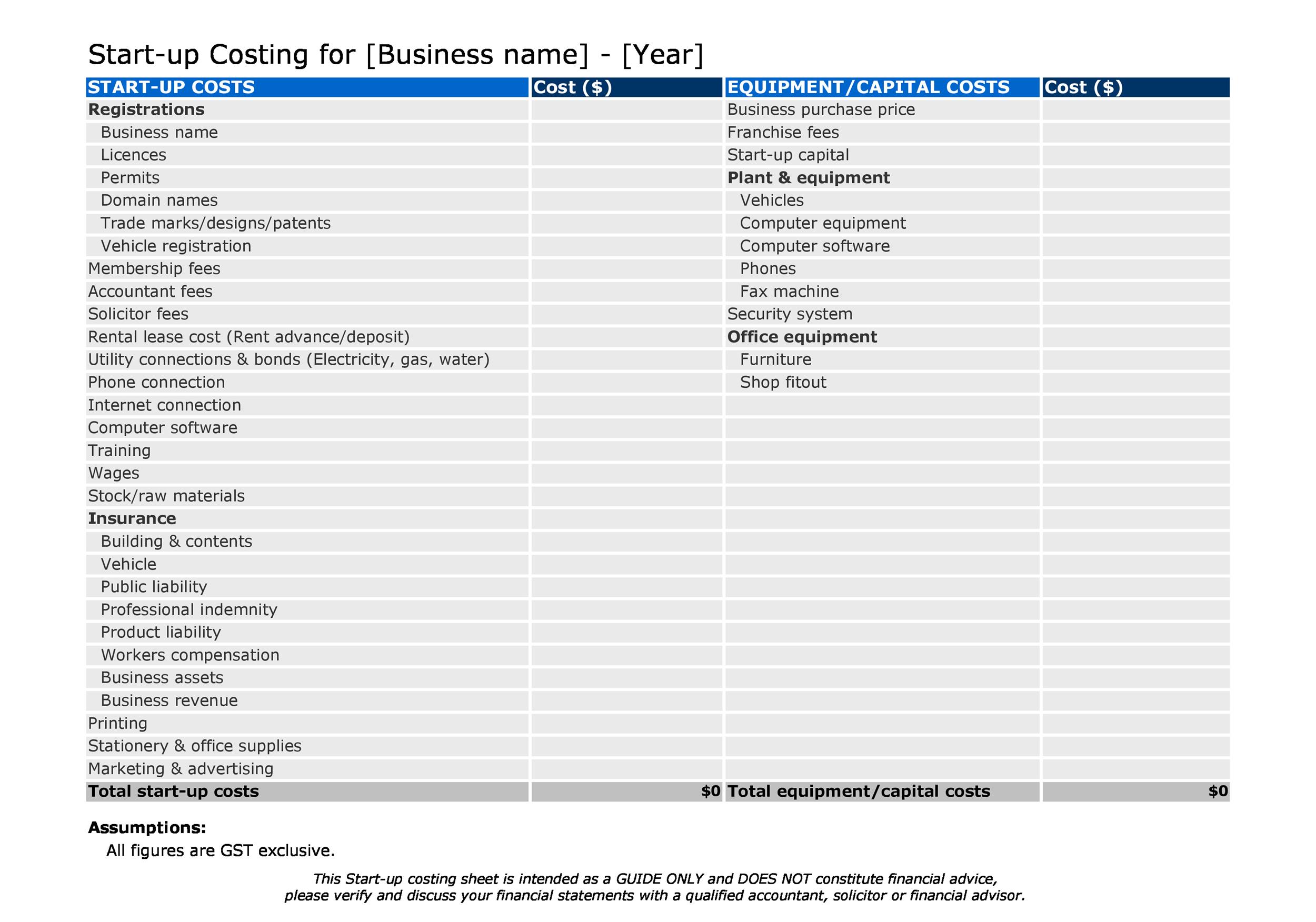

Once you have a solid understanding of your business model and target market, you can create a financial plan. This includes estimating your startup costs, revenue, and expenses. You can use online tools such as Excel or Google Sheets to create a financial plan, and you can also use templates provided by the SBA or other online resources.

In addition to a financial plan, you’ll also need to create a marketing plan. This includes identifying your marketing channels, such as social media, email marketing, or paid advertising, and creating a content marketing strategy. You can use online tools such as Hootsuite or Buffer to manage your social media accounts and schedule posts in advance.

Finally, you’ll need to create an operational plan, which includes identifying your business operations, such as production, logistics, and customer service. You can use online tools such as Trello or Asana to manage your business operations and assign tasks to team members.

By following these steps, you can create a solid business plan on a budget. Remember, the key to creating a successful business plan is to be flexible and adaptable, and to continually monitor and adjust your plan as your business grows and evolves.

Bootstrapping 101: Managing Finances and Minimizing Expenses

When starting a business with limited capital, it’s essential to manage finances effectively to ensure the business remains afloat. Bootstrapping, or self-funding, requires careful financial planning and discipline to minimize expenses and maximize revenue. Here are some tips on how to manage finances and minimize expenses when starting a business with $10,000.

First, create a budget that outlines projected income and expenses. This will help you identify areas where you can cut costs and allocate resources more efficiently. Consider using the 50/30/20 rule, where 50% of your budget goes towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Next, prioritize spending by focusing on essential expenses such as rent, utilities, and equipment. Cut back on non-essential expenses such as travel, entertainment, and subscriptions. Consider negotiating with suppliers or vendors to get the best possible prices.

Another way to minimize expenses is to take advantage of free or low-cost resources. Utilize online tools and software to manage finances, marketing, and operations. Consider using open-source software or free trials to test products before committing to a purchase.

Additionally, consider outsourcing or delegating tasks to freelancers or contractors. This can help reduce labor costs and free up time to focus on high-priority tasks. Platforms like Upwork, Fiverr, and Freelancer can connect you with talented professionals who can help with tasks such as writing, design, and programming.

Finally, maintain a cash flow by managing accounts receivable and payable. Consider offering discounts or incentives to customers who pay promptly, and negotiate with suppliers to extend payment terms. This will help ensure a steady flow of cash and reduce the risk of financial strain.

By following these tips, entrepreneurs can effectively manage finances and minimize expenses when starting a business with $10,000. Remember, bootstrapping requires discipline and creativity, but with the right mindset and strategies, it’s possible to build a successful business on a limited budget.

Building a Strong Online Presence without Breaking the Bank

In today’s digital age, having a professional online presence is crucial for businesses to succeed. However, many entrepreneurs believe that creating a strong online presence requires a significant investment, which is not necessarily true. With a little creativity and resourcefulness, it’s possible to build a professional online presence without breaking the bank.

First, start by creating a website that showcases your business and its offerings. You don’t need to spend thousands of dollars on a custom-built website. Instead, use website builders like Wix, Squarespace, or WordPress to create a professional-looking website at a fraction of the cost.

Next, utilize social media to reach your target audience and build your brand. Create profiles on platforms like Facebook, Twitter, Instagram, and LinkedIn, and post regular updates to engage with your followers. You can also use social media advertising to reach a wider audience and drive traffic to your website.

Another way to build a strong online presence is to develop a content marketing strategy. Create high-quality content that provides value to your target audience, such as blog posts, videos, and infographics. Share this content on your website and social media channels to attract and engage with your audience.

Additionally, optimize your website for search engines to improve your visibility and drive organic traffic. Use keywords relevant to your business and industry, and make sure your website is mobile-friendly and loads quickly.

Finally, use online tools and resources to manage your online presence and save time. Use tools like Hootsuite or Buffer to schedule social media posts, and use analytics tools like Google Analytics to track your website traffic and engagement.

By following these tips, entrepreneurs can build a strong online presence without breaking the bank. Remember, building a professional online presence takes time and effort, but with the right strategies and tools, it’s possible to create a successful online presence that drives business growth and revenue.

Networking and Partnerships: Leveraging Relationships to Grow Your Business

When starting a business with $10,000, it’s essential to leverage relationships and partnerships to grow your business. Networking and partnerships can help you access new markets, gain valuable insights, and build a strong support system. Here are some ways to network effectively and build partnerships that can help your business thrive.

First, attend industry events and conferences to connect with other entrepreneurs and potential partners. Use these events to learn about new trends and technologies, and to build relationships with people who can help your business grow.

Next, join online communities and forums related to your industry. These platforms can help you connect with other entrepreneurs and potential partners, and can provide valuable insights and advice.

Another way to build partnerships is to collaborate with other businesses. Look for businesses that complement your own, and consider partnering with them to offer joint products or services.

Additionally, consider finding a mentor who can provide guidance and support as you grow your business. A mentor can help you navigate challenges and make informed decisions, and can provide valuable insights and advice.

Finally, use social media to build relationships and partnerships. Use platforms like LinkedIn and Twitter to connect with other entrepreneurs and potential partners, and to build a strong online presence.

By building relationships and partnerships, entrepreneurs can access new markets, gain valuable insights, and build a strong support system. Remember, networking and partnerships are key to growing a successful business, and can help you overcome challenges and achieve your goals.

Some successful businesses that have leveraged relationships and partnerships to grow their business include Airbnb, which partnered with local businesses to offer unique experiences to its customers, and Uber, which partnered with local drivers to offer a ride-sharing service.

Overcoming Common Challenges Faced by New Entrepreneurs

Starting a business with $10,000 can be a challenging and daunting task, especially for new entrepreneurs. However, with the right mindset and strategies, it’s possible to overcome common challenges and achieve success. Here are some common challenges faced by new entrepreneurs and tips on how to overcome them.

One of the most common challenges faced by new entrepreneurs is self-doubt. Many entrepreneurs struggle with feelings of inadequacy and uncertainty, which can hold them back from taking action and pursuing their goals. To overcome self-doubt, it’s essential to focus on your strengths and accomplishments, and to remind yourself of your vision and goals.

Another common challenge faced by new entrepreneurs is time management. With so many tasks and responsibilities to handle, it’s easy to get overwhelmed and lose focus. To overcome this challenge, it’s essential to prioritize your tasks, set clear goals and deadlines, and use tools and resources to manage your time more effectively.

Adapting to change is also a common challenge faced by new entrepreneurs. The business landscape is constantly evolving, and entrepreneurs must be able to adapt quickly to stay ahead of the competition. To overcome this challenge, it’s essential to stay informed about industry trends and developments, and to be open to new ideas and perspectives.

Additionally, new entrepreneurs often struggle with finding the right resources and support. To overcome this challenge, it’s essential to seek out mentors and advisors who can provide guidance and support, and to leverage online resources and communities to connect with other entrepreneurs and experts.

Finally, new entrepreneurs often struggle with staying motivated and focused. To overcome this challenge, it’s essential to set clear goals and deadlines, and to celebrate your achievements and progress along the way. It’s also essential to take care of your physical and mental health, and to prioritize self-care and well-being.

By overcoming these common challenges, new entrepreneurs can set themselves up for success and achieve their goals. Remember, starting a business with $10,000 requires hard work, dedication, and perseverance, but with the right mindset and strategies, it’s possible to overcome any obstacle and achieve success.

Scaling Your Business for Long-Term Success

Once a business has gained traction and is generating consistent revenue, it’s essential to focus on scaling for long-term success. Scaling a business involves expanding operations, increasing revenue, and maintaining a competitive edge. For entrepreneurs who have successfully started a business with $10,000, scaling requires careful planning, strategic decision-making, and a willingness to adapt to changing market conditions.

To scale a business effectively, it’s crucial to identify areas of opportunity and prioritize investments that will drive growth. This may involve hiring additional staff, expanding product or service offerings, or investing in new technologies. It’s also essential to maintain a focus on customer satisfaction and continue to deliver high-quality products or services that meet the evolving needs of the target market.

One key strategy for scaling a business is to develop strategic partnerships with other companies or organizations. This can help to expand the business’s reach, improve efficiency, and increase revenue. For example, a business that has started with $10,000 may partner with a larger company to access new markets, technologies, or expertise.

Another critical aspect of scaling a business is to maintain a strong online presence. This includes continuing to develop and refine the business’s website, social media, and content marketing strategies. By leveraging digital channels, businesses can reach new customers, build brand awareness, and drive sales.

In addition to these strategies, it’s also essential to focus on financial management and planning. This includes developing a comprehensive financial plan, managing cash flow, and making strategic investments in the business. By maintaining a strong financial foundation, businesses can ensure that they have the resources needed to scale and achieve long-term success.

Finally, scaling a business requires a willingness to adapt to changing market conditions and customer needs. This involves staying up-to-date with industry trends, monitoring customer feedback, and making adjustments to the business strategy as needed. By being agile and responsive to change, businesses can stay ahead of the competition and achieve long-term success.

For entrepreneurs who have started a business with $10,000, scaling requires careful planning, strategic decision-making, and a willingness to adapt to changing market conditions. By focusing on customer satisfaction, developing strategic partnerships, maintaining a strong online presence, managing finances effectively, and adapting to change, businesses can achieve long-term success and realize their full potential.