Understanding the Costs of Starting a Business

When considering starting a business, one of the most critical factors to evaluate is the initial investment required. The question “is 10k enough to start a business” is a common concern for many entrepreneurs. However, the answer depends on various factors, including the type of business, industry, and target market. To determine whether $10,000 is sufficient, it’s essential to understand the different expenses associated with starting a business.

Initial investments can include costs such as business registration, licenses, and permits. Operational costs, on the other hand, encompass expenses like rent, utilities, and equipment. Marketing expenses, including advertising and promotional materials, are also a significant consideration. As these costs can add up quickly, it’s crucial to have a solid financial plan in place to ensure the sustainability of the business.

A well-structured financial plan should include a detailed breakdown of projected income and expenses. This will help entrepreneurs identify areas where costs can be reduced or optimized. For instance, instead of renting a physical office space, entrepreneurs can consider coworking spaces or remote work arrangements to minimize overhead costs. By carefully managing expenses, entrepreneurs can ensure that their initial investment is utilized efficiently.

In addition to managing expenses, entrepreneurs should also consider the potential revenue streams for their business. This includes identifying target markets, developing a pricing strategy, and creating a sales plan. By understanding the revenue potential of their business, entrepreneurs can make informed decisions about their initial investment and determine whether $10,000 is sufficient to get started.

Ultimately, the key to successfully starting a business with a limited budget is careful planning and creativity. By understanding the costs associated with starting a business and developing a solid financial plan, entrepreneurs can set themselves up for success and make the most of their initial investment.

How to Determine If $10,000 Is Sufficient for Your Business Venture

To determine whether $10,000 is enough to start a business, entrepreneurs must carefully evaluate their business idea, industry, and target market. The first step is to assess the type of business they want to start. For instance, a service-based business may require less initial investment than a product-based business. Additionally, entrepreneurs should research their industry to understand the typical startup costs and revenue potential.

Next, entrepreneurs should identify their target market and assess the level of competition. This will help them determine the marketing expenses required to reach their target audience. A solid understanding of the target market will also enable entrepreneurs to create a realistic pricing strategy and revenue projections.

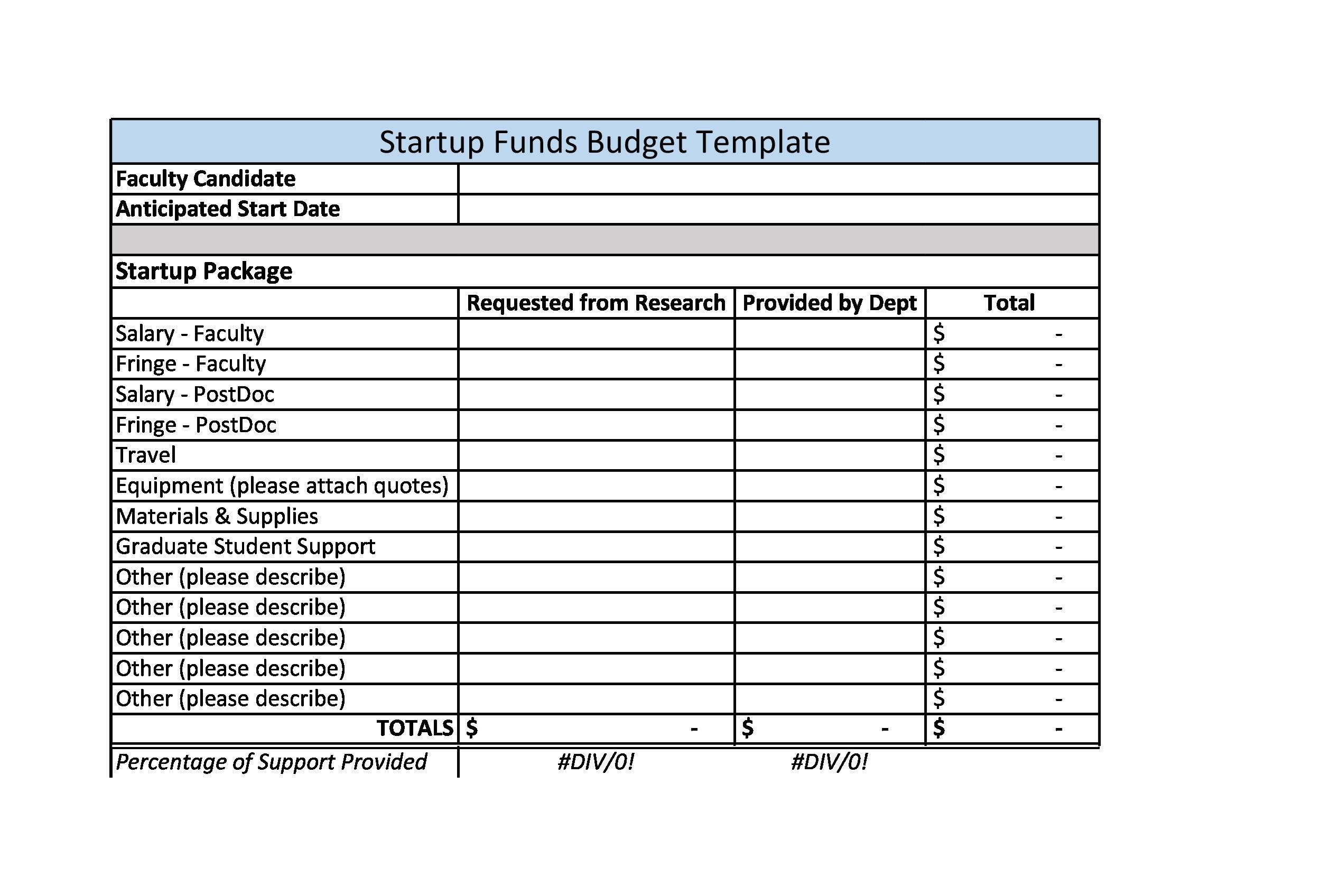

Once entrepreneurs have a clear understanding of their business idea, industry, and target market, they can create a comprehensive budget. This should include all startup costs, such as initial investments, operational costs, and marketing expenses. By prioritizing expenses and allocating funds effectively, entrepreneurs can ensure that their initial investment is utilized efficiently.

To create a realistic budget, entrepreneurs should consider the following factors:

- Initial investments: business registration, licenses, and permits

- Operational costs: rent, utilities, and equipment

- Marketing expenses: advertising, promotional materials, and website development

- Revenue projections: pricing strategy and sales plan

By carefully evaluating these factors and creating a comprehensive budget, entrepreneurs can determine whether $10,000 is sufficient to start their business. If not, they can explore alternative funding options or adjust their business plan to reduce costs.

Ultimately, the key to successfully starting a business with a limited budget is careful planning and creativity. By understanding the costs associated with starting a business and creating a realistic budget, entrepreneurs can set themselves up for success and make the most of their initial investment.

The Pros and Cons of Bootstrapping Your Business with a Limited Budget

Bootstrapping a business with a limited budget can be a challenging but rewarding experience. On one hand, bootstrapping can foster creativity and resourcefulness, as entrepreneurs are forced to think outside the box and find innovative solutions to problems. This approach can also help entrepreneurs develop a strong sense of financial discipline and responsibility.

On the other hand, bootstrapping can limit growth and scalability, as entrepreneurs may not have the necessary funds to invest in marketing, hiring, and other essential business activities. Additionally, bootstrapping can be stressful and overwhelming, as entrepreneurs may have to take on multiple roles and responsibilities.

Despite these challenges, many successful businesses have started with limited funding. For example, Airbnb, the popular online marketplace for short-term rentals, was started with just $1,000 in seed funding. The company’s founders, Brian Chesky and Joe Gebbia, bootstrapped the business by hosting guests in their own apartment and using the revenue to fund further growth.

Another example is Dropbox, the cloud storage company, which was started with just $15,000 in seed funding. The company’s founders, Drew Houston and Arash Ferdowsi, bootstrapped the business by developing a minimum viable product and using customer feedback to iterate and improve the service.

These examples demonstrate that it is possible to start a successful business with limited funding. However, it’s essential to carefully consider the pros and cons of bootstrapping and to develop a solid financial plan to ensure the sustainability of the business.

To make the most of bootstrapping, entrepreneurs should focus on the following strategies:

- Develop a minimum viable product to test the market and gather feedback

- Use customer revenue to fund further growth and development

- Keep costs low by outsourcing non-essential tasks and using free or low-cost marketing channels

- Focus on high-impact activities that drive revenue and growth

By adopting these strategies, entrepreneurs can overcome the challenges of bootstrapping and build a successful business with limited funding.

Exploring Alternative Funding Options for Your Business

While $10,000 can be a good starting point for some businesses, others may require more significant funding to get off the ground. If you’re wondering “is 10k enough to start a business,” the answer may depend on your specific needs and circumstances. Fortunately, there are alternative funding options available to help bridge the financial gap.

Crowdfunding is one popular option for entrepreneurs seeking to raise capital. Platforms like Kickstarter, Indiegogo, and GoFundMe allow you to create a campaign and share it with a large audience, potentially attracting thousands of backers. However, crowdfunding success is not guaranteed, and it’s essential to have a solid marketing strategy in place to promote your campaign.

Loans are another option for businesses that require more substantial funding. Traditional lenders, such as banks and credit unions, offer a range of loan products, including small business loans and lines of credit. However, these loans often come with strict repayment terms and may require collateral. Alternative lenders, such as online loan providers, may offer more flexible terms, but often at higher interest rates.

Investors are another potential source of funding for businesses. Venture capitalists, angel investors, and private equity firms invest in businesses in exchange for equity. This option can be attractive for businesses with high growth potential, but it’s essential to have a solid business plan and pitch to attract investors.

Before pursuing alternative funding options, it’s crucial to prepare a solid pitch and financial projections. This will help you demonstrate your business’s potential and attract potential investors or lenders. Consider the following tips when preparing your pitch:

- Develop a clear and concise business plan that outlines your goals, target market, and financial projections.

- Create a compelling pitch that showcases your business’s unique value proposition and growth potential.

- Prepare a detailed financial plan, including projected income statements, balance sheets, and cash flow statements.

- Research potential investors or lenders and tailor your pitch to their specific interests and requirements.

By exploring alternative funding options and preparing a solid pitch, you can increase your chances of securing the funding you need to turn your entrepreneurial dreams into reality. Remember, the question “is 10k enough to start a business” may not have a one-size-fits-all answer, but with the right funding and support, you can overcome financial challenges and achieve success.

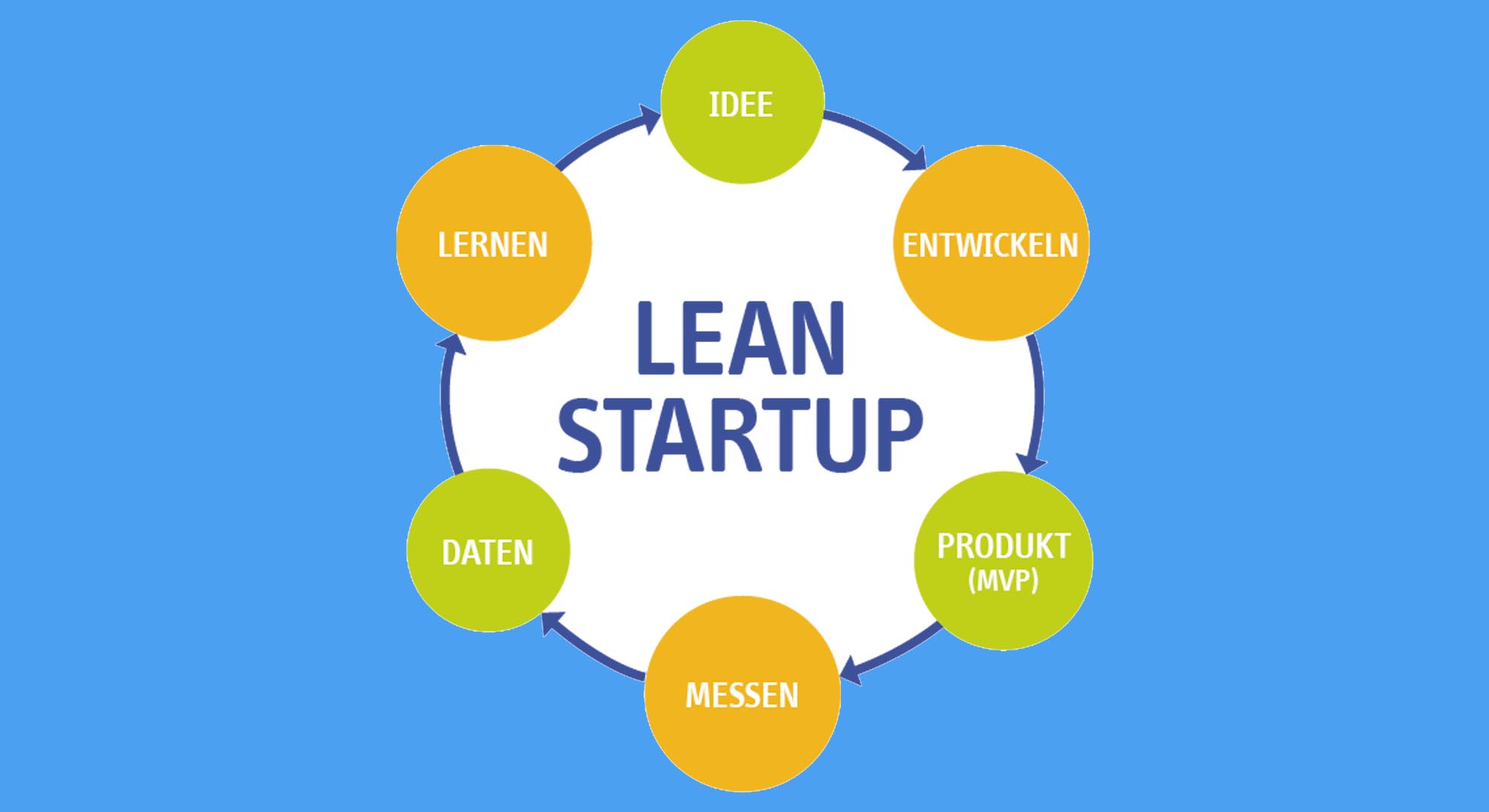

Creating a Lean Business Model to Maximize Your Initial Investment

When asking “is 10k enough to start a business,” it’s essential to consider the efficiency of your business model. A lean business model can help entrepreneurs maximize their initial investment by streamlining operations, reducing waste, and focusing on high-impact activities. This approach enables businesses to achieve more with less, making the most of their limited resources.

A lean business model is centered around the idea of continuous improvement and eliminating non-essential activities. This involves identifying and prioritizing the most critical tasks that drive revenue and growth, while eliminating or outsourcing less important functions. By doing so, businesses can reduce costs, increase productivity, and improve overall efficiency.

To create a lean business model, consider the following strategies:

- Streamline your operations by automating repetitive tasks and outsourcing non-core functions.

- Focus on high-impact activities that drive revenue and growth, such as marketing and sales.

- Eliminate waste by reducing unnecessary expenses and minimizing overhead costs.

- Continuously monitor and evaluate your business’s performance, making adjustments as needed.

By adopting a lean business model, entrepreneurs can make the most of their initial investment and increase their chances of success. This approach requires careful planning, creativity, and a willingness to adapt to changing circumstances. By prioritizing efficiency and effectiveness, businesses can achieve more with less and overcome the challenges associated with limited funding.

Some successful businesses that have adopted lean business models include:

- Dropbox, which streamlined its operations by automating customer support and focusing on high-impact activities.

- Airbnb, which eliminated waste by reducing unnecessary expenses and minimizing overhead costs.

- Warby Parker, which continuously monitors and evaluates its business’s performance, making adjustments as needed.

By following in the footsteps of these successful businesses, entrepreneurs can create a lean business model that maximizes their initial investment and sets them up for long-term success. Remember, the key to success lies in careful planning, creativity, and perseverance – not just the amount of money you have to start with.

Real-Life Examples of Successful Businesses Started with Limited Funding

While $10,000 may seem like a limited budget to start a business, many successful entrepreneurs have proven that it’s possible to achieve success with careful planning and creativity. Here are a few inspiring examples of businesses that started with limited funding:

Airbnb, the popular online marketplace for short-term rentals, was founded in 2008 by Brian Chesky and Joe Gebbia with just $1,000 in seed money. The duo started by renting out air mattresses in their living room to attendees of a design conference in San Francisco. Today, Airbnb is a global company with a valuation of over $50 billion.

Warby Parker, the trendy eyewear brand, was founded in 2010 by Neil Blumenthal and Dave Gilboa with just $120,000 in seed money. The company started as an online-only retailer and has since expanded to over 100 physical stores across the US and Canada. Warby Parker’s valuation is now over $1.5 billion.

Dropbox, the cloud storage company, was founded in 2007 by Drew Houston and Arash Ferdowsi with just $15,000 in seed money. The company started as a simple file-sharing service and has since grown to become one of the leading cloud storage providers in the world, with a valuation of over $10 billion.

These examples demonstrate that it’s possible to start a successful business with limited funding. However, it’s essential to note that each of these companies had a solid business plan, a strong team, and a willingness to adapt and evolve over time.

So, is $10,000 enough to start a business? The answer depends on the type of business, the industry, and the target market. However, with careful planning, creativity, and perseverance, it’s possible to achieve success even with limited funding. As these examples show, the key to success lies in identifying a genuine need in the market, creating a unique value proposition, and executing a well-thought-out business plan.

Overcoming Common Challenges Faced by Entrepreneurs with Limited Funding

Starting a business with limited funding can be challenging, but it’s not impossible. However, entrepreneurs with limited funding often face unique challenges that can hinder their progress. Here are some common challenges faced by entrepreneurs with limited funding and practical advice on how to overcome them:

Managing Cash Flow: One of the biggest challenges faced by entrepreneurs with limited funding is managing cash flow. With limited funds, it can be difficult to pay bills, salaries, and other expenses on time. To overcome this challenge, entrepreneurs can prioritize their expenses, create a cash flow forecast, and explore alternative funding options such as invoice financing or crowdfunding.

Finding Affordable Talent: Attracting and retaining top talent can be difficult for entrepreneurs with limited funding. To overcome this challenge, entrepreneurs can consider hiring freelancers or part-time employees, offering equity or stock options, and providing opportunities for professional development and growth.

Competing with Larger Businesses: Entrepreneurs with limited funding often struggle to compete with larger businesses that have more resources and marketing budgets. To overcome this challenge, entrepreneurs can focus on niche markets, build strong relationships with customers, and leverage social media and content marketing to reach a wider audience.

Scaling the Business: Limited funding can limit the growth and scalability of a business. To overcome this challenge, entrepreneurs can focus on building a lean business model, outsourcing non-core functions, and exploring alternative funding options such as venture capital or angel investors.

Staying Focused on Long-Term Goals: With limited funding, entrepreneurs can get caught up in short-term thinking and lose sight of their long-term goals. To overcome this challenge, entrepreneurs can create a business plan with clear goals and objectives, prioritize their activities, and stay focused on their vision.

While starting a business with limited funding can be challenging, it’s not impossible. By understanding the common challenges faced by entrepreneurs with limited funding and taking practical steps to overcome them, entrepreneurs can increase their chances of success and build a sustainable business. Remember, is 10k enough to start a business? It depends on the entrepreneur’s ability to manage their finances, find affordable talent, compete with larger businesses, scale their business, and stay focused on their long-term goals.

Conclusion: Is $10,000 Enough to Start a Business?

In conclusion, whether $10,000 is enough to start a business depends on various factors, including the type of business, industry, and target market. While it’s possible to start a business with limited funding, it’s essential to have a solid financial plan in place, prioritize expenses, and explore alternative funding options.

Throughout this article, we’ve discussed the pros and cons of bootstrapping a business with a limited budget, explored alternative funding options, and provided tips on how to create a lean business model and overcome common challenges faced by entrepreneurs with limited funding.

Ultimately, the success of a business depends on careful planning, creativity, and perseverance. With the right mindset and strategies, entrepreneurs can turn their entrepreneurial dreams into reality, even with limited funding.

So, is 10k enough to start a business? The answer is yes, but it requires careful planning, creativity, and perseverance. By understanding the costs of starting a business, creating a realistic budget, and exploring alternative funding options, entrepreneurs can increase their chances of success and build a sustainable business.

In today’s competitive business landscape, entrepreneurs need to be resourceful, adaptable, and innovative to succeed. With the right mindset and strategies, $10,000 can be enough to start a business and achieve entrepreneurial success.

Remember, starting a business is just the first step. The real challenge lies in growing and scaling the business, and that requires ongoing effort, dedication, and perseverance. By staying focused on long-term goals and continuously adapting to changing market conditions, entrepreneurs can build a successful and sustainable business, even with limited funding.