Breaking Free from the Paycheck-to-Paycheck Cycle

Living paycheck to paycheck can be a frustrating and stressful experience. It’s a cycle that can be difficult to break, but it’s essential to find ways to make your money work for you if you want to achieve financial freedom. The key to breaking free from this cycle is to understand that it’s not just about earning a higher income, but also about managing your finances effectively. By creating a budget, reducing debt, and building savings, you can start to make progress towards achieving your financial goals.

One of the main reasons people struggle to break free from the paycheck-to-paycheck cycle is that they don’t have a clear understanding of their financial situation. They may not know how much they’re spending, where their money is going, or how to make the most of their income. To overcome this, it’s essential to track your expenses, create a budget, and prioritize your spending. By doing so, you can identify areas where you can cut back and allocate your money more effectively.

Another critical aspect of breaking free from the paycheck-to-paycheck cycle is to reduce debt and build savings. High-interest debt, such as credit card balances, can be a significant obstacle to achieving financial freedom. By paying off these debts and building an emergency fund, you can reduce your financial stress and create a safety net for unexpected expenses. This will give you the peace of mind to focus on long-term financial goals, such as investing and wealth-building.

So, how can you make your money work for you? It starts by taking control of your finances and making a plan. By creating a budget, reducing debt, and building savings, you can break free from the paycheck-to-paycheck cycle and start building wealth. Remember, it’s not just about earning a higher income; it’s about managing your finances effectively and making the most of your money.

By following these steps, you can start to make progress towards achieving your financial goals and breaking free from the paycheck-to-paycheck cycle. It may take time and discipline, but the payoff will be worth it. You’ll be able to enjoy financial freedom, reduce stress, and achieve your long-term goals. So, take the first step today and start making your money work for you.

Understanding the Power of Compound Interest

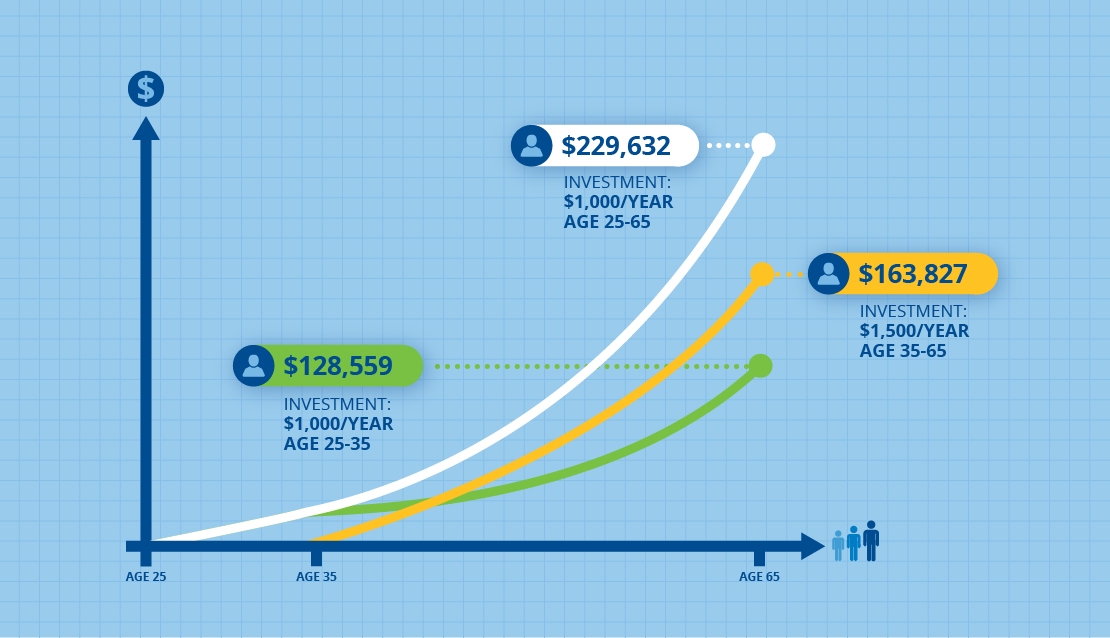

Compound interest is a powerful financial concept that can help your money grow over time. It’s a key strategy for making your money work for you, and it’s essential to understand how it works. Compound interest is the interest earned on both the principal amount and any accrued interest over time. This means that your money can grow exponentially, as the interest earned in previous periods becomes the base for the next period’s interest calculation.

For example, let’s say you deposit $1,000 into a savings account that earns a 5% annual interest rate. At the end of the first year, you’ll have earned $50 in interest, making your total balance $1,050. In the second year, you’ll earn 5% interest on the new balance of $1,050, which is $52.50. This means that your total balance will now be $1,102.50. As you can see, the interest earned in the first year becomes the base for the second year’s interest calculation, resulting in a higher interest payment.

Compound interest can be used to your advantage in various investments and savings accounts, such as certificates of deposit (CDs), bonds, and retirement accounts. By taking advantage of compound interest, you can grow your wealth over time and achieve your long-term financial goals. For instance, if you start saving for retirement early, you can take advantage of compound interest to grow your retirement fund significantly over time.

So, how can you make the most of compound interest? It’s essential to start saving and investing early, as the power of compound interest grows over time. Additionally, consider investing in accounts that offer higher interest rates, such as high-yield savings accounts or certificates of deposit (CDs). By doing so, you can maximize your returns and make your money work for you.

Another way to leverage compound interest is to make regular deposits into your savings or investment accounts. This can help you take advantage of the power of compound interest and grow your wealth over time. For example, if you deposit $500 per month into a savings account that earns a 5% annual interest rate, you’ll earn more interest over time than if you deposited a lump sum of $6,000 at the beginning of the year.

By understanding the power of compound interest and using it to your advantage, you can make your money work for you and achieve your long-term financial goals. Remember, it’s essential to start saving and investing early, as the power of compound interest grows over time.

Investing in Assets that Generate Passive Income

Investing in assets that generate passive income is a key strategy for making your money work for you. Passive income is earnings that are generated without actively working for them, and it can provide a steady stream of revenue to help you achieve your financial goals. There are several types of assets that can generate passive income, including real estate, dividend-paying stocks, and peer-to-peer lending.

Real estate is a popular choice for generating passive income, as it can provide rental income through tenants or property appreciation over time. To get started with real estate investing, consider investing in a real estate investment trust (REIT) or a real estate crowdfunding platform. These options allow you to invest in real estate without directly managing properties.

Dividend-paying stocks are another type of asset that can generate passive income. Dividend-paying stocks are shares in companies that distribute a portion of their profits to shareholders in the form of dividends. To get started with dividend-paying stocks, consider investing in established companies with a history of paying consistent dividends. Some popular dividend-paying stocks include Coca-Cola, Johnson & Johnson, and Procter & Gamble.

Peer-to-peer lending is a relatively new type of asset that can generate passive income. Peer-to-peer lending platforms allow you to lend money to individuals or small businesses, earning interest on your investment. To get started with peer-to-peer lending, consider investing in a platform like Lending Club or Prosper.

When investing in assets that generate passive income, it’s essential to consider your financial goals and risk tolerance. Passive income investments can provide a steady stream of revenue, but they may also come with some level of risk. For example, real estate investing can be affected by market fluctuations, while dividend-paying stocks can be impacted by company performance.

So, how can you make your money work for you through passive income investments? It’s essential to start by educating yourself on the different types of assets that can generate passive income. Consider consulting with a financial advisor or conducting your own research to determine which investments are right for you. Additionally, consider starting small and gradually increasing your investment over time.

By investing in assets that generate passive income, you can create a steady stream of revenue to help you achieve your financial goals. Remember to always consider your financial goals and risk tolerance when investing, and don’t be afraid to seek professional advice if needed.

Creating a Budget that Works for You

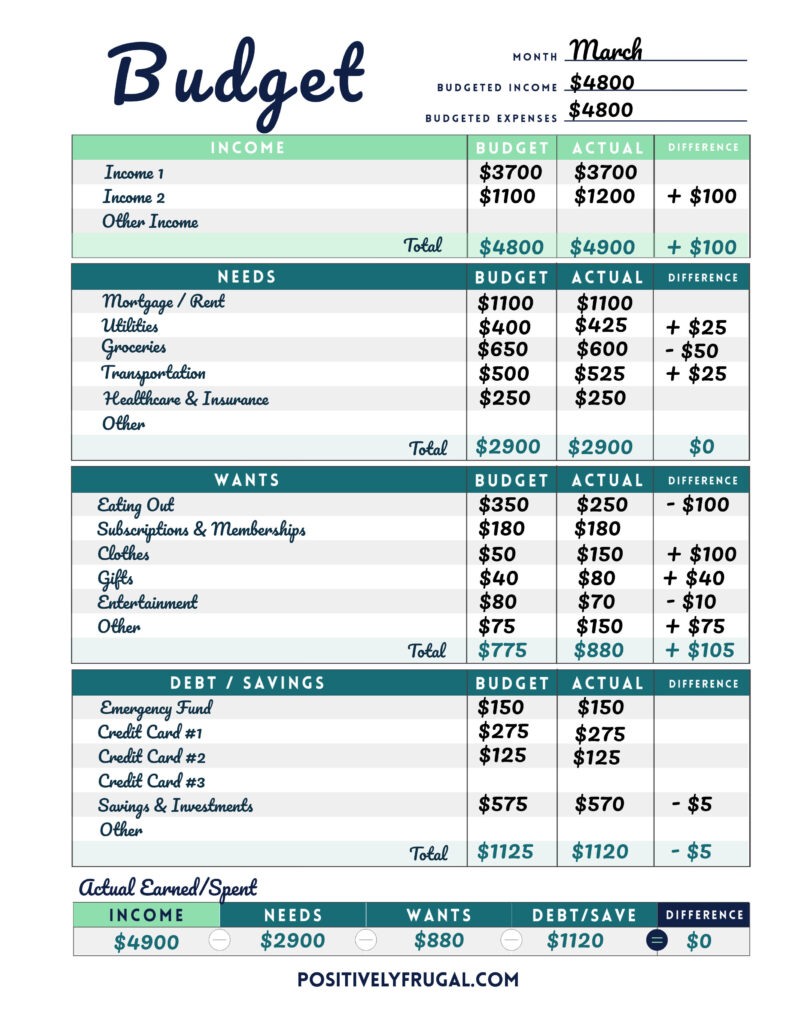

Creating a budget is a crucial step in making your money work for you. A budget is a plan for how you want to allocate your income towards different expenses, savings, and investments. By having a budget, you can ensure that you are making the most of your money and achieving your financial goals.

So, how can you create a budget that works for you? The first step is to track your income and expenses. This will give you a clear picture of where your money is going and help you identify areas where you can cut back. You can use a budgeting app or spreadsheet to make it easier to track your finances.

Next, you need to categorize your expenses into different groups, such as housing, transportation, food, and entertainment. This will help you see where your money is being spent and make adjustments accordingly. You should also prioritize your expenses, focusing on essential expenses such as rent/mortgage, utilities, and food.

Another important aspect of creating a budget is to set financial goals. What do you want to achieve with your money? Do you want to save for a down payment on a house? Pay off debt? Build an emergency fund? By setting specific goals, you can create a budget that is tailored to your needs and helps you achieve your objectives.

It’s also essential to consider your income and expenses in relation to each other. Make sure you are not overspending in any one category, and that you have enough money set aside for savings and investments. A general rule of thumb is to allocate 50% of your income towards essential expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

By following these steps, you can create a budget that works for you and helps you achieve your financial goals. Remember, a budget is not a one-time task, but an ongoing process that requires regular monitoring and adjustments. By staying on top of your finances, you can make your money work for you and achieve financial freedom.

Additionally, consider using the 50/30/20 rule as a guideline for allocating your income. This rule suggests that 50% of your income should go towards essential expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment. By following this rule, you can ensure that you are making the most of your money and achieving your financial goals.

Minimizing Debt and Maximizing Savings

High-interest debt can be a significant obstacle to building wealth and achieving financial freedom. When you’re paying exorbitant interest rates on credit cards, personal loans, or other debts, it can be challenging to make progress on your financial goals. To make your money work for you, it’s essential to minimize debt and maximize savings.

So, how can you make your money work for you by reducing debt? Start by prioritizing your debts, focusing on the ones with the highest interest rates first. Consider consolidating debt into a lower-interest loan or balance transfer credit card. Make more than the minimum payment each month to pay off the principal balance faster. You can also try the snowball method, where you pay off smaller debts first to build momentum and confidence.

In addition to debt reduction, maximizing savings is crucial for building wealth. Aim to save at least 10% to 20% of your net income each month. Consider setting up automatic transfers from your checking account to your savings or investment accounts. Take advantage of tax-advantaged accounts such as 401(k), IRA, or Roth IRA for retirement savings. You can also explore high-yield savings accounts or certificates of deposit (CDs) for short-term savings goals.

By minimizing debt and maximizing savings, you’ll be able to free up more money in your budget to invest in assets that generate passive income. This, in turn, can help you build wealth faster and achieve financial freedom. Remember, making your money work for you requires discipline, patience, and a solid understanding of personal finance. By following these strategies, you’ll be well on your way to creating a brighter financial future.

For example, let’s say you have a credit card with a $2,000 balance and an 18% interest rate. By paying more than the minimum payment each month, you can pay off the principal balance faster and save money on interest. If you can pay $500 per month, you’ll pay off the debt in about 4 months and save around $300 in interest. That’s $300 that can be invested in a high-yield savings account or used to pay off other debts.

Similarly, by maximizing savings, you can build an emergency fund to cover unexpected expenses and avoid going further into debt. Aim to save 3-6 months’ worth of living expenses in a easily accessible savings account. This fund will provide a cushion in case of job loss, medical emergencies, or other financial setbacks.

By combining debt reduction and savings strategies, you’ll be able to make your money work for you and achieve financial freedom. Remember to stay disciplined, patient, and informed to make the most of your financial journey.

Building Multiple Income Streams

Having multiple income streams is crucial for reducing financial risk and achieving long-term financial stability. When you rely on a single income source, you’re vulnerable to financial shocks, such as job loss or market downturns. By diversifying your income streams, you can create a safety net and ensure that you’re always generating revenue, regardless of market conditions.

So, how can you make your money work for you by building multiple income streams? Start by exploring alternative sources of income, such as starting a side business or investing in a small business. Consider freelancing, consulting, or coaching, which can provide a flexible and lucrative income stream. You can also invest in dividend-paying stocks, real estate investment trusts (REITs), or peer-to-peer lending platforms, which can generate passive income.

Another strategy is to monetize your skills and expertise by creating and selling online courses, ebooks, or other digital products. You can also rent out a spare room on Airbnb, rent out your car on Turo, or sell handmade products on Etsy. The key is to identify your strengths and passions and find ways to monetize them.

For example, let’s say you have a full-time job as a marketing specialist, but you also have a passion for photography. You can start a side business offering photography services to local clients, which can generate an additional $1,000 to $2,000 per month. Alternatively, you can invest in a small business, such as a food truck or a coffee shop, which can provide a steady stream of income.

Having multiple income streams can also provide tax benefits, such as deductions for business expenses or investment losses. Additionally, it can help you build wealth faster, as you’ll have more money to invest and save. By diversifying your income streams, you can create a more stable and secure financial future.

Remember, building multiple income streams takes time and effort, but it’s a crucial step in achieving financial freedom. By exploring alternative sources of income and monetizing your skills and expertise, you can create a more resilient and prosperous financial future. So, take the first step today and start building multiple income streams to make your money work for you.

Some popular platforms for building multiple income streams include:

- Upwork or Freelancer for freelancing and consulting

- Udemy or Teachable for creating and selling online courses

- Amazon Kindle Direct Publishing or Etsy for selling digital products or handmade goods

- Robinhood or Stash for investing in stocks and ETFs

- Peer-to-peer lending platforms, such as Lending Club or Prosper

These platforms can provide a starting point for building multiple income streams and achieving financial freedom.

Staying Disciplined and Patient in Your Financial Journey

Building wealth and achieving financial freedom requires discipline and patience. It’s easy to get caught up in get-rich-quick schemes or impulsive financial decisions, but these can often lead to financial ruin. To make your money work for you, it’s essential to stay focused on your long-term financial goals and avoid making emotional or impulsive decisions.

So, how can you stay disciplined and patient in your financial journey? Start by setting clear financial goals and creating a comprehensive wealth-building plan. Break down your goals into smaller, achievable steps, and focus on making progress one step at a time. Avoid getting caught up in market volatility or short-term market fluctuations, and instead, focus on the long-term trends and fundamentals.

It’s also essential to avoid lifestyle inflation, where you increase your spending as your income increases. Instead, direct excess funds towards your financial goals, such as saving, investing, or paying off debt. Consider implementing a “50/30/20” rule, where 50% of your income goes towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Another strategy is to automate your finances, by setting up automatic transfers from your checking account to your savings or investment accounts. This can help you avoid emotional or impulsive decisions and ensure that you’re consistently making progress towards your financial goals.

For example, let’s say you’re trying to save for a down payment on a house. Instead of trying to save a large sum of money all at once, break it down into smaller, achievable steps. Set up automatic transfers from your checking

Putting it All Together: Creating a Comprehensive Wealth-Building Plan

Creating a comprehensive wealth-building plan requires a combination of strategies and techniques. By understanding the power of compound interest, investing in assets that generate passive income, creating a budget that works for you, minimizing debt and maximizing savings, building multiple income streams, and staying disciplined and patient, you can make your money work for you and achieve financial freedom.

So, how can you put it all together and create a comprehensive wealth-building plan? Start by assessing your current financial situation and identifying areas for improvement. Consider your income, expenses, debts, and savings, and create a budget that accounts for all of these factors. Next, identify your financial goals and prioritize them, whether it’s saving for a down payment on a house, paying off debt, or building a retirement fund.

Once you have a clear understanding of your financial situation and goals, you can start building your wealth-building plan. Consider investing in assets that generate passive income, such as real estate or dividend-paying stocks, and create a diversified investment portfolio. Build multiple income streams, such as starting a side business or investing in a small business, and stay disciplined and patient in your financial journey.

Remember, creating a comprehensive wealth-building plan takes time and effort, but it’s essential for achieving financial freedom. By following these strategies and