Unlocking the Secrets to Doubling Your Money

Doubling $1000 may seem like a daunting task, but with the right investment strategy, it can be a achievable goal. The key to success lies in understanding the various investment options available and making informed decisions. In this article, we will explore the different ways to double $1000, including low-risk investments, higher-risk options, and alternative investment strategies.

Investing wisely requires a combination of knowledge, patience, and discipline. It’s essential to understand the concept of compound interest and how it can help grow your investment over time. Compound interest is the interest earned on both the principal amount and any accrued interest. By harnessing the power of compound interest, you can potentially double $1000 in a relatively short period.

Before we dive into the various investment options, it’s crucial to understand the importance of setting clear financial goals. What do you want to achieve by doubling $1000? Are you looking to save for a specific purpose, such as a down payment on a house or a big purchase? Or do you want to build a safety net for unexpected expenses? Whatever your goal, it’s essential to have a clear understanding of what you want to achieve.

With a solid understanding of your financial goals and the power of compound interest, you’re ready to explore the different investment options available. From low-risk investments like high-yield savings accounts and certificates of deposit to higher-risk options like the stock market and real estate, there are various ways to double $1000. In the following sections, we will delve into each of these options, providing you with the knowledge and insights needed to make informed investment decisions.

Understanding the Power of Compound Interest

Compound interest is a powerful force that can help grow your investment over time. It’s a key concept to understand when learning how to double 1000 dollars. Compound interest is the interest earned on both the principal amount and any accrued interest. This means that the interest earned in previous periods becomes the base for the interest earned in subsequent periods, resulting in exponential growth.

For example, let’s say you invest $1000 in a savings account that earns a 5% annual interest rate. At the end of the first year, you’ll have earned $50 in interest, making your total balance $1050. In the second year, you’ll earn 5% interest on the new balance of $1050, which is $52.50. This process continues, with the interest earned in each period becoming the base for the interest earned in the next period.

Compound interest can be used to double $1000 in a relatively short period. For instance, if you invest $1000 in a savings account that earns a 10% annual interest rate, it will take approximately 7 years to double your money. However, if you invest in a higher-yielding investment, such as a certificate of deposit (CD) or a peer-to-peer lending platform, you may be able to double your money in a shorter period.

It’s essential to note that compound interest can work against you if you’re not careful. For example, if you have high-interest debt, such as credit card debt, the interest can compound quickly, making it difficult to pay off the principal amount. Therefore, it’s crucial to understand how compound interest works and use it to your advantage when investing.

Exploring High-Yield Savings Accounts and Certificates of Deposit

High-yield savings accounts and certificates of deposit (CDs) are low-risk investment options that can provide a stable return on investment. These options are ideal for those who want to learn how to double 1000 dollars without taking on excessive risk. High-yield savings accounts typically offer higher interest rates than traditional savings accounts, allowing you to earn a higher return on your investment.

Certificates of deposit (CDs) are time deposits offered by banks with a fixed interest rate and maturity date. They tend to be low-risk and provide a fixed return, making them an attractive option for those who want to preserve their capital. CDs can be used to double $1000 over time, but it’s essential to understand the terms and conditions before investing.

For example, a 5-year CD with a 2.5% annual interest rate can help you double $1000 in approximately 10 years. However, you’ll need to keep your money locked in the CD for the specified term to avoid early withdrawal penalties. High-yield savings accounts, on the other hand, offer more flexibility, allowing you to access your money when needed.

When considering high-yield savings accounts and CDs, it’s crucial to research and compares rates from different banks and financial institutions. Look for options with competitive interest rates, low fees, and flexible terms. Additionally, consider working with a financial advisor to determine the best investment strategy for your individual needs and goals.

While high-yield savings accounts and CDs may not offer the highest returns on investment, they can provide a stable foundation for your investment portfolio. By combining these options with other investment strategies, you can increase your chances of doubling $1000 and achieving your long-term financial goals.

Investing in the Stock Market: A Higher-Risk, Higher-Reward Option

For those willing to take on more risk, investing in the stock market can be a lucrative way to double $1000. The stock market offers a wide range of investment opportunities, from individual stocks to exchange-traded funds (ETFs) and index funds. When done correctly, stock market investing can provide higher returns than more conservative options, making it an attractive choice for those looking to grow their wealth quickly.

To get started with stock market investing, it’s essential to understand the basics. This includes learning about different types of stocks, such as growth stocks, dividend stocks, and value stocks. It’s also crucial to understand the concept of diversification, which involves spreading investments across various asset classes to minimize risk.

One way to minimize risk when investing in the stock market is to focus on established companies with a proven track record of success. These companies often have a lower risk profile and can provide more stable returns over time. Additionally, investing in index funds or ETFs can provide broad diversification and reduce the risk of individual stocks.

Another key aspect of stock market investing is timing. It’s essential to have a long-term perspective and avoid making emotional decisions based on short-term market fluctuations. This means staying invested during periods of market volatility and avoiding the temptation to buy or sell based on emotions.

For those looking to double $1000 through stock market investing, it’s essential to have a solid understanding of the market and a well-thought-out investment strategy. This may involve working with a financial advisor or conducting extensive research to identify the best investment opportunities.

Some popular stock market investment options for doubling $1000 include:

- Index funds or ETFs that track the S&P 500 or other broad market indices

- Dividend-paying stocks with a history of stable returns

- Growth stocks with strong potential for long-term growth

By understanding the stock market and making informed investment decisions, it’s possible to double $1000 and achieve long-term financial success. However, it’s essential to remember that stock market investing involves risk, and there are no guarantees of returns. As with any investment, it’s crucial to do your research, set clear goals, and develop a well-thought-out strategy to achieve success.

Peer-to-Peer Lending: A Lucrative Alternative to Traditional Investments

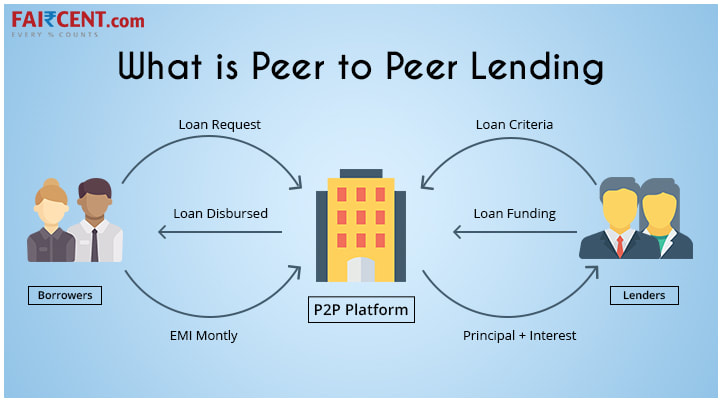

For those looking to double $1000, peer-to-peer lending offers a unique and potentially lucrative investment opportunity. Peer-to-peer lending platforms, such as Lending Club and Prosper, allow individuals to lend money to others, earning interest on their investment. This alternative to traditional investments has gained popularity in recent years, offering a new way to grow your wealth.

Peer-to-peer lending works by connecting borrowers with investors, bypassing traditional financial institutions. Platforms like Lending Club and Prosper facilitate the process, handling loan applications, credit checks, and repayment collections. Investors can browse loan listings, selecting which loans to fund and at what interest rate.

The benefits of peer-to-peer lending are numerous. For one, it offers a higher return on investment compared to traditional savings accounts or CDs. Additionally, peer-to-peer lending allows investors to diversify their portfolios, spreading risk across multiple loans and borrowers. This diversification can help mitigate potential losses, making it a more attractive option for those looking to double $1000.

However, peer-to-peer lending also carries risks. Borrowers may default on their loans, leaving investors with a loss. To minimize this risk, it’s essential to carefully evaluate loan listings, considering factors such as credit score, loan term, and interest rate. Platforms like Lending Club and Prosper also offer tools and resources to help investors make informed decisions.

Some popular peer-to-peer lending options for doubling $1000 include:

- Lending Club: One of the largest peer-to-peer lending platforms, offering a range of loan options and competitive interest rates.

- Prosper: Another well-established platform, providing a user-friendly interface and robust loan listings.

- Upstart: A newer platform, focusing on younger borrowers and offering competitive interest rates.

When investing in peer-to-peer lending, it’s essential to have a solid understanding of the process and the associated risks. By doing your research, diversifying your portfolio, and carefully evaluating loan listings, you can potentially double $1000 through peer-to-peer lending. As with any investment, it’s crucial to be patient, stay informed, and adapt to changing market conditions.

By incorporating peer-to-peer lending into your investment strategy, you can tap into a new and innovative way to grow your wealth. With the potential for higher returns and diversification benefits, peer-to-peer lending is an attractive option for those looking to double $1000 and achieve long-term financial success.

Real Estate Investing: A Long-Term Strategy for Doubling $1000

Real estate investing is a popular strategy for building wealth over the long-term. With the potential for rental income, property appreciation, and tax benefits, real estate can be an attractive option for those looking to double $1000. However, real estate investing also requires a significant amount of capital, time, and effort.

One way to invest in real estate is through rental properties. By purchasing a property and renting it out to tenants, investors can earn a steady stream of income. However, this strategy requires a significant amount of capital for the down payment, closing costs, and ongoing expenses such as property maintenance and management.

Another option for real estate investing is through real estate investment trusts (REITs). REITs allow individuals to invest in a diversified portfolio of properties without directly managing them. This can be a more accessible option for those with limited capital or experience in real estate investing.

Real estate investing also offers tax benefits, such as deductions for mortgage interest, property taxes, and operating expenses. Additionally, real estate values can appreciate over time, providing a potential long-term return on investment.

However, real estate investing also carries risks, such as market fluctuations, tenant vacancies, and property damage. It’s essential to conduct thorough research, consult with experts, and develop a solid investment strategy to mitigate these risks.

Some popular real estate investment options for doubling $1000 include:

- Rental properties: Investing in a rental property can provide a steady stream of income and potential long-term appreciation.

- Real estate investment trusts (REITs): REITs offer a diversified portfolio of properties and can provide a more accessible option for real estate investing.

- Real estate crowdfunding: Platforms like Fundrise and Rich Uncles allow individuals to invest in real estate development projects or existing properties.

When investing in real estate, it’s essential to have a long-term perspective and a solid understanding of the market. By conducting thorough research, developing a solid investment strategy, and being patient, investors can potentially double $1000 through real estate investing.

Real estate investing requires a significant amount of time, effort, and capital. However, with the potential for rental income, property appreciation, and tax benefits, it can be a lucrative option for those looking to build wealth over the long-term. By understanding the benefits and risks of real estate investing, individuals can make informed decisions and develop a successful investment strategy.

Avoiding Common Mistakes that Can Derail Your Investment Goals

When it comes to doubling $1000, it’s essential to avoid common mistakes that can derail your investment goals. By understanding these mistakes and taking steps to avoid them, you can increase your chances of success and achieve your financial objectives.

One of the most significant mistakes investors make is lack of patience. Investing is a long-term game, and it’s essential to have a time horizon of at least five years. Trying to make quick profits or getting caught up in get-rich-quick schemes can lead to significant losses and derail your investment goals.

Another common mistake is lack of research. Investing in something you don’t understand or haven’t researched properly can lead to poor investment decisions and significant losses. It’s essential to take the time to research and understand the investment before putting your money into it.

Diversification is also critical when it comes to investing. Putting all your eggs in one basket can lead to significant losses if that investment doesn’t perform well. By diversifying your portfolio across different asset classes and investments, you can reduce your risk and increase your potential returns.

Emotional decision-making is another common mistake investors make. Investing is a rational process, and it’s essential to separate your emotions from your investment decisions. Making decisions based on fear, greed, or other emotions can lead to poor investment choices and significant losses.

Some other common mistakes to avoid when trying to double $1000 include:

- Not having a clear investment strategy

- Not monitoring and adjusting your portfolio regularly

- Not considering fees and expenses

- Not having an emergency fund in place

By avoiding these common mistakes and taking a disciplined and patient approach to investing, you can increase your chances of success and achieve your financial objectives. Remember, doubling $1000 requires time, effort, and a solid understanding of the investment process.

It’s also essential to stay informed and up-to-date with market trends and developments. This can help you make informed investment decisions and avoid potential pitfalls. By combining a solid investment strategy with a disciplined and patient approach, you can achieve your financial goals and double $1000.

Staying Disciplined and Patient: The Key to Long-Term Investment Success

When it comes to doubling $1000, staying disciplined and patient is crucial to achieving long-term investment success. Investing is a marathon, not a sprint, and it’s essential to have a long-term perspective to ride out market fluctuations and avoid making impulsive decisions.

One of the most significant challenges investors face is staying motivated and focused on their long-term goals. It’s easy to get caught up in short-term market volatility and make emotional decisions that can derail your investment strategy. However, by staying disciplined and patient, you can avoid making costly mistakes and stay on track to achieving your financial objectives.

So, how can you stay disciplined and patient when investing? Here are a few tips:

- Set clear investment goals: Define your investment objectives and risk tolerance to help guide your investment decisions.

- Develop a long-term investment strategy: Create a comprehensive investment plan that outlines your investment approach and helps you stay focused on your long-term goals.

- Monitor and adjust your portfolio regularly: Regularly review your portfolio to ensure it remains aligned with your investment objectives and make adjustments as needed.

- Avoid emotional decision-making: Stay informed but avoid making impulsive decisions based on short-term market fluctuations.

Additionally, it’s essential to stay informed and up-to-date with market trends and developments. This can help you make informed investment decisions and avoid potential pitfalls. By combining a solid investment strategy with a disciplined and patient approach, you can achieve your financial goals and double $1000.

Remember, doubling $1000 requires time, effort, and a solid understanding of the investment process. By staying disciplined and patient, you can avoid making costly mistakes and stay on track to achieving your financial objectives. Whether you’re investing in the stock market, real estate, or peer-to-peer lending, a long-term perspective and a disciplined approach are essential to achieving success.

By following these tips and staying committed to your long-term investment goals, you can overcome the challenges of investing and achieve financial success. Doubling $1000 is within reach, but it requires a disciplined and patient approach. Stay focused, stay informed, and stay committed to your investment strategy to achieve your financial objectives.