Navigating the World of Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a vital benefit offered by many companies, including Home Depot, to their employees. Understanding the intricacies of these plans is crucial for making informed decisions about one’s healthcare coverage. Home Depot, as a major employer, provides health insurance to its employees, which can be a significant factor in attracting and retaining top talent.

Employer-sponsored health insurance plans can offer several benefits, including lower premium costs, access to a wider network of healthcare providers, and additional benefits such as dental and vision coverage. However, these plans can also have drawbacks, such as limited flexibility and potential gaps in coverage. It is essential to carefully evaluate the pros and cons of employer-sponsored health insurance to make the most of this benefit.

Home Depot’s health insurance options are designed to provide employees with comprehensive coverage at an affordable cost. The company offers a range of plans, including medical, dental, and vision coverage, to cater to the diverse needs of its employees. By understanding the specifics of Home Depot’s health insurance plans, employees can make informed decisions about their healthcare coverage and take advantage of the benefits offered.

One of the critical factors to consider when evaluating employer-sponsored health insurance is the cost. Home Depot health insurance cost can vary depending on the specific plan chosen, the employee’s location, and other factors. It is essential to carefully review the plan details, including premium costs, deductibles, copays, and coinsurance, to determine the best option for one’s needs and budget.

By understanding the world of employer-sponsored health insurance and carefully evaluating Home Depot’s health insurance options, employees can make informed decisions about their healthcare coverage and take advantage of the benefits offered. In the next section, we will explore the key factors to consider when choosing the right health insurance plan for your needs.

How to Choose the Right Health Insurance Plan for Your Needs

Selecting the right health insurance plan can be a daunting task, especially with the numerous options available. When considering Home Depot’s health insurance options, it’s essential to evaluate several factors to ensure you choose the plan that best suits your needs. One of the critical factors to consider is the premium cost, which can vary significantly depending on the plan and your location. Home Depot health insurance cost can range from affordable to expensive, depending on the specific plan and your individual circumstances.

Another crucial factor to consider is the deductible, which is the amount you must pay out-of-pocket before your insurance coverage kicks in. Home Depot’s health insurance plans offer various deductible options, ranging from low to high. It’s essential to carefully evaluate the deductible amount and how it will impact your overall healthcare costs.

Copays and coinsurance are also essential factors to consider when choosing a health insurance plan. Copays are the fixed amounts you pay for doctor visits, prescriptions, and other healthcare services, while coinsurance is the percentage of costs you pay after meeting your deductible. Home Depot’s health insurance plans offer different copay and coinsurance options, so it’s crucial to understand how these will impact your healthcare costs.

Network coverage is another vital factor to consider when choosing a health insurance plan. Home Depot’s health insurance plans offer access to a vast network of healthcare providers, including doctors, hospitals, and specialists. However, it’s essential to ensure that your primary care physician and any specialists you see are part of the network to avoid additional costs.

Home Depot’s health insurance options also offer various benefits, including preventive care, prescription coverage, and mental health services. When evaluating these plans, it’s essential to consider your individual needs and ensure that the plan you choose provides the necessary benefits to meet those needs.

By carefully evaluating these factors and considering your individual needs, you can choose the right health insurance plan for your needs and budget. In the next section, we will delve into the specifics of Home Depot health insurance costs, including premium rates, out-of-pocket expenses, and any additional fees.

Breaking Down Home Depot Health Insurance Costs: What to Expect

Understanding the costs associated with Home Depot health insurance is crucial for making informed decisions about your healthcare coverage. The cost of Home Depot health insurance can vary depending on several factors, including the specific plan you choose, your location, and your individual circumstances.

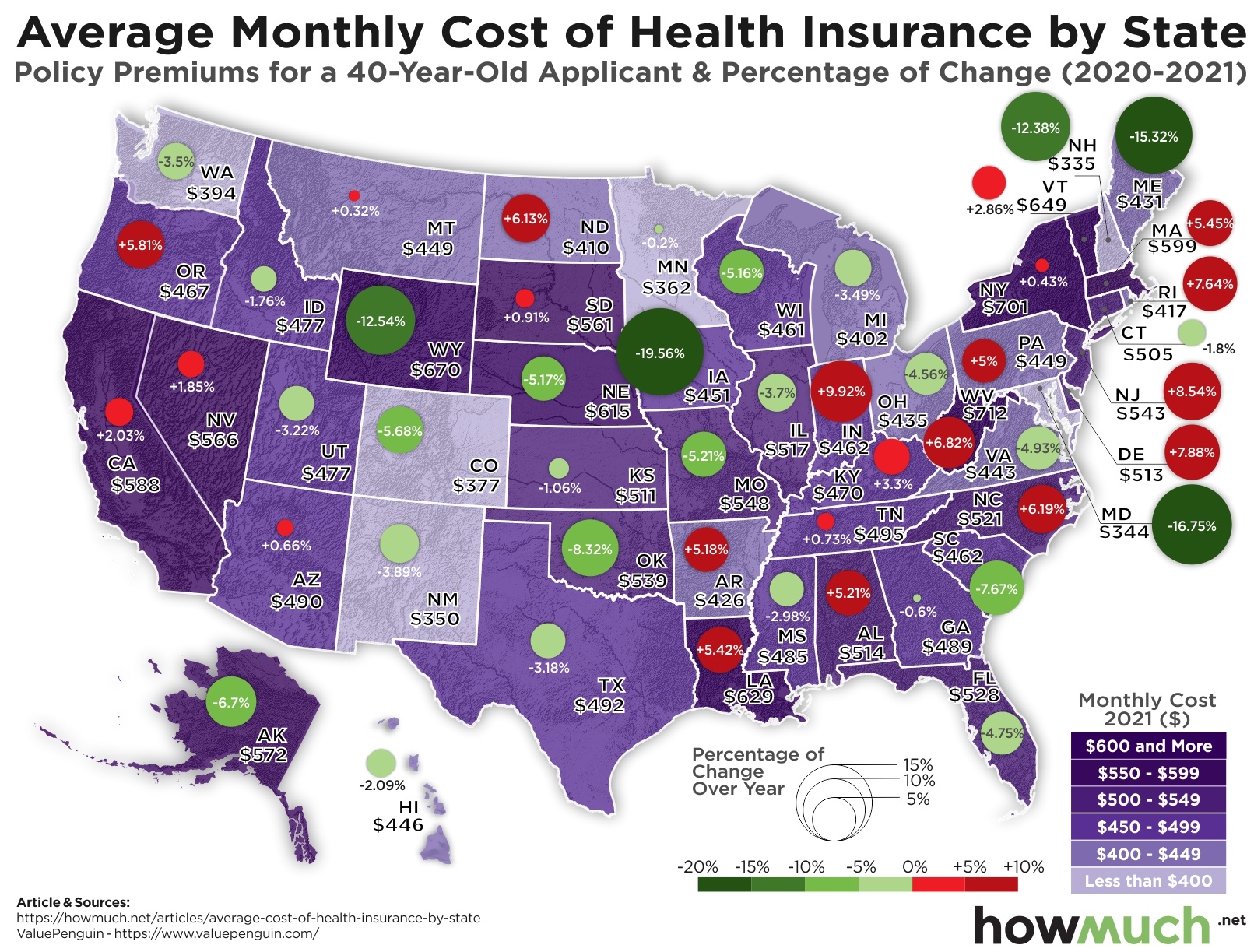

Home Depot health insurance premium rates can range from around $300 to over $1,000 per month, depending on the plan and your age. For example, the Home Depot health insurance cost for a single person under the age of 30 may be around $300 per month, while a family plan for a household with two adults and two children may cost over $1,000 per month.

In addition to premium rates, Home Depot health insurance plans also come with out-of-pocket expenses, such as deductibles, copays, and coinsurance. The deductible for Home Depot health insurance plans can range from $500 to $2,000 per year, depending on the plan. Copays for doctor visits and prescriptions can range from $20 to $50 per visit, while coinsurance can range from 10% to 30% of the total cost.

Home Depot health insurance plans also come with additional fees, such as administrative fees and network access fees. These fees can range from $10 to $50 per month, depending on the plan and your location.

It’s worth noting that Home Depot health insurance costs are generally competitive with industry averages. According to a recent study, the average cost of employer-sponsored health insurance in the United States is around $500 per month for a single person and over $1,500 per month for a family plan. Home Depot health insurance costs are generally in line with these averages, although they can vary depending on the specific plan and your individual circumstances.

By understanding the costs associated with Home Depot health insurance, you can make informed decisions about your healthcare coverage and choose the plan that best meets your needs and budget. In the next section, we will review the various health insurance plans offered by Home Depot, including their features, benefits, and limitations.

Home Depot Health Insurance: A Review of Plan Options and Features

Home Depot offers a range of health insurance plans to its employees, each with its own unique features, benefits, and limitations. Understanding the specifics of each plan is crucial for making informed decisions about your healthcare coverage.

One of the most popular plans offered by Home Depot is the HDHP (High-Deductible Health Plan) option. This plan comes with a higher deductible, but lower premium costs. The HDHP plan is ideal for employees who are generally healthy and do not require frequent medical care. However, it may not be the best option for employees with chronic health conditions or those who require regular medical attention.

Another plan option offered by Home Depot is the PPO (Preferred Provider Organization) plan. This plan provides a wider network of healthcare providers and more flexible coverage options. However, it also comes with higher premium costs and out-of-pocket expenses. The PPO plan is ideal for employees who require frequent medical care or have a large family.

Home Depot also offers an HMO (Health Maintenance Organization) plan, which provides comprehensive coverage at a lower cost. However, this plan comes with a narrower network of healthcare providers and more restrictive coverage options. The HMO plan is ideal for employees who are willing to trade off flexibility for lower costs.

In addition to these plan options, Home Depot also offers a range of additional benefits, including dental and vision coverage, life insurance, and disability insurance. These benefits can provide additional peace of mind and financial protection for employees and their families.

When evaluating Home Depot’s health insurance plans, it’s essential to consider your individual needs and circumstances. For example, if you have a chronic health condition, you may want to opt for a plan with more comprehensive coverage. On the other hand, if you are generally healthy, a lower-cost plan with a higher deductible may be a better option.

By understanding the specifics of Home Depot’s health insurance plans, you can make informed decisions about your healthcare coverage and choose the plan that best meets your needs and budget. In the next section, we will provide tips and strategies for maximizing your Home Depot health insurance benefits.

Maximizing Your Home Depot Health Insurance Benefits: Tips and Strategies

To get the most out of Home Depot’s health insurance plans, it’s essential to understand how to navigate the system and optimize your benefits. Here are some tips and strategies to help you maximize your Home Depot health insurance benefits:

1. Understand your plan: Take the time to review your plan documents and understand what is covered and what is not. This will help you avoid unexpected medical bills and ensure that you receive the care you need.

2. Use in-network providers: Home Depot’s health insurance plans have a network of providers who have agreed to provide care at a discounted rate. Using in-network providers can help you save money on medical bills and reduce your out-of-pocket expenses.

3. Take advantage of preventive care: Home Depot’s health insurance plans cover a range of preventive care services, including annual physicals, vaccinations, and screenings. Taking advantage of these services can help you stay healthy and avoid costly medical bills down the line.

4. Use generic medications: Generic medications are often significantly cheaper than brand-name medications, but they are just as effective. Using generic medications can help you save money on prescription costs and reduce your out-of-pocket expenses.

5. Keep track of your expenses: Keeping track of your medical expenses can help you stay on top of your costs and ensure that you are not overspending. Home Depot’s health insurance plans offer online tools and resources to help you track your expenses and stay organized.

6. Ask questions: If you have questions about your plan or need help navigating the system, don’t hesitate to ask. Home Depot’s customer support team is available to help you with any questions or concerns you may have.

By following these tips and strategies, you can maximize your Home Depot health insurance benefits and get the most out of your plan. Remember to always review your plan documents and understand what is covered and what is not, and don’t hesitate to ask for help if you need it.

In the next section, we will compare Home Depot’s health insurance offerings to those of other major retailers, highlighting any differences in costs, coverage, and benefits.

Home Depot Health Insurance vs. Other Retailers: A Comparison

Home Depot is not the only retailer that offers health insurance to its employees. Other major retailers, such as Walmart and Target, also offer health insurance plans to their employees. But how do Home Depot’s health insurance offerings compare to those of other retailers?

One key difference between Home Depot’s health insurance plans and those of other retailers is the cost. Home Depot’s health insurance plans tend to be more expensive than those of other retailers, especially for employees who are not eligible for subsidies. However, Home Depot’s plans also offer more comprehensive coverage and a wider network of providers.

Another difference between Home Depot’s health insurance plans and those of other retailers is the level of coverage. Home Depot’s plans tend to offer more generous coverage for things like prescription medications and mental health services. However, other retailers may offer more limited coverage in these areas.

It’s also worth noting that Home Depot’s health insurance plans are designed to be more flexible and adaptable to the needs of its employees. For example, Home Depot offers a range of plan options that allow employees to choose the level of coverage that is right for them. Other retailers may not offer this level of flexibility.

In terms of customer support, Home Depot’s health insurance plans tend to receive high marks from employees. Home Depot’s customer support team is available to help employees with any questions or concerns they may have, and the company also offers a range of online resources and tools to help employees navigate the health insurance system.

Overall, while Home Depot’s health insurance plans may be more expensive than those of other retailers, they also offer more comprehensive coverage and a wider network of providers. Additionally, Home Depot’s plans are designed to be more flexible and adaptable to the needs of its employees, and the company’s customer support team is available to help employees with any questions or concerns they may have.

In the next section, we will address frequently asked questions and concerns about Home Depot health insurance, including eligibility, enrollment, and customer support.

Common Questions and Concerns About Home Depot Health Insurance

As a Home Depot employee, you may have questions and concerns about the company’s health insurance plans. Here are some frequently asked questions and concerns about Home Depot health insurance:

Q: Who is eligible for Home Depot health insurance?

A: Home Depot health insurance is available to all regular full-time and part-time employees who work at least 20 hours per week.

Q: How do I enroll in Home Depot health insurance?

A: You can enroll in Home Depot health insurance during the annual open enrollment period or within 30 days of your hire date. You can also make changes to your coverage during the annual open enrollment period.

Q: What is the cost of Home Depot health insurance?

A: The cost of Home Depot health insurance varies depending on the plan you choose and your individual circumstances. You can expect to pay a portion of the premium cost, which will be deducted from your paycheck.

Q: What is covered under Home Depot health insurance?

A: Home Depot health insurance plans cover a range of medical services, including doctor visits, hospital stays, and prescription medications. The specific services covered will depend on the plan you choose.

Q: How do I file a claim with Home Depot health insurance?

A: You can file a claim with Home Depot health insurance by submitting a claim form to the insurance company. You can also contact the insurance company directly to ask questions or get help with the claims process.

Q: What kind of customer support does Home Depot offer for its health insurance plans?

A: Home Depot offers a range of customer support services for its health insurance plans, including a dedicated customer service team and online resources. You can contact the customer service team with questions or concerns about your coverage.

By understanding the answers to these frequently asked questions and concerns, you can make informed decisions about your Home Depot health insurance coverage and get the most out of your benefits.

In the next section, we will summarize the key points discussed in the article, emphasizing the importance of carefully evaluating Home Depot’s health insurance options to make informed decisions about one’s healthcare coverage.

Conclusion: Making Informed Decisions About Home Depot Health Insurance

In conclusion, Home Depot’s health insurance options offer a range of benefits and features that can help employees and their families access affordable healthcare. By carefully evaluating the different plan options, considering factors such as premium costs, deductibles, copays, and network coverage, employees can make informed decisions about their healthcare coverage.

It’s essential to remember that Home Depot health insurance costs can vary depending on the plan and individual circumstances. However, by understanding the specifics of Home Depot’s health insurance plans and comparing them to industry averages, employees can make informed decisions about their healthcare coverage.

Additionally, by taking advantage of the tips and strategies outlined in this article, employees can maximize their Home Depot health insurance benefits and get the most out of their coverage. Whether you’re a new employee or a seasoned veteran, understanding Home Depot’s health insurance options can help you make informed decisions about your healthcare coverage.

By carefully evaluating Home Depot’s health insurance options and making informed decisions about your coverage, you can ensure that you and your family have access to affordable healthcare. Remember to always review your plan documents, ask questions, and seek help when needed to get the most out of your Home Depot health insurance benefits.

With this comprehensive guide, you’re now equipped with the knowledge and tools to navigate the world of Home Depot health insurance and make informed decisions about your healthcare coverage. Take control of your health and well-being today!