What is Cash App and How Does it Work?

Cash App is a popular peer-to-peer payment service that allows users to send and receive money, invest in stocks, and manage their finances. Developed by Square, Inc., Cash App has become a go-to platform for individuals looking for a convenient and user-friendly way to handle their money. With over 30 million monthly active users, Cash App has established itself as a major player in the fintech industry.

At its core, Cash App is a mobile payment service that enables users to transfer money to friends, family, and businesses. The app also offers a range of features, including the ability to invest in stocks, buy and sell Bitcoin, and receive direct deposits. Cash App’s user base is diverse, with individuals from all walks of life using the platform to manage their finances.

One of the key benefits of Cash App is its ease of use. The app’s intuitive interface makes it simple for users to navigate and perform transactions. Additionally, Cash App offers a range of security features, including encryption and two-factor authentication, to protect users’ sensitive information.

For those looking to make money through Cash App, the platform offers a range of opportunities. From investing in stocks to participating in the Cash App referral program, users can earn extra income through the app. In the next section, we’ll explore the various ways to make money through Cash App and provide an overview of each opportunity.

By understanding how Cash App works and its features, users can unlock the full potential of the platform and start earning extra income. Whether you’re looking to invest in stocks, receive cashback rewards, or participate in the referral program, Cash App offers a range of opportunities to make money. In the following sections, we’ll dive deeper into each of these opportunities and provide tips and strategies for maximizing earnings.

Exploring Cash App’s Money-Making Opportunities

Cash App offers a range of opportunities for users to make money, from investing in stocks to participating in the referral program. In this section, we’ll explore each of these opportunities and provide an overview of their potential earnings.

One of the most popular ways to make money through Cash App is by investing in stocks. With the app’s investing feature, users can buy and sell stocks with as little as $1. This makes it an accessible option for those new to investing. Additionally, Cash App offers a range of educational resources to help users get started with investing.

Another way to make money through Cash App is by participating in the referral program. Users can earn money by referring friends and family to the app. The program offers a rewards structure that incentivizes users to promote the app to their network. By sharing their unique referral link, users can earn a bonus for each new user who signs up and makes a qualifying transaction.

Cash App also offers cashback rewards on certain purchases. Users can earn a percentage of their purchase back as cash, which can be redeemed for gift cards, deposited into their bank account, or used to invest in stocks. This makes it a great option for those looking to earn extra money on their daily purchases.

For those looking to make money through Cash App, it’s essential to understand the potential earnings of each opportunity. Investing in stocks, for example, can offer higher returns over the long-term, but it also comes with higher risks. Participating in the referral program, on the other hand, can offer a more predictable stream of income, but the earnings may be lower.

By understanding the different money-making opportunities available through Cash App, users can make informed decisions about how to use the app to earn extra income. Whether you’re looking to invest in stocks, participate in the referral program, or earn cashback rewards, Cash App offers a range of options to suit your financial goals.

When it comes to making money through Cash App, it’s essential to have a clear understanding of the app’s features and opportunities. By doing so, users can unlock the full potential of the app and start earning extra income. In the next section, we’ll provide a step-by-step guide on how to get started with Cash App investing.

How to Get Started with Cash App Investing

Investing in stocks through Cash App is a straightforward process that can be completed in a few steps. To get started, users need to set up an account and fund it with money. This can be done by linking a bank account or debit card to the app.

Once the account is funded, users can navigate to the investing interface by tapping on the “Investing” tab on the bottom navigation bar. From here, users can browse through

Maximizing Cash App Rewards and Cashback

Cash App offers a range of rewards and cashback opportunities that can help users earn extra income. To maximize these rewards, users should use the app for daily purchases, take advantage of bonus offers, and utilize the Cash App debit card.

One of the easiest ways to earn rewards through Cash App is by using the app for daily purchases. Users can earn cashback on purchases made at popular retailers, restaurants, and online stores. To maximize cashback rewards, users should use the app for all their daily purchases, including groceries, gas, and dining out.

Cash App also offers bonus offers that can help users earn extra rewards. These offers can include cashback on specific purchases, discounts on popular items, and exclusive deals on experiences. Users should regularly check the app for new bonus offers and take advantage of them to maximize their rewards.

The Cash App debit card is another way to earn rewards and cashback. The card offers cashback on purchases made at popular retailers, restaurants, and online stores. Users can also earn rewards on ATM withdrawals and other transactions. To maximize rewards, users should use the debit card for all their daily purchases and transactions.

Additionally, users can earn rewards by participating in Cash App’s rewards program. The program offers cashback on purchases made at popular retailers, restaurants, and online stores. Users can also earn rewards on ATM withdrawals and other transactions. To maximize rewards, users should regularly check the app for new rewards opportunities and take advantage of them.

By using the app for daily purchases, taking advantage of bonus offers, and utilizing the Cash App debit card, users can maximize their rewards and cashback earnings. This can help users earn extra income and make the most of their Cash App experience.

Maximizing rewards and cashback earnings is just one way to make money through Cash App. In the next section, we’ll explore the Cash App referral program and how it can be a lucrative opportunity for users.

The Cash App Referral Program: A Lucrative Opportunity

The Cash App referral program is a lucrative opportunity for users to earn extra income. By referring friends and family to the app, users can earn a bonus for each new user who signs up and makes a qualifying transaction.

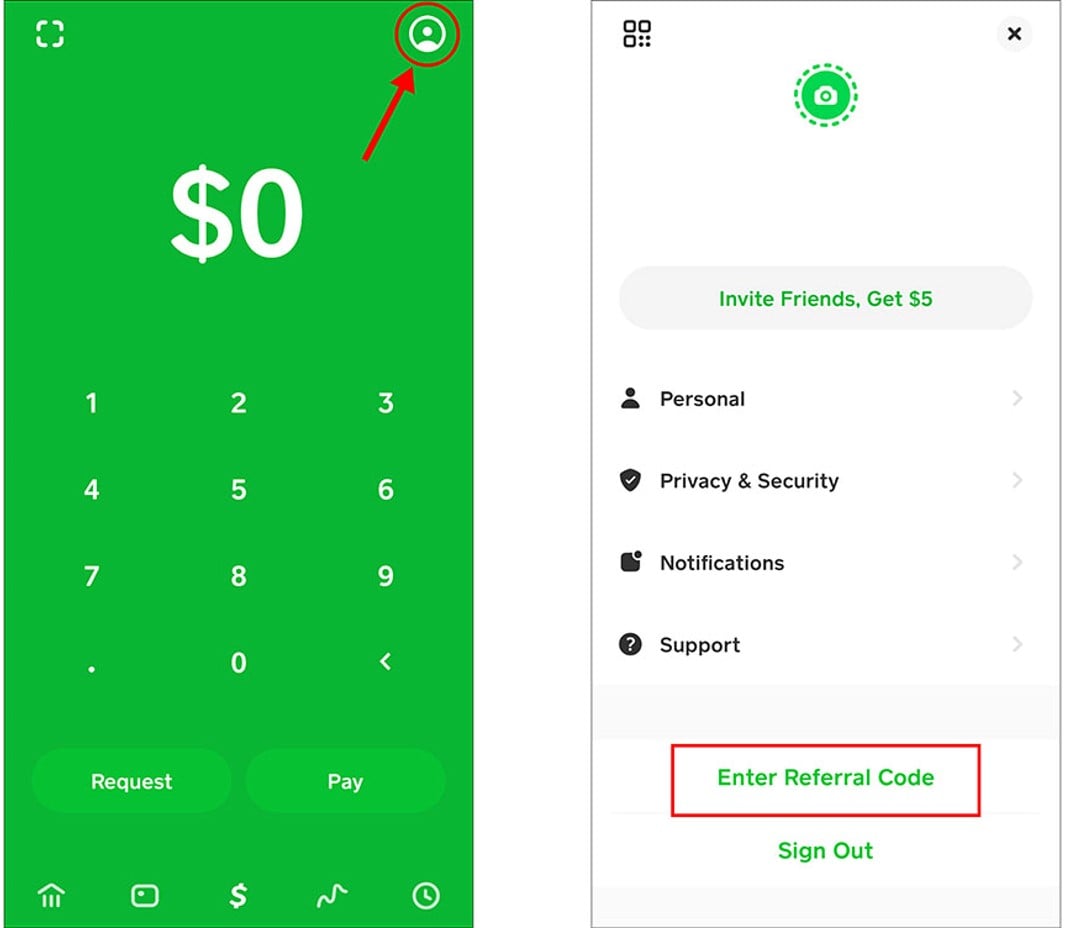

To participate in the referral program, users need to share their unique referral link with friends and family. This link can be shared via social media, email, or text message. When a new user signs up using the referral link and makes a qualifying transaction, the referring user earns a bonus.

The rewards structure for the referral program is straightforward. For each new user who signs up and makes a qualifying transaction, the referring user earns a $5 bonus. There is no limit to the number of referrals a user can make, and the bonuses can add up quickly.

One of the key strategies for successful referrals is to promote the program responsibly. Users should only share their referral link with people they know, and should not spam or solicit referrals. This will help to ensure that the referrals are legitimate and that the user earns the bonus.

Another strategy for successful referrals is to provide value to the new user. Users can do this by sharing tips and advice on how to use the app, or by providing support and guidance as the new user gets started. This will help to build trust and increase the chances of a successful referral.

The potential earnings from the referral program are significant. With a $5 bonus for each new user who signs up and makes a qualifying transaction, users can earn hundreds or even thousands of dollars per month. This makes the referral program a lucrative opportunity for users who are looking to earn extra income.

By participating in the Cash App referral program, users can earn extra income and make the most of their Cash App experience. In the next section, we’ll explore how to manage Cash App finances effectively, including budgeting, saving, and avoiding unnecessary fees.

Managing Your Cash App Finances Effectively

Managing your Cash App finances effectively is crucial to making the most of the app’s money-making opportunities. By following a few simple tips and strategies, users can ensure that they are using the app in a way that is financially responsible and sustainable.

One of the most important things to do when using Cash App is to budget effectively. This means setting a budget and sticking to it, rather than overspending or making impulse purchases. Users can set a budget by tracking their income and expenses, and then making a plan for how they want to allocate their money.

Another key aspect of managing your Cash App finances effectively is saving. By setting aside a portion of their income each month, users can build up their savings over time and achieve their long-term financial goals. Cash App makes it easy to save by offering a range of savings tools and features, including the ability to set aside a portion of their income automatically.

Avoiding unnecessary fees is also an important part of managing your Cash App finances effectively. Users should be aware of the fees associated with using the app, and take steps to minimize them. For example, users can avoid ATM fees by using in-network ATMs, and can avoid overdraft fees by keeping a close eye on their account balance.

Finally, users should prioritize financial discipline and responsible money management when using Cash App. This means being mindful of their spending habits, avoiding debt, and making smart financial decisions. By following these tips and strategies, users can ensure that they are using Cash App in a way that is financially responsible and sustainable.

By managing your Cash App finances effectively, you can make the most of the app’s money-making opportunities and achieve your long-term financial goals. In the next section, we’ll discuss common mistakes to avoid when using Cash App for earnings, and provide cautionary tales and expert advice.

Common Mistakes to Avoid When Using Cash App for Earnings

When using Cash App for earnings, there are several common mistakes to avoid. By being aware of these mistakes, users can ensure that they are using the app in a way that is financially responsible and sustainable.

One of the most common mistakes to avoid is neglecting to read the terms and conditions of the app. This can lead to unexpected fees, penalties, and other financial consequences. Users should take the time to carefully review the terms and conditions before using the app.

Another mistake to avoid is ignoring fees. Cash App charges fees for certain transactions, such as ATM withdrawals and instant deposits. Users should be aware of these fees and take steps to minimize them.

Failing to diversify investments is also a common mistake to avoid. When investing in stocks through Cash App, users should spread their investments across a range of assets to minimize risk. This can help to ensure that their investments are sustainable and profitable over the long-term.

Additionally, users should avoid making impulse purchases or investments. Cash App makes it easy to make transactions quickly and easily, but users should take the time to carefully consider their decisions before making a purchase or investment.

Finally, users should avoid neglecting to monitor their account activity. Cash App provides users with a range of tools and features to help them track their account activity and stay on top of their finances. Users should take advantage of these tools to ensure that their account is secure and their finances are in order.

By avoiding these common mistakes, users can ensure that they are using Cash App in a way that is financially responsible and sustainable. In the next section, we’ll summarize the key takeaways from the article and emphasize the potential for Cash App to become a lucrative side hustle.

Conclusion: Turning Cash App into a Lucrative Side Hustle

Cash App is a powerful tool for earning extra income, and with the right strategies and mindset, it can become a lucrative side hustle. By following the tips and advice outlined in this article, readers can unlock the full potential of Cash App and start earning extra money.

Whether you’re looking to make money through cashback rewards, investing in stocks, or participating in the Cash App referral program, there are many opportunities to earn extra income through the app. By being aware of the common mistakes to avoid and taking steps to manage your finances effectively, you can ensure that your Cash App experience is financially responsible and sustainable.

So why not start exploring the opportunities outlined in this article and turn Cash App into a lucrative side hustle? With its user-friendly interface, range of features, and potential for high earnings, Cash App is an ideal platform for anyone looking to make extra money.

Remember to always prioritize financial discipline and responsible money management, and don’t be afraid to try new things and take calculated risks. With the right mindset and strategies, you can unlock the full potential of Cash App and start earning the extra income you deserve.

Thanks for reading, and we hope you found this article informative and helpful. If you have any questions or comments, please don’t hesitate to reach out. Happy earning!

:max_bytes(150000):strip_icc()/Cash_App_01-c7abb9356f1643a8bdb913034c53147d.jpg)

:max_bytes(150000):strip_icc()/05_Cash_App-b81c9e32809e4ca980118e5b287bc00e.jpg)