Breaking Down the Benefits of Part-Time Health Insurance

Having health insurance is essential for part-time employees, providing financial protection, access to medical care, and peace of mind. Despite the importance of health coverage, many part-time workers struggle to find affordable options. Companies that offer health insurance for part-time employees can be a game-changer, offering a competitive edge in the job market and improving employee satisfaction. In this article, we will explore the benefits of part-time health insurance and provide guidance on finding companies that offer this valuable benefit.

One of the primary advantages of part-time health insurance is financial protection. Medical bills can be overwhelming, and without insurance, part-time employees may be forced to pay out-of-pocket for healthcare expenses. This can lead to financial strain, debt, and even bankruptcy. By offering health insurance, companies can help part-time employees avoid these financial pitfalls and ensure they receive necessary medical care.

In addition to financial protection, part-time health insurance provides access to medical care. With insurance, part-time employees can visit doctors, receive treatment, and fill prescriptions without worrying about the cost. This is particularly important for part-time employees with chronic conditions or ongoing health needs. By offering health insurance, companies can help part-time employees manage their health and improve their overall well-being.

Part-time health insurance also offers peace of mind. When part-time employees have health insurance, they can focus on their work and personal lives without worrying about medical expenses. This can lead to increased productivity, job satisfaction, and overall happiness. Companies that offer health insurance for part-time employees demonstrate a commitment to their workers’ well-being and can reap the benefits of a healthier, happier workforce.

While the benefits of part-time health insurance are clear, finding companies that offer this benefit can be challenging. In the next section, we will provide tips and strategies for part-time employees to find companies that offer health insurance, including researching companies, checking job listings, and asking about benefits during the hiring process.

How to Find Companies Offering Health Insurance for Part-Time Employees

For part-time employees, finding companies that offer health insurance can be a daunting task. However, with the right strategies and resources, it is possible to locate companies that provide this valuable benefit. In this section, we will provide tips and advice on how to find companies that offer health insurance for part-time employees.

One of the most effective ways to find companies that offer health insurance for part-time employees is to research companies online. Utilize search engines and job boards to search for companies that offer health insurance as a benefit. Look for companies that explicitly state that they offer health insurance to part-time employees. Some companies may also offer health insurance to part-time employees through a third-party provider, so be sure to investigate these options as well.

Another way to find companies that offer health insurance for part-time employees is to check job listings. When searching for part-time jobs, look for listings that mention health insurance as a benefit. This can be a good indication that the company offers health insurance to its part-time employees. Additionally, be sure to read the fine print and understand the terms and conditions of the health insurance plan.

Asking about benefits during the hiring process is also an effective way to find companies that offer health insurance for part-time employees. During the interview process, be sure to ask about the company’s benefits package and whether health insurance is included. This can give you a better understanding of the company’s commitment to its employees’ health and well-being.

Networking with current or former employees of a company can also provide valuable insights into the company’s benefits package. Ask about their experiences with the company’s health insurance plan and whether it is a good option for part-time employees.

Finally, be sure to check with professional associations and industry groups to see if they offer health insurance plans for part-time employees. Some associations may offer group health insurance plans that are specifically designed for part-time employees.

By utilizing these strategies, part-time employees can increase their chances of finding companies that offer health insurance. In the next section, we will highlight several companies that offer health insurance for part-time employees, including real company names such as Starbucks, Costco, and UPS.

Top Companies That Offer Health Insurance for Part-Time Employees

Several companies offer health insurance for part-time employees, providing a valuable benefit that can help attract and retain top talent. Here are a few examples of companies that offer health insurance for part-time employees:

Starbucks is one company that offers health insurance for part-time employees. The company’s health insurance plan, called the “Starbucks Health Insurance Plan,” provides coverage for part-time employees who work at least 20 hours per week. The plan includes medical, dental, and vision coverage, as well as access to a health savings account.

Costco is another company that offers health insurance for part-time employees. The company’s health insurance plan, called the “Costco Health Insurance Plan,” provides coverage for part-time employees who work at least 24 hours per week. The plan includes medical, dental, and vision coverage, as well as access to a health savings account.

UPS is a company that offers health insurance for part-time employees. The company’s health insurance plan, called the “UPS Health Insurance Plan,” provides coverage for part-time employees who work at least 20 hours per week. The plan includes medical, dental, and vision coverage, as well as access to a health savings account.

Other companies that offer health insurance for part-time employees include Amazon, Walmart, and Target. These companies offer a range of health insurance plans, including medical, dental, and vision coverage, as well as access to health savings accounts.

When evaluating health insurance plans offered by companies, it’s essential to consider the types of coverage offered, eligibility requirements, and costs. Part-time employees should also consider the company’s overall benefits package, including paid time off, retirement plans, and other perks.

In addition to these companies, there are many other employers that offer health insurance for part-time employees. Part-time employees can search for companies that offer health insurance by researching online, checking job listings, and asking about benefits during the hiring process.

In the next section, we will explore the different types of health insurance plans available to part-time employees, including group plans, individual plans, and catastrophic plans.

Understanding the Types of Health Insurance Plans Available

Part-time employees have several options when it comes to health insurance plans. Understanding the different types of plans available can help part-time employees make informed decisions about their health coverage. Here are some of the most common types of health insurance plans available to part-time employees:

Group plans are one type of health insurance plan available to part-time employees. These plans are typically offered by employers and provide coverage for a group of employees. Group plans can be more affordable than individual plans and often offer more comprehensive coverage. However, group plans may have eligibility requirements, such as working a certain number of hours per week.

Individual plans are another type of health insurance plan available to part-time employees. These plans are purchased directly by the individual and can be more expensive than group plans. However, individual plans can provide more flexibility and customization options. Part-time employees can choose from a range of individual plans, including catastrophic plans, which provide limited coverage at a lower cost.

Catastrophic plans are a type of individual plan that provides limited coverage at a lower cost. These plans are designed for individuals who do not need comprehensive coverage but want to protect themselves against catastrophic medical expenses. Catastrophic plans typically have higher deductibles and copays than other types of plans.

Short-term health insurance plans are another option for part-time employees. These plans provide temporary coverage for a limited period, usually up to 12 months. Short-term plans can be more affordable than other types of plans but often have limited coverage and may not provide essential health benefits.

Association health plans (AHPs) are a type of group plan that allows small businesses and self-employed individuals to band together to purchase health insurance. AHPs can provide more affordable coverage options for part-time employees but may have limited coverage and eligibility requirements.

When evaluating health insurance plans, part-time employees should consider the pros and cons of each type of plan. Group plans can provide more comprehensive coverage, but may have eligibility requirements. Individual plans can provide more flexibility, but may be more expensive. Catastrophic plans can provide limited coverage at a lower cost, but may not provide essential health benefits.

In the next section, we will provide guidance on what part-time employees should look for when evaluating health insurance plans, including coverage options, deductibles, copays, and network providers.

What to Look for When Evaluating Part-Time Health Insurance Plans

When evaluating part-time health insurance plans, there are several factors to consider. Here are some key things to look for:

Coverage options: What services are covered under the plan? Are there any exclusions or limitations? Are there any additional coverage options available, such as dental or vision coverage?

Deductibles: What is the deductible amount? Is it a flat fee or a percentage of the medical bill? Are there any copays or coinsurance requirements?

Copays: What are the copay amounts for doctor visits, prescriptions, and other services? Are there any limits on the number of copays per year?

Network providers: Who are the network providers? Are they local or national? Are there any restrictions on seeing out-of-network providers?

Maximum out-of-pocket costs: What is the maximum amount that can be paid out-of-pocket per year? Are there any limits on the amount of copays or coinsurance?

Preventive care: Are preventive care services, such as annual physicals and screenings, covered under the plan?

Prescription coverage: Are prescription medications covered under the plan? Are there any limits on the number of prescriptions per year?

Additional benefits: Are there any additional benefits, such as wellness programs or employee assistance programs, offered under the plan?

Cost: What is the premium cost of the plan? Are there any discounts available for part-time employees?

Eligibility requirements: Are there any eligibility requirements, such as working a certain number of hours per week, to qualify for the plan?

Enrollment process: What is the enrollment process like? Are there any deadlines or restrictions on enrolling in the plan?

Customer service: What kind of customer service is available? Are there any online resources or phone support available to answer questions and resolve issues?

By carefully evaluating these factors, part-time employees can make informed decisions about their health insurance coverage and choose a plan that meets their needs and budget.

In the next section, we will offer advice on how part-time employees can balance the cost of health insurance with their limited income, including tips on budgeting, negotiating with employers, and exploring affordable coverage options.

How to Balance Health Insurance Costs with Part-Time Income

Part-time employees often face challenges when it comes to balancing the cost of health insurance with their limited income. However, there are several strategies that can help part-time employees manage the cost of health insurance and ensure they have access to quality healthcare.

Budgeting is a crucial step in managing the cost of health insurance. Part-time employees should create a budget that takes into account their income, expenses, and health insurance premiums. By prioritizing their spending and making adjustments as needed, part-time employees can ensure they have enough money to pay for health insurance premiums.

Negotiating with employers is another way part-time employees can balance the cost of health insurance with their limited income. Part-time employees can ask their employers about potential discounts or subsidies that may be available to help offset the cost of health insurance premiums. Employers may be willing to work with part-time employees to find a solution that meets their needs and budget.

Exploring affordable coverage options is also essential for part-time employees. Part-time employees can research and compare different health insurance plans to find one that meets their needs and budget. They can also consider enrolling in a catastrophic plan, which provides limited coverage at a lower cost.

Part-time employees can also consider enrolling in a health savings account (HSA) or flexible spending account (FSA) to help manage the cost of health insurance. These accounts allow part-time employees to set aside pre-tax dollars to pay for medical expenses, which can help reduce their out-of-pocket costs.

Additionally, part-time employees can take advantage of tax credits and subsidies that may be available to help offset the cost of health insurance premiums. For example, the Affordable Care Act (ACA) provides tax credits to eligible individuals and families who purchase health insurance through the marketplace.

By implementing these strategies, part-time employees can balance the cost of health insurance with their limited income and ensure they have access to quality healthcare. In the next section, we will discuss common challenges part-time employees face when seeking health insurance, including limited employer offerings, high costs, and complex enrollment processes.

Common Challenges Part-Time Employees Face When Seeking Health Insurance

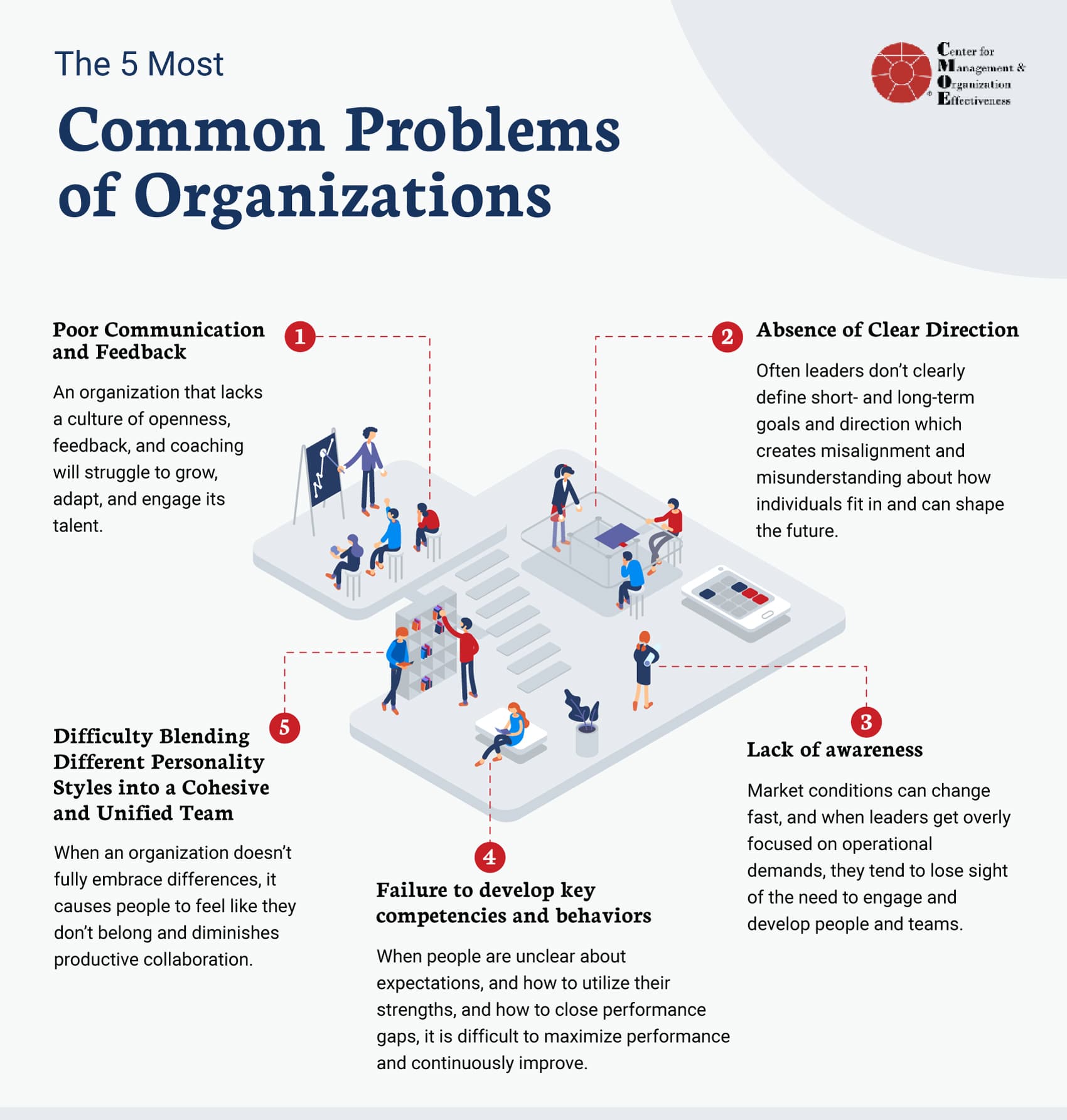

Part-time employees often face unique challenges when seeking health insurance. One of the most significant challenges is limited employer offerings. Many companies do not offer health insurance to part-time employees, or the coverage may be limited or unaffordable.

High costs are another challenge part-time employees face when seeking health insurance. Health insurance premiums can be expensive, and part-time employees may not have the financial resources to afford them. Additionally, part-time employees may not be eligible for subsidies or tax credits that can help offset the cost of health insurance.

Complex enrollment processes are also a challenge for part-time employees. Enrolling in a health insurance plan can be a confusing and time-consuming process, especially for those who are not familiar with the healthcare system. Part-time employees may need to navigate multiple websites, phone numbers, and paperwork to enroll in a plan.

Limited provider networks are another challenge part-time employees face when seeking health insurance. Some health insurance plans may have limited provider networks, which can make it difficult for part-time employees to access medical care. Part-time employees may need to travel long distances or pay out-of-network costs to see a doctor or specialist.

Pre-existing condition exclusions are also a challenge for part-time employees. Some health insurance plans may exclude coverage for pre-existing conditions, which can be a significant challenge for part-time employees who have ongoing health needs

Common Challenges Part-Time Employees Face When Seeking Health Insurance

Part-time employees often face unique challenges when seeking health insurance. One of the most significant challenges is limited employer offerings. Many companies do not offer health insurance to part-time employees, or the coverage may be limited or unaffordable.

High costs are another challenge part-time employees face when seeking health insurance. Health insurance premiums can be expensive, and part-time employees may not have the financial resources to afford them. Additionally, part-time employees may not be eligible for subsidies or tax credits that can help offset the cost of health insurance.

Complex enrollment processes are also a challenge for part-time employees. Enrolling in a health insurance plan can be a confusing and time-consuming process, especially for those who are not familiar with the healthcare system. Part-time employees may need to navigate multiple websites, phone numbers, and paperwork to enroll in a plan.

Limited provider networks are another challenge part-time employees face when seeking health insurance. Some health insurance plans may have limited provider networks, which can make it difficult for part-time employees to access medical care. Part-time employees may need to travel long distances or pay out-of-network costs to see a doctor or specialist.

Pre-existing condition exclusions are also a challenge for part-time employees. Some health insurance plans may exclude coverage for pre-existing conditions, which can be a significant challenge for part-time employees who have ongoing health needs