How to Choose the Right Brokerage Firm for Your Needs

When it comes to buying and selling stocks, selecting a reputable and reliable brokerage firm is crucial for success. With so many options available, it can be overwhelming to determine the best place to buy stock. However, by considering a few key factors, investors can make an informed decision that meets their needs and helps them achieve their financial goals.

One of the most important factors to consider when choosing a brokerage firm is fees. Different firms charge varying fees for services such as trading, account maintenance, and management. Some firms may also offer discounts for frequent traders or large account balances. Investors should carefully review the fee structure of each firm to ensure it aligns with their investment strategy and budget.

Another key factor to consider is the range of investment products offered. Some brokerage firms specialize in specific types of investments, such as options or forex, while others offer a broader range of products. Investors should consider the types of investments they want to make and choose a firm that offers the necessary products and services.

In addition to fees and investment products, investors should also consider the level of customer service and support offered by each firm. This includes the availability of online trading platforms, mobile apps, and customer support teams. Investors should choose a firm that offers the level of service and support they need to feel confident and in control of their investments.

Finally, investors should consider the reputation and reliability of each firm. This includes researching the firm’s history, reading reviews and testimonials from other customers, and checking for any regulatory warnings or fines. By choosing a reputable and reliable firm, investors can help ensure their investments are safe and secure.

By carefully considering these factors, investors can choose the best place to buy stock and achieve their financial goals. Whether you’re a seasoned investor or just starting out, selecting the right brokerage firm is an important decision that can have a significant impact on your investment success.

Understanding the Different Types of Brokerage Accounts

When it comes to buying and selling stocks, having the right type of brokerage account is essential. There are several types of accounts available, each with its own benefits and drawbacks. Understanding the differences between these accounts can help investors choose the best place to buy stock and achieve their financial goals.

Cash accounts are the most basic type of brokerage account. They allow investors to buy and sell stocks using their own money, without the need for margin or leverage. Cash accounts are ideal for beginners or those who want to keep their investments simple. However, they may not offer the same level of flexibility as other types of accounts.

Margin accounts, on the other hand, allow investors to borrow money from the brokerage firm to buy stocks. This can be beneficial for experienced investors who want to increase their buying power or take advantage of market opportunities. However, margin accounts also come with higher risks, as investors can lose more money than they initially invested.

Retirement accounts, such as 401(k) or IRA accounts, are designed for long-term investing. They offer tax benefits and other incentives to help investors save for retirement. Retirement accounts are ideal for those who want to invest for the future and take advantage of tax-advantaged savings.

Other types of brokerage accounts include robo-advisor accounts, which offer automated investment management, and micro-investing accounts, which allow investors to buy fractional shares of stocks. Each type of account has its own unique features and benefits, and investors should carefully consider their options before choosing the best place to buy stock.

In addition to the type of account, investors should also consider the fees and commissions associated with each account. Some accounts may have higher fees or commissions than others, which can eat into investment returns. By understanding the different types of brokerage accounts and their associated fees, investors can make informed decisions and choose the best place to buy stock for their needs.

Top Brokerage Firms for Buying Stocks: A Comparison

When it comes to buying stocks, choosing the right brokerage firm is crucial. With so many options available, it can be overwhelming to determine the best place to buy stock. In this article, we will compare and contrast three of the top brokerage firms for buying stocks: Fidelity, Charles Schwab, and Robinhood.

Fidelity is one of the largest and most well-established brokerage firms in the industry. They offer a wide range of investment products, including stocks, options, ETFs, and mutual funds. Fidelity is known for its competitive pricing, with commissions starting at $4.95 per trade. They also offer a user-friendly online trading platform and mobile app, making it easy to buy and sell stocks on the go.

Charles Schwab is another top brokerage firm that offers a wide range of investment products and services. They are known for their competitive pricing, with commissions starting at $4.95 per trade. Schwab also offers a robust online trading platform and mobile app, as well as a network of over 300 branches across the US.

Robinhood is a newer brokerage firm that has gained popularity in recent years due to its commission-free trading model. They offer a simple and intuitive online trading platform and mobile app, making it easy to buy and sell stocks without paying any commissions. However, Robinhood’s investment product offerings are limited compared to Fidelity and Schwab.

When it comes to customer service, all three firms offer 24/7 support via phone, email, and online chat. However, Fidelity and Schwab have a more extensive network of branches and financial advisors, making it easier to get in-person support.

In terms of fees, Fidelity and Schwab have similar commission structures, with fees starting at $4.95 per trade. Robinhood, on the other hand, offers commission-free trading, but may charge other fees for services such as wire transfers and account maintenance.

Ultimately, the best place to buy stock will depend on your individual needs and preferences. If you’re looking for a wide range of investment products and competitive pricing, Fidelity or Schwab may be the best choice. If you’re looking for a simple and commission-free trading experience, Robinhood may be the way to go.

The Benefits of Online Brokerages for Stock Trading

Online brokerages have revolutionized the way people buy and sell stocks. With the rise of online trading platforms, investors can now access the stock market from anywhere, at any time. This has made it easier than ever to find the best place to buy stock and start investing.

One of the main benefits of online brokerages is lower fees. Traditional brick-and-mortar brokerages often charge higher fees for trading, account maintenance, and other services. Online brokerages, on the other hand, can offer lower fees due to lower overhead costs. This can save investors a significant amount of money over time.

Another benefit of online brokerages is increased accessibility. With online trading platforms, investors can access the stock market from anywhere with an internet connection. This makes it easier to buy and sell stocks on the go, without having to visit a physical brokerage office.

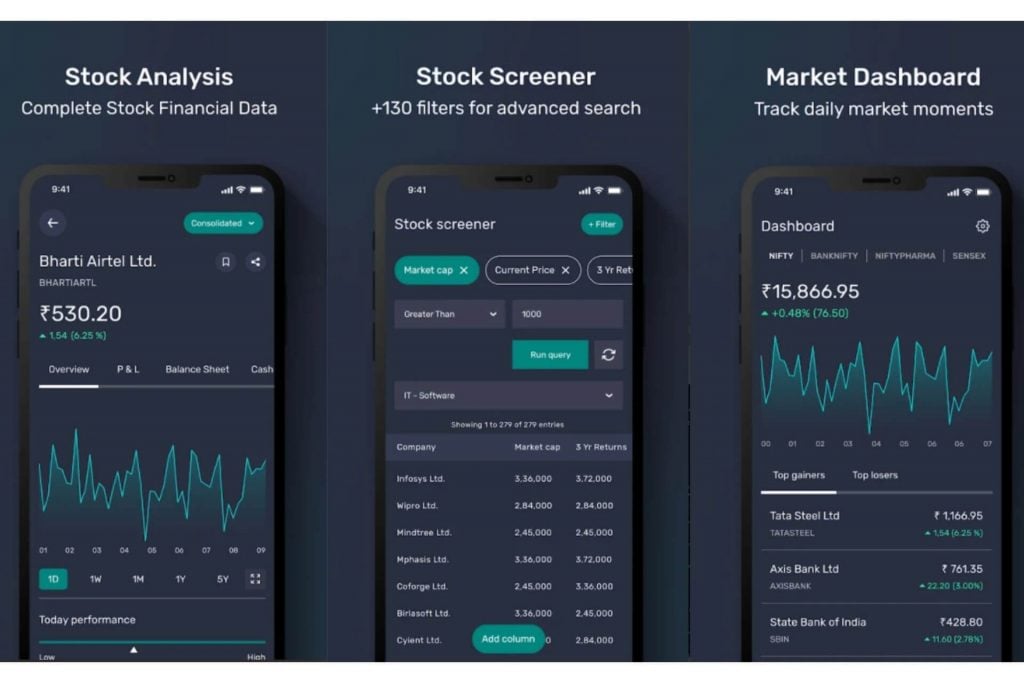

Online brokerages also offer advanced trading tools and features. Many online brokerages offer real-time market data, charts, and analysis tools to help investors make informed decisions. Some online brokerages also offer mobile apps, allowing investors to trade on the go.

In addition to these benefits, online brokerages also offer a range of investment products and services. Many online brokerages offer stocks, options, ETFs, mutual funds, and other investment products. Some online brokerages also offer retirement accounts, such as IRAs and 401(k)s.

When choosing an online brokerage, investors should consider several factors. These include fees, investment products, trading tools, and customer service. Investors should also consider the reputation and reliability of the online brokerage, as well as its regulatory compliance.

Overall, online brokerages offer a range of benefits for investors. With lower fees, increased accessibility, and advanced trading tools, online brokerages make it easier than ever to find the best place to buy stock and start investing.

What to Look for in a Mobile Trading App

With the rise of mobile trading, investors can now access the stock market from anywhere, at any time. However, with so many mobile trading apps available, it can be overwhelming to choose the right one. When looking for a mobile trading app, there are several key features to consider.

First and foremost, ease of use is essential. A good mobile trading app should be intuitive and easy to navigate, even for those who are new to stock trading. Look for an app that offers a clean and simple interface, with clear and concise language.

Real-time market data is also crucial. A good mobile trading app should provide up-to-the-minute market data, including stock prices, charts, and news. This will help investors make informed decisions and stay on top of market trends.

Security measures are also a top priority. A good mobile trading app should offer robust security features, including encryption, two-factor authentication, and secure login protocols. This will help protect investors’ personal and financial information.

Another important feature to consider is trading functionality. A good mobile trading app should offer a range of trading options, including buy and sell orders, limit orders, and stop-loss orders. It should also offer real-time trade execution and confirmation.

Finally, customer support is essential. A good mobile trading app should offer 24/7 customer support, including phone, email, and online chat support. This will help investors get the help they need, when they need it.

Some popular mobile trading apps that offer these features include Fidelity, Charles Schwab, and Robinhood. These apps offer a range of features and tools, including real-time market data, trading functionality, and security measures.

When choosing a mobile trading app, investors should consider their individual needs and preferences. They should also read reviews and do their research to find the best app for their needs.

By considering these key features and doing their research, investors can find the best mobile trading app for their needs and start trading with confidence.

Avoiding Common Mistakes When Buying Stocks

When it comes to buying stocks, there are several common mistakes that investors can make. These mistakes can lead to significant losses and undermine the potential for long-term success. By understanding these common mistakes, investors can take steps to avoid them and make more informed decisions.

One of the most common mistakes is lack of research. Many investors fail to do their due diligence on a stock before buying it. This can lead to investing in a company that is not financially stable or has a poor track record. To avoid this mistake, investors should thoroughly research a company’s financials, management team, and industry trends before making a decision.

Another common mistake is emotional decision-making. Investors often make decisions based on emotions rather than logic. This can lead to buying stocks that are not a good fit for their investment goals or risk tolerance. To avoid this mistake, investors should develop a clear investment strategy and stick to it, even in times of market volatility.

Inadequate risk management is also a common mistake. Investors often fail to consider the potential risks associated with a particular stock or investment strategy. This can lead to significant losses if the investment does not perform as expected. To avoid this mistake, investors should develop a risk management strategy that includes diversification, position sizing, and stop-loss orders.

Not having a long-term perspective is another common mistake. Many investors focus on short-term gains rather than long-term success. This can lead to making impulsive decisions based on short-term market fluctuations rather than a well-thought-out investment strategy. To avoid this mistake, investors should develop a long-term investment strategy that includes a clear set of goals and a well-diversified portfolio.

Finally, not monitoring and adjusting the portfolio is a common mistake. Investors often fail to regularly review their portfolio and make adjustments as needed. This can lead to a portfolio that is no longer aligned with their investment goals or risk tolerance. To avoid this mistake, investors should regularly review their portfolio and make adjustments as needed to ensure that it remains aligned with their investment strategy.

By avoiding these common mistakes, investors can increase their chances of success in the stock market. It’s essential to remember that investing in the stock market involves risk, and there are no guarantees of success. However, by being informed and taking a disciplined approach, investors can make more informed decisions and achieve their long-term investment goals.

Long-Term Investing Strategies for Success

When it comes to investing in the stock market, having a long-term strategy is crucial for success. A well-thought-out plan can help investors navigate the ups and downs of the market and achieve their financial goals. In this article, we will discuss the importance of long-term investing strategies and provide tips for implementing them.

Dollar-cost averaging is a popular long-term investing strategy that involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This strategy can help reduce the impact of market volatility and timing risks, as it allows investors to buy more shares when prices are low and fewer shares when prices are high.

Diversification is another key component of a successful long-term investing strategy. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their exposure to market risks and increase their potential for returns. A diversified portfolio can include a mix of stocks, bonds, real estate, and other investment vehicles.

Regular portfolio rebalancing is also essential for long-term investing success. As market conditions change, a portfolio’s asset allocation can become unbalanced, leading to increased risk and reduced returns. By regularly reviewing and rebalancing their portfolio, investors can ensure that their investments remain aligned with their financial goals and risk tolerance.

Long-term investing strategies can also involve tax-efficient investing. By minimizing taxes and maximizing after-tax returns, investors can increase their wealth over time. This can involve strategies such as tax-loss harvesting, charitable donations, and tax-deferred investing.

Finally, long-term investing strategies require discipline and patience. Investors must be willing to ride out market fluctuations and avoid making impulsive decisions based on short-term market movements. By staying focused on their long-term goals and avoiding emotional decision-making, investors can increase their chances of success in the stock market.

By incorporating these long-term investing strategies into their investment plan, investors can increase their potential for success and achieve their financial goals. Whether you’re a seasoned investor or just starting out, having a well-thought-out plan can help you navigate the complexities of the stock market and achieve your long-term financial objectives.

Getting Started with Stock Investing: A Step-by-Step Guide

Getting started with stock investing can seem daunting, but it doesn’t have to be. With a little guidance, anyone can begin investing in the stock market and start building their wealth. In this article, we will provide a step-by-step guide for getting started with stock investing.

Step 1: Open a Brokerage Account

The first step in getting started with stock investing is to open a brokerage account. This can be done online or in person at a brokerage firm. When choosing a brokerage firm, consider factors such as fees, commissions, and investment products offered.

Step 2: Fund the Account

Once the brokerage account is open, it’s time to fund it. This can be done by depositing money into the account via check, wire transfer, or electronic funds transfer. The amount of money needed to open an account varies by brokerage firm, but it’s typically around $1,000.

Step 3: Choose Your Investments

With the account funded, it’s time to choose your investments. This can include individual stocks, mutual funds, exchange-traded funds (ETFs), and other investment vehicles. Consider factors such as risk tolerance, investment goals, and time horizon when making your investment decisions.

Step 4: Make Your First Trade

Once you’ve chosen your investments, it’s time to make your first trade. This can be done online or over the phone with a brokerage firm representative. Be sure to understand the fees and commissions associated with buying and selling stocks before making your first trade.

Step 5: Monitor and Adjust Your Portfolio

After making your first trade, it’s essential to monitor and adjust your portfolio as needed. This can include rebalancing your portfolio to ensure it remains aligned with your investment goals and risk tolerance.

By following these steps, anyone can get started with stock investing and begin building their wealth. Remember to always do your research, consider your risk tolerance, and consult with a financial advisor if needed.

Investing in the stock market can seem intimidating, but it doesn’t have to be. By taking the time to educate yourself and develop a solid investment strategy, you can achieve your financial goals and build a secure financial future.