Breaking Down the Barriers to Investing

Investing can seem daunting, especially for those who are new to the world of finance. However, with the right mindset and knowledge, anyone can start investing and growing their wealth. One of the biggest barriers to investing is the misconception that it requires a large amount of money. The truth is, investing can be done with as little as $5000. In fact, investing your first $5000 can be a great way to get started and set yourself up for long-term financial success.

Another common fear that holds people back from investing is the risk of losing money. While it’s true that investing always carries some level of risk, there are ways to mitigate this risk and ensure that your investments are working for you. By understanding your financial goals and risk tolerance, you can make informed investment decisions that align with your values and goals.

Additionally, many people believe that investing is only for the wealthy or financially sophisticated. However, with the rise of online investment platforms and robo-advisors, investing has become more accessible than ever. Anyone can invest their first $5000 and start building wealth, regardless of their financial background or experience.

So, how to invest your first $5000? The first step is to educate yourself on the different investment options available. This includes understanding the pros and cons of different investment products, such as stocks, bonds, and ETFs. By taking the time to learn about investing and understanding your options, you can make informed decisions that will help you achieve your financial goals.

Investing your first $5000 can seem overwhelming, but it doesn’t have to be. By breaking down the barriers to investing and taking the first step, you can start building wealth and achieving your long-term financial goals. Remember, investing is a journey, and it’s okay to start small. The key is to be consistent, patient, and informed, and to always keep your financial goals in mind.

Understanding Your Financial Goals and Risk Tolerance

Before investing your first $5000, it’s essential to understand your financial goals and risk tolerance. This will help you determine the right investment strategy and ensure that your investments align with your values and objectives. To start, consider what you want to achieve through investing. Are you saving for a specific goal, such as a down payment on a house or retirement? Or are you looking to generate passive income or grow your wealth over time?

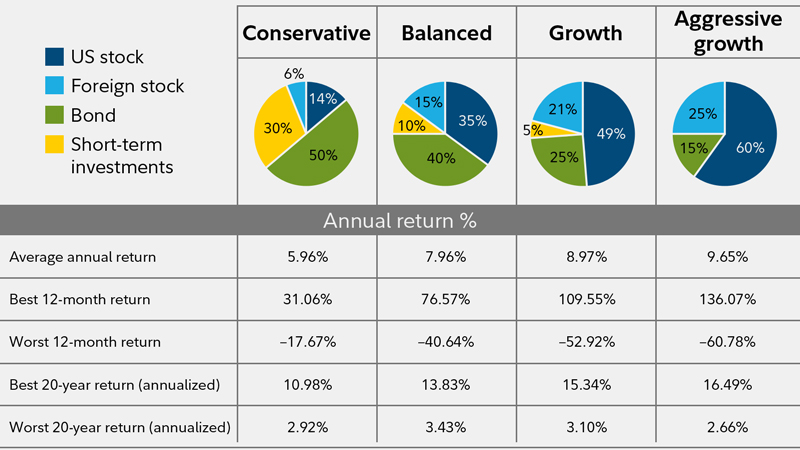

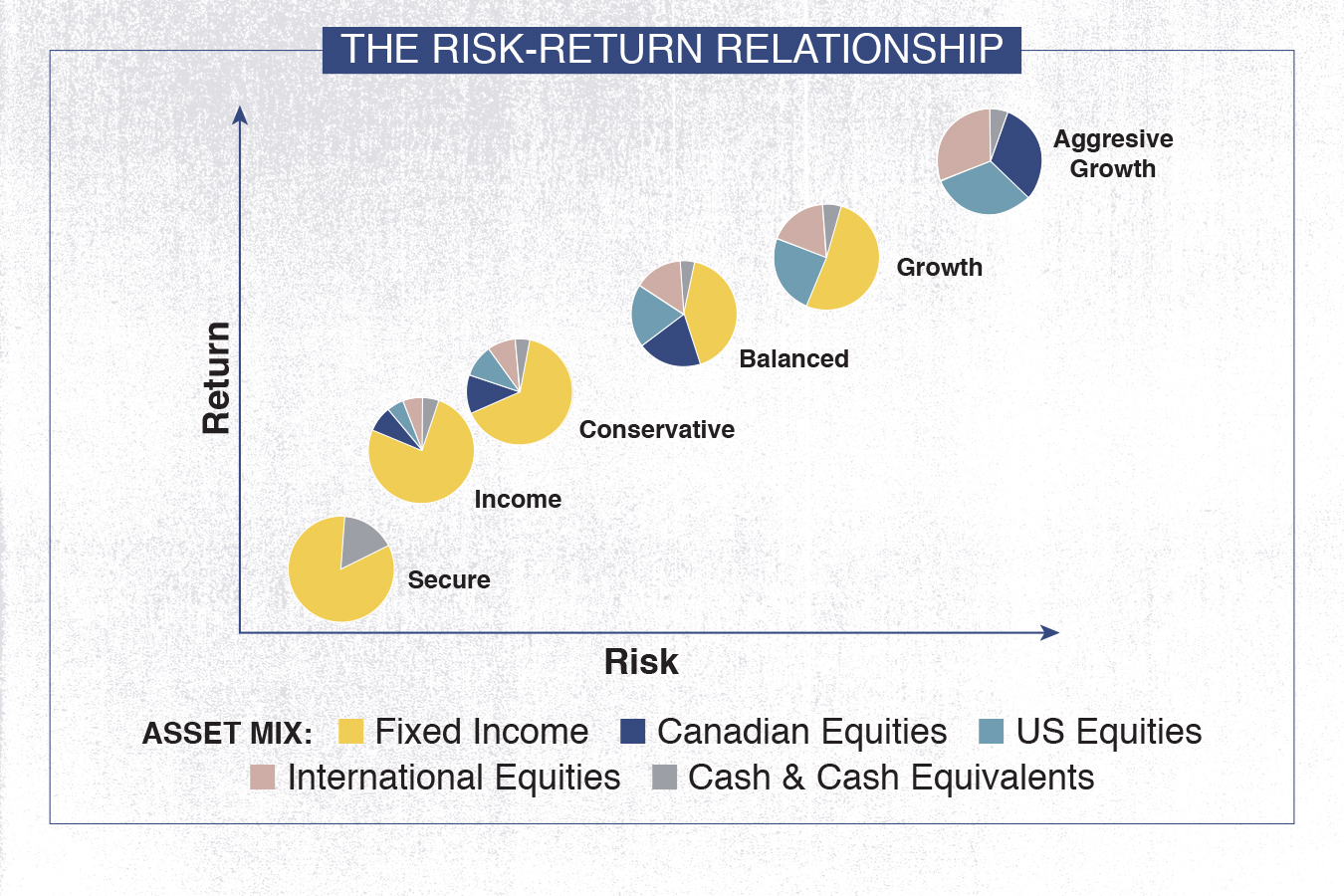

Next, assess your risk tolerance by considering your comfort level with market volatility and potential losses. If you’re risk-averse, you may prefer more conservative investments, such as bonds or money market funds. On the other hand, if you’re willing to take on more risk, you may consider investing in stocks or other higher-risk assets.

To determine your risk tolerance, ask yourself a few questions: How would you feel if your investment portfolio declined by 10% or 20% in a single year? Would you be able to sleep at night knowing that your investments are subject to market fluctuations? Or would you be tempted to sell your investments and cut your losses?

By understanding your financial goals and risk tolerance, you can create an investment plan that works for you. For example, if you’re saving for a specific goal, you may want to consider a more conservative investment strategy to ensure that you meet your target. On the other hand, if you’re looking to grow your wealth over time, you may be willing to take on more risk and invest in higher-growth assets.

When it comes to investing your first $5000, it’s also important to consider your time horizon. If you have a long time horizon, you may be able to ride out market fluctuations and take on more risk. However, if you need to access your money in the short term, you may want to consider more liquid investments, such as a high-yield savings account or a money market fund.

By taking the time to understand your financial goals and risk tolerance, you can create an investment plan that helps you achieve your objectives and minimizes your risk. Remember, investing is a long-term game, and it’s essential to be patient and disciplined in order to achieve consistent returns over time.

Exploring Investment Options for Your First $5000

When it comes to investing your

Exploring Investment Options for Your First $5000

When it comes to investing your first $5000, there are several options to consider. Each option has its pros and cons, and it’s essential to understand these before making a decision. Here are some popular investment options for first-time investors:

High-Yield Savings Accounts: These accounts offer a low-risk way to earn interest on your money. They are liquid, meaning you can access your money when needed, and typically offer higher interest rates than traditional savings accounts. However, the returns may not be as high as other investment options.

Index Funds: These funds track a specific market index, such as the S&P 500, and offer broad diversification and low fees. They are a great option for first-time investors who want to invest in the stock market without trying to pick individual stocks.

ETFs (Exchange-Traded Funds): ETFs are similar to index funds but trade on an exchange like stocks. They offer flexibility and diversification, and can be a good option for investors who want to invest in a specific sector or asset class.

Robo-Advisors: These online platforms offer automated investment management and diversified portfolios. They are a great option for first-time investors who want a hands-off approach to investing. Robo-advisors typically offer low fees and minimal account requirements.

Individual Stocks: Investing in individual stocks can be a higher-risk option, but it can also offer higher potential returns. It’s essential to do your research and understand the company’s financials, industry trends, and competitive landscape before investing.

When considering these investment options, it’s essential to think about your financial goals, risk tolerance, and time horizon. For example, if you’re saving for a short-term goal, a high-yield savings account or a money market fund may be a good option. However, if you’re looking to grow your wealth over the long term, a diversified portfolio of stocks or ETFs may be a better choice.

Ultimately, the key to successful investing is to find an option that aligns with your financial goals and risk tolerance. By understanding the pros and cons of each option, you can make an informed decision and start investing your first $5000 with confidence.

Diversification Strategies for Long-Term Success

Diversification is a key concept in investing, and it’s essential to understand how to allocate your $5000 across different asset classes, sectors, and geographic regions to minimize risk and maximize returns. By spreading your investments across various asset classes, you can reduce your exposure to any one particular market or sector, and increase your potential for long-term growth.

One way to diversify your portfolio is to invest in a mix of low-risk and high-risk assets. For example, you could allocate 40% of your portfolio to low-risk assets such as bonds or money market funds, and 60% to higher-risk assets such as stocks or real estate. This will help you balance your risk and potential returns, and ensure that your portfolio is well-diversified.

Another way to diversify your portfolio is to invest in different sectors and industries. For example, you could invest in a mix of technology stocks, healthcare stocks, and financial stocks. This will help you spread your risk across different sectors and industries, and increase your potential for long-term growth.

Geographic diversification is also important, as it can help you reduce your exposure to any one particular market or region. For example, you could invest in a mix of US stocks, international stocks, and emerging market stocks. This will help you spread your risk across different regions and markets, and increase your potential for long-term growth.

When it comes to diversifying your portfolio, it’s also important to consider your risk tolerance and investment goals. For example, if you’re a conservative investor, you may want to allocate a larger portion of your portfolio to low-risk assets such as bonds or money market funds. On the other hand, if you’re an aggressive investor, you may want to allocate a larger portion of your portfolio to higher-risk assets such as stocks or real estate.

By diversifying your portfolio and allocating your $5000 across different asset classes, sectors, and geographic regions, you can minimize risk and maximize returns over the long term. Remember, diversification is a key concept in investing, and it’s essential to understand how to diversify your portfolio to achieve long-term success.

Managing Risk and Avoiding Common Investing Mistakes

Investing in the stock market can be a great way to grow your wealth over time, but it’s not without risks. As a new investor, it’s essential to understand how to manage risk and avoid common investing mistakes. One of the most significant risks in investing is market volatility. To manage this risk, consider using dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market’s performance.

Another common investing mistake is trying to time the market. This involves trying to predict when the market will go up or down and investing accordingly. However, this strategy is often unsuccessful and can lead to significant losses. Instead, focus on long-term investing and avoid making emotional decisions based on short-term market fluctuations.

Stop-loss orders are another useful tool for managing risk. These orders allow you to set a price at which you want to sell a stock if it falls below a certain level. This can help you limit your losses if the market declines. Regular portfolio rebalancing is also essential for managing risk. This involves reviewing your portfolio regularly and making adjustments to ensure that it remains aligned with your investment goals and risk tolerance.

Over-diversification is another common mistake that new investors make. This involves spreading your investments too thinly across different asset classes, sectors, and geographic regions. While diversification is essential for managing risk, over-diversification can lead to reduced returns and increased complexity. Instead, focus on creating a diversified portfolio that aligns with your investment goals and risk tolerance.

Finally, it’s essential to avoid emotional decision-making when investing. This involves making investment decisions based on emotions rather than logic and evidence. To avoid this, focus on creating a long-term investment plan and sticking to it, even during times of market volatility.

By understanding how to manage risk and avoid common investing mistakes, you can increase your chances of success in the stock market. Remember, investing is a long-term game, and it’s essential to be patient and disciplined to achieve consistent returns over time.

Monitoring and Adjusting Your Investment Portfolio

Once you’ve invested your first $5000, it’s essential to regularly monitor your investment portfolio and adjust it as needed. This will help you stay on track with your financial goals and ensure that your investments are performing as expected. To monitor your portfolio, you can use online tools and resources, such as investment tracking software or mobile apps.

When monitoring your portfolio, pay attention to the performance of your individual investments, as well as the overall performance of your portfolio. Look for areas where you can improve, such as rebalancing your portfolio to maintain an optimal asset allocation. You should also keep an eye on fees and expenses, as these can eat into your returns over time.

To adjust your portfolio, you can use a variety of strategies, such as rebalancing, tax-loss harvesting, and dollar-cost averaging. Rebalancing involves adjusting your portfolio to maintain an optimal asset allocation, while tax-loss harvesting involves selling losing positions to offset gains from winning positions. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market’s performance.

It’s also essential to stay informed about market trends and economic conditions, as these can impact your investments. You can use online resources, such as financial news websites and investment blogs, to stay up-to-date on market developments. Additionally, consider consulting with a financial advisor or investment professional for personalized advice and guidance.

By regularly monitoring and adjusting your investment portfolio, you can help ensure that your investments are aligned with your financial goals and risk tolerance. Remember, investing is a long-term game, and it’s essential to be patient and disciplined to achieve consistent returns over time.

When adjusting your portfolio, it’s also essential to consider your risk tolerance and investment goals. If you’re a conservative investor, you may want to adjust your portfolio to reduce risk and increase stability. On the other hand, if you’re an aggressive investor, you may want to adjust your portfolio to increase potential returns and take on more risk.

Ultimately, the key to successful investing is to stay informed, be patient, and make adjustments as needed. By following these tips and staying focused on your long-term goals, you can help ensure that your investments are working for you and achieving consistent returns over time.

Staying Disciplined and Patient for Long-Term Investing Success

Investing in the stock market can be a great way to grow your wealth over time, but it requires discipline and patience. To achieve long-term success, it’s essential to stay focused on your financial goals and avoid emotional decision-making. This means riding out market fluctuations and avoiding the temptation to buy or sell based on short-term market movements.

One of the most significant challenges for new investors is managing their emotions. Fear and greed can lead to impulsive decisions, which can ultimately harm your investment portfolio. To avoid this, it’s essential to develop a long-term investment strategy and stick to it, even during times of market volatility.

Another key aspect of successful investing is patience. Investing is a long-term game, and it’s essential to give your investments time to grow. This means avoiding the temptation to withdraw your money during times of market downturns and instead, focusing on the long-term potential of your investments.

To stay disciplined and patient, it’s essential to educate yourself on investing and personal finance. This includes understanding the basics of investing, such as risk management, diversification, and asset allocation. It also means staying informed about market trends and economic conditions, but avoiding emotional decision-making based on short-term market movements.

Additionally, consider working with a financial advisor or investment professional who can provide personalized guidance and support. They can help you develop a long-term investment strategy and provide valuable insights and advice during times of market volatility.

By staying disciplined and patient, you can achieve long-term success in the stock market and grow your wealth over time. Remember, investing is a marathon, not a sprint, and it’s essential to focus on the long-term potential of your investments rather than short-term market movements.

Ultimately, the key to successful investing is to stay focused on your financial goals, avoid emotional decision-making, and ride out market fluctuations. By following these tips and staying disciplined and patient, you can achieve long-term success in the stock market and grow your wealth over time.