Understanding the Power of Compound Interest

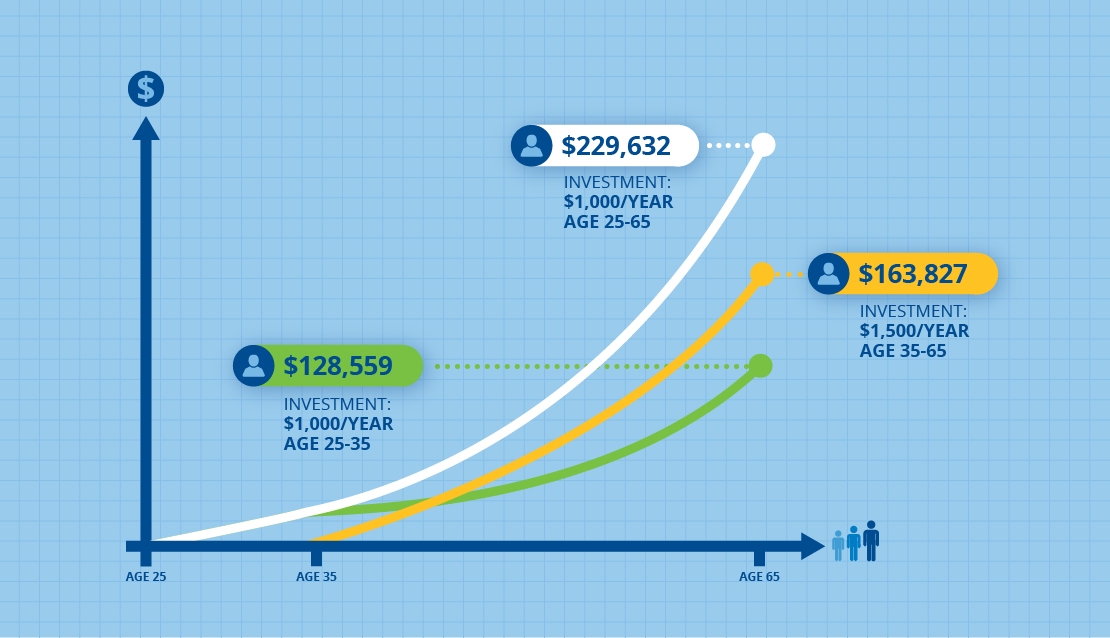

Compound interest is a powerful force that can help investors achieve their long-term financial goals. It is the process of earning interest on both the principal amount and any accrued interest over time. When it comes to average stock market returns, compound interest can play a significant role in growing wealth over time. By harnessing the power of compound interest, investors can potentially earn higher returns on their investments, making it an essential concept to understand for anyone looking to achieve consistent long-term gains.

In the context of average stock market returns, compound interest can be particularly effective when combined with a long-term investment strategy. By leaving investments to compound over time, investors can potentially earn higher returns than if they were to withdraw their interest earnings periodically. This is because the interest earned on the principal amount is reinvested, allowing the investment to grow exponentially over time.

For example, if an investor were to earn an average annual return of 7% on their stock market investment, they could potentially earn a total return of 50% over a 10-year period, assuming the interest is compounded annually. This demonstrates the significant impact that compound interest can have on average stock market returns, and highlights the importance of considering this factor when developing a long-term investment strategy.

Furthermore, compound interest can also help to mitigate the effects of market volatility on average stock market returns. By earning interest on both the principal amount and any accrued interest, investors can potentially reduce the impact of market downturns on their investments. This can help to provide a more stable source of returns over the long-term, making it an attractive option for investors seeking consistent average stock market returns.

In conclusion, compound interest is a powerful tool that can help investors achieve their long-term financial goals. By understanding how compound interest works, and how it can be applied to average stock market returns, investors can potentially earn higher returns on their investments and achieve consistent long-term gains.

Historical Stock Market Performance: What to Expect

Understanding the historical performance of the stock market is crucial for investors seeking average stock market returns. Over the long-term, the stock market has consistently provided higher returns compared to other investment options, such as bonds and savings accounts. However, it’s essential to recognize that past performance is not a guarantee of future results, and market volatility can significantly impact investment returns.

Historically, the S&P 500 index, which is widely considered a benchmark for the US stock market, has provided average annual returns of around 10% over the past several decades. However, this average return is based on a long-term perspective, and actual returns can vary significantly from year to year. For example, during the 2008 financial crisis, the S&P 500 index declined by over 38%, while in 2013, it surged by over 32%.

It’s also important to consider the impact of inflation on average stock market returns. Over the long-term, inflation can erode the purchasing power of investments, reducing their real returns. However, stocks have historically provided a hedge against inflation, as companies can pass on increased costs to consumers, maintaining their profit margins.

Another critical aspect of historical stock market performance is the concept of bull and bear markets. A bull market is characterized by a prolonged period of rising stock prices, while a bear market is marked by a sustained decline. Understanding these market cycles is essential for investors, as they can significantly impact average stock market returns.

For instance, during the 1990s, the US stock market experienced a prolonged bull market, with the S&P 500 index rising by over 400%. In contrast, the 2000s saw a bear market, with the index declining by over 40%. By recognizing these market cycles, investors can adjust their investment strategies to maximize their returns and minimize their losses.

In conclusion, understanding historical stock market performance is vital for investors seeking average stock market returns. By recognizing the long-term trends and patterns in the market, investors can make informed decisions and develop effective investment strategies to achieve their financial goals.

How to Calculate Average Stock Market Returns

Calculating average stock market returns is a crucial step in evaluating investment performance and making informed decisions. There are several methods to calculate average returns, including the use of historical data and online tools. In this section, we will provide a step-by-step guide on how to calculate average stock market returns and discuss the importance of considering fees and inflation when evaluating investment performance.

One of the most common methods to calculate average stock market returns is the arithmetic mean return method. This method involves calculating the average return of a stock or portfolio over a specific period, usually a year or a decade. The formula for calculating the arithmetic mean return is:

Arithmetic Mean Return = (Sum of Returns) / Number of Years

For example, if a stock has returned 10%, 12%, and 15% over the past three years, the arithmetic mean return would be (10 + 12 + 15) / 3 = 12.33%.

Another method to calculate average stock market returns is the geometric mean return method. This method takes into account the compounding effect of returns over time and provides a more accurate picture of investment performance. The formula for calculating the geometric mean return is:

Geometric Mean Return = (Product of (1 + Return))^ (1/Number of Years) – 1

Using the same example as above, the geometric mean return would be (1 + 0.10) x (1 + 0.12) x (1 + 0.15) = 1.1233, and the average return would be 1.1233^(1/3) – 1 = 11.67%.

When calculating average stock market returns, it’s essential to consider fees and inflation. Fees can significantly impact investment returns, and inflation can erode the purchasing power of investments over time. To account for fees, investors can use the net-of-fees return method, which subtracts fees from the gross return. To account for inflation, investors can use the real return method, which adjusts the return for inflation.

Online tools, such as stock screeners and investment calculators, can also be used to calculate average stock market returns. These tools provide a convenient and efficient way to evaluate investment performance and make informed decisions.

In conclusion, calculating average stock market returns is a crucial step in evaluating investment performance and making informed decisions. By using the arithmetic mean return method, geometric mean return method, and considering fees and inflation, investors can gain a better understanding of their investment performance and make more informed decisions.

Factors Influencing Average Stock Market Returns

Average stock market returns are influenced by a variety of factors, including economic indicators, interest rates, and geopolitical events. Understanding these factors is crucial for investors seeking to achieve consistent long-term gains. In this section, we will discuss the key factors that influence average stock market returns and explain how they can impact investment decisions and portfolio performance.

Economic indicators, such as GDP growth, inflation, and unemployment rates, can significantly impact average stock market returns. A strong economy with low unemployment and moderate inflation can lead to higher stock prices and increased average returns. On the other hand, a weak economy with high unemployment and high inflation can lead to lower stock prices and decreased average returns.

Interest rates also play a crucial role in influencing average stock market returns. When interest rates are low, investors are more likely to invest in stocks, leading to higher stock prices and increased average returns. Conversely, when interest rates are high, investors may prefer to invest in bonds or other fixed-income securities, leading to lower stock prices and decreased average returns.

Geopolitical events, such as wars, natural disasters, and elections, can also impact average stock market returns. These events can create uncertainty and volatility in the market, leading to decreased average returns. However, they can also create opportunities for investors who are able to navigate the uncertainty and capitalize on the volatility.

Other factors that can influence average stock market returns include company-specific news, industry trends, and market sentiment. Company-specific news, such as earnings announcements and product launches, can impact the stock price of individual companies and influence average returns. Industry trends, such as the growth of technology or healthcare, can also impact average returns by influencing the stock prices of companies within those industries. Market sentiment, which refers to the overall attitude of investors towards the market, can also impact average returns by influencing the stock prices of individual companies and the overall market.

In addition to these factors, average stock market returns can also be influenced by the actions of central banks and governments. Monetary policy decisions, such as interest rate changes and quantitative easing, can impact average returns by influencing the overall level of economic activity and the attractiveness of stocks relative to other investments. Fiscal policy decisions, such as tax changes and government spending, can also impact average returns by influencing the overall level of economic activity and the profitability of individual companies.

By understanding the factors that influence average stock market returns, investors can make more informed investment decisions and develop strategies to achieve consistent long-term gains. This may involve diversifying their portfolios across different asset classes and industries, staying informed about economic and market trends, and adapting to changing market conditions.

Investment Strategies for Consistent Long-Term Gains

Investors seeking consistent long-term gains in the stock market can employ various investment strategies to achieve their goals. In this section, we will discuss several investment strategies that can help investors achieve average stock market returns, including dollar-cost averaging, dividend investing, and index fund investing.

Dollar-cost averaging is a popular investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This strategy can help investors reduce the impact of market volatility and timing risks, as they will be investing in the market at various price levels. By investing a fixed amount of money at regular intervals, investors can also take advantage of lower prices during market downturns, which can help them achieve higher average returns over the long-term.

Dividend investing is another investment strategy that can help investors achieve consistent long-term gains. Dividend-paying stocks can provide a regular stream of income, which can help investors achieve higher average returns over the long-term. Additionally, dividend-paying stocks tend to be less volatile than non-dividend paying stocks, which can help investors reduce their risk exposure. By investing in dividend-paying stocks, investors can also benefit from the potential for long-term capital appreciation, as the underlying companies can continue to grow and increase their dividend payments over time.

Index fund investing is a popular investment strategy that involves investing in a fund that tracks a specific market index, such as the S&P 500. Index funds can provide investors with broad diversification and can help them achieve average stock market returns over the long-term. Additionally, index funds tend to have lower fees than actively managed funds, which can help investors save money on investment costs. By investing in index funds, investors can also benefit from the potential for long-term capital appreciation, as the underlying companies can continue to grow and increase their earnings over time.

Other investment strategies that can help investors achieve consistent long-term gains include value investing, growth investing, and sector rotation. Value investing involves investing in undervalued companies with strong fundamentals, which can help investors achieve higher average returns over the long-term. Growth investing involves investing in companies with high growth potential, which can help investors achieve higher average returns over the long-term. Sector rotation involves investing in specific sectors or industries that are expected to outperform the broader market, which can help investors achieve higher average returns over the long-term.

By employing these investment strategies, investors can increase their chances of achieving consistent long-term gains in the stock market. However, it’s essential to remember that each investment strategy carries its own risks and rewards, and investors should carefully consider their investment goals, risk tolerance, and time horizon before investing in the stock market.

Real-World Examples of Average Stock Market Returns

Understanding how average stock market returns have performed in the past can help investors make more informed decisions about their investments. In this section, we will provide real-world examples of average stock market returns, including case studies of successful investors and historical market performance.

One of the most well-known examples of average stock market returns is the performance of the S&P 500 index. Over the past several decades, the S&P 500 has provided average annual returns of around 10%, making it one of the most successful investments in the stock market. However, it’s essential to note that past performance is not a guarantee of future results, and investors should always do their own research and consider their own risk tolerance before investing.

Another example of average stock market returns is the performance of Warren Buffett’s Berkshire Hathaway. Over the past several decades, Berkshire Hathaway has provided average annual returns of around 20%, making it one of the most successful investments in the stock market. Buffett’s success can be attributed to his value investing strategy, which involves investing in undervalued companies with strong fundamentals.

Historical market performance can also provide valuable insights into average stock market returns. For example, during the 1990s, the stock market experienced a significant bull run, with the S&P 500 index rising by over 400%. However, during the 2000s, the stock market experienced a significant bear market, with the S&P 500 index falling by over 40%. By understanding how the market has performed in the past, investors can gain a better understanding of the potential risks and rewards of investing in the stock market.

It’s also essential to note that average stock market returns can vary significantly depending on the time period and market conditions. For example, during the 1980s, the stock market experienced a significant bull run, with the S&P 500 index rising by over 200%. However, during the 1990s, the stock market experienced a significant correction, with the S&P 500 index falling by over 20%. By understanding how the market has performed in the past, investors can gain a better understanding of the potential risks and rewards of investing in the stock market.

In addition to these examples, there are many other real-world examples of average stock market returns that can provide valuable insights into the potential risks and rewards of investing in the stock market. By studying these examples and understanding how the market has performed in the past, investors can make more informed decisions about their investments and achieve their long-term financial goals.

Common Mistakes to Avoid When Investing in the Stock Market

Investing in the stock market can be a great way to achieve average stock market returns and grow wealth over time. However, there are several common mistakes that investors make that can hinder their success. In this section, we will identify some of the most common mistakes that investors make when seeking average stock market returns and offer tips on how to avoid them.

One of the most common mistakes that investors make is emotional decision-making. This involves making investment decisions based on emotions rather than logic and research. For example, an investor may sell their stocks during a market downturn due to fear, rather than holding on to them and waiting for the market to recover. To avoid emotional decision-making, investors should develop a clear investment strategy and stick to it, even during times of market volatility.

Another common mistake that investors make is lack of diversification. This involves investing too much of their portfolio in a single stock or industry, which can increase their risk exposure. To avoid lack of diversification, investors should spread their investments across a variety of asset classes and industries, which can help to reduce their risk exposure and increase their potential for average stock market returns.

Inadequate risk management is another common mistake that investors make. This involves failing to assess and manage risk exposure, which can lead to significant losses during times of market volatility. To avoid inadequate risk management, investors should assess their risk tolerance and develop a risk management strategy that aligns with their investment goals and risk tolerance.

Not staying informed is another common mistake that investors make. This involves failing to stay up-to-date with market news and trends, which can lead to missed opportunities and poor investment decisions. To avoid not staying informed, investors should regularly read financial news and analysis, and stay informed about market trends and developments.

Finally, not having a long-term perspective is another common mistake that investors make. This involves focusing too much on short-term gains and not enough on long-term growth. To avoid not having a long-term perspective, investors should develop a long-term investment strategy and focus on achieving their long-term goals, rather than trying to time the market or make quick profits.

By avoiding these common mistakes, investors can increase their chances of achieving average stock market returns and growing their wealth over time. It’s essential to remember that investing in the stock market involves risk, and there are no guarantees of success. However, by developing a clear investment strategy, staying informed, and avoiding common mistakes, investors can increase their potential for success and achieve their long-term financial goals.

Staying Disciplined and Patient in Pursuit of Long-Term Gains

Investing in the stock market requires discipline and patience in order to achieve consistent average stock market returns. It’s essential to stay informed about market trends and developments, but it’s equally important to avoid making emotional decisions based on short-term market fluctuations. By maintaining a long-term perspective and staying disciplined, investors can increase their chances of achieving their financial goals.

One of the key challenges that investors face is the temptation to try to time the market or make quick profits. However, this approach can be fraught with risk and can lead to significant losses. Instead, investors should focus on developing a long-term investment strategy that aligns with their financial goals and risk tolerance.

Another important aspect of staying disciplined and patient is to avoid making emotional decisions based on market volatility. It’s natural to feel anxious or fearful during times of market downturn, but it’s essential to remember that market fluctuations are a normal part of the investment cycle. By staying informed and maintaining a long-term perspective, investors can avoid making impulsive decisions that can harm their investment performance.

In addition to staying informed and avoiding emotional decisions, investors should also focus on maintaining a diversified portfolio. This can help to reduce risk and increase the potential for long-term gains. By spreading investments across a variety of asset classes and industries, investors can reduce their exposure to any one particular market or sector.

Finally, investors should also focus on maintaining a long-term perspective when evaluating their investment performance. It’s essential to remember that investing in the stock market is a long-term game, and it’s not uncommon for investments to experience periods of volatility or decline. By maintaining a long-term perspective and staying disciplined, investors can increase their chances of achieving their financial goals and achieving consistent average stock market returns.

By following these principles, investors can increase their chances of achieving consistent average stock market returns and growing their wealth over time. It’s essential to remember that investing in the stock market involves risk, but by staying informed, maintaining a long-term perspective, and avoiding emotional decisions, investors can increase their potential for long-term success.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Use_a_Moving_Average_to_Buy_Stocks_Jun_2020-03-9a5827ab870c4e4bb463b18617feb88a.jpg)