Understanding the Importance of Home Insurance in Florida

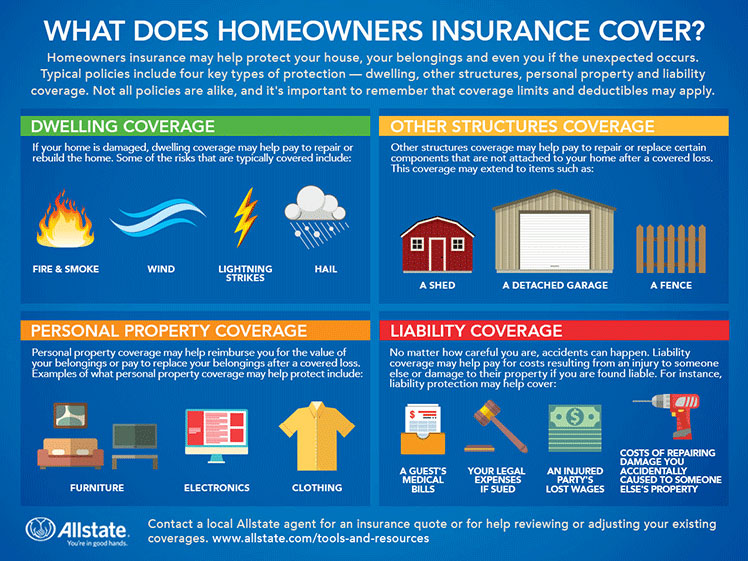

Florida homeowners face a unique set of risks, from hurricanes and tropical storms to sinkholes and theft. In fact, according to the Insurance Information Institute, Florida has the highest average homeowner insurance premiums in the country. However, having affordable home insurance in Florida is crucial for protecting one’s financial well-being and peace of mind. Home insurance provides financial protection against losses or damages to a home and its contents, as well as liability coverage in case of accidents or injuries on the property.

Without home insurance, Florida homeowners may be left to foot the bill for costly repairs or rebuilding after a disaster. This can be financially devastating, especially for those who are not prepared. Furthermore, many mortgage lenders require homeowners to have insurance coverage as a condition of the loan. Therefore, it is essential for Florida homeowners to understand the importance of home insurance and to take steps to secure affordable coverage.

Home insurance can provide a range of benefits, including financial protection against natural disasters, theft, and liability. It can also provide coverage for additional living expenses, such as temporary housing and food, if a home is uninhabitable due to damage or destruction. By having affordable home insurance in Florida, homeowners can rest assured that they are protected against the unexpected and can focus on rebuilding and recovering in the event of a disaster.

In addition to providing financial protection, home insurance can also offer peace of mind. Knowing that one’s home and belongings are protected can reduce stress and anxiety, especially during times of uncertainty. Moreover, having home insurance can also provide a sense of security and stability, which is essential for maintaining a healthy and happy lifestyle.

Overall, having affordable home insurance in Florida is crucial for protecting one’s financial well-being and peace of mind. By understanding the importance of home insurance and taking steps to secure affordable coverage, Florida homeowners can rest assured that they are prepared for the unexpected and can focus on enjoying their homes and communities.

How to Find Affordable Home Insurance Quotes in Florida

When it comes to finding affordable home insurance in Florida, shopping around and comparing rates is crucial. With so many insurance companies offering coverage in the state, homeowners can easily get overwhelmed by the numerous options. However, by taking the time to research and compare rates, homeowners can find the best coverage for their needs and budget.

One of the most effective ways to find affordable home insurance quotes in Florida is to work with an independent insurance agent. These agents represent multiple insurance companies and can provide homeowners with a range of quotes and options. Additionally, independent agents often have a deep understanding of the Florida insurance market and can provide valuable insights and advice.

Homeowners can also find affordable home insurance quotes in Florida by taking advantage of discounts. Many insurance companies offer discounts for things like security systems, storm shutters, and energy-efficient upgrades. By investing in these upgrades, homeowners can not only lower their insurance rates but also improve the safety and value of their home.

Some insurance companies that offer affordable rates in Florida include State Farm and Allstate. These companies have a long history of providing coverage in the state and offer a range of discounts and incentives. However, it’s essential to remember that the cheapest option may not always be the best. Homeowners should carefully review policy terms and conditions to ensure they are getting the coverage they need.

Another way to find affordable home insurance quotes in Florida is to use online comparison tools. These tools allow homeowners to enter their information and receive quotes from multiple insurance companies. This can be a quick and easy way to compare rates and find the best coverage. However, homeowners should be cautious when using online tools and make sure they are working with reputable companies.

Finally, homeowners should not be afraid to negotiate with insurance companies. By asking about discounts and incentives, homeowners can often lower their rates and find more affordable coverage. Additionally, homeowners should carefully review their policy and ask questions if they are unsure about anything.

By following these tips, homeowners can find affordable home insurance quotes in Florida and protect their homes and finances. Remember, finding the right coverage takes time and research, but it’s essential for ensuring the long-term security and stability of your home.

Factors Affecting Home Insurance Rates in Florida

Home insurance rates in Florida are influenced by a variety of factors, including location, property value, and claims history. Understanding these factors can help homeowners mitigate them and lower their insurance rates. In this section, we will explore the key factors that affect home insurance rates in Florida and provide tips on how to reduce them.

Location is one of the most significant factors affecting home insurance rates in Florida. Homes located in areas prone to natural disasters, such as hurricanes and floods, are considered higher-risk and therefore have higher insurance rates. Additionally, homes located in areas with high crime rates or near environmental hazards, such as sinkholes, may also have higher insurance rates.

Property value is another important factor that affects home insurance rates in Florida. The more valuable the property, the higher the insurance rate. This is because the insurance company is taking on more risk by insuring a more valuable property. However, homeowners can mitigate this factor by investing in security systems, storm shutters, and other safety features that can reduce the risk of damage or loss.

Claims history is also a significant factor that affects home insurance rates in Florida. Homeowners who have made multiple claims in the past may be considered higher-risk and therefore have higher insurance rates. However, homeowners can mitigate this factor by avoiding unnecessary claims and taking steps to prevent damage or loss, such as installing security systems and maintaining their property.

Other factors that can affect home insurance rates in Florida include the age and condition of the property, the type of construction, and the presence of certain features, such as a swimming pool or trampoline. Homeowners can mitigate these factors by maintaining their property, investing in safety features, and shopping around for insurance quotes.

By understanding the factors that affect home insurance rates in Florida, homeowners can take steps to mitigate them and lower their insurance rates. This can help make affordable home insurance in Florida a reality, even for those with higher-risk properties. By shopping around, comparing rates, and taking advantage of discounts, homeowners can find the best coverage for their needs and budget.

In addition to mitigating the factors that affect home insurance rates, homeowners can also take steps to reduce their insurance rates by investing in safety features and maintaining their property. This can include installing security systems, storm shutters, and other safety features that can reduce the risk of damage or loss. By taking these steps, homeowners can not only lower their insurance rates but also protect their property and finances.

The Benefits of Bundling Home and Auto Insurance in Florida

Bundling home and auto insurance in Florida can be a great way to save money and simplify your insurance needs. By combining your home and auto insurance policies with the same insurance company, you can take advantage of discounts, convenience, and streamlined claims processing. In this section, we will explore the benefits of bundling home and auto insurance in Florida and discuss how to find the best bundled insurance options.

One of the main benefits of bundling home and auto insurance in Florida is the discount you can receive. Many insurance companies offer discounts to customers who bundle their policies, which can range from 5% to 20% off your total premium. This can be a significant savings, especially for homeowners who have multiple vehicles or a high-value home.

Another benefit of bundling home and auto insurance in Florida is the convenience it offers. By having both policies with the same insurance company, you can simplify your insurance needs and reduce the amount of paperwork and administrative tasks you need to complete. This can be especially helpful for busy homeowners who don’t have a lot of time to manage their insurance policies.

In addition to discounts and convenience, bundling home and auto insurance in Florida can also provide streamlined claims processing. If you need to file a claim, having both policies with the same insurance company can make the process easier and faster. This can be especially important in the event of a natural disaster or other catastrophic event, when every minute counts.

Some insurance companies that offer bundling discounts in Florida include GEICO and Progressive. These companies offer a range of insurance products, including home and auto insurance, and can provide discounts to customers who bundle their policies. However, it’s essential to shop around and compare rates to find the best bundled insurance options for your needs and budget.

When bundling home and auto insurance in Florida, it’s essential to carefully review your policies and ensure that you have the right coverage for your needs. This includes reviewing your policy limits, deductibles, and coverage options to ensure that you have the right protection in place. By taking the time to review your policies and shop around for the best rates, you can find affordable home insurance in Florida and protect your home and finances.

In conclusion, bundling home and auto insurance in Florida can be a great way to save money and simplify your insurance needs. By taking advantage of discounts, convenience, and streamlined claims processing, you can find affordable home insurance in Florida and protect your home and finances. Remember to shop around, compare rates, and carefully review your policies to ensure that you have the right coverage for your needs and budget.

Florida-Specific Home Insurance Coverage Options

Florida homeowners face unique risks that require specialized insurance coverage. In addition to standard home insurance policies, Florida homeowners may need to consider additional coverage options to protect against Florida-specific risks. In this section, we will explore the unique coverage options available to Florida homeowners, including hurricane insurance, flood insurance, and sinkhole insurance.

Hurricane insurance is a critical coverage option for Florida homeowners. Hurricanes can cause catastrophic damage to homes and properties, and having adequate insurance coverage can help protect against financial loss. Florida homeowners can purchase hurricane insurance as a separate policy or as an endorsement to their standard home insurance policy.

Flood insurance is another important coverage option for Florida homeowners. Flooding can occur due to heavy rainfall, storm surges, or other natural disasters, and can cause significant damage to homes and properties. The National Flood Insurance Program (NFIP) provides flood insurance coverage to homeowners, and Florida homeowners can also purchase private flood insurance policies.

Sinkhole insurance is a unique coverage option that is specific to Florida. Sinkholes can occur due to the state’s geology, and can cause significant damage to homes and properties. Florida homeowners can purchase sinkhole insurance as a separate policy or as an endorsement to their standard home insurance policy.

Other Florida-specific coverage options include windstorm insurance and storm surge insurance. Windstorm insurance provides coverage against damage caused by high winds, while storm surge insurance provides coverage against damage caused by storm surges. Florida homeowners can also consider purchasing umbrella insurance policies, which provide additional liability coverage beyond the standard home insurance policy.

When purchasing Florida-specific coverage options, it’s essential to carefully review the policy terms and conditions to ensure that you have the right coverage for your needs. Florida homeowners should also shop around and compare rates to find the best coverage options for their budget.

In addition to purchasing Florida-specific coverage options, homeowners can also take steps to mitigate the risks associated with these coverage options. For example, homeowners can install storm shutters or impact-resistant windows to reduce the risk of wind damage. Homeowners can also install a sump pump or French drain to reduce the risk of flooding.

By understanding the unique coverage options available to Florida homeowners, homeowners can make informed decisions about their insurance coverage and protect their homes and finances against Florida-specific risks. Remember to shop around, compare rates, and carefully review policy terms and conditions to find the best coverage options for your needs and budget.

Common Mistakes to Avoid When Buying Home Insurance in Florida

When buying home insurance in Florida, it’s essential to avoid common mistakes that can lead to inadequate coverage or higher premiums. In this section, we will identify common mistakes that Florida homeowners make when buying home insurance and provide tips for avoiding these mistakes and finding the right coverage.

One of the most common mistakes that Florida homeowners make when buying home insurance is underinsuring their property. This can happen when homeowners don’t accurately assess the value of their home and its contents, leading to inadequate coverage in the event of a loss. To avoid this mistake, homeowners should carefully assess the value of their home and its contents and ensure that they have sufficient coverage.

Another common mistake that Florida homeowners make when buying home insurance is not reading policy terms and conditions. This can lead to misunderstandings about what is covered and what is not, which can result in denied claims or unexpected expenses. To avoid this mistake, homeowners should carefully read their policy terms and conditions and ask questions if they are unsure about anything.

Not shopping around is another common mistake that Florida homeowners make when buying home insurance. This can lead to higher premiums and inadequate coverage. To avoid this mistake, homeowners should shop around and compare rates from different insurance companies to find the best coverage for their needs and budget.

Not considering additional coverage options is another common mistake that Florida homeowners make when buying home insurance. This can include coverage options such as flood insurance, hurricane insurance, and sinkhole insurance. To avoid this mistake, homeowners should consider their specific risks and ensure that they have adequate coverage.

Finally, not reviewing and updating their policy regularly is another common mistake that Florida homeowners make when buying home insurance. This can lead to inadequate coverage or higher premiums. To avoid this mistake, homeowners should review and update their policy regularly to ensure that they have adequate coverage and are taking advantage of any available discounts.

By avoiding these common mistakes, Florida homeowners can find affordable home insurance in Florida and protect their homes and finances against unexpected risks. Remember to shop around, compare rates, and carefully review policy terms and conditions to find the best coverage for your needs and budget.

In addition to avoiding these common mistakes, Florida homeowners can also take steps to mitigate their risks and lower their insurance premiums. This can include installing security systems, storm shutters, and other safety features that can reduce the risk of damage or loss. By taking these steps, homeowners can find affordable home insurance in Florida and protect their homes and finances.

Florida Home Insurance Discounts and Incentives

Homeowners in Florida can take advantage of various discounts and incentives to lower their home insurance rates. Insurance companies offer these discounts to encourage homeowners to take steps to mitigate risks and reduce the likelihood of claims. By understanding the available discounts and incentives, Florida homeowners can find affordable home insurance that meets their needs and budget.

One of the most common discounts available to Florida homeowners is the security system discount. Homeowners who install a security system that meets certain standards can qualify for a discount on their home insurance premiums. This discount can range from 5% to 20% depending on the insurance company and the type of security system installed.

Another discount available to Florida homeowners is the storm shutter discount. Homeowners who install storm shutters on their windows and doors can qualify for a discount on their home insurance premiums. This discount can range from 5% to 15% depending on the insurance company and the type of storm shutters installed.

Energy-efficient upgrades can also qualify homeowners for discounts on their home insurance premiums. Homeowners who install energy-efficient appliances, windows, and doors can qualify for a discount on their home insurance premiums. This discount can range from 5% to 10% depending on the insurance company and the type of energy-efficient upgrades installed.

In addition to these discounts, some insurance companies offer discounts for homeowners who are members of certain organizations or have certain professions. For example, some insurance companies offer discounts to homeowners who are members of the military or have a certain level of education.

Homeowners in Florida can also take advantage of state-specific discounts and incentives. For example, the state of Florida offers a discount to homeowners who install wind-resistant features on their homes. This discount can range from 5% to 15% depending on the type of wind-resistant features installed.

To take advantage of these discounts and incentives, homeowners in Florida should shop around and compare rates from different insurance companies. They should also review their policy terms and conditions to ensure they are eligible for the discounts and incentives they are interested in. By doing so, homeowners in Florida can find affordable home insurance that meets their needs and budget.

Conclusion: Finding Affordable Home Insurance in Florida

Protecting a home in Florida without breaking the bank requires careful consideration and research. By understanding the importance of home insurance, shopping around for quotes, and taking advantage of discounts, homeowners can find affordable coverage that meets their needs and budget.

It’s essential for Florida homeowners to be aware of the unique risks associated with living in the state, such as hurricanes, floods, and sinkholes. By investing in specialized coverage options, such as hurricane insurance and flood insurance, homeowners can ensure they are adequately protected against these risks.

In addition to specialized coverage options, homeowners can also take advantage of discounts and incentives to lower their insurance rates. By installing security systems, storm shutters, and energy-efficient upgrades, homeowners can qualify for discounts and reduce their premiums.

Bundling home and auto insurance is another way for Florida homeowners to save money on their insurance premiums. By combining their policies with a single insurance company, homeowners can take advantage of discounts and streamline their claims processing.

Ultimately, finding affordable home insurance in Florida requires a combination of research, planning, and smart decision-making. By following the tips and strategies outlined in this article, homeowners can find the best coverage for their needs and budget, and enjoy peace of mind knowing their home is protected.

When searching for affordable home insurance in Florida, it’s crucial to shop around and compare rates from different insurance companies. Homeowners should also review their policy terms and conditions to ensure they are eligible for discounts and incentives. By taking the time to research and compare options, homeowners can find the most affordable and comprehensive coverage available.

By investing in affordable home insurance in Florida, homeowners can protect their property and financial well-being from the unique risks associated with living in the state. With the right coverage, homeowners can enjoy their Sunshine State home without worrying about the financial burden of unexpected events.