Understanding the Value of Your Time

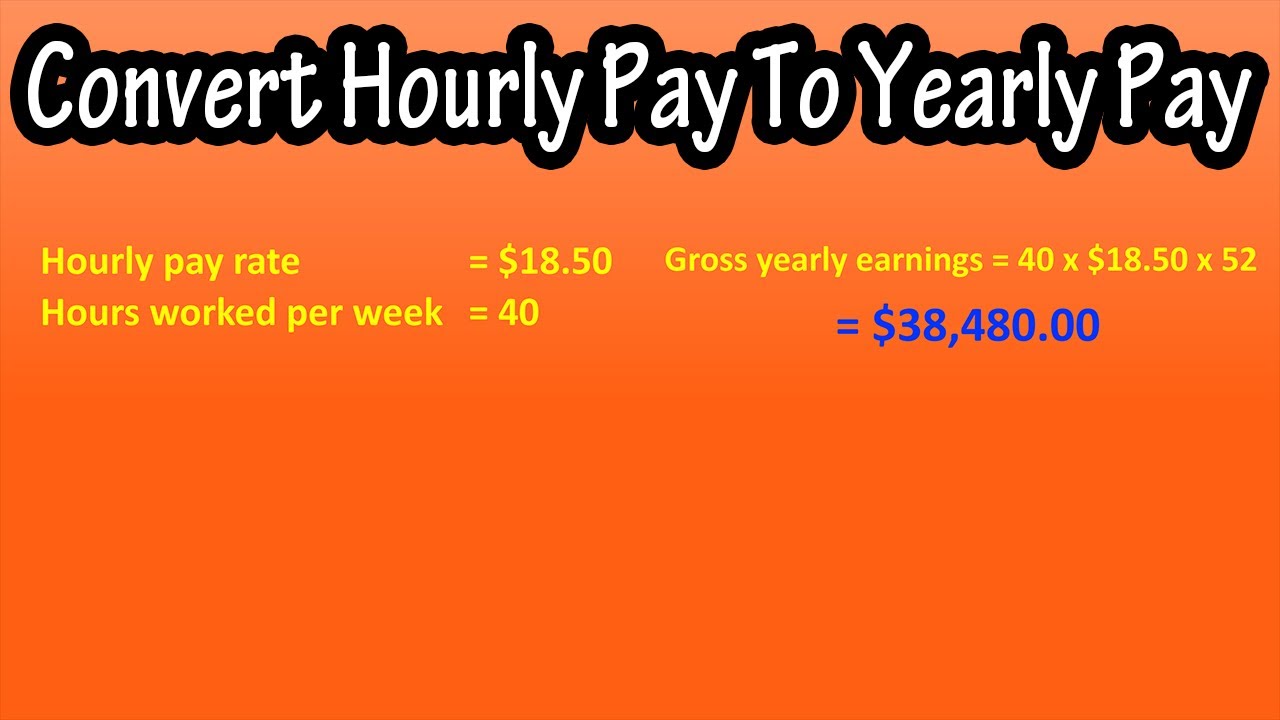

Calculating your hourly wage is a crucial step in understanding the value of your time. For individuals earning $15 an hour, it’s essential to consider how this translates to an annual income. Assuming a standard full-time schedule of 40 hours per week and 52 weeks per year, the annual income would be approximately $31,200. However, this figure does not take into account factors like taxes, benefits, and overtime pay, which can significantly impact the actual take-home pay.

For instance, taxes can range from 15% to 30% of the annual income, depending on the individual’s tax bracket and location. Benefits, such as health insurance, retirement plans, and paid time off, can also vary greatly from employer to employer. Overtime pay, on the other hand, can increase the annual income, but it’s essential to consider the impact of working extended hours on overall well-being.

To get a more accurate picture of the annual income, it’s crucial to factor in these variables. Using online calculators or consulting with a financial advisor can help individuals earning $15 an hour better understand their take-home pay and make informed decisions about their finances. By doing so, they can create a more realistic budget and make the most of their annual income.

Moreover, understanding the value of time can also help individuals prioritize their spending and make conscious financial decisions. By allocating their time and resources effectively, they can achieve a better work-life balance and make progress towards their long-term financial goals. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, having a clear understanding of the annual income is essential for making progress towards financial stability.

Creating a Budget That Works for You

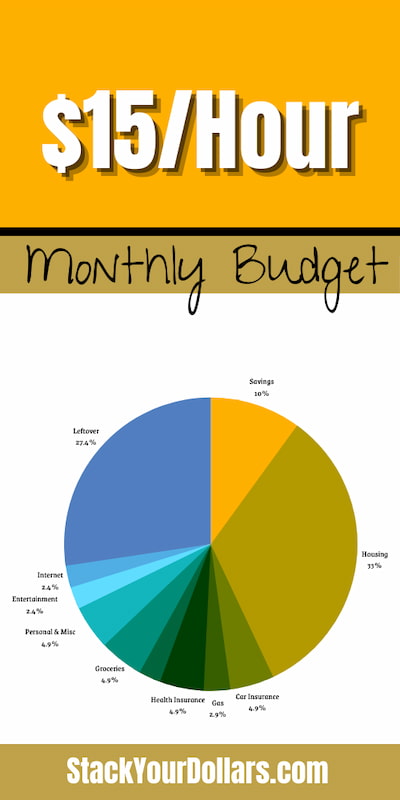

Creating a budget is a crucial step in managing your finances effectively, especially when earning an annual income of $15 an hour. A well-crafted budget helps you prioritize your spending, make conscious financial decisions, and achieve your long-term financial goals. To create a budget that works for you, start by tracking your income and expenses to understand where your money is going.

Begin by categorizing your expenses into needs, wants, and debt repayment. Needs include essential expenses like rent, utilities, and groceries, while wants include discretionary spending like dining out or entertainment. Debt repayment includes any outstanding debts, such as credit card balances or personal loans. Allocate your annual income accordingly, ensuring that you’re meeting your needs, reducing debt, and saving for the future.

Consider using the 50/30/20 rule as a guideline for allocating your income. Allocate 50% of your annual income towards needs, 30% towards wants, and 20% towards saving and debt repayment. This rule provides a flexible framework for managing your finances and achieving a balance between spending and saving.

Another essential aspect of creating a budget is to prioritize needs over wants. Ensure that you’re meeting your essential expenses before allocating money towards discretionary spending. Consider ways to reduce expenses, such as cooking at home instead of dining out or canceling subscription services you don’t use.

Investing is also a crucial aspect of creating a budget. Consider contributing to a retirement account, such as a 401(k) or IRA, to take advantage of compound interest and build wealth over time. You can also explore other investment options, such as a brokerage account or robo-advisor, to grow your wealth and achieve your long-term financial goals.

Finally, review and adjust your budget regularly to ensure that it’s working for you. Life is unpredictable, and your budget should be flexible enough to accommodate changes in your income or expenses. By creating a budget that accounts for your annual income and prioritizes your needs, you can make the most of your $15 an hour wage and achieve financial stability.

Maximizing Your Earning Potential

Individuals earning an annual income of $15 an hour can increase their earning potential by acquiring new skills, taking on additional responsibilities, or pursuing promotions. One effective way to boost earning potential is to develop in-demand skills that are highly valued by employers. This can include skills such as coding, data analysis, digital marketing, or foreign languages.

Another way to increase earning potential is to take on additional responsibilities at work. This can include volunteering for special projects, offering to help colleagues with their workload, or taking on a leadership role within the company. By demonstrating a willingness to go above and beyond, individuals can position themselves for promotions and salary increases.

Pursuing promotions is also an effective way to increase earning potential. This can involve seeking out new job opportunities within the company or exploring external job openings that offer higher salaries and better benefits. By networking with colleagues and industry professionals, individuals can stay informed about job opportunities and make strategic career moves.

Additionally, individuals can also consider starting a side hustle or freelancing to supplement their income. This can include offering services such as writing, graphic design, or consulting, or selling products online through platforms such as Etsy or eBay. By diversifying their income streams, individuals can reduce their reliance on a single source of income and increase their overall earning potential.

It’s also important to note that increasing earning potential often requires a combination of hard work, dedication, and strategic planning. By setting clear career goals and developing a plan to achieve them, individuals can position themselves for success and increase their earning potential over time.

For example, an individual earning an annual income of $15 an hour could aim to increase their salary by 10% within the next year by taking on additional responsibilities and developing new skills. By achieving this goal, they can increase their annual income to $16.50 an hour, which can have a significant impact on their overall financial stability and security.

The Power of Compound Interest: Growing Your Wealth Over Time

Compound interest is a powerful financial concept that can help individuals earning an annual income of $15 an hour grow their wealth over time. Compound interest is the interest earned on both the principal amount and any accrued interest over time. This means that the interest earned in previous periods becomes the base for the interest earned in subsequent periods, resulting in exponential growth.

For example, if an individual earning $15 an hour saves $1,000 per year in a high-yield savings account earning 2% interest, they will earn $20 in interest in the first year. In the second year, they will earn 2% interest on the new balance of $1,020, resulting in $20.40 in interest. This may not seem like a lot, but over time, the interest earned can add up significantly.

Consider the following example: an individual earning $15 an hour saves $1,000 per year for 10 years in a high-yield savings account earning 2% interest. At the end of the 10-year period, they will have saved $10,000 and earned approximately $1,200 in interest, resulting in a total balance of $11,200. This is a significant return on investment, especially considering the relatively small amount of money saved each year.

Investing in a retirement account, such as a 401(k) or IRA, can also take advantage of compound interest. These accounts offer tax benefits and potentially higher returns than a traditional savings account, making them an attractive option for individuals looking to grow their wealth over time.

It’s essential to note that compound interest requires patience and discipline. It’s crucial to start saving and investing early, as the power of compound interest grows exponentially over time. Even small, consistent savings can add up to significant returns in the long run.

For individuals earning an annual income of $15 an hour, taking advantage of compound interest can be a game-changer. By starting to save and invest early, they can build wealth over time and achieve long-term financial stability. Whether it’s through a high-yield savings account or a retirement account, compound interest can help individuals earning $15 an hour make the most of their annual income.

How to Make the Most of Your Annual Income

Individuals earning an annual income of $15 an hour can make the most of their income by implementing strategies to reduce expenses, increase income, and build wealth. One effective way to reduce expenses is to create a budget that accounts for all necessary expenses, such as rent, utilities, and groceries. By prioritizing essential expenses and cutting back on discretionary spending, individuals can free up more money in their budget to save and invest.

Another way to make the most of your annual income is to increase your income through side hustles or freelance work. This can include offering services such as writing, graphic design, or consulting, or selling products online through platforms such as Etsy or eBay. By diversifying your income streams, you can reduce your reliance on a single source of income and increase your overall earning potential.

Building wealth is also an important aspect of making the most of your annual income. This can include investing in a retirement account, such as a 401(k) or IRA, or investing in a taxable brokerage account. By starting to save and invest early, individuals can take advantage of compound interest and build wealth over time.

Additionally, individuals can also make the most of their annual income by taking advantage of tax-advantaged accounts, such as a Roth IRA or a Health Savings Account (HSA). These accounts offer tax benefits and can help individuals save for specific expenses, such as retirement or medical expenses.

It’s also important to note that making the most of your annual income requires discipline and patience. By creating a budget, increasing income, and building wealth, individuals can achieve long-term financial stability and security. However, it’s essential to avoid getting caught up in get-rich-quick schemes or investing in high-risk investments that can put your financial stability at risk.

For example, an individual earning $15 an hour can make the most of their annual income by creating a budget that allocates 50% of their income towards essential expenses, 30% towards discretionary spending, and 20% towards saving and investing. By following this budget and taking advantage of tax-advantaged accounts, individuals can build wealth over time and achieve long-term financial stability.

Real-Life Examples of Successful Budgeting and Investing

Individuals earning an annual income of $15 an hour can learn from real-life examples of successful budgeting and investing. For instance, Sarah, a 30-year-old administrative assistant, earns $15 an hour and has been able to save $10,000 in her emergency fund by creating a budget that allocates 50% of her income towards essential expenses, 30% towards discretionary spending, and 20% towards saving and investing.

Sarah’s budgeting strategy includes using the 50/30/20 rule, which has helped her prioritize her expenses and make conscious financial decisions. She also takes advantage of tax-advantaged accounts, such as a Roth IRA, to save for retirement and other long-term goals.

Another example is John, a 40-year-old maintenance worker, who earns $15 an hour and has been able to increase his income by taking on a side hustle as a freelance writer. John’s side hustle has allowed him to earn an additional $5,000 per year, which he uses to pay off debt and build wealth.

John’s investing strategy includes using a taxable brokerage account to invest in a diversified portfolio of stocks and bonds. He also takes advantage of dollar-cost averaging to reduce his investment risk and increase his potential returns.

These real-life examples demonstrate that individuals earning an annual income of $15 an hour can achieve financial stability and security by creating a budget, investing in tax-advantaged accounts, and taking advantage of side hustles and freelance work. By following these strategies, individuals can build wealth over time and achieve their long-term financial goals.

It’s also important to note that successful budgeting and investing require discipline and patience. Individuals must be willing to make sacrifices and prioritize their financial goals in order to achieve success. However, with the right strategies and mindset, individuals earning an annual income of $15 an hour can achieve financial stability and security.

Overcoming Financial Challenges and Setbacks

Individuals earning an annual income of $15 an hour may face various financial challenges and setbacks, including debt, financial emergencies, and unexpected expenses. To overcome these challenges, it’s essential to have a solid financial plan in place, including a budget, emergency fund, and debt repayment strategy.

One common financial challenge faced by individuals on a $15 an hour wage is debt. To overcome debt, it’s essential to create a debt repayment plan that prioritizes high-interest debt, such as credit card balances, and focuses on paying off debt quickly. Consider consolidating debt into a lower-interest loan or balance transfer credit card, and make timely payments to avoid late fees and interest charges.

Another financial challenge is financial emergencies, such as car repairs or medical bills. To overcome financial emergencies, it’s essential to have an emergency fund in place that covers 3-6 months of living expenses. This fund can provide a cushion against unexpected expenses and help individuals avoid going into debt.

Unexpected expenses, such as car maintenance or home repairs, can also be a financial challenge. To overcome unexpected expenses, it’s essential to prioritize needs over wants and make adjustments to the budget as needed. Consider setting aside a small amount each month for unexpected expenses, and prioritize essential expenses, such as rent/mortgage, utilities, and groceries.

Finally, individuals on a $15 an hour wage may face financial setbacks, such as job loss or reduced hours. To overcome financial setbacks, it’s essential to have a plan in place, including a budget, emergency fund, and debt repayment strategy. Consider seeking assistance from a financial advisor or credit counselor, and prioritize essential expenses to ensure financial stability.

By having a solid financial plan in place, individuals earning an annual income of $15 an hour can overcome financial challenges and setbacks, and achieve long-term financial stability and security.

Building a Secure Financial Future

Creating a secure financial future is crucial for individuals earning an annual income of $15 an hour. By following the tips and strategies outlined in this article, individuals can make the most of their annual income, reduce expenses, increase income, and build wealth over time.

First and foremost, it’s essential to create a budget that accounts for all necessary expenses, including rent/mortgage, utilities, groceries, and transportation. By prioritizing essential expenses and cutting back on discretionary spending, individuals can free up more money in their budget to save and invest.

Next, individuals should focus on increasing their income through side hustles, freelance work, or pursuing promotions. By diversifying their income streams, individuals can reduce their reliance on a single source of income and increase their overall earning potential.

In addition to increasing income, individuals should also focus on building wealth over time. This can be achieved through saving and investing in a diversified portfolio of stocks, bonds, and other assets. By taking advantage of compound interest and dollar-cost averaging, individuals can grow their wealth over time and achieve long-term financial stability.

Finally, individuals should prioritize their financial goals and create a plan to achieve them. This may include paying off debt, building an emergency fund, or saving for retirement. By staying focused and motivated, individuals can overcome financial challenges and setbacks and achieve a secure financial future.

In conclusion, earning an annual income of $15 an hour requires careful financial planning and management. By creating a budget, increasing income, building wealth, and prioritizing financial goals, individuals can make the most of their annual income and achieve a secure financial future.