What Does $15 an Hour Really Mean for Your Finances?

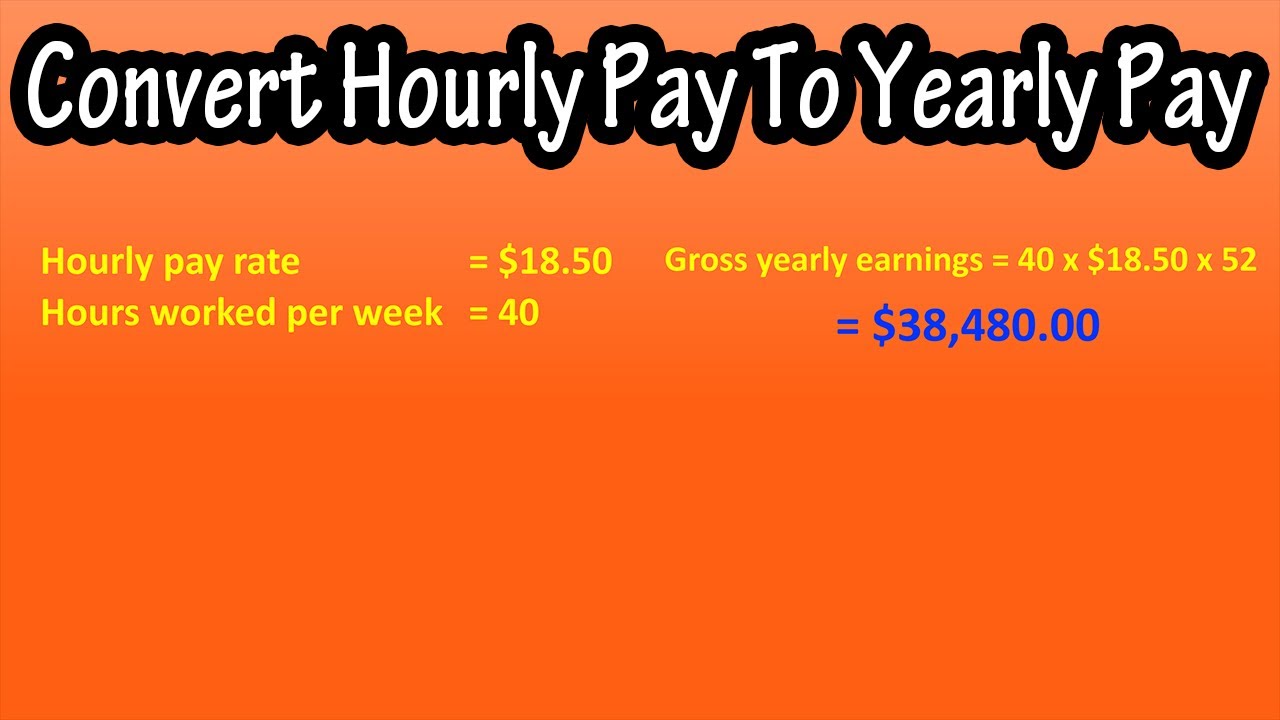

Earning $15 an hour can have a significant impact on your finances, but it’s essential to understand the bigger picture. Assuming a 40-hour workweek and 52 weeks per year, an annual income of $15 an hour translates to approximately $31,200 per year. This amount is slightly above the national average for many entry-level positions, but it’s crucial to consider the cost of living in your area and how this income will affect your daily life.

For instance, in cities with a high cost of living, such as San Francisco or New York, $31,200 per year may not be enough to cover basic expenses like housing, food, and transportation. In contrast, in areas with a lower cost of living, this income can provide a relatively comfortable lifestyle. It’s essential to create a budget that accounts for your specific expenses and financial goals.

When evaluating the annual income of $15 an hour, it’s also important to consider the potential for overtime pay and benefits. Many employers offer benefits like health insurance, retirement plans, and paid time off, which can add significant value to your overall compensation package. Additionally, overtime pay can increase your annual income, but it’s crucial to weigh the pros and cons of working extra hours and how it may impact your work-life balance.

To put this income into perspective, here are some examples of how $31,200 per year can be allocated:

- Housing: 30% of annual income ($9,360 per year) for rent or mortgage payments

- Food: 10% of annual income ($3,120 per year) for groceries and dining out

- Transportation: 10% of annual income ($3,120 per year) for car payments, insurance, and gas

- Savings: 10% of annual income ($3,120 per year) for emergency funds and retirement

- Entertainment and miscellaneous: 40% of annual income ($12,480 per year) for hobbies, travel, and unexpected expenses

Keep in mind that these are rough estimates, and your individual circumstances may vary. However, this breakdown should give you a general idea of how $15 an hour can impact your finances and help you create a budget that suits your needs.

How to Make the Most of a $15 an Hour Job: Budgeting and Saving Strategies

Creating a budget is essential to making the most of a $15 an hour job. The 50/30/20 rule is a simple and effective way to allocate your income. Allocate 50% of your annual income of $15 an hour towards necessary expenses like housing, utilities, and food. Use 30% for discretionary spending like entertainment, hobbies, and travel. And, put 20% towards saving and debt repayment.

Emergency funds are also crucial to financial stability. Aim to save 3-6 months’ worth of living expenses in an easily accessible savings account. This fund will help you cover unexpected expenses, avoiding debt and financial stress.

Reducing expenses is another key aspect of budgeting. Identify areas where you can cut back on unnecessary spending, such as subscription services, dining out, or entertainment. Consider ways to lower your necessary expenses, like finding a roommate to split housing costs or canceling subscription services.

Utilize budgeting apps and tools to track your expenses and stay on top of your finances. Some popular options include:

- Mint: A free app that tracks your spending, creates a budget, and sets financial goals.

- Personal Capital: A free app that helps you track your income and expenses, investments, and debts.

- YNAB (You Need a Budget): A paid app that provides a comprehensive budgeting system and investment tracking.

Additionally, consider implementing a “pay yourself first” approach, where you set aside a portion of your income for savings and investments before spending on other things. This will help you prioritize your financial goals and make the most of your $15 an hour income.

By following these budgeting and saving strategies, you can make the most of your annual income of $15 an hour and achieve financial stability. Remember to regularly review and adjust your budget to ensure you’re on track to meet your financial goals.

The Impact of Overtime and Benefits on Your Annual Income

Overtime pay and benefits can significantly impact your annual income, making it essential to understand how they work. Overtime pay is typically 1.5 times the regular hourly rate, which can increase your annual income of $15 an hour. However, working overtime can also impact your work-life balance, leading to burnout and decreased productivity.

Benefits, on the other hand, can add substantial value to your overall compensation package. Health insurance, retirement plans, and paid time off are just a few examples of benefits that can increase your annual income. For instance, if your employer offers a 401(k) matching program, you can contribute a portion of your income to the plan, and your employer will match it, increasing your retirement savings.

Other benefits, such as health insurance premiums, can also reduce your taxable income. By understanding the different types of benefits and how they impact your annual income, you can make informed decisions about your compensation package and optimize your earnings.

Here are some examples of benefits that can impact your annual income:

- Health insurance: A $300 monthly premium can reduce your taxable income by $3,600 per year.

- Retirement plans: A 401(k) matching program can increase your retirement savings by $1,000 to $2,000 per year.

- Paid time off: 10 days of paid vacation per year can increase your annual income by $1,500 to $3,000.

When evaluating the impact of overtime and benefits on your annual income, consider the following:

- Overtime pay: Calculate the additional income earned from working overtime and consider the potential impact on your work-life balance.

- Benefits: Evaluate the value of benefits, such as health insurance and retirement plans, and consider how they can increase your annual income.

- Compensation package: Consider the overall value of your compensation package, including salary, benefits, and overtime pay, to ensure you’re optimizing your earnings.

By understanding the impact of overtime and benefits on your annual income, you can make informed decisions about your compensation package and increase your earnings potential.

How to Increase Your Earning Potential Beyond $15 an Hour

While earning $15 an hour can provide a comfortable lifestyle, increasing your earning potential can lead to even greater financial stability and opportunities. Acquiring new skills, pursuing certifications or education, and negotiating salary are just a few ways to boost your earning potential.

Investing in your education and skills can significantly impact your earning potential. Consider pursuing certifications or degrees in high-demand fields, such as technology, healthcare, or finance. This can lead to higher-paying job opportunities and increased earning potential.

Networking and building professional relationships are also crucial to increasing your earning potential. Attend industry events, join professional organizations, and connect with colleagues and mentors to build a strong network. This can lead to job opportunities, promotions, and increased earning potential.

Negotiating salary is another key aspect of increasing your earning potential. Research the market value of your role and industry, and prepare a solid case for why you deserve a higher salary. This can lead to increased earning potential and a more comfortable lifestyle.

Here are some examples of high-demand jobs that pay more than $15 an hour:

- Software developer: $30-$50 per hour

- Nurse practitioner: $40-$60 per hour

- Financial analyst: $25-$40 per hour

- Data scientist: $30-$50 per hour

Additionally, consider the following strategies to increase your earning potential:

- Freelancing or consulting: Offer your skills and expertise on a freelance or consulting basis to increase your earning potential.

- Starting a side business: Start a side business or entrepreneurial venture to increase your earning potential and build wealth.

- Investing in stocks or real estate: Invest in stocks or real estate to build wealth and increase your earning potential.

By acquiring new skills, pursuing certifications or education, negotiating salary, and building a strong network, you can increase your earning potential and achieve a more comfortable lifestyle.

The Role of Taxes and Deductions in Your Annual Income

Taxes and deductions play a significant role in determining your take-home pay, and it’s essential to understand how they impact your annual income of $15 an hour. The amount of taxes you pay depends on your income level, filing status, and the number of dependents you claim.

Federal income taxes are typically the largest tax deduction from your paycheck. The federal income tax rate ranges from 10% to 37%, depending on your income level. State and local taxes can also impact your take-home pay, with rates varying depending on where you live.

Deductions, on the other hand, can reduce your taxable income, resulting in a lower tax bill. Common deductions include:

- 401(k) contributions: Contributions to a 401(k) plan can reduce your taxable income, and the funds grow tax-deferred.

- Health insurance premiums: Premiums paid for health insurance can be deducted from your taxable income.

- Charitable donations: Donations to qualified charitable organizations can be deducted from your taxable income.

Understanding how taxes and deductions impact your annual income of $15 an hour can help you make informed decisions about your finances. By maximizing your deductions and minimizing your taxes, you can increase your take-home pay and achieve a more comfortable lifestyle.

Here’s an example of how taxes and deductions can impact your annual income of $15 an hour:

- Gross income: $31,200 per year (based on 40 hours/week and 52 weeks/year)

- Federal income taxes: 20% of gross income (approximately $6,240 per year)

- State and local taxes: 5% of gross income (approximately $1,560 per year)

- Deductions: 401(k) contributions (5% of gross income, approximately $1,560 per year)

- Take-home pay: approximately $22,800 per year

By understanding the role of taxes and deductions in your annual income, you can make informed decisions about your finances and optimize your take-home pay.

Comparing $15 an Hour to Other Income Levels: A Reality Check

When considering the annual income of $15 an hour, it’s essential to compare it to other income levels to gain a better understanding of its value. The minimum wage, for example, is currently $7.25 per hour, which translates to an annual income of $15,080. While $15 an hour is significantly higher than the minimum wage, it’s still important to consider the pros and cons of each income level.

On the other hand, higher-paying jobs can offer significantly more than $15 an hour. For instance, a software engineer can earn an average of $40 per hour, which translates to an annual income of $83,200. However, these jobs often require specialized skills and education, and may come with higher levels of stress and responsibility.

Here’s a comparison of the annual income of $15 an hour to other income levels:

- Minimum wage: $7.25 per hour, $15,080 per year

- $15 an hour: $31,200 per year

- $25 an hour: $52,000 per year

- $40 an hour: $83,200 per year

As you can see, the annual income of $15 an hour falls somewhere in the middle of these income levels. While it’s not the highest-paying job, it’s still a relatively comfortable income that can provide a good standard of living.

However, it’s essential to consider the pros and cons of each income level, including the impact on lifestyle and financial stability. For example:

- Minimum wage: May not be enough to cover basic expenses, leading to financial stress and instability.

- $15 an hour: Can provide a comfortable standard of living, but may not offer much room for savings or investments.

- Higher-paying jobs: Can offer greater financial stability and opportunities for savings and investments, but may come with higher levels of stress and responsibility.

Ultimately, the annual income of $15 an hour can provide a good standard of living, but it’s essential to consider the pros and cons of each income level and make informed decisions about your finances.

Success Stories: People Who Have Thrived on a $15 an Hour Income

While earning $15 an hour may not be the highest-paying job, many individuals have successfully managed their finances and achieved their goals on this income. Here are a few inspiring stories:

Meet Sarah, a single mother who works as a customer service representative earning $15 an hour. Despite the challenges of raising a child on her own, Sarah has managed to create a budget that works for her. She allocates 50% of her income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. Sarah has also taken advantage of her company’s 401(k) matching program and has started saving for her child’s education.

Then there’s John, a recent college graduate who works as a data analyst earning $15 an hour. John has prioritized saving and investing, and has managed to save 20% of his income each month. He has also taken advantage of his company’s health insurance benefits and has started building an emergency fund.

These individuals are just a few examples of people who have thrived on a $15 an hour income. By creating a budget, saving, and investing, they have managed to achieve financial stability and security.

Here are some common traits among individuals who have successfully managed their finances on a $15 an hour income:

- They create a budget and stick to it.

- They prioritize saving and investing.

- They take advantage of employer-matched retirement accounts.

- They build an emergency fund.

- They invest in their education and skills.

By following these strategies, individuals can make the most of their $15 an hour income and achieve financial stability and security.

Conclusion: Making the Most of a $15 an Hour Income

In conclusion, earning $15 an hour can provide a comfortable lifestyle, but it’s essential to make the most of this income by budgeting, saving, and increasing earning potential. By understanding the impact of taxes and deductions, comparing this income to other income levels, and learning from success stories, individuals can take control of their finances and achieve financial stability and security.

Remember, the annual income of $15 an hour is just a starting point. By acquiring new skills, pursuing certifications or education, and negotiating salary, individuals can increase their earning potential and achieve their long-term financial goals.

Ultimately, making the most of a $15 an hour income requires discipline, patience, and a willingness to learn and adapt. By following the strategies outlined in this article, individuals can unlock a comfortable lifestyle and achieve financial freedom.

Key takeaways:

- Create a budget and stick to it.

- Save and invest for the future.

- Take advantage of employer-matched retirement accounts.

- Build an emergency fund.

- Invest in your education and skills.

By following these tips and staying committed to your financial goals, you can make the most of your $15 an hour income and achieve a comfortable lifestyle.