What Does $15 an Hour Really Mean for Your Finances?

Earning $15 an hour can have a significant impact on one’s lifestyle and financial stability. To understand the true value of this hourly wage, it’s essential to calculate the annual income it translates to. Assuming a full-time schedule of 40 hours per week and 52 weeks per year, the annual income would be approximately $31,200. This amount can provide a comfortable lifestyle, covering basic needs such as housing, food, and transportation, as well as allowing for some savings and debt repayment.

However, the reality of earning $15 an hour can vary greatly depending on individual circumstances. For instance, those living in areas with a high cost of living may find it challenging to make ends meet, while those in areas with a lower cost of living may enjoy a more comfortable lifestyle. Additionally, factors such as taxes, health insurance, and other benefits can impact take-home pay, affecting the overall annual income.

Despite these variations, earning $15 an hour can provide a solid foundation for financial stability. With careful budgeting and planning, individuals can make the most of their income, allocating funds towards essential expenses, savings, and debt repayment. This, in turn, can lead to long-term financial stability and a more comfortable lifestyle.

For example, consider an individual who earns $15 an hour and works 40 hours per week. After deducting taxes and other expenses, their take-home pay might be around $2,400 per month. With a budget that allocates 50% towards essential expenses, 30% towards savings and debt repayment, and 20% towards discretionary spending, this individual can make the most of their annual income of $31,200.

In conclusion, earning $15 an hour can provide a comfortable lifestyle and financial stability, but it’s crucial to consider individual circumstances and factors that impact take-home pay. By understanding the true value of this hourly wage and creating a budget that works, individuals can make the most of their annual income and achieve long-term financial stability.

Calculating Your Annual Income: A Step-by-Step Guide

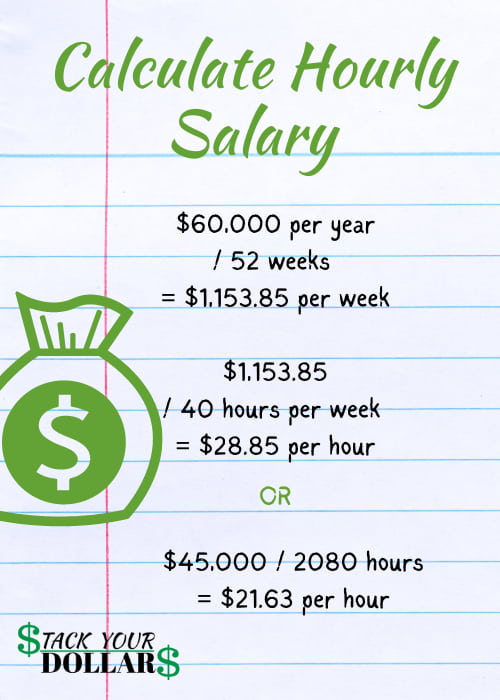

Calculating your annual income based on an hourly wage of $15 can be a straightforward process. To determine your annual income, you’ll need to know the number of hours you work per week and the number of weeks you work per year. Here’s a step-by-step guide to help you calculate your annual income:

Step 1: Determine your hourly wage. In this case, it’s $15 per hour.

Step 2: Calculate the number of hours you work per week. This can vary depending on your schedule, but for this example, let’s assume you work 40 hours per week.

Step 3: Calculate the number of weeks you work per year. This can also vary, but for this example, let’s assume you work 52 weeks per year.

Step 4: Multiply the number of hours you work per week by the number of weeks you work per year. This will give you your total hours worked per year. In this case, it’s 40 hours/week x 52 weeks/year = 2,080 hours/year.

Step 5: Multiply your total hours worked per year by your hourly wage. This will give you your annual income. In this case, it’s 2,080 hours/year x $15/hour = $31,200 per year.

As you can see, calculating your annual income based on an hourly wage of $15 is a simple process. However, it’s essential to consider other factors that can impact your take-home pay, such as taxes, health insurance, and other benefits.

For example, if you work part-time or have an irregular schedule, your annual income may be lower. Let’s say you work 20 hours per week and 26 weeks per year. Your total hours worked per year would be 20 hours/week x 26 weeks/year = 520 hours/year. Your annual income would be 520 hours/year x $15/hour = $7,800 per year.

On the other hand, if you work overtime or have a side hustle, your annual income may be higher. Let’s say you work 50 hours per week and 52 weeks per year, and you also earn an additional $5,000 per year from a side hustle. Your total hours worked per year would be 50 hours/week x 52 weeks/year = 2,600 hours/year. Your annual income would be 2,600 hours/year x $15/hour = $39,000 per year, plus the additional $5,000 from your side hustle, for a total annual income of $44,000.

By understanding how to calculate your annual income based on an hourly wage of $15, you can better plan your finances and make informed decisions about your career and lifestyle.

How to Make the Most of Your $15 an Hour Income

Earning $15 an hour can provide a comfortable lifestyle, but it’s essential to make the most of your income to achieve long-term financial stability. Here are some tips and strategies to help you maximize your earnings:

1. Negotiate raises: If you’re currently earning $15 an hour, it’s essential to negotiate raises to increase your income. Research the market rate for your job and make a strong case for why you deserve a raise. This can help you earn an additional $1-2 per hour, which can translate to an extra $2,000-4,000 per year.

2. Take on side hustles: Side hustles can provide an additional source of income, which can help you earn more than $15 an hour. Consider freelancing, tutoring, or selling products online. This can help you earn an extra $5-10 per hour, which can translate to an extra $10,000-20,000 per year.

3. Invest in personal development: Investing in personal development can help you increase your earning potential. Consider taking courses or getting certified in a specific skill. This can help you earn an additional $2-5 per hour, which can translate to an extra $4,000-10,000 per year.

4. Budget and save: Budgeting and saving are essential to making the most of your income. Create a budget that allocates 50% of your income towards essential expenses, 30% towards savings and debt repayment, and 20% towards discretionary spending. This can help you save an extra $5,000-10,000 per year.

5. Invest in a retirement account: Investing in a retirement account can help you save for the future. Consider contributing to a 401(k) or IRA. This can help you save an extra $5,000-10,000 per year.

By implementing these strategies, you can make the most of your $15 an hour income and achieve long-term financial stability. Remember to regularly review and adjust your budget to ensure you’re on track to meet your financial goals.

For example, let’s say you earn $15 an hour and work 40 hours per week. Your annual income would be $31,200. By negotiating a raise, taking on a side hustle, and investing in personal development, you can increase your income to $40,000-50,000 per year. This can provide a more comfortable lifestyle and help you achieve long-term financial stability.

In addition to these strategies, it’s essential to consider the impact of taxes on your income. Taxes can reduce your take-home pay, so it’s essential to understand how to minimize tax liabilities and maximize net earnings. By following these tips and strategies, you can make the most of your $15 an hour income and achieve long-term financial stability.

Comparing $15 an Hour to the National Average: Is it a Good Income?

The national average income varies depending on the region, industry, and occupation. According to the Bureau of Labor Statistics, the median hourly wage for all occupations in the United States was $25.72 in May 2020. In comparison, $15 an hour is slightly below the national average.

However, it’s essential to consider the cost of living in different regions. For example, $15 an hour may be a good income in areas with a low cost of living, such as the Midwest or the South. In contrast, $15 an hour may not be enough to cover the high cost of living in areas like New York City or San Francisco.

Pros of earning $15 an hour include:

- A stable income that can cover basic needs, such as housing, food, and transportation.

- Opportunities for advancement and career growth, especially in industries with a high demand for skilled workers.

- A sense of financial security and stability, which can reduce stress and improve overall well-being.

Cons of earning $15 an hour include:

- A relatively low income compared to the national average, which may limit financial flexibility and opportunities for savings and investment.

- Difficulty affording luxuries or discretionary expenses, such as travel or entertainment.

- Potential for income stagnation, especially in industries with limited opportunities for advancement or wage growth.

Ultimately, whether $15 an hour is a good income depends on individual circumstances, including the cost of living, occupation, and personal financial goals. By understanding the pros and cons of earning $15 an hour, individuals can make informed decisions about their career and financial future.

For example, let’s say you earn $15 an hour and work 40 hours per week. Your annual income would be $31,200. While this may not be a high income compared to the national average, it can still provide a comfortable lifestyle in areas with a low cost of living. Additionally, with opportunities for advancement and career growth, you may be able to increase your income over time.

In contrast, if you live in an area with a high cost of living, $15 an hour may not be enough to cover your expenses. In this case, you may need to consider alternative career options or seek additional income sources to achieve financial stability.

Jobs That Pay $15 an Hour: Exploring Your Career Options

Earning an annual income of $15 an hour can provide a comfortable lifestyle, but it’s essential to explore career options that offer this wage. Various jobs across different industries pay around $15 an hour, including entry-level positions, skilled trades, and professional roles. Understanding the job market, required skills, and growth opportunities can help individuals make informed decisions about their careers.

Entry-level jobs that pay $15 an hour often require minimal education or training. Examples include retail managers, customer service representatives, and data entry clerks. These roles can provide a stepping stone for career advancement and may offer opportunities for professional development.

Skilled trades, such as electricians, plumbers, and HVAC technicians, can also earn an annual income of $15 an hour. These jobs typically require specialized training or certification and offer a sense of job security and stability.

Professional roles, including marketing coordinators, human resources assistants, and software developers, may also pay around $15 an hour. These positions often require a degree or relevant work experience and offer opportunities for career growth and advancement.

When exploring career options, it’s crucial to research the job market and required skills. This can help individuals understand the demand for certain jobs, the level of competition, and the potential for growth. Additionally, considering factors such as work-life balance, job satisfaction, and opportunities for professional development can help individuals make informed decisions about their careers.

Some examples of jobs that pay around $15 an hour include:

- Retail Manager: $14.90 – $16.50 per hour

- Customer Service Representative: $14.50 – $16.00 per hour

- Data Entry Clerk: $14.00 – $15.50 per hour

- Electrician: $15.00 – $20.00 per hour

- Marketing Coordinator: $15.50 – $18.00 per hour

- Software Developer: $16.00 – $25.00 per hour

Keep in mind that salaries can vary depending on location, industry, and experience. It’s essential to research the job market and required skills to understand the potential earning potential and growth opportunities.

The Impact of Taxes on Your $15 an Hour Income

Taxes play a significant role in determining take-home pay, and understanding their impact is crucial for individuals earning an annual income of $15 an hour. The amount of taxes owed depends on various factors, including tax brackets, deductions, and exemptions. In this section, we will explore how taxes affect $15 an hour income and provide tips on minimizing tax liabilities and maximizing net earnings.

Federal income taxes are typically withheld from an employee’s paycheck, and the amount withheld depends on the tax bracket. For a single person earning $15 an hour, or approximately $31,200 per year, the federal income tax rate is around 12%. However, this rate may vary depending on the individual’s tax situation and the number of dependents claimed.

In addition to federal income taxes, individuals may also be subject to state and local taxes. These taxes can range from 0% to over 9%, depending on the state and locality. For example, someone earning $15 an hour in California would pay around 9% in state income taxes, while someone in Texas would pay no state income taxes.

To minimize tax liabilities and maximize net earnings, individuals can take advantage of various tax deductions and exemptions. For example, contributions to a 401(k) or IRA can reduce taxable income, while deductions for mortgage interest, charitable donations, and medical expenses can also lower tax liabilities.

Here are some examples of how different tax scenarios can impact take-home pay for someone earning $15 an hour:

- Single person with no dependents, earning $31,200 per year:

- Federal income taxes: 12% (approximately $3,744 per year)

- State income taxes (California): 9% (approximately $2,808 per year)

- Take-home pay: approximately $24,648 per year

- Single person with one dependent, earning $31,200 per year:

- Federal income taxes: 10% (approximately $3,120 per year)

- State income taxes (Texas): 0% (approximately $0 per year)

- Take-home pay: approximately $28,080 per year

As shown in these examples, taxes can significantly impact take-home pay. By understanding how taxes work and taking advantage of available deductions and exemptions, individuals can minimize their tax liabilities and maximize their net earnings.

To make the most of a $15 an hour income, it’s essential to consider taxes when creating a budget and financial plan. By accounting for taxes and taking steps to minimize tax liabilities, individuals can ensure they have enough money to cover essential expenses, save for the future, and achieve long-term financial stability.

Creating a Budget That Works for You: A $15 an Hour Income Example

Creating a budget is a crucial step in managing finances, especially when earning an annual income of $15 an hour. A well-crafted budget can help individuals prioritize expenses, save for the future, and achieve long-term financial stability. In this section, we will provide a sample budget for someone earning $15 an hour, highlighting allocations for essential expenses, savings, and debt repayment.

Assuming a 40-hour workweek and 52 weeks per year, an individual earning $15 an hour can expect to earn approximately $31,200 per year. After taxes, the take-home pay would be around $24,000 to $26,000 per year, depending on the tax bracket and deductions.

Here is a sample budget for someone earning $15 an hour:

- Essential Expenses (50% of take-home pay):

- Rent/Mortgage: 25% (approximately $500 to $600 per month)

- Utilities (electricity, water, gas, internet): 5% (approximately $100 to $150 per month)

- Food: 10% (approximately $200 to $250 per month)

- Transportation (car payment, insurance, gas): 5% (approximately $100 to $150 per month)

- Minimum debt payments (credit cards, loans): 5% (approximately $100 to $150 per month)

- Savings (20% of take-home pay):

- Emergency fund: 10% (approximately $200 to $250 per month)

- Retirement savings (401(k), IRA): 5% (approximately $100 to $150 per month)

- Other savings goals (college fund, down payment): 5% (approximately $100 to $150 per month)

- Debt Repayment (10% of take-home pay):

- Credit card debt: 5% (approximately $100 to $150 per month)

- Student loans: 3% (approximately $60 to $90 per month)

- Personal loans: 2% (approximately $40 to $60 per month)

- Discretionary Income (20% of take-home pay):

- Entertainment (dining out, movies, hobbies): 10% (approximately $200 to $250 per month)

- Travel: 5% (approximately $100 to $150 per month)

- Personal expenses (gym membership, pet expenses): 5% (approximately $100 to $150 per month)

This sample budget allocates 50% of take-home pay towards essential expenses, 20% towards savings, 10% towards debt repayment, and 20% towards discretionary income. Of course, this is just a starting point, and individuals can adjust the budget to suit their specific needs and financial goals.

Regularly reviewing and adjusting the budget is crucial to ensure financial stability. Individuals should track their expenses, income, and savings to identify areas for improvement and make adjustments as needed. By following this budget example and making smart financial decisions, individuals earning an annual income of $15 an hour can achieve long-term financial stability and create a comfortable lifestyle.

Conclusion: Turning $15 an Hour into a Comfortable Annual Income

Earning an annual income of $15 an hour can provide a comfortable lifestyle, but it requires careful financial planning and management. By understanding the significance of this hourly wage, calculating annual income, and making the most of earnings, individuals can achieve long-term financial stability.

Throughout this article, we have explored the various aspects of earning $15 an hour, including its impact on lifestyle, budgeting, and career opportunities. We have also discussed the importance of negotiating raises, taking on side hustles, and investing in personal development to maximize earnings.

In addition, we have analyzed the pros and cons of earning $15 an hour compared to the national average income and the cost of living in different regions. We have also provided a sample budget and emphasized the importance of regularly reviewing and adjusting one’s budget to ensure financial stability.

Ultimately, turning $15 an hour into a comfortable annual income requires a combination of financial discipline, smart decision-making, and a willingness to take control of one’s finances. By following the tips and strategies outlined in this article, individuals can unlock a comfortable lifestyle and achieve long-term financial stability.

Key takeaways from this article include:

- Earning $15 an hour can provide a comfortable lifestyle, but it requires careful financial planning and management.

- Calculating annual income and understanding the impact of taxes on take-home pay is crucial for financial stability.

- Maximizing earnings through negotiating raises, taking on side hustles, and investing in personal development is essential for long-term financial stability.

- Creating a budget and regularly reviewing and adjusting it is vital for ensuring financial stability.

- Earning $15 an hour can provide a range of career opportunities, including entry-level positions, skilled trades, and professional roles.

By taking control of their finances, exploring career opportunities, and striving for long-term financial stability, individuals earning $15 an hour can unlock a comfortable lifestyle and achieve their financial goals.