Understanding the Annual Income Potential of a $15 an Hour Job

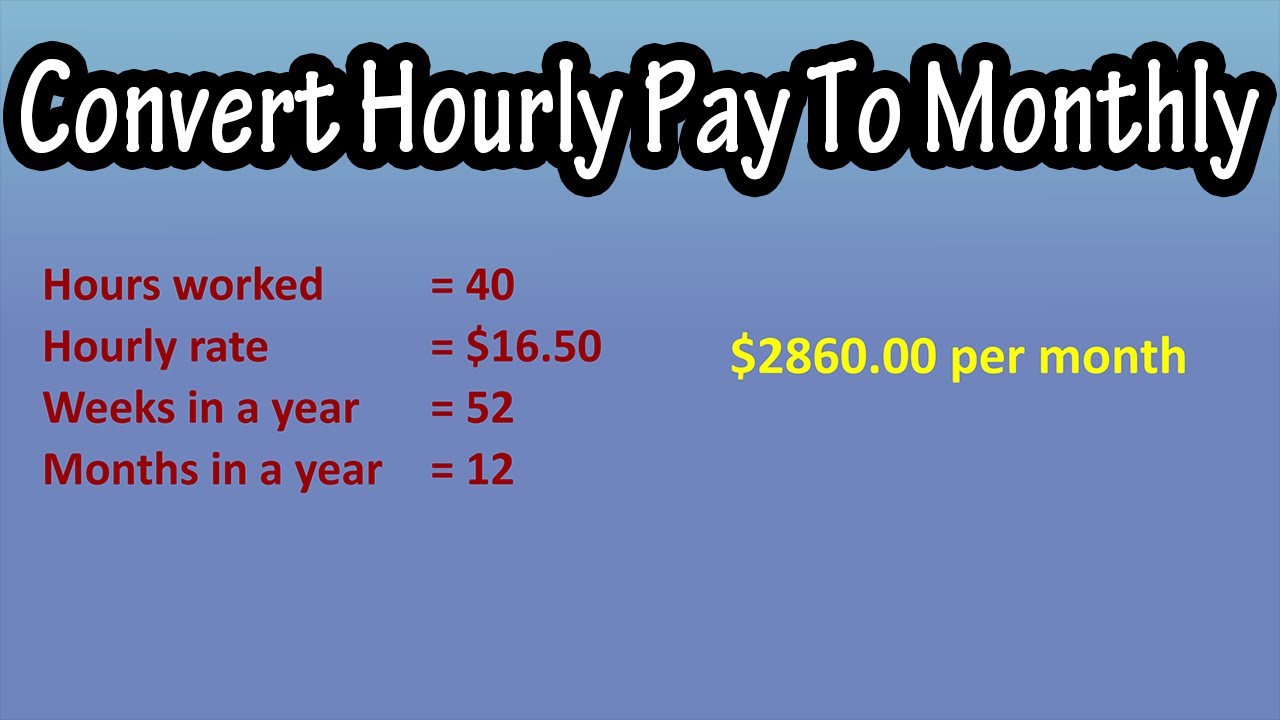

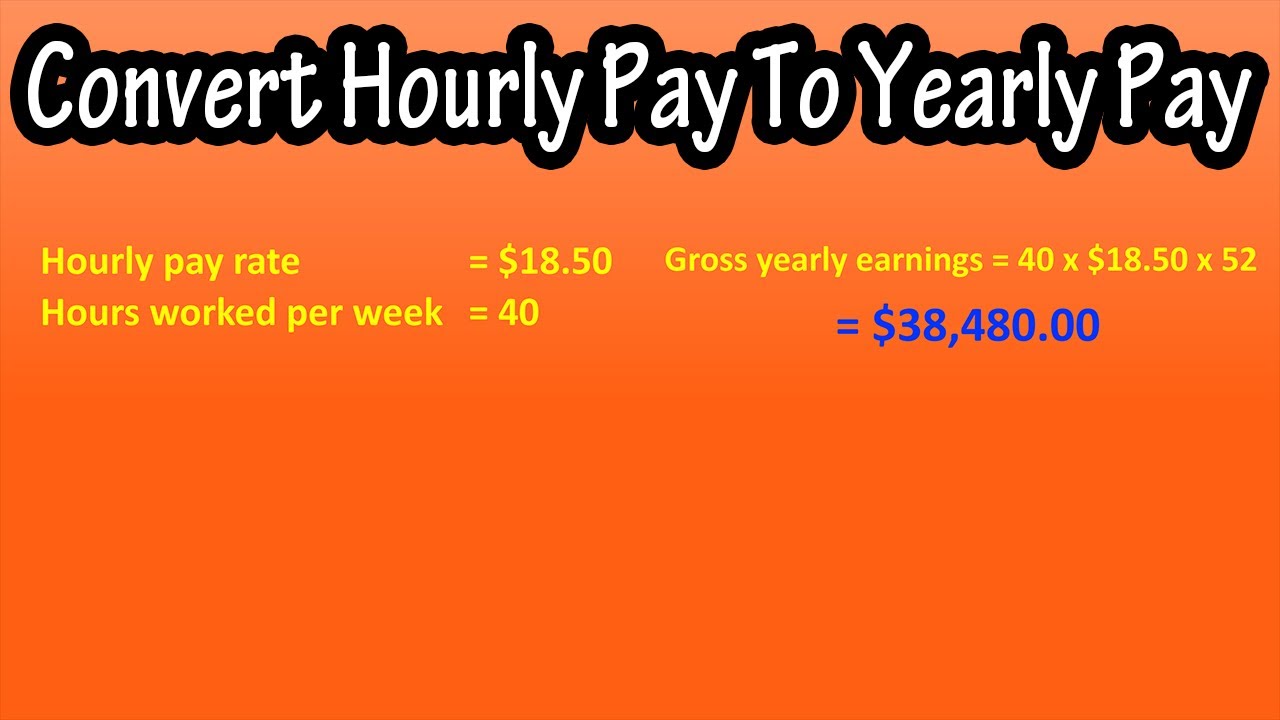

To calculate the annual income of a $15 an hour job, it’s essential to consider the number of hours worked per week and the number of weeks worked per year. Assuming a standard 40-hour workweek and 52 weeks per year, the annual income can be estimated as follows: $15/hour x 40 hours/week x 52 weeks/year = $31,200 per year. This translates to a yearly salary of $31,200, which can provide a comfortable lifestyle for individuals with modest expenses.

However, it’s crucial to note that this calculation does not take into account factors like overtime, bonuses, or benefits, which can impact the total annual income. Additionally, taxes and other deductions can reduce the take-home pay, making it essential to consider these factors when estimating the annual income of a $15 an hour job.

For instance, if an individual works 45 hours a week, their annual income would increase to $35,100 per year, assuming the same hourly wage and number of weeks worked per year. Similarly, if they work 50 hours a week, their annual income would be $39,000 per year. These examples illustrate the potential for increased earnings with additional hours worked.

It’s also important to consider the impact of inflation on the annual income of a $15 an hour job. As the cost of living increases, the purchasing power of the same hourly wage may decrease, making it essential to factor in inflation when estimating the annual income.

By understanding the calculation behind the annual income of a $15 an hour job, individuals can better plan their finances, make informed decisions about their career, and strive for a comfortable lifestyle. Whether you’re just starting out or looking to advance your career, knowing your annual income potential is crucial for achieving your financial goals.

How to Maximize Your Earnings: Tips for Boosting Your Annual Income

While a $15 an hour wage can provide a comfortable lifestyle, there are ways to increase earnings beyond the standard 40-hour workweek. One strategy is to take on overtime, which can significantly boost annual income. For example, working an additional 10 hours per week at $15 an hour can increase annual income by $7,800. However, it’s essential to consider the potential impact on work-life balance and overall well-being.

Another approach is to pursue additional income streams, such as freelancing, part-time jobs, or selling products online. These opportunities can provide a supplemental income, which can be used to pay off debt, build savings, or invest in the future. For instance, freelancing on the side can generate an additional $5,000 to $10,000 per year, depending on the type of work and the number of clients.

Negotiating raises is also an effective way to increase earnings. By researching industry standards, highlighting achievements, and making a strong case for a raise, individuals can potentially increase their annual income by $2,000 to $5,000. Additionally, asking for benefits like additional vacation time, flexible work arrangements, or professional development opportunities can also enhance overall compensation.

Furthermore, investing in education and training can lead to higher earning potential in the long run. Pursuing certifications, diplomas, or degrees can increase annual income by $5,000 to $10,000 or more, depending on the field and level of education. For example, a certified IT professional can earn up to $20 an hour, while a registered nurse can earn up to $30 an hour.

By exploring these opportunities, individuals can maximize their earnings and increase their annual income beyond the standard $15 an hour wage. Whether it’s through overtime, additional income streams, negotiating raises, or investing in education, there are ways to boost earnings and achieve a more comfortable lifestyle.

The Impact of Taxes and Benefits on Your Take-Home Pay

When considering the annual income of a $15 an hour job, it’s essential to factor in the impact of taxes and benefits on take-home pay. While the gross income may be $31,200 per year, based on a 40-hour workweek and 52 weeks per year, the net income will be lower due to taxes and other deductions.

Taxes can significantly reduce the take-home pay of a $15 an hour job. Federal income taxes, state income taxes, and payroll taxes can all take a bite out of the annual income. For example, assuming a single person with no dependents, the federal income tax rate for a $31,200 annual income would be around 12%. This translates to approximately $3,744 in federal income taxes per year.

In addition to taxes, other deductions such as health insurance premiums, retirement plan contributions, and other benefits can also reduce the take-home pay. For instance, if an employee contributes 10% of their income to a 401(k) plan, that’s an additional $3,120 per year deducted from their paycheck.

To estimate the net income of a $15 an hour job, it’s crucial to consider these deductions. A general rule of thumb is to assume 25-30% of the gross income will go towards taxes and benefits. Based on this, the net income of a $15 an hour job would be around $22,000 to $23,000 per year.

Understanding the impact of taxes and benefits on take-home pay is vital for creating a realistic budget and financial plan. By factoring in these deductions, individuals can better plan for their financial future and make the most of their annual income of $15 an hour.

Creating a Budget That Works for You: Managing Your Annual Income

Managing the annual income of a $15 an hour job requires a thoughtful and realistic budget. A budget helps individuals prioritize expenses, save for the future, and make the most of their earnings. To create a budget that works, consider the 50/30/20 rule: 50% of the net income goes towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Necessary expenses include rent/mortgage, utilities, groceries, transportation, and minimum debt payments. These expenses should be prioritized and accounted for first. For example, if the net income is $22,000 per year, or around $1,833 per month, necessary expenses might include $800 for rent, $150 for utilities, $500 for groceries, and $200 for transportation.

Discretionary spending includes entertainment, hobbies, and lifestyle upgrades. While it’s essential to enjoy life, it’s crucial to keep discretionary spending in check. Allocate 30% of the net income towards discretionary spending, and be mindful of areas where costs can be reduced. For instance, consider cooking at home instead of eating out or finding free entertainment options in the community.

Saving and debt repayment are critical components of a budget. Allocate 20% of the net income towards saving for the future, paying off high-interest debt, and building an emergency fund. Consider contributing to a retirement account, such as a 401(k) or IRA, and take advantage of employer matching contributions. Additionally, focus on paying off high-interest debt, such as credit card balances, as soon as possible.

A budget is not a one-time task; it’s an ongoing process that requires regular monitoring and adjustments. Track expenses, income, and savings progress to ensure the budget is working effectively. Make adjustments as needed to stay on track and achieve long-term financial goals.

By creating a budget that accounts for the annual income of a $15 an hour job, individuals can make the most of their earnings, achieve financial stability, and build a comfortable lifestyle. Remember to prioritize necessary expenses, keep discretionary spending in check, and focus on saving and debt repayment to ensure a secure financial future.

Investing in Your Future: Strategies for Growing Your Wealth

Investing in the future is crucial for individuals earning the annual income of $15 an hour. By making smart investment decisions, it’s possible to grow wealth over time and achieve long-term financial goals. One of the most effective ways to invest is through retirement savings plans, such as 401(k) or IRA accounts.

Many employers offer 401(k) or other retirement plans that match employee contributions. This means that for every dollar contributed to the plan, the employer will match it with a certain amount of money. For example, if an individual contributes 5% of their income to a 401(k) plan, the employer may match it with 3% or 4%. This can significantly boost the overall retirement savings over time.

In addition to retirement savings, education and training programs can also be a valuable investment. Acquiring new skills or certifications can lead to career advancement opportunities and higher earning potential. For instance, an individual earning $15 an hour may be able to increase their income to $20 or $25 an hour by acquiring specialized skills or certifications.

Other long-term investments to consider include stocks, bonds, and real estate. These investments can provide a potential source of passive income and help grow wealth over time. However, it’s essential to do thorough research and consult with a financial advisor before making any investment decisions.

When investing on a $15 an hour income, it’s crucial to start small and be consistent. Consider setting aside a fixed amount each month or from each paycheck and investing it in a diversified portfolio. This can help reduce financial stress and create a sense of security for the future.

Investing in the future requires discipline, patience, and a solid understanding of personal finance. By making informed investment decisions and taking advantage of available resources, individuals earning the annual income of $15 an hour can create a brighter financial future and achieve their long-term goals.

Some popular investment options for individuals earning $15 an hour include:

- Micro-investing apps, such as Acorns or Stash, that allow users to invest small amounts of money into a diversified portfolio.

- Robo-advisors, such as Betterment or Wealthfront, that provide automated investment management and financial planning.

- Employer-sponsored retirement plans, such as 401(k) or 403(b) plans, that offer tax benefits and potential employer matching contributions.

By exploring these options and creating a personalized investment strategy, individuals earning $15 an hour can take control of their financial future and build wealth over time.

Overcoming Financial Challenges: How to Stay Afloat on a $15 an Hour Wage

Despite careful financial planning, individuals earning the annual income of $15 an hour may still face financial challenges. Unexpected expenses, medical emergencies, or car repairs can quickly deplete savings and create financial stress. To overcome these challenges, it’s essential to have a plan in place.

Building an emergency fund is crucial for staying afloat on a $15 an hour wage. Aim to save 3-6 months’ worth of living expenses in a easily accessible savings account. This fund can provide a cushion in case of unexpected expenses or income disruptions.

Seeking assistance programs can also provide relief during financial difficulties. Many organizations offer assistance with rent, utilities, and food expenses. Additionally, some employers offer employee assistance programs (EAPs) that provide financial counseling and support.

Managing debt is another critical aspect of overcoming financial challenges. Focus on paying off high-interest debt, such as credit card balances, as soon as possible. Consider consolidating debt into a lower-interest loan or balance transfer credit card.

Creating a budget that accounts for irregular expenses can also help alleviate financial stress. Set aside a small amount each month for expenses like car maintenance, property taxes, or insurance premiums.

Finally, taking advantage of tax credits and deductions can help reduce the financial burden of a $15 an hour wage. Claiming credits like the Earned Income Tax Credit (EITC) or Child Tax Credit can provide a significant boost to take-home pay.

Some additional strategies for overcoming financial challenges on a $15 an hour wage include:

- Using the 50/30/20 rule to allocate income towards necessary expenses, discretionary spending, and saving.

- Implementing a “reverse budget” that prioritizes savings and debt repayment over discretionary spending.

- Utilizing cash flow management tools, such as budgeting apps or spreadsheets, to track income and expenses.

- Seeking support from financial advisors or credit counselors for personalized guidance.

By having a plan in place and taking proactive steps to manage finances, individuals earning the annual income of $15 an hour can overcome financial challenges and achieve a more stable financial future.

Advancing Your Career: Opportunities for Growth and Higher Earning Potential

While a $15 an hour wage can provide a comfortable lifestyle, there are opportunities for career advancement and higher earning potential. Investing in education and training programs, certifications, and promotions can lead to increased earning potential and a more fulfilling career.

Education and training programs can provide the skills and knowledge needed to advance in a career. Consider pursuing a degree or certification in a field related to your current job or industry. Many employers offer tuition reimbursement or professional development programs to support employee education and training.

Certifications can also demonstrate expertise and commitment to a particular field. Research certifications relevant to your industry and job function, and consider obtaining them to increase earning potential and career advancement opportunities.

Promotions are another way to increase earning potential. Consider taking on additional responsibilities, volunteering for special projects, or seeking out mentorship opportunities to demonstrate your value to your employer.

Some popular career advancement opportunities for individuals earning the annual income of $15 an hour include:

- Pursuing a degree in a field related to their current job or industry.

- Obtaining certifications or licenses relevant to their job function.

- Seeking out promotions or additional responsibilities within their current company.

- Exploring new job opportunities in their industry or field.

By investing in education and training, certifications, and promotions, individuals earning the annual income of $15 an hour can increase their earning potential and advance their careers. This can lead to a more fulfilling and financially stable lifestyle.

Some popular resources for career advancement and education include:

- Online courses and degree programs, such as Coursera or Udemy.

- Professional certifications, such as CompTIA or Cisco.

- Industry-specific training programs, such as those offered by the National Restaurant Association or the American Hotel and Lodging Association.

- Career counseling and coaching services, such as those offered by the National Career Development Association.

By taking advantage of these resources and opportunities, individuals earning the annual income of $15 an hour can advance their careers and increase their earning potential.

Conclusion: Making the Most of a $15 an Hour Wage

Making the most of a $15 an hour wage requires careful financial planning, smart investing, and career advancement. By understanding the annual income potential of a $15 an hour job and maximizing earnings through overtime, additional income streams, and raises, individuals can increase their take-home pay. However, it’s essential to consider the impact of taxes, benefits, and other deductions on net income and plan accordingly. Creating a budget that accounts for annual income and prioritizes expenses, savings, and debt management is crucial for achieving financial stability.

Investing in education, training, and certifications can also lead to career advancement and higher earning potential. Additionally, exploring opportunities for growth and development within the current company or industry can lead to promotions and increased annual income. By adopting a long-term perspective and making informed financial decisions, individuals earning $15 an hour can overcome common financial challenges and build a more secure financial future.

Ultimately, the key to making the most of a $15 an hour wage is to be proactive and strategic in managing one’s finances and career. By taking control of annual income, investing in the future, and pursuing opportunities for growth, individuals can unlock a more comfortable lifestyle and achieve their long-term financial goals. With the right mindset and approach, a $15 an hour wage can be a stepping stone to financial stability and success.