Understanding the Benefits of CD Accounts

Certificate of Deposit (CD) accounts have been a staple of savings strategies for decades, offering a low-risk way to earn fixed returns on deposited funds. But are CD accounts worth it for your savings goals? To answer this question, it’s essential to understand the benefits of CD accounts and how they can provide a stable source of returns for savers.

One of the primary advantages of CD accounts is their fixed interest rate, which is typically higher than traditional savings accounts. This means that savers can earn a predictable return on their investment, without worrying about market fluctuations. Additionally, CD accounts are insured by the FDIC, which protects deposits up to $250,000, providing an added layer of security.

CD accounts also offer a range of term lengths, from a few months to several years, allowing savers to choose the duration that best aligns with their financial goals. This flexibility makes CD accounts an attractive option for those looking to save for specific expenses, such as a down payment on a house or a car.

Furthermore, CD accounts can be an effective way to avoid the temptation of dipping into savings, as early withdrawal penalties can be steep. This feature can help savers stay committed to their long-term goals, even when faced with short-term financial challenges.

While CD accounts may not offer the highest returns compared to other investment options, their low-risk nature and predictable returns make them an attractive choice for those seeking a stable source of income. As with any investment, it’s crucial to weigh the pros and cons and consider individual financial situations and goals before deciding if a CD account is right for you.

How to Choose the Best CD Account for Your Needs

With so many CD account options available, selecting the right one can be overwhelming. To ensure you find a CD account that aligns with your financial goals, consider the following factors: interest rates, term lengths, and minimum deposit requirements.

Interest rates are a crucial factor in choosing a CD account. Look for accounts with competitive rates that align with your financial goals. Some popular CD account options, such as Ally Bank CD and Marcus CD, offer high-yield interest rates that can help you maximize your returns.

Term lengths are also an essential consideration. CD accounts come with a range of term lengths, from a few months to several years. Choose a term length that aligns with your financial goals, such as a short-term CD for emergency funds or a long-term CD for retirement savings.

Minimum deposit requirements are another factor to consider. Some CD accounts require a minimum deposit, which can range from a few hundred to several thousand dollars. Make sure you understand the minimum deposit requirements before opening a CD account.

When evaluating CD accounts, also consider the bank’s reputation, customer service, and online banking platform. A reputable bank with excellent customer service and a user-friendly online platform can make managing your CD account easier and more convenient.

Ultimately, the best CD account for you will depend on your individual financial situation and goals. By considering interest rates, term lengths, and minimum deposit requirements, you can find a CD account that helps you achieve your savings objectives. Remember to always read the fine print and understand the terms and conditions before opening a CD account.

The Pros and Cons of CD Accounts: Weighing the Advantages and Disadvantages

CD accounts offer a range of benefits, including higher interest rates than traditional savings accounts and low risk. However, they also come with some drawbacks that should be carefully considered before opening an account.

One of the main advantages of CD accounts is their low risk. CD accounts are insured by the FDIC, which protects deposits up to $250,000. This means that even if the bank fails, depositors’ funds are protected. Additionally, CD accounts offer a fixed interest rate, which can provide a stable source of returns for savers.

Another benefit of CD accounts is their higher interest rates compared to traditional savings accounts. CD accounts can offer interest rates that are significantly higher than those offered by traditional savings accounts, making them an attractive option for savers looking to maximize their returns.

However, CD accounts also come with some disadvantages. One of the main drawbacks is the early withdrawal penalty. If a depositor withdraws their funds before the end of the term, they may be subject to a penalty, which can reduce their returns. Additionally, CD accounts have limited liquidity, meaning that depositors may not be able to access their funds until the end of the term.

Another potential drawback of CD accounts is the opportunity cost. By locking in a fixed interest rate for a set period, depositors may miss out on higher interest rates that may become available during the term. This can result in lower returns over the long term.

Despite these drawbacks, CD accounts can still be a valuable tool for savers looking to maximize their returns. By carefully considering the pros and cons and choosing a CD account that aligns with their financial goals, depositors can make the most of this savings option.

CD Accounts vs. Other Savings Options: Which is Right for You?

When it comes to saving money, there are several options available, each with its own unique benefits and drawbacks. CD accounts are just one of many savings options, and it’s essential to compare them to other alternatives to determine which one is right for you.

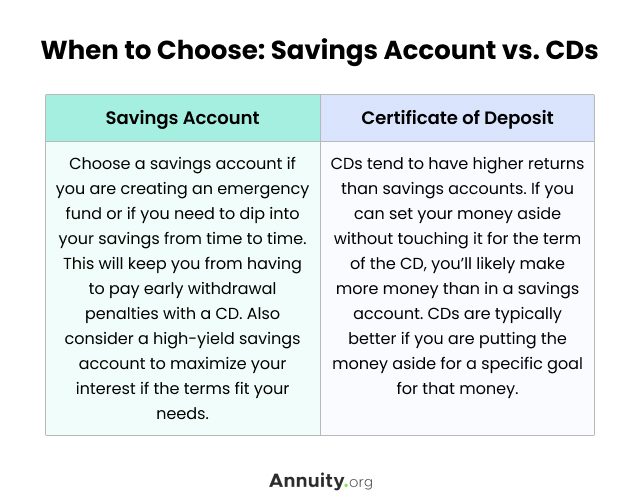

High-yield savings accounts, for example, offer a liquid savings option with competitive interest rates. Unlike CD accounts, high-yield savings accounts allow depositors to access their funds at any time, making them a great option for emergency funds or short-term savings goals.

Money market accounts, on the other hand, offer a low-risk investment option with competitive interest rates and limited check-writing privileges. While they may not offer the same level of liquidity as high-yield savings accounts, money market accounts can provide a stable source of returns for savers.

Treasury bills, or T-bills, are another low-risk investment option that can provide a stable source of returns. T-bills are backed by the full faith and credit of the US government, making them an extremely low-risk investment option. However, they typically offer lower interest rates than CD accounts or high-yield savings accounts.

When comparing CD accounts to other savings options, it’s essential to consider your individual financial goals and situation. If you’re looking for a low-risk investment option with competitive interest rates and don’t need immediate access to your funds, a CD account may be a great option. However, if you need easy access to your funds or are looking for a more liquid savings option, a high-yield savings account or money market account may be a better fit.

Ultimately, the decision between a CD account and other savings options depends on your individual financial goals and situation. By carefully considering your options and choosing the one that best aligns with your goals, you can make the most of your savings and achieve financial success.

Strategies for Maximizing Your CD Account Returns

To get the most out of your CD account, it’s essential to employ strategies that optimize your returns. One popular strategy is laddering, which involves opening multiple CD accounts with different term lengths. This approach allows you to take advantage of higher interest rates for longer-term CDs while still maintaining liquidity.

Another strategy is barbelling, which involves opening a CD account with a shorter term length and another with a longer term length. This approach allows you to balance the trade-off between interest rates and liquidity, ensuring that you have access to your funds when needed while still earning competitive interest rates.

Taking advantage of rate increases is also a great way to maximize your CD account returns. By monitoring interest rates and opening a new CD account when rates increase, you can earn higher returns on your savings. Additionally, some CD accounts offer rate bumps or step-up rates, which can provide an opportunity to increase your returns over time.

It’s also essential to consider the compounding frequency of your CD account. Compounding frequency refers to how often the interest is added to the principal balance. More frequent compounding can result in higher returns over time, so it’s essential to choose a CD account with a compounding frequency that aligns with your financial goals.

Finally, it’s crucial to avoid common mistakes that can reduce your CD account returns. These include not reading the fine print, not considering early withdrawal penalties, and not monitoring interest rates. By avoiding these mistakes and employing strategies that optimize your returns, you can make the most of your CD account and achieve your savings goals.

Common Mistakes to Avoid When Opening a CD Account

When opening a CD account, it’s essential to avoid common mistakes that can reduce your returns or lead to unnecessary penalties. One of the most significant mistakes is not reading the fine print. CD accounts often come with complex terms and conditions, including early withdrawal penalties, interest rate changes, and minimum deposit requirements.

Another mistake is not considering early withdrawal penalties. CD accounts often come with penalties for early withdrawals, which can reduce your returns or even result in losses. It’s essential to understand the penalties associated with your CD account and plan accordingly.

Not monitoring interest rates is also a common mistake. CD accounts often come with fixed interest rates, but rates can change over time. Failing to monitor interest rates can result in missed opportunities to earn higher returns or avoid lower returns.

Additionally, not considering the minimum deposit requirements can also be a mistake. CD accounts often come with minimum deposit requirements, which can range from a few hundred to several thousand dollars. Failing to meet these requirements can result in penalties or reduced returns.

Finally, not considering alternative options can also be a mistake. CD accounts are just one of many savings options available, and it’s essential to consider alternative options, such as high-yield savings accounts, money market accounts, or Treasury bills, to determine which one is best for your financial goals.

By avoiding these common mistakes, you can make the most of your CD account and achieve your savings goals. Remember to always read the fine print, consider early withdrawal penalties, monitor interest rates, meet minimum deposit requirements, and consider alternative options before opening a CD account.

CD Account Alternatives: Exploring Other Low-Risk Investment Options

While CD accounts can be an attractive option for those seeking low-risk investments, they may not be the best fit for everyone. Fortunately, there are alternative low-risk investment options available that can provide similar benefits. In this section, we’ll explore some of these alternatives and discuss their benefits and drawbacks.

Bonds are one popular alternative to CD accounts. Government and corporate bonds offer a fixed return over a specified period, typically with lower risk than stocks or other investments. However, bonds often come with a higher minimum investment requirement than CD accounts, and their returns may be lower. Additionally, bonds can be subject to interest rate risk, meaning their value may decrease if interest rates rise.

Treasury notes, also known as T-notes, are another low-risk investment option. These short-term government securities offer a fixed return over a period of two to 10 years. T-notes are backed by the full faith and

Conclusion: Are CD Accounts Worth It for Your Savings Goals?

In conclusion, CD accounts can be a valuable addition to a savings strategy, offering a low-risk investment option with fixed interest rates and FDIC insurance. However, whether CD accounts are worth it for your savings goals depends on your individual financial situation and objectives.

By understanding the benefits and drawbacks of CD accounts, including their advantages over traditional savings accounts and potential drawbacks such as early withdrawal penalties, you can make an informed decision about whether a CD account is right for you. Additionally, considering alternative low-risk investment options, such as bonds and Treasury notes, can help you determine the best course of action for your savings goals.

Ultimately, CD accounts can provide a stable source of returns for savers, but it’s essential to carefully evaluate your options and consider your individual financial circumstances before making a decision. By doing so, you can maximize your savings and achieve your long-term financial goals.

When deciding whether to open a CD account, ask yourself: Are CD accounts worth it for my savings goals? Do the benefits of a CD account, including higher interest rates and low risk, outweigh the potential drawbacks, such as early withdrawal penalties and limited liquidity? By carefully considering these factors, you can make an informed decision that aligns with your financial objectives.

In today’s low-interest-rate environment, CD accounts can be an attractive option for savers seeking a low-risk investment with a fixed return. However, it’s crucial to remember that CD accounts are just one part of a comprehensive savings strategy. By diversifying your savings and considering alternative investment options, you can optimize your returns and achieve your long-term financial goals.

In summary, CD accounts can be a valuable addition to a savings strategy, but it’s essential to carefully evaluate your options and consider your individual financial circumstances before making a decision. By doing so, you can maximize your savings and achieve your long-term financial goals.