What is a Balance Transfer and How Can it Benefit Your Business?

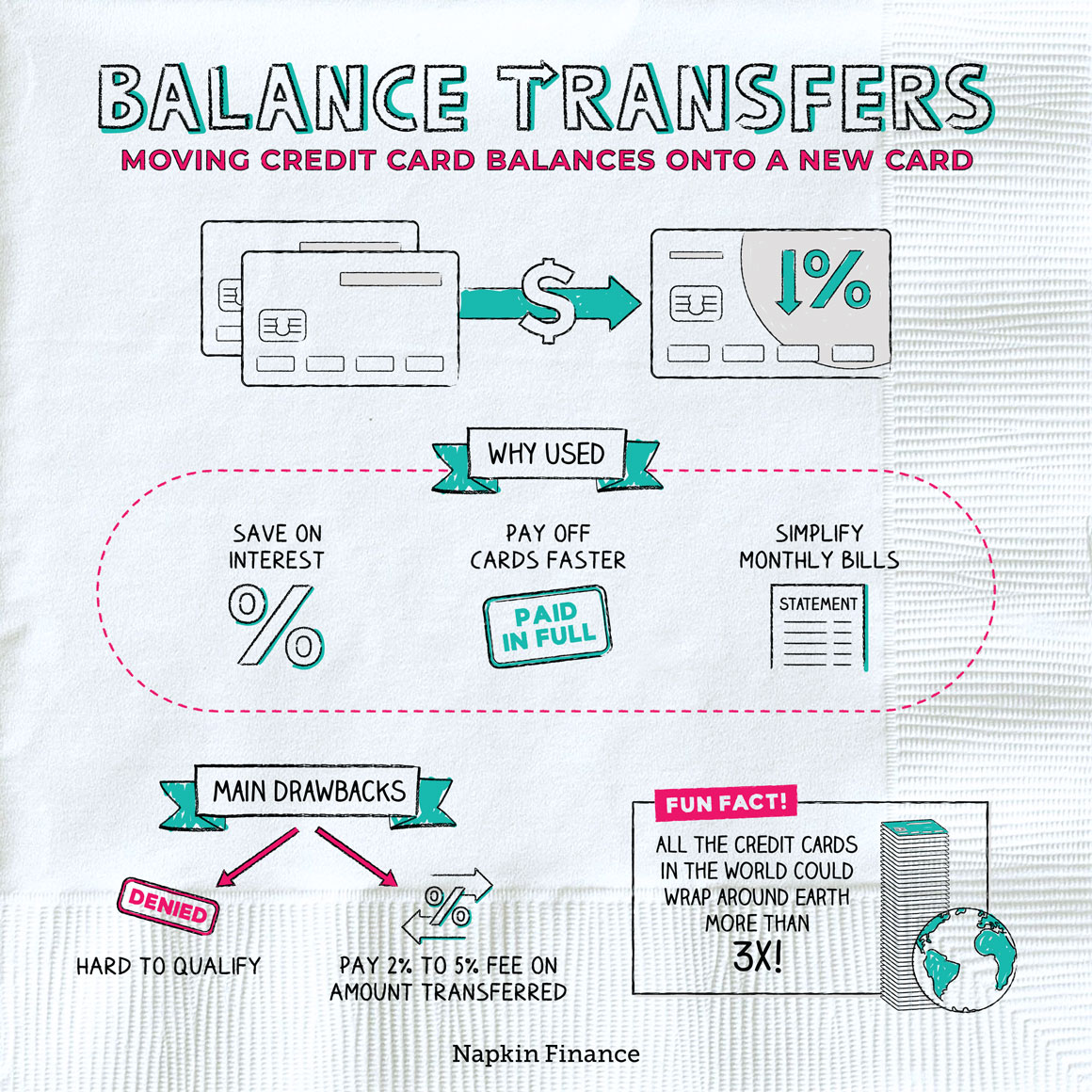

A balance transfer is a financial strategy that allows business owners to transfer outstanding balances from one credit card to another, often with a lower interest rate or more favorable terms. This can be a valuable tool for businesses looking to manage cash flow, reduce debt, and save on interest rates. By consolidating debt into a single credit card with a lower interest rate, businesses can simplify their finances and free up more money in their budget for growth and investment.

Balance transfer business credit cards can offer a range of benefits, including 0% introductory APRs, lower balance transfer fees, and rewards programs. These benefits can help businesses save money on interest rates, reduce debt, and earn rewards on purchases. For example, a business that transfers a $10,000 balance from a credit card with an 18% interest rate to a balance transfer credit card with a 0% introductory APR can save $1,800 in interest rates over the first year.

In addition to saving on interest rates, balance transfer business credit cards can also help businesses manage cash flow. By consolidating debt into a single credit card, businesses can simplify their finances and reduce the number of payments they need to make each month. This can help businesses avoid late fees and penalties, and free up more money in their budget for growth and investment.

Furthermore, balance transfer business credit cards can also provide businesses with more flexibility and control over their finances. With a balance transfer credit card, businesses can choose to pay off their debt quickly, or take advantage of a longer repayment period. This can help businesses manage their cash flow and make more strategic financial decisions.

Overall, balance transfer business credit cards can be a valuable tool for businesses looking to manage cash flow, reduce debt, and save on interest rates. By understanding the benefits and drawbacks of balance transfer credit cards, businesses can make more informed financial decisions and achieve their goals.

How to Choose the Best Balance Transfer Business Credit Card for Your Needs

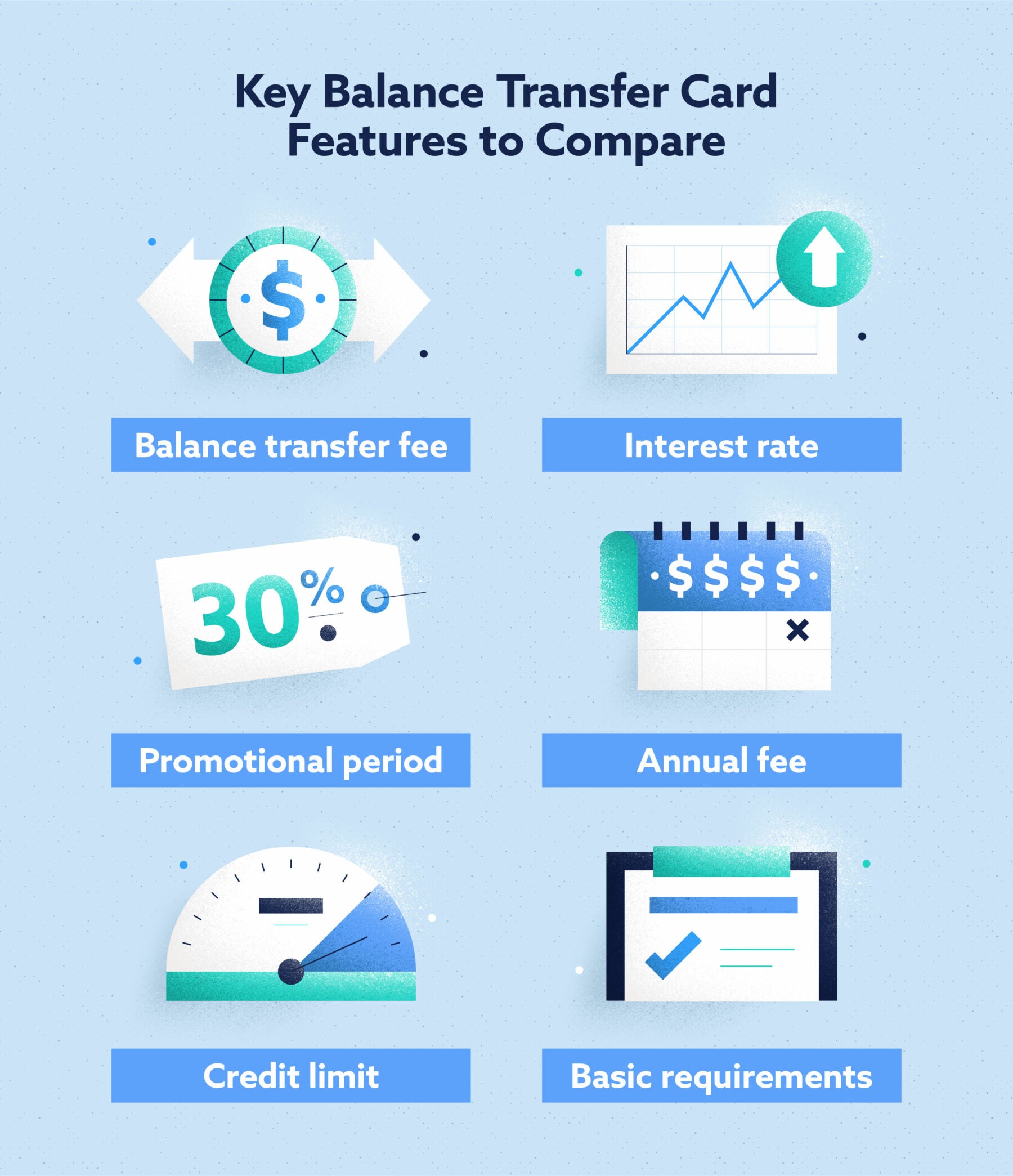

When selecting a balance transfer business credit card, there are several key factors to consider. The introductory APR, balance transfer fee, credit limit, and rewards program are all important considerations that can impact the overall value of the credit card. By carefully evaluating these factors, business owners can choose the best balance transfer credit card for their needs and make the most of this financial tool.

One of the most important factors to consider is the introductory APR. This is the interest rate that will be applied to the transferred balance during the introductory period, which can range from 6 to 18 months. A lower introductory APR can save businesses a significant amount of money in interest rates, making it easier to pay off the transferred balance. For example, a business that transfers a $10,000 balance to a credit card with a 0% introductory APR can save $1,800 in interest rates over the first year.

In addition to the introductory APR, the balance transfer fee is also an important consideration. This is a one-time fee that is charged when the balance is transferred, and it can range from 3% to 5% of the transferred amount. By choosing a credit card with a lower balance transfer fee, businesses can save money on this upfront cost. For example, a business that transfers a $10,000 balance to a credit card with a 3% balance transfer fee will pay $300 in fees, compared to $500 for a credit card with a 5% balance transfer fee.

The credit limit is also an important factor to consider. This is the maximum amount that can be charged on the credit card, and it can impact the business’s ability to make purchases and manage cash flow. By choosing a credit card with a higher credit limit, businesses can have more flexibility and freedom to make purchases and manage their finances.

Finally, the rewards program is also an important consideration. This is a program that offers rewards and incentives for making purchases on the credit card, such as cash back, points, or travel miles. By choosing a credit card with a rewards program that aligns with the business’s needs and spending habits, businesses can earn valuable rewards and incentives that can help offset the cost of the credit card.

By carefully evaluating these factors, business owners can choose the best balance transfer business credit card for their needs and make the most of this financial tool. Whether you’re looking to save on interest rates, reduce debt, or earn rewards, there’s a balance transfer credit card that can help you achieve your financial goals.

Top Balance Transfer Business Credit Cards to Consider

When it comes to balance transfer business credit cards, there are several top options to consider. These credit cards offer a range of benefits, including 0% introductory APRs, low balance transfer fees, and rewards programs. Here are some of the top balance transfer business credit cards available in the market:

The Chase Ink Business Cash Credit Card is a popular option for business owners. This credit card offers a 0% introductory APR for 12 months, a balance transfer fee of 3%, and a rewards program that offers 5% cash back on office supplies and 2% cash back on gas. The credit card also has a credit limit of up to $25,000 and no annual fee.

Another top option is the Capital One Spark Cash for Business. This credit card offers a 0% introductory APR for 12 months, a balance transfer fee of 3%, and a rewards program that offers 2% cash back on all purchases. The credit card also has a credit limit of up to $50,000 and no annual fee.

The American Express Blue Business Cash Card is also a top option for business owners. This credit card offers a 0% introductory APR for 12 months, a balance transfer fee of 3%, and a rewards program that offers 2% cash back on all purchases. The credit card also has a credit limit of up to $50,000 and no annual fee.

When comparing these credit cards, it’s essential to consider the introductory APR, balance transfer fee, credit limit, and rewards program. By carefully evaluating these factors, business owners can choose the best balance transfer credit card for their needs and make the most of this financial tool.

In addition to these top options, there are several other balance transfer business credit cards available in the market. Some other options to consider include the Citi Double Cash Card, the Discover it Business Card, and the Bank of America Cash Rewards for Business credit card. Each of these credit cards offers a range of benefits, including 0% introductory APRs, low balance transfer fees, and rewards programs.

By doing your research and comparing different credit cards, you can find the best balance transfer business credit card for your needs. Whether you’re looking to save on interest rates, reduce debt, or earn rewards, there’s a balance transfer credit card that can help you achieve your financial goals.

Understanding the Fine Print: Balance Transfer Fees and Interest Rates

When using a balance transfer business credit card, it’s essential to understand the fine print, particularly when it comes to balance transfer fees and interest rates. These costs can add up quickly, and if not managed properly, can negate the benefits of using a balance transfer credit card.

Balance transfer fees are typically charged as a percentage of the transferred amount, ranging from 3% to 5%. For example, if you transfer a $10,000 balance to a credit card with a 3% balance transfer fee, you’ll be charged $300 in fees. It’s essential to factor in these fees when calculating the total cost of a balance transfer.

Interest rates are another critical factor to consider. While many balance transfer credit cards offer 0% introductory APRs, these rates are typically only available for a limited time, such as 6 to 18 months. After the introductory period ends, the regular APR will apply, which can be significantly higher. For example, a credit card with a 0% introductory APR for 12 months may have a regular APR of 18% after the introductory period ends.

To calculate the total cost of a balance transfer, you’ll need to consider both the balance transfer fee and the interest rate. For example, if you transfer a $10,000 balance to a credit card with a 3% balance transfer fee and a 0% introductory APR for 12 months, you’ll pay $300 in fees upfront. If you don’t pay off the balance in full within the introductory period, you’ll be charged interest on the remaining balance at the regular APR.

To avoid common pitfalls, it’s essential to read the fine print carefully and understand the terms and conditions of your balance transfer credit card. Here are some tips to help you avoid common mistakes:

1. Calculate the total cost of the balance transfer, including the balance transfer fee and interest rate.

2. Make sure you understand the introductory APR period and the regular APR that will apply after the introductory period ends.

3. Pay off the balance in full within the introductory period to avoid interest charges.

4. Avoid making new purchases on the credit card until the balance transfer is paid off in full.

By understanding the fine print and avoiding common pitfalls, you can make the most of your balance transfer business credit card and achieve your financial goals.

Maximizing the Benefits of a Balance Transfer Business Credit Card

To get the most out of a balance transfer business credit card, it’s essential to use it strategically as part of a larger financial plan. Here are some strategies to help you maximize the benefits of a balance transfer credit card:

1. Pay off debt quickly: The key to maximizing the benefits of a balance transfer credit card is to pay off the debt as quickly as possible. This will help you avoid interest charges and make the most of the 0% introductory APR.

2. Avoid new purchases: While it can be tempting to make new purchases on a balance transfer credit card, it’s essential to avoid doing so until the balance transfer is paid off in full. This will help you avoid accumulating new debt and make it easier to pay off the balance transfer.

3. Take advantage of rewards programs: Many balance transfer business credit cards offer rewards programs that can help you earn cash back, points, or travel miles. By taking advantage of these rewards programs, you can earn valuable rewards and incentives that can help offset the cost of the credit card.

4. Use the credit card as part of a larger financial plan: A balance transfer credit card should be used as part of a larger financial plan that includes a budget, cash flow management, and debt reduction strategies. By using the credit card in conjunction with these strategies, you can make the most of the benefits and achieve your financial goals.

5. Monitor your credit score: Your credit score plays a significant role in determining the interest rate you’ll qualify for on a balance transfer credit card. By monitoring your credit score and working to improve it, you can qualify for better interest rates and terms on your credit card.

By following these strategies, you can maximize the benefits of a balance transfer business credit card and achieve your financial goals. Remember to always use the credit card responsibly and as part of a larger financial plan.

In addition to these strategies, it’s also essential to consider the following tips when using a balance transfer credit card:

1. Make timely payments: Making timely payments is essential to avoiding interest charges and late fees.

2. Keep the credit utilization ratio low: Keeping the credit utilization ratio low will help you avoid negatively impacting your credit score.

3. Avoid applying for multiple credit cards: Applying for multiple credit cards can negatively impact your credit score and make it harder to qualify for better interest rates and terms.

By following these tips and strategies, you can make the most of a balance transfer business credit card and achieve your financial goals.

Common Mistakes to Avoid When Using a Balance Transfer Business Credit Card

While balance transfer business credit cards can be a valuable tool for managing debt and reducing financial stress, there are several common mistakes that business owners should avoid when using these credit cards. Here are some of the most common mistakes to watch out for:

1. Not paying off debt quickly enough: One of the biggest mistakes business owners make when using a balance transfer credit card is not paying off the debt quickly enough. This can lead to interest charges and fees that can add up quickly, negating the benefits of the balance transfer.

2. Accumulating new debt: Another common mistake is accumulating new debt on the credit card while trying to pay off the balance transfer. This can lead to a cycle of debt that can be difficult to break, and can ultimately harm the business’s financial health.

3. Not monitoring credit scores: Business owners should also avoid not monitoring their credit scores when using a balance transfer credit card. This can lead to missed payments, late fees, and other negative consequences that can harm the business’s credit score.

4. Not reading the fine print: Finally, business owners should avoid not reading the fine print when using a balance transfer credit card. This can lead to unexpected fees, interest charges, and other negative consequences that can harm the business’s financial health.

To avoid these mistakes, business owners should take the following steps:

1. Create a budget and stick to it: Business owners should create a budget that takes into account the balance transfer and any other debt obligations. This will help ensure that the debt is paid off quickly and efficiently.

2. Make timely payments: Business owners should make timely payments on the credit card to avoid late fees and interest charges.

3. Monitor credit scores: Business owners should monitor their credit scores regularly to ensure that they are not missing payments or accumulating new debt.

4. Read the fine print: Business owners should read the fine print carefully to avoid unexpected fees and interest charges.

By avoiding these common mistakes, business owners can use balance transfer business credit cards effectively and achieve their financial goals.

Alternatives to Balance Transfer Business Credit Cards

While balance transfer business credit cards can be a valuable tool for managing debt and improving cash flow, they may not be the best solution for every business. Fortunately, there are alternative options available that can provide similar benefits without the potential drawbacks of balance transfer credit cards. In this section, we’ll explore some of these alternatives and discuss their pros and cons.

One alternative to balance transfer business credit cards is a small business loan. Small business loans can provide a lump sum of capital that can be used to pay off debt, cover expenses, or invest in growth initiatives. Unlike balance transfer credit cards, small business loans often have fixed interest rates and repayment terms, which can make it easier to budget and plan for the future. However, small business loans may require collateral and can have stricter qualification requirements than balance transfer credit cards.

Another alternative is a line of credit. A line of credit is a type of loan that allows businesses to borrow and repay funds as needed. Lines of credit can be secured or unsecured and often have variable interest rates. They can be a good option for businesses that need to manage cash flow or cover unexpected expenses. However, lines of credit can have fees and may require collateral.

Cash flow management tools are another alternative to balance transfer business credit cards. These tools can help businesses manage their finances and improve cash flow by providing real-time visibility into income and expenses, automating payments, and offering predictive analytics. Cash flow management tools can be especially useful for businesses that struggle with cash flow or have irregular income. However, they may not provide the same level of financing as balance transfer credit cards or small business loans.

Invoice financing is another option for businesses that need to manage cash flow. Invoice financing allows businesses to borrow against outstanding invoices, providing quick access to capital. This can be especially useful for businesses that have slow-paying customers or need to cover expenses before receiving payment. However, invoice financing can have high fees and may require businesses to give up control of their invoices.

Finally, some businesses may consider using a personal loan or credit card to manage debt or cover expenses. While this can be a convenient option, it’s essential to keep personal and business finances separate to avoid commingling funds and potential tax implications. Additionally, personal loans and credit cards may have higher interest rates and fees than balance transfer business credit cards or small business loans.

When choosing an alternative to balance transfer business credit cards, it’s essential to consider the pros and cons of each option and evaluate which one best meets your business needs. By doing your research and selecting the right financing solution, you can improve your business’s financial health and achieve long-term success.

Conclusion: Making the Most of Balance Transfer Business Credit Cards

In conclusion, balance transfer business credit cards can be a valuable tool for business owners looking to manage debt, improve cash flow, and reduce financial stress. By understanding the concept of balance transfer, choosing the right credit card, and using it responsibly, businesses can save on interest rates, consolidate debt, and achieve long-term financial success.

It’s essential to remember that balance transfer business credit cards are not a one-size-fits-all solution. Business owners must carefully consider their financial situation, credit score, and needs before selecting a credit card. By doing so, they can avoid common pitfalls, such as accumulating new debt, and maximize the benefits of a balance transfer credit card.

Additionally, business owners should be aware of alternative options to balance transfer business credit cards, such as small business loans, lines of credit, and cash flow management tools. By exploring these alternatives and choosing the best solution for their needs, businesses can ensure they are making the most of their financial resources.

Ultimately, using balance transfer business credit cards responsibly and as part of a larger financial plan is crucial for achieving long-term financial success. By doing their research, choosing the right credit card, and using it wisely, business owners can take control of their finances, reduce stress, and focus on growing their business.

As the business landscape continues to evolve, it’s essential for business owners to stay informed and adapt to new financial tools and strategies. By staying ahead of the curve and making smart financial moves, businesses can thrive in today’s competitive market and achieve their goals.

In summary, balance transfer business credit cards can be a powerful tool for businesses looking to manage debt and improve cash flow. By understanding the benefits and drawbacks, choosing the right credit card, and using it responsibly, businesses can achieve long-term financial success and drive growth.

.jpg?1637650346)