Understanding Medicare Advantage Plans: A Comprehensive Guide

Medicare Advantage plans offer an alternative to Original Medicare, providing additional benefits and often lower out-of-pocket costs. To choose the best advantage plan for Medicare, it’s essential to understand the basics of these plans. Medicare Advantage plans are offered by private insurance companies approved by Medicare, and they must provide at least the same level of coverage as Original Medicare. However, many plans offer additional benefits, such as dental, vision, and hearing coverage, as well as wellness programs and fitness memberships.

Popular Medicare Advantage plans like UnitedHealthcare and Humana offer a range of benefits and network providers. UnitedHealthcare, for example, offers a large network of providers and a range of plan options, including HMO and PPO plans. Humana, on the other hand, offers a range of plans with varying levels of coverage and costs. When choosing a Medicare Advantage plan, it’s essential to evaluate the network providers, coverage, and costs to ensure you’re getting the best advantage plan for your Medicare needs.

Medicare Advantage plans can be categorized into several types, including Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Private Fee-for-Service (PFFS) plans. HMO plans require you to receive care from providers within the plan’s network, while PPO plans offer more flexibility in choosing providers. PFFS plans allow you to see any Medicare-approved provider, but may require higher out-of-pocket costs.

When evaluating Medicare Advantage plans, consider the following factors: network providers, coverage, costs, and additional benefits. Ensure the plan’s network includes your primary care physician and any specialists you see regularly. Also, evaluate the plan’s coverage, including any gaps in coverage and the level of coverage for services like hospital stays and outpatient care. Finally, consider the plan’s costs, including premiums, copays, and coinsurance.

By understanding the basics of Medicare Advantage plans and evaluating the factors mentioned above, you can choose the best advantage plan for your Medicare needs. Remember to research and compare plans carefully to ensure you’re getting the best value for your money.

How to Choose the Best Medicare Advantage Plan for Your Needs

Choosing the best Medicare Advantage plan requires careful consideration of several factors. With so many plans available, it can be overwhelming to navigate the options and find the best fit for your needs. To start, evaluate the network providers included in each plan. Ensure that your primary care physician and any specialists you see regularly are part of the plan’s network. This will help you avoid surprise medical bills and ensure that you receive seamless care.

Next, compare the costs and coverage of each plan. Consider the premium, copays, coinsurance, and maximum out-of-pocket costs. Some plans may offer lower premiums but higher out-of-pocket costs, while others may offer more comprehensive coverage but higher premiums. It’s essential to weigh the costs and benefits of each plan to determine which one provides the best value for your money.

In addition to network providers and costs, consider the additional benefits offered by each plan. Many Medicare Advantage plans include dental, vision, and hearing coverage, as well as wellness programs and fitness memberships. These benefits can enhance your overall health and well-being, but may also increase the plan’s premium. Evaluate the importance of these benefits to you and factor them into your decision.

Another crucial factor to consider is the plan’s star rating. Medicare assigns star ratings to each plan based on its quality and performance. Plans with higher star ratings tend to offer better care and more comprehensive coverage. Look for plans with 4 or 5 stars to ensure that you’re getting a high-quality plan.

Finally, consider the plan’s customer service and support. Look for plans with 24/7 customer support and a user-friendly website or mobile app. This will help you navigate the plan’s benefits and services more easily and get the help you need when you need it.

By carefully evaluating these factors, you can choose the best Medicare Advantage plan for your needs. Remember to take your time and do your research to ensure that you’re getting the best value for your money. With the right plan, you can maximize your Medicare benefits and enjoy better health and well-being.

Top Medicare Advantage Plans for 2023: A Review of the Best Options

With so many Medicare Advantage plans available, it can be challenging to determine which one is the best fit for your needs. In this article, we’ll review and compare top Medicare Advantage plans for 2023, including Aetna, Cigna, and Kaiser Permanente. We’ll highlight their strengths, weaknesses, and unique features to help you make an informed decision.

Aetna is a well-established insurance company that offers a range of Medicare Advantage plans. Their plans are known for their comprehensive coverage, including dental, vision, and hearing benefits. Aetna’s plans also offer a large network of providers, making it easy to find a doctor or hospital in your area. However, Aetna’s plans can be more expensive than some other options, with higher premiums and out-of-pocket costs.

Cigna is another popular insurance company that offers Medicare Advantage plans. Their plans are known for their flexibility, with a range of options to choose from, including HMO and PPO plans. Cigna’s plans also offer a unique feature called the “Healthy Rewards” program, which rewards members for taking healthy actions, such as getting regular check-ups and exercising regularly. However, Cigna’s plans can have higher copays and coinsurance than some other options.

Kaiser Permanente is a well-respected insurance company that offers Medicare Advantage plans in several states. Their plans are known for their comprehensive coverage, including dental, vision, and hearing benefits. Kaiser Permanente’s plans also offer a unique feature called the “Thrive” program, which provides members with access to wellness programs and fitness classes. However, Kaiser Permanente’s plans can be more expensive than some other options, with higher premiums and out-of-pocket costs.

When choosing a Medicare Advantage plan, it’s essential to consider your individual needs and preferences. Think about the type of coverage you need, the network of providers, and the costs associated with the plan. By carefully evaluating these factors, you can choose the best advantage plan for your Medicare needs. Remember to also consider the plan’s star rating, which can give you an idea of the plan’s quality and performance.

In conclusion, Aetna, Cigna, and Kaiser Permanente are all top Medicare Advantage plans for 2023. Each plan has its strengths and weaknesses, and the best plan for you will depend on your individual needs and preferences. By carefully evaluating these plans and considering your options, you can choose the best advantage plan for your Medicare needs and maximize your benefits.

What to Look for in a Medicare Advantage Plan: Key Features to Consider

When selecting a Medicare Advantage plan, it’s essential to consider several key features that can impact your healthcare expenses and overall satisfaction with the plan. In this article, we’ll discuss the essential features to look for in a Medicare Advantage plan, including maximum out-of-pocket costs, copays, and coinsurance.

Maximum out-of-pocket costs are a critical feature to consider when selecting a Medicare Advantage plan. This is the maximum amount you’ll pay for healthcare expenses in a calendar year, excluding premiums. Look for plans with lower maximum out-of-pocket costs to minimize your financial risk. For example, some plans may have a maximum out-of-pocket cost of $3,000, while others may have a maximum out-of-pocket cost of $6,000.

Copays and coinsurance are also essential features to consider when selecting a Medicare Advantage plan. Copays are the fixed amounts you pay for healthcare services, such as doctor visits or prescriptions. Coinsurance is the percentage of healthcare costs you pay after meeting your deductible. Look for plans with lower copays and coinsurance to minimize your out-of-pocket costs.

Another key feature to consider is the plan’s network of providers. Look for plans with a large network of providers, including primary care physicians, specialists, and hospitals. This will ensure that you have access to quality care when you need it. Additionally, consider the plan’s coverage for prescription medications, including the formulary and any restrictions or limitations.

Finally, consider the plan’s additional benefits, such as dental, vision, and hearing coverage. These benefits can enhance your overall health and well-being, but may also increase the plan’s premium. Look for plans that offer comprehensive coverage for these services, including routine cleanings, exams, and procedures.

By carefully evaluating these key features, you can choose the best advantage plan for your Medicare needs. Remember to also consider the plan’s star rating, which can give you an idea of the plan’s quality and performance. With the right plan, you can maximize your Medicare benefits and enjoy better health and well-being.

In addition to these key features, consider the plan’s customer service and support. Look for plans with 24/7 customer support and a user-friendly website or mobile app. This will ensure that you can easily access information and get help when you need it.

Ultimately, the best advantage plan for Medicare is one that meets your individual needs and preferences. By carefully evaluating these key features and considering your options, you can choose a plan that provides comprehensive coverage, affordable costs, and quality care.

Medicare Advantage Plan Star Ratings: What Do They Mean for You?

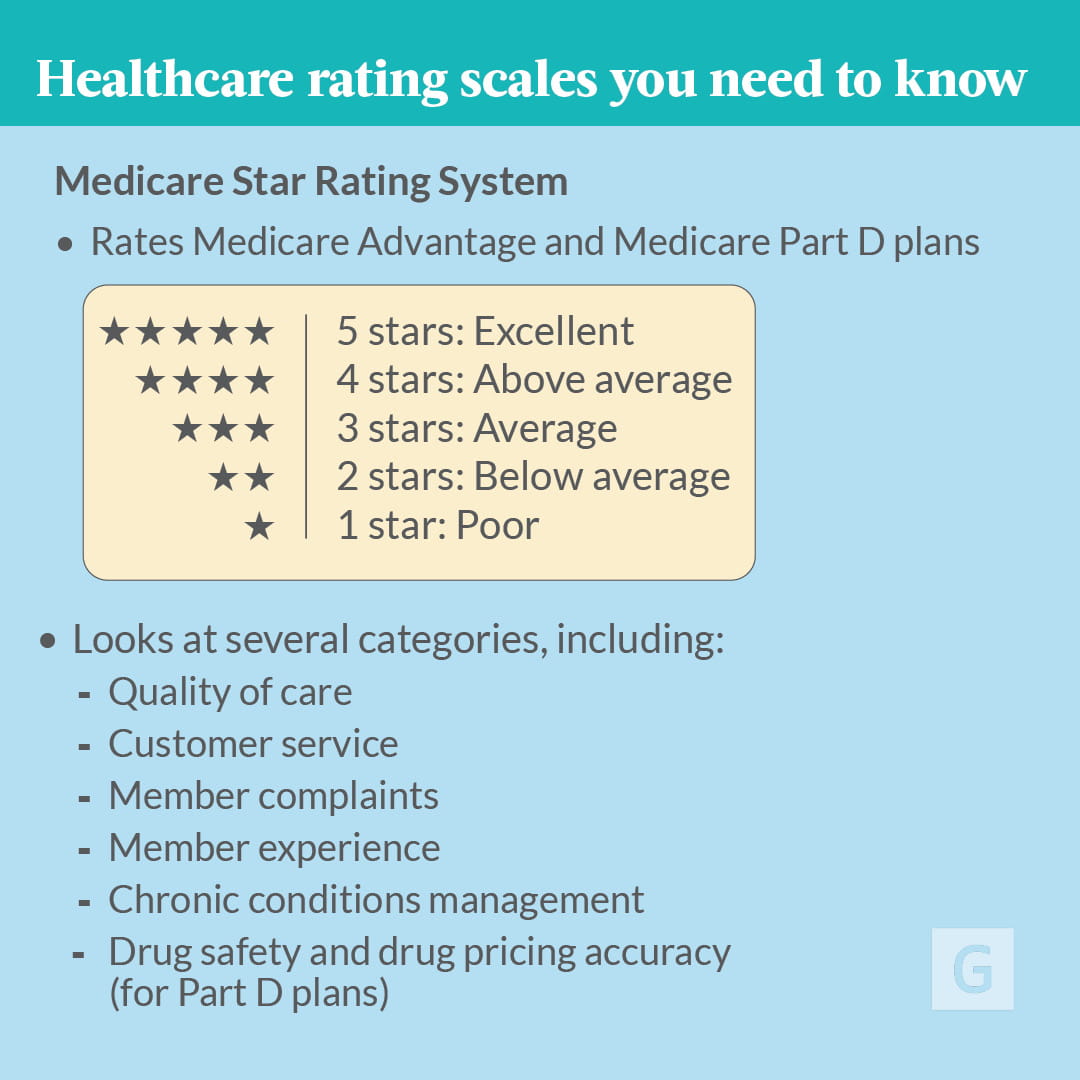

Medicare Advantage plan star ratings are a way to measure the quality of care provided by Medicare Advantage plans. The star rating system is based on a 5-star scale, with 5 stars being the highest rating. The ratings are based on a variety of factors, including the plan’s performance on quality measures, patient satisfaction, and access to care.

The Medicare Advantage plan star rating system is designed to help Medicare beneficiaries make informed decisions about their healthcare coverage. By evaluating the star ratings of different plans, beneficiaries can get an idea of the quality of care provided by each plan and make a more informed decision about which plan to choose.

So, what do the star ratings mean for you? A 5-star plan is considered to be a high-quality plan that provides excellent care and service to its members. A 4-star plan is considered to be a good plan that provides good care and service, but may have some areas for improvement. A 3-star plan is considered to be an average plan that provides adequate care and service, but may have some significant areas for improvement. A 2-star plan is considered to be a low-quality plan that provides poor care and service, and a 1-star plan is considered to be a very low-quality plan that provides very poor care and service.

When choosing a Medicare Advantage plan, it’s essential to consider the plan’s star rating. A plan with a high star rating is more likely to provide high-quality care and service, which can result in better health outcomes and a more positive healthcare experience. Additionally, plans with high star ratings may offer additional benefits and services, such as wellness programs and disease management programs, which can help you stay healthy and manage chronic conditions.

It’s also important to note that the star rating system is not the only factor to consider when choosing a Medicare Advantage plan. Other factors, such as the plan’s network of providers, coverage, and costs, should also be taken into account. By considering all of these factors, you can make an informed decision about which plan is best for you.

In addition to the star rating system, Medicare also provides a list of top-rated Medicare Advantage plans in each state. These plans have been recognized for their high-quality care and service, and may be a good option for beneficiaries who are looking for a high-quality plan.

Overall, the Medicare Advantage plan star rating system is a valuable tool for Medicare beneficiaries who are looking for a high-quality plan. By evaluating the star ratings of different plans, beneficiaries can make an informed decision about which plan is best for them and get the care and service they need to stay healthy.

How to Enroll in a Medicare Advantage Plan: A Step-by-Step Guide

Enrolling in a Medicare Advantage plan can be a straightforward process if you know what to expect. In this article, we’ll provide a step-by-step guide on how to enroll in a Medicare Advantage plan, including eligibility requirements, enrollment periods, and the application process.

Step 1: Determine Your Eligibility

To be eligible for a Medicare Advantage plan, you must be enrolled in Medicare Part A and Part B, and live in the plan’s service area. You can check your eligibility by contacting Medicare or visiting their website.

Step 2: Choose Your Enrollment Period

There are several enrollment periods throughout the year when you can enroll in a Medicare Advantage plan. The most common enrollment periods are:

Annual Election Period (AEP): This period runs from October 15 to December 7 each year, and is the main enrollment period for Medicare Advantage plans.

Initial Enrollment Period (IEP): This period is for individuals who are newly eligible for Medicare, and typically runs for 7 months.

Special Enrollment Period (SEP): This period is for individuals who experience a qualifying life event, such as losing their current coverage or moving to a new area.

Step 3: Research and Compare Plans

Once you’ve determined your eligibility and chosen your enrollment period, it’s time to research and compare Medicare Advantage plans. You can use Medicare’s Plan Finder tool to compare plans in your area, or contact insurance companies directly to learn more about their plans.

Step 4: Apply for Coverage

Once you’ve chosen a plan, you can apply for coverage online, by phone, or by mail. You’ll need to provide some personal and health information, as well as your Medicare card and identification.

Step 5: Review and Understand Your Coverage

After you’ve applied for coverage, review your plan’s coverage and benefits to ensure you understand what’s included. You can also contact your plan’s customer service department if you have any questions or concerns.

By following these steps, you can enroll in a Medicare Advantage plan that meets your needs and budget. Remember to carefully review your plan’s coverage and benefits, and don’t hesitate to ask for help if you need it.

Common Mistakes to Avoid When Choosing a Medicare Advantage Plan

Choosing a Medicare Advantage plan can be a complex and overwhelming process, especially for those who are new to Medicare. While there are many resources available to help you make an informed decision, there are also common mistakes that people make when selecting a Medicare Advantage plan. In this article, we’ll highlight some of the most common mistakes to avoid when choosing a Medicare Advantage plan.

Mistake #1: Not Evaluating Network Providers

One of the most common mistakes people make when choosing a Medicare Advantage plan is not evaluating the plan’s network providers. It’s essential to ensure that your primary care physician and any specialists you see regularly are part of the plan’s network. If they’re not, you may face higher out-of-pocket costs or have to switch doctors.

Mistake #2: Overlooking Additional Benefits

Medicare Advantage plans often offer additional benefits, such as dental, vision, and hearing coverage. However, some people overlook these benefits or don’t understand what’s included. Make sure to carefully review the plan’s benefits and ask questions if you’re unsure.

Mistake #3: Not Comparing Costs

Another common mistake people make is not comparing the costs of different Medicare Advantage plans. While the premium may be lower for one plan, the out-of-pocket costs may be higher. Make sure to carefully review the plan’s costs, including copays, coinsurance, and deductibles.

Mistake #4: Not Checking the Plan’s Star Rating

Medicare Advantage plans are rated on a 5-star scale, with 5 stars being the highest rating. While a plan’s star rating isn’t the only factor to consider, it can give you an idea of the plan’s quality and performance. Make sure to check the plan’s star rating and read reviews from other members.

Mistake #5: Not Understanding the Plan’s Appeal Process

Finally, some people don’t understand the plan’s appeal process. If you’re denied coverage for a service or treatment, you have the right to appeal. Make sure to understand the plan’s appeal process and how to file an appeal if necessary.

By avoiding these common mistakes, you can choose a Medicare Advantage plan that meets your needs and budget. Remember to carefully review the plan’s benefits, costs, and network providers, and don’t hesitate to ask questions if you’re unsure.

Maximizing Your Medicare Advantage Plan Benefits: Tips and Strategies

To get the most out of your Medicare Advantage plan, it’s essential to understand how to navigate the system and take advantage of the benefits available to you. By following these tips and strategies, you can maximize your plan’s benefits and reduce your healthcare expenses.

One of the most effective ways to maximize your Medicare Advantage plan benefits is to use preventive care services. Many plans offer free or low-cost preventive care services, such as annual physicals, vaccinations, and screenings. These services can help identify health problems early, reducing the risk of complications and costly treatments.

Another way to get the most out of your plan is to take advantage of wellness programs. Many Medicare Advantage plans offer wellness programs, such as fitness classes, nutrition counseling, and stress management. These programs can help you maintain a healthy lifestyle, reducing your risk of chronic diseases and improving your overall well-being.

It’s also important to understand your plan’s appeal process. If you’re denied coverage for a service or treatment, you have the right to appeal the decision. Knowing how to navigate the appeal process can help you get the care you need, even if it’s initially denied.

In addition to these strategies, it’s essential to carefully review your plan’s benefits and coverage. Make sure you understand what’s covered, what’s not, and what your out-of-pocket costs will be. This can help you avoid unexpected expenses and make informed decisions about your care.

Choosing the best advantage plan for Medicare requires careful consideration of your healthcare needs and budget. By evaluating your options carefully and selecting a plan that meets your needs, you can maximize your benefits and reduce your healthcare expenses. Remember to consider factors such as network providers, coverage, and additional benefits when selecting a plan.

Finally, don’t forget to take advantage of additional benefits offered by your plan, such as dental and vision coverage. These benefits can help you maintain good oral and eye health, reducing your risk of related health problems.

By following these tips and strategies, you can get the most out of your Medicare Advantage plan and reduce your healthcare expenses. Remember to carefully review your plan’s benefits and coverage, use preventive care services, take advantage of wellness programs, and understand your plan’s appeal process. With the right plan and a little knowledge, you can maximize your Medicare Advantage plan benefits and enjoy better health and financial security.