Understanding the Importance of Medicare Advantage Plans

Medicare Advantage plans have become an increasingly popular choice for individuals seeking to maximize their Medicare benefits. These plans, offered by private insurance companies, provide an alternative to Original Medicare, offering additional benefits and often lower out-of-pocket costs. To choose the best advantage plan for Medicare, it’s essential to understand the basics of these plans and how they differ from Original Medicare.

Medicare Advantage plans are designed to provide comprehensive coverage, including hospital stays, doctor visits, and other medical services. They often include additional benefits, such as dental, vision, and hearing coverage, which are not typically covered by Original Medicare. Furthermore, Medicare Advantage plans may offer lower copays and coinsurance compared to Original Medicare, making them an attractive option for those seeking to reduce their healthcare expenses.

One of the primary benefits of Medicare Advantage plans is the ability to budget for healthcare expenses more effectively. These plans often have a maximum out-of-pocket (MOOP) limit, which caps the amount an individual must pay for healthcare expenses within a calendar year. This feature can provide peace of mind for those on a fixed income or with limited financial resources.

Another advantage of Medicare Advantage plans is the ability to choose from a range of plan options, each with its unique features and benefits. For example, some plans may offer a wider network of providers, while others may provide additional benefits, such as gym memberships or transportation services. By selecting the best advantage plan for Medicare, individuals can tailor their coverage to meet their specific needs and preferences.

When evaluating Medicare Advantage plans, it’s crucial to consider factors such as network providers, costs, and additional benefits. By carefully weighing these factors, individuals can make an informed decision and choose a plan that provides the best value for their healthcare dollars.

How to Choose the Right Medicare Advantage Plan for Your Needs

With numerous Medicare Advantage plans available, selecting the best advantage plan for Medicare can be a daunting task. To make an informed decision, it’s essential to evaluate several key factors, including network providers, costs, and additional benefits.

First, consider the network of providers associated with each plan. Ensure that your primary care physician and any specialists you see regularly are part of the plan’s network. This will help minimize out-of-pocket costs and ensure seamless care coordination. Additionally, check if the plan has a wide network of hospitals and healthcare facilities in your area.

Next, compare the costs associated with each plan, including premiums, deductibles, copays, and coinsurance. While a lower premium may seem appealing, consider the overall cost of the plan, including any additional fees or charges. Some plans may offer lower copays or coinsurance for certain services, which could save you money in the long run.

Another crucial factor to consider is the additional benefits offered by each plan. Some Medicare Advantage plans may include dental, vision, or hearing coverage, which can be valuable if you require these services regularly. Other plans may offer wellness programs, gym memberships, or transportation services, which can enhance your overall health and well-being.

When evaluating Medicare Advantage plans, it’s also essential to consider the plan’s reputation and quality ratings. Look for plans with high star ratings from Medicare, which indicate a high level of quality and customer satisfaction. Additionally, check if the plan has any accreditations or certifications from reputable organizations, such as the National Committee for Quality Assurance (NCQA).

Finally, carefully review the plan’s details, including the summary of benefits, coverage documents, and any exclusions or limitations. Ensure you understand what is covered and what is not, as well as any requirements for pre-authorizations or referrals.

By carefully evaluating these factors and considering your individual needs and preferences, you can choose the best advantage plan for Medicare that meets your unique requirements and provides the best value for your healthcare dollars.

Aetna vs. UnitedHealthcare: Comparing Top Medicare Advantage Plans

When it comes to choosing a Medicare Advantage plan, two of the most popular options are Aetna and UnitedHealthcare. Both plans offer a range of benefits and features, but they also have some key differences. In this section, we’ll compare and contrast these two plans to help you decide which one might be the best advantage plan for Medicare for your needs.

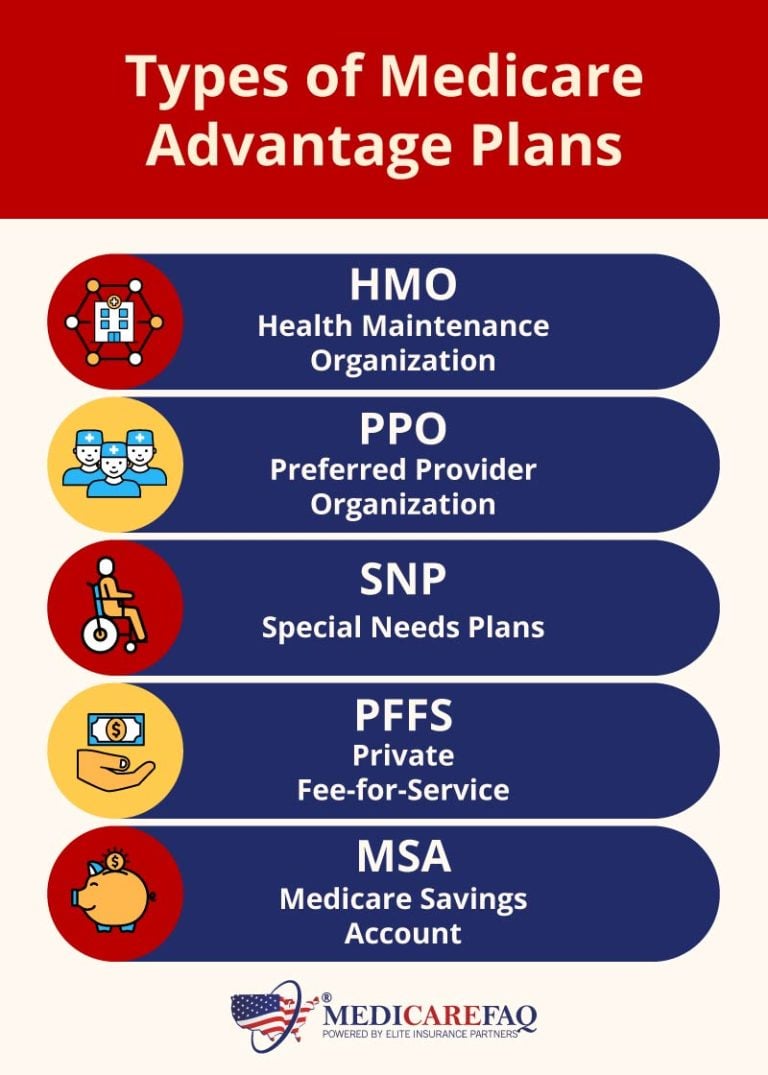

Aetna’s Medicare Advantage plans are known for their flexibility and customization options. They offer a range of plans, including HMO, PPO, and SNP options, which can be tailored to meet individual needs and budgets. Aetna’s plans also often include additional benefits, such as dental, vision, and hearing coverage, which can be valuable for those who require these services regularly.

UnitedHealthcare’s Medicare Advantage plans, on the other hand, are known for their comprehensive coverage and wide network of providers. They offer a range of plans, including HMO, PPO, and SNP options, which can provide access to a large network of doctors, hospitals, and other healthcare providers. UnitedHealthcare’s plans also often include additional benefits, such as wellness programs and gym memberships, which can enhance overall health and well-being.

One key difference between Aetna and UnitedHealthcare’s Medicare Advantage plans is the cost. Aetna’s plans tend to be more affordable, with lower premiums and out-of-pocket costs. However, UnitedHealthcare’s plans often offer more comprehensive coverage, which can be worth the added cost for those who require more extensive medical services.

Another difference is the network of providers. Aetna’s plans often have a smaller network of providers, which can be a drawback for those who require specialized care. UnitedHealthcare’s plans, on the other hand, have a much larger network of providers, which can provide more options for those who require specialized care.

Ultimately, the choice between Aetna and UnitedHealthcare’s Medicare Advantage plans will depend on your individual needs and preferences. If you’re looking for a more affordable plan with flexible customization options, Aetna might be the better choice. If you’re looking for a more comprehensive plan with a wide network of providers, UnitedHealthcare might be the better choice.

What to Look for in a Medicare Advantage Plan: Key Features to Consider

When evaluating Medicare Advantage plans, there are several key features to consider to ensure you choose the best advantage plan for Medicare that meets your needs. In this section, we’ll discuss the essential features to look for in a Medicare Advantage plan, including maximum out-of-pocket costs, copays, and coinsurance.

Maximum out-of-pocket (MOOP) costs are a critical feature to consider when evaluating Medicare Advantage plans. The MOOP is the maximum amount you’ll pay for healthcare expenses within a calendar year. After reaching the MOOP, the plan pays 100% of eligible expenses. Look for plans with a lower MOOP to minimize your out-of-pocket costs.

Copays and coinsurance are also essential features to consider. Copays are fixed amounts you pay for specific services, such as doctor visits or prescriptions. Coinsurance is a percentage of the cost of a service that you pay after meeting the deductible. Look for plans with lower copays and coinsurance rates to reduce your out-of-pocket costs.

Another key feature to consider is the plan’s network of providers. Ensure that your primary care physician and any specialists you see regularly are part of the plan’s network. This will help minimize out-of-pocket costs and ensure seamless care coordination.

Additionally, consider the plan’s coverage for additional benefits, such as dental, vision, and hearing coverage. These benefits can be valuable if you require these services regularly. Some plans may also offer wellness programs, gym memberships, or transportation services, which can enhance your overall health and well-being.

Finally, evaluate the plan’s customer service and support. Look for plans with 24/7 customer support, online resources, and mobile apps to help you manage your care and benefits.

By carefully evaluating these key features, you can choose a Medicare Advantage plan that meets your needs and provides the best value for your healthcare dollars. Remember to consider your individual needs and preferences when evaluating plans, and don’t hesitate to reach out to the plan’s customer service team if you have any questions or concerns.

The Role of Star Ratings in Evaluating Medicare Advantage Plans

Medicare’s Star Rating system is a valuable tool for evaluating the quality of Medicare Advantage plans. The Star Rating system assigns a rating of one to five stars to each plan, based on its performance in several key areas, including quality of care, patient satisfaction, and customer service.

The Star Rating system is designed to help beneficiaries make informed decisions when choosing a Medicare Advantage plan. By evaluating a plan’s Star Rating, beneficiaries can get a sense of the plan’s overall quality and performance. Plans with higher Star Ratings tend to have better quality of care, higher patient satisfaction, and more comprehensive customer service.

When evaluating Medicare Advantage plans, it’s essential to consider the plan’s Star Rating. Plans with four or five stars are generally considered to be high-quality plans that offer excellent care and service. Plans with lower Star Ratings may have some quality issues or limitations that could impact the beneficiary’s experience.

It’s also important to note that the Star Rating system is not a perfect measure of a plan’s quality. There may be other factors to consider, such as the plan’s network of providers, coverage, and costs. However, the Star Rating system can provide a useful starting point for evaluating Medicare Advantage plans and making informed decisions.

In addition to the overall Star Rating, Medicare also assigns separate ratings for specific aspects of a plan’s performance, such as quality of care, patient satisfaction, and customer service. These ratings can provide a more detailed picture of a plan’s strengths and weaknesses.

By considering a plan’s Star Rating and other performance metrics, beneficiaries can make informed decisions and choose the best advantage plan for Medicare that meets their needs and provides high-quality care and service.

Medicare Advantage Plans with Additional Benefits: Are They Worth It?

Some Medicare Advantage plans offer additional benefits that can enhance your overall health and well-being. These benefits may include gym memberships, transportation services, meal delivery, or other perks that can make a big difference in your daily life. But are these benefits worth the added cost?

To answer this question, let’s take a closer look at some of the additional benefits that Medicare Advantage plans may offer. Gym memberships, for example, can be a great way to stay active and healthy, especially for seniors who may have mobility issues or chronic health conditions. Transportation services can also be a big help, especially for those who have trouble getting to doctor’s appointments or other medical services.

Meal delivery services can also be a valuable benefit, especially for seniors who have trouble cooking or preparing meals on their own. These services can provide healthy, nutritious meals that can help support overall health and well-being.

But while these benefits can be valuable, they may also come with an added cost. Some Medicare Advantage plans may charge higher premiums or have higher out-of-pocket costs in order to offer these additional benefits. So, are they worth it?

The answer to this question will depend on your individual needs and circumstances. If you’re someone who values the convenience and flexibility of additional benefits, and you’re willing to pay a bit more for them, then a Medicare Advantage plan with additional benefits may be a good choice for you.

On the other hand, if you’re on a tight budget or you’re not sure if you’ll use the additional benefits, then a more basic Medicare Advantage plan may be a better option. Ultimately, the decision will depend on your individual needs and priorities.

When evaluating Medicare Advantage plans with additional benefits, be sure to carefully review the plan’s details and costs. Consider what benefits are included, and how much they’ll cost. Also, think about your individual needs and priorities, and whether the additional benefits are worth the added cost.

Navigating the Medicare Advantage Plan Enrollment Process

Enrolling in a Medicare Advantage plan can be a complex process, but understanding the eligibility requirements, enrollment periods, and plan options can help make the process smoother. In this section, we’ll walk you through the steps to enroll in a Medicare Advantage plan and provide tips for navigating the process.

Eligibility Requirements: To be eligible for a Medicare Advantage plan, you must be enrolled in Medicare Part A and Part B, and you must live in the plan’s service area. You can check your eligibility by contacting Medicare or visiting the Medicare website.

Enrollment Periods: There are several enrollment periods throughout the year, including the Annual Election Period (AEP), the Medicare Advantage Open Enrollment Period (OEP), and the Special Enrollment Period (SEP). The AEP typically runs from October 15 to December 7, while the OEP runs from January 1 to March 31. The SEP is available to individuals who experience a qualifying life event, such as losing employer-sponsored coverage or moving to a new area.

Plan Options: During the enrollment period, you can choose from a variety of Medicare Advantage plans, including HMO, PPO, SNP, and MSA plans. Each plan has its own unique features, benefits, and costs, so it’s essential to carefully review the plan details before making a decision.

Enrollment Process: To enroll in a Medicare Advantage plan, you can contact the plan directly, visit the Medicare website, or work with a licensed insurance agent. You’ll need to provide your Medicare number, date of birth, and other personal information to complete the enrollment process.

Switching Plans: If you’re already enrolled in a Medicare Advantage plan and want to switch to a different plan, you can do so during the AEP or OEP. You can also switch plans during the SEP if you experience a qualifying life event.

Tips for Navigating the Enrollment Process: To ensure a smooth enrollment process, it’s essential to carefully review the plan details, including the benefits, costs, and network providers. You should also consider seeking the advice of a licensed insurance agent or Medicare expert to help you navigate the process.

By understanding the eligibility requirements, enrollment periods, and plan options, you can make an informed decision and choose the best advantage plan for Medicare that meets your needs and budget.

Common Mistakes to Avoid When Choosing a Medicare Advantage Plan

Choosing the best advantage plan for Medicare can be a daunting task, especially with the numerous options available. However, selecting the wrong plan can lead to unexpected costs, reduced coverage, and decreased satisfaction. To ensure that beneficiaries make an informed decision, it’s essential to be aware of common mistakes to avoid when choosing a Medicare Advantage plan.

One of the most significant errors is underestimating costs. Many individuals focus solely on the monthly premium, neglecting to consider other expenses such as copays, coinsurance, and deductibles. These additional costs can add up quickly, leading to financial strain. To avoid this mistake, carefully review the plan’s cost structure and consider all expenses, not just the premium.

Another common mistake is overlooking network limitations. Medicare Advantage plans often have specific networks of providers, and receiving care from out-of-network providers can result in higher costs or reduced coverage. Beneficiaries should verify that their primary care physician and specialists are part of the plan’s network before enrolling.

Failing to review plan details carefully is also a common error. Medicare Advantage plans can have varying levels of coverage, and some may offer additional benefits such as dental, vision, or hearing coverage. Beneficiaries should thoroughly review the plan’s details, including the summary of benefits and coverage documents, to ensure they understand what is included and what is not.

Not considering the plan’s star rating is another mistake to avoid. Medicare’s Star Rating system evaluates the quality of Medicare Advantage plans based on factors such as customer service, claims processing, and healthcare quality. Plans with higher star ratings tend to offer better coverage and services. Beneficiaries should look for plans with at least a 4-star rating to ensure they are getting a high-quality plan.

Lastly, not seeking professional advice is a common mistake. Choosing the best advantage plan for Medicare can be complex, and seeking guidance from a licensed insurance professional or a Medicare expert can be invaluable. These professionals can help beneficiaries navigate the enrollment process, answer questions, and provide personalized recommendations.

By being aware of these common mistakes, beneficiaries can make an informed decision when choosing a Medicare Advantage plan. Remember, selecting the right plan can have a significant impact on healthcare costs, coverage, and overall satisfaction. Take the time to carefully evaluate plans, consider all costs, and seek professional advice to ensure the best possible outcome.