Navigating the World of Business Loans: What You Need to Know

Securing the right financing is crucial for businesses to grow, expand, and thrive. However, navigating the complex world of business loans can be daunting, especially for entrepreneurs and small business owners. With numerous banks and lenders offering various loan options, it’s essential to find the best bank for a business loan that meets your specific needs. In this article, we’ll provide a comprehensive guide to help you make informed decisions and unlock the right financing for your business.

The process of finding the best bank for a business loan can be overwhelming, with numerous factors to consider, such as interest rates, repayment terms, and customer service. Moreover, the ever-changing landscape of business financing means that what works today may not work tomorrow. To stay ahead of the curve, it’s vital to stay informed and adapt to the latest trends and developments in the industry.

According to a recent survey, nearly 70% of small business owners rely on loans to fund their operations. However, many struggle to find the right lender, with over 50% reporting difficulty in securing a loan. This highlights the need for a comprehensive guide that provides valuable insights and practical advice on finding the best bank for a business loan.

Throughout this article, we’ll delve into the world of business loans, exploring the various options available, and providing tips and advice on how to select the best bank for your business loan needs. Whether you’re a seasoned entrepreneur or just starting out, this guide will equip you with the knowledge and expertise necessary to make informed decisions and secure the best financing for your business.

So, what makes a bank the best for a business loan? Is it the interest rate, the repayment terms, or the customer service? The answer lies in finding a bank that offers a combination of these factors, tailored to your specific business needs. In the next section, we’ll explore the key factors to consider when choosing the best bank for your business loan needs.

How to Choose the Best Bank for Your Business Loan Needs

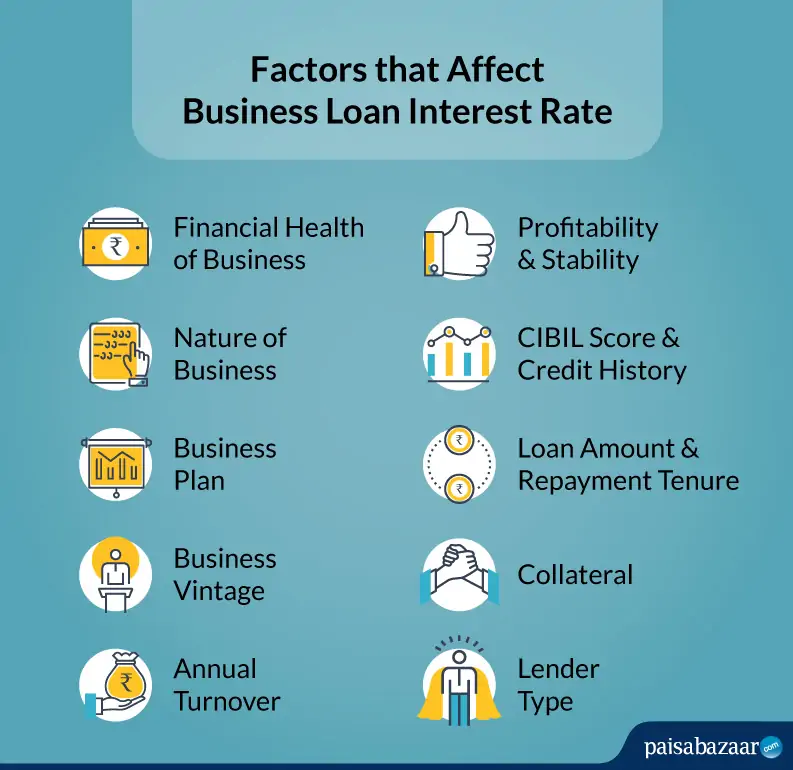

When it comes to selecting the best bank for a business loan, there are several factors to consider. With so many banks and lenders offering various loan options, it’s essential to do your research and compare different banks and their offerings. Here are some tips to help you choose the best bank for your business loan needs:

First and foremost, consider the interest rate offered by the bank. A lower interest rate can save your business money in the long run, but be sure to also consider the repayment terms and any fees associated with the loan. Some banks may offer more flexible repayment terms, such as a longer repayment period or a lower monthly payment, which can be beneficial for businesses with cash flow constraints.

Another important factor to consider is customer service. Look for a bank that offers personalized service and a dedicated business banking team. This can be especially beneficial for businesses that require ongoing support and guidance. Additionally, consider the bank’s reputation and reviews from other business owners to ensure you’re working with a reputable and trustworthy lender.

It’s also essential to consider the bank’s loan requirements and qualifications. Some banks may have stricter requirements, such as a higher credit score or more extensive financial documentation, while others may be more lenient. Be sure to review the bank’s requirements carefully and ensure you meet the necessary qualifications before applying.

Finally, don’t be afraid to shop around and compare different banks and their offerings. This can help you find the best bank for your business loan needs and ensure you’re getting the best deal possible. By doing your research and considering these factors, you can make an informed decision and secure the best financing for your business.

Some popular banks for business loans include Wells Fargo, Chase, and Bank of America. These banks offer a range of loan options and have a reputation for providing excellent customer service. However, it’s essential to do your research and compare different banks and their offerings to find the best fit for your business.

In the next section, we’ll review and compare popular banks that offer business loans, highlighting their strengths and weaknesses, and providing examples of successful business loan stories.

https://www.youtube.com/watch?v=2zc_2ECjtl0

Top Banks for Business Loans: A Review of Popular Options

When it comes to finding the best bank for a business loan, there are several popular options to consider. In this section, we’ll review and compare three of the top banks for business loans: Wells Fargo, Chase, and Bank of America.

Wells Fargo is one of the largest banks in the US, with a wide range of business loan options available. They offer competitive interest rates, flexible repayment terms, and a dedicated business banking team. Wells Fargo also has a strong reputation for providing excellent customer service, making them a popular choice among business owners.

Chase is another top bank for business loans, with a variety of loan options available, including term loans, lines of credit, and commercial mortgages. They offer competitive interest rates and flexible repayment terms, as well as a range of additional services, such as cash management and payroll processing. Chase also has a strong online platform, making it easy for business owners to manage their accounts and apply for loans.

Bank of America is also a top bank for business loans, with a wide range of loan options available, including term loans, lines of credit, and commercial mortgages. They offer competitive interest rates and flexible repayment terms, as well as a range of additional services, such as cash management and payroll processing. Bank of America also has a strong reputation for providing excellent customer service, making them a popular choice among business owners.

All three of these banks have their strengths and weaknesses, and the best bank for your business loan needs will depend on your specific circumstances. However, by doing your research and comparing different banks and their offerings, you can make an informed decision and secure the best financing for your business.

For example, Wells Fargo’s BusinessLoan program offers competitive interest rates and flexible repayment terms, making it a popular choice among business owners. Chase’s Business Line of Credit program offers a range of benefits, including competitive interest rates and flexible repayment terms, as well as a range of additional services, such as cash management and payroll processing. Bank of America’s Business Advantage program offers a range of benefits, including competitive interest rates and flexible repayment

Understanding Business Loan Requirements: What You Need to Qualify

When applying for a business loan, it’s essential to understand the typical requirements for qualifying. These requirements may vary depending on the bank or lender, but there are some common factors that are typically considered. In this section, we’ll discuss the typical requirements for qualifying for a business loan, including credit score, business history, and financial statements.

Credit score is a critical factor in determining whether a business qualifies for a loan. A good credit score can help a business qualify for a loan with a lower interest rate and more favorable terms. Typically, a credit score of 650 or higher is considered good, but some lenders may have more stringent requirements. To improve your chances of approval, it’s essential to maintain a good credit score by making timely payments and keeping credit utilization low.

Business history is another important factor in determining whether a business qualifies for a loan. Lenders typically look for businesses with a proven track record of success, including a stable income stream and a solid business plan. To improve your chances of approval, it’s essential to have a well-written business plan and a clear understanding of your business’s financials.

Financial statements are also a critical factor in determining whether a business qualifies for a loan. Lenders typically require businesses to provide financial statements, including balance sheets, income statements, and cash flow statements. To improve your chances of approval, it’s essential to have accurate and up-to-date financial statements that demonstrate a stable financial position.

In addition to these factors, lenders may also consider other requirements, such as collateral, industry experience, and management team. To improve your chances of approval, it’s essential to have a solid understanding of these requirements and to be prepared to provide the necessary documentation.

By understanding the typical requirements for qualifying for a business loan, you can improve your chances of approval and secure the best financing for your business. In the next section, we’ll discuss the benefits of working with a community bank or credit union for a business loan.

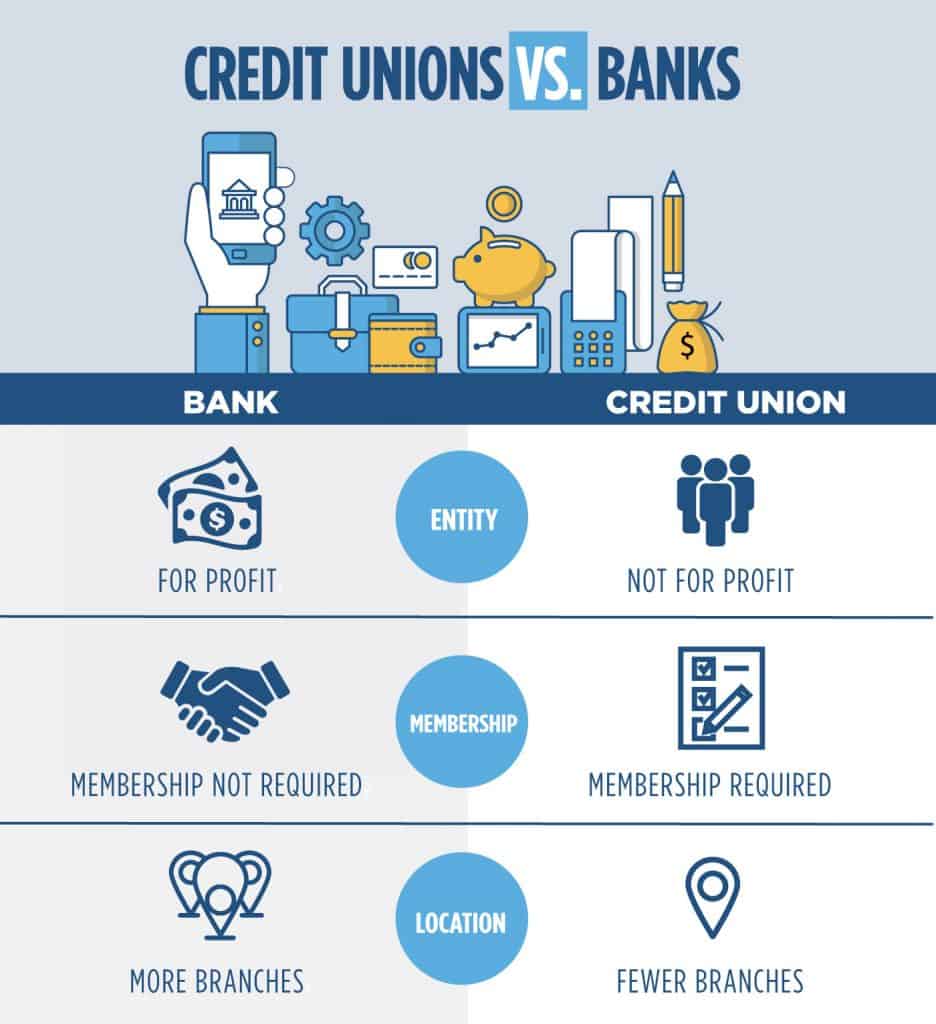

The Benefits of Working with a Community Bank or Credit Union

When it comes to finding the best bank for a business loan, many business owners overlook the benefits of working with a community bank or credit union. These institutions offer a range of advantages, including personalized service, flexible terms, and community involvement. In this section, we’ll explore the benefits of working with a community bank or credit union for a business loan.

One of the primary benefits of working with a community bank or credit union is personalized service. Unlike larger banks, community banks and credit unions are often more willing to work with business owners to understand their unique needs and provide tailored solutions. This can result in a more positive and supportive banking experience.

Another benefit of working with a community bank or credit union is flexible terms. These institutions often have more flexible lending requirements and may be more willing to work with business owners who have less-than-perfect credit or other challenges. This can make it easier for business owners to secure the financing they need to grow and succeed.

Community involvement is another key benefit of working with a community bank or credit union. These institutions are often deeply involved in the local community and may offer a range of programs and services to support local businesses. This can include everything from business loan programs to financial education and training.

For example, a community bank may offer a business loan program specifically designed for small businesses or startups. This program may include flexible terms, such as lower interest rates or longer repayment periods, as well as personalized service and support. By working with a community bank or credit union, business owners can tap into these resources and gain a competitive edge.

In addition to these benefits, community banks and credit unions often have a more localized focus, which can result in faster decision-making and more efficient service. This can be especially beneficial for business owners who need quick access to capital or other financial resources.

By considering the benefits of working with a community bank or credit union, business owners can make an informed decision about their financing options and choose the best bank for their business loan needs. In the next section, we’ll explore the benefits of online lenders as a viable alternative for business loans.

Online Lenders: A Viable Alternative for Business Loans

In recent years, online lenders have emerged as a viable alternative for business loans. These lenders offer a range of benefits, including faster application processes, more flexible terms, and lower interest rates. In this section, we’ll explore the benefits of online lenders and review some popular options.

One of the primary benefits of online lenders is their speed and efficiency. Unlike traditional banks, online lenders can process applications quickly and provide funding in a matter of days or even hours. This can be especially beneficial for businesses that need quick access to capital.

Another benefit of online lenders is their flexibility. These lenders often have more lenient requirements and may be more willing to work with businesses that have less-than-perfect credit or other challenges. This can make it easier for businesses to secure the financing they need to grow and succeed.

Some popular online lenders for business loans include Lending Club and Funding Circle. These lenders offer a range of loan options, including term loans, lines of credit, and invoice financing. They also have a reputation for providing excellent customer service and support.

For example, Lending Club offers a range of loan options, including term loans and lines of credit. They also have a fast and efficient application process, with funding available in as little as 24 hours. Funding Circle also offers a range of loan options, including term loans and invoice financing. They have a reputation for providing excellent customer service and support, and have funded over $10 billion in loans to date.

By considering online lenders as a viable alternative for business loans, business owners can make an informed decision about their financing options and choose the best bank for their business loan needs. In the next section, we’ll discuss common mistakes to avoid when applying for a business loan.

Common Mistakes to Avoid When Applying for a Business Loan

When applying for a business loan, there are several common mistakes to avoid. These mistakes can result in a denied loan application, or worse, a loan with unfavorable terms. In this section, we’ll discuss some of the most common mistakes to avoid when applying for a business loan.

One of the most common mistakes is a poor credit history. A poor credit history can make it difficult to qualify for a loan, and may result in a higher interest rate or less favorable terms. To avoid this mistake, it’s essential to check your credit report and score before applying for a loan, and to take steps to improve your credit if necessary.

Another common mistake is inadequate financial planning. This can include a lack of financial statements, such as balance sheets and income statements, or a lack of a clear business plan. To avoid this mistake, it’s essential to have a solid financial plan in place, including a detailed business plan and financial statements.

A lack of collateral is also a common mistake. Collateral is an asset that can be used to secure a loan, such as a building or equipment. Without collateral, it may be difficult to qualify for a loan, or the interest rate may be higher. To avoid this mistake, it’s essential to have a clear understanding of the collateral requirements for the loan, and to have a plan in place to provide collateral if necessary.

Finally, it’s essential to avoid applying for too many loans at once. This can result in a lower credit score, and may make it more difficult to qualify for a loan. To avoid this mistake, it’s essential to research and compare different loan options, and to apply for only one loan at a time.

By avoiding these common mistakes, business owners can increase their chances of approval and secure the best financing for their business. In the next section, we’ll summarize the key takeaways from the article and provide a conclusion.

Conclusion: Finding the Best Bank for Your Business Loan Needs

In conclusion, finding the right bank for a business loan is a critical decision that can have a significant impact on the success of your business. By doing your research, comparing options, and making informed decisions, you can secure the best financing for your business and achieve your goals.

Remember, the best bank for a business loan is one that offers competitive interest rates, flexible repayment terms, and excellent customer service. It’s also essential to consider the bank’s reputation, experience, and expertise in business lending.

By following the tips and advice outlined in this article, you can make an informed decision and find the best bank for your business loan needs. Don’t be afraid to shop around, compare options, and negotiate terms to get the best deal possible.

Ultimately, the key to finding the best bank for a business loan is to do your research, be prepared, and make informed decisions. By taking the time to understand your options and make a thoughtful decision, you can secure the financing you need to grow and succeed.

As you navigate the complex world of business financing, remember that finding the right bank for a business loan is just the first step. It’s essential to also consider other factors, such as your business plan, financial statements, and credit score, to ensure that you’re well-positioned for success.

By following the guidance outlined in this article, you can make informed decisions and find the best bank for your business loan needs. Good luck!