Why Choosing the Right Savings Account Matters

Selecting the right savings account is a crucial step in achieving your financial goals. With so many options available, it’s essential to consider factors such as interest rates, fees, and mobile banking capabilities to ensure you’re getting the most out of your savings. The best banks for savings accounts offer a combination of competitive interest rates, low fees, and user-friendly online platforms. By choosing the right savings account, you can earn higher interest rates, avoid unnecessary fees, and manage your finances more efficiently.

Interest rates play a significant role in determining the best savings account for your needs. High-yield savings accounts offer higher interest rates than traditional savings accounts, allowing you to earn more interest on your deposits. However, it’s essential to consider the fees associated with these accounts, as they can eat into your earnings. Look for accounts with low or no fees, such as maintenance fees, overdraft fees, or ATM fees.

Mobile banking capabilities are also an essential consideration when choosing a savings account. The best banks for savings accounts offer user-friendly mobile apps that allow you to manage your finances on-the-go. Look for apps that offer features such as mobile deposit, bill pay, and account alerts. Additionally, consider the bank’s online platform and customer support, as these can significantly impact your overall banking experience.

Ultimately, the right savings account for you will depend on your individual financial goals and needs. By considering factors such as interest rates, fees, and mobile banking capabilities, you can choose a savings account that helps you achieve your financial objectives. Whether you’re looking to save for a short-term goal or long-term investment, the best banks for savings accounts can provide you with the tools and resources you need to succeed.

How to Find the Best Savings Account for Your Needs

When searching for the best banks for savings accounts, it’s essential to have a clear understanding of your financial goals and needs. To find the right savings account, follow these steps:

First, determine your savings goals. Are you saving for a short-term goal, such as a vacation or down payment on a house? Or are you looking to save for a long-term goal, such as retirement? Knowing your goals will help you determine the type of savings account that’s right for you.

Next, research and compare savings accounts from different banks. Look for accounts that offer competitive interest rates, low fees, and user-friendly online platforms. Consider factors such as minimum balance requirements, ATM fees, and mobile banking capabilities.

When evaluating interest rates, consider the annual percentage yield (APY) and the compounding frequency. A higher APY and daily compounding can result in higher earnings over time. Additionally, look for accounts with low or no fees, such as maintenance fees, overdraft fees, or ATM fees.

Minimum balance requirements are also an essential consideration. Some savings accounts require a minimum balance to avoid fees or earn interest. Consider accounts with low or no minimum balance requirements to avoid unnecessary fees.

Finally, consider the bank’s reputation and customer support. Look for banks with a strong reputation and 24/7 customer support. A user-friendly online platform and mobile banking app can also make it easier to manage your finances on-the-go.

By following these steps, you can find the best savings account for your needs and achieve your financial goals. Remember to always read the fine print and understand the terms and conditions of the account before opening.

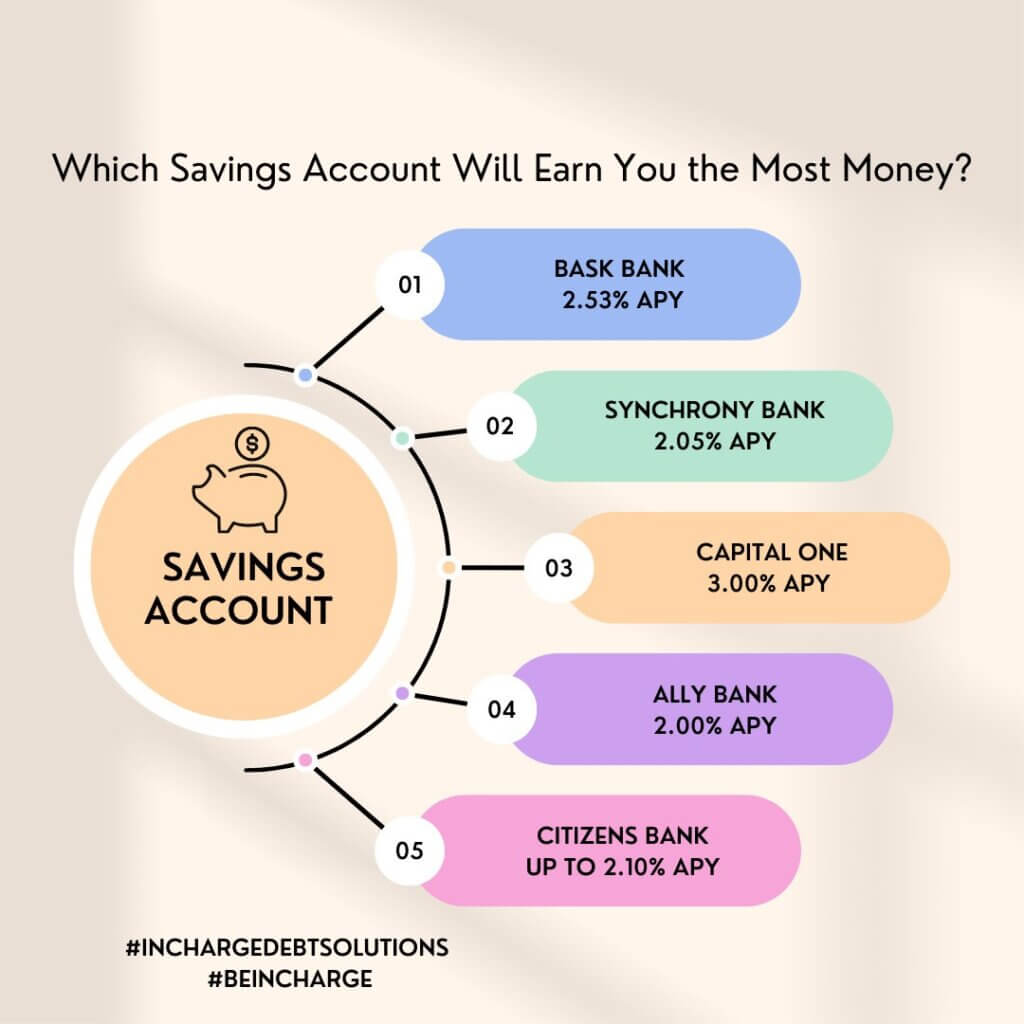

Top Savings Accounts for High-Yield Interest Rates

High-yield savings accounts offer a higher interest rate than traditional savings accounts, making them an attractive option for those looking to maximize their savings. Here are some of the top high-yield savings accounts from top banks:

Ally Bank’s Online Savings Account offers a competitive interest rate of 2.20% APY, with no minimum balance requirement and no monthly maintenance fees. Ally Bank is a well-established online bank with a strong reputation for customer service and user-friendly online platforms.

Marcus by Goldman Sachs offers a high-yield savings account with a 2.15% APY, with no minimum balance requirement and no fees. Marcus is a relatively new online bank, but it has quickly gained a reputation for its competitive interest rates and user-friendly mobile app.

Discover Bank’s Online Savings Account offers a 2.10% APY, with no minimum balance requirement and no fees. Discover Bank is a well-established online bank with a strong reputation for customer service and a user-friendly online platform.

These high-yield savings accounts are ideal for those looking to maximize their savings without sacrificing accessibility and convenience. However, it’s essential to note that interest rates are subject to change and may not be available in all states.

When choosing a high-yield savings account, consider factors such as interest rates, fees, and minimum balance requirements. It’s also essential to evaluate the bank’s reputation, customer service, and online platform to ensure it meets your needs.

By choosing a high-yield savings account from a top bank, you can earn a higher interest rate on your savings and achieve your financial goals. Remember to always read the fine print and understand the terms and conditions of the account before opening.

Best Savings Accounts for Low Fees and Minimums

When it comes to savings accounts, fees and minimums can eat into your earnings and make it difficult to reach your financial goals. Fortunately, there are several banks that offer savings accounts with low or no fees, making it easier to save and grow your money.

Capital One 360 is a popular online bank that offers a 360 Savings Account with no fees and no minimum balance requirement. This account also offers a competitive interest rate of 2.05% APY, making it an attractive option for those looking to maximize their savings.

CIT Bank is another online bank that offers a High Yield Savings Account with no fees and no minimum balance requirement. This account offers a competitive interest rate of 2.15% APY and is FDIC-insured, making it a safe and secure option for savers.

Other banks that offer savings accounts with low or no fees include American Express National Bank, Barclays, and Discover Bank. These accounts often come with competitive interest rates and minimal fees, making them a great option for those looking to save and grow their money.

When evaluating savings accounts with low or no fees, consider factors such as interest rates, minimum balance requirements, and mobile banking capabilities. It’s also essential to evaluate the bank’s reputation, customer service, and online platform to ensure it meets your needs.

By choosing a savings account with low or no fees, you can avoid unnecessary charges and maximize your earnings. Remember to always read the fine print and understand the terms and conditions of the account before opening.

Savings Accounts with Innovative Features and Technology

In recent years, several banks have introduced innovative features and technologies to their savings accounts, making it easier for customers to manage their finances and reach their savings goals. Here are some examples of savings accounts with unique features:

Chime is a mobile-only bank that offers a Savings Account with a unique feature called “SpotMe”. This feature allows customers to overdraft up to $100 without incurring any fees. Chime also offers a mobile app that allows customers to track their spending, set budgets, and receive alerts when their account balance is low.

Simple is another mobile-only bank that offers a Savings Account with a unique feature called “Goals”. This feature allows customers to set savings goals and track their progress towards reaching those goals. Simple also offers a mobile app that allows customers to track their spending, set budgets, and receive alerts when their account balance is low.

Other banks that offer savings accounts with innovative features include Digit, which offers a Savings Account with an automatic savings feature that transfers small amounts of money from the customer’s checking account to their savings account, and Qapital, which offers a Savings Account with a feature that allows customers to set savings goals and track their progress towards reaching those goals.

When evaluating savings accounts with innovative features, consider factors such as the types of features offered, the user experience of the mobile app, and the fees associated with the account. It’s also essential to evaluate the bank’s reputation, customer service, and online platform to ensure it meets your needs.

By choosing a savings account with innovative features, you can take advantage of new technologies and tools that can help you manage your finances and reach your savings goals. Remember to always read the fine print and understand the terms and conditions of the account before opening.

Traditional Banks with Competitive Savings Accounts

While online banks and credit unions have gained popularity in recent years, traditional banks still offer competitive savings accounts that can help you reach your financial goals. Here are some examples of traditional banks with competitive savings accounts:

Bank of America’s Advantage Savings Account offers a competitive interest rate of 2.00% APY, with a minimum balance requirement of $100. This account also comes with a mobile banking app and online platform that allows you to manage your finances on-the-go.

Wells Fargo’s Way2Save Savings Account offers a competitive interest rate of 2.05% APY, with a minimum balance requirement of $25. This account also comes with a mobile banking app and online platform that allows you to manage your finances on-the-go.

Chase’s Savings Account offers a competitive interest rate of 2.10% APY, with a minimum balance requirement of $300. This account also comes with a mobile banking app and online platform that allows you to manage your finances on-the-go.

While traditional banks may not offer the same level of innovation as online banks and credit unions, they still provide a range of benefits, including a wide network of branches and ATMs, and a reputation for stability and security.

When evaluating traditional banks with competitive savings accounts, consider factors such as interest rates, fees, and minimum balance requirements. It’s also essential to evaluate the bank’s reputation, customer service, and online platform to ensure it meets your needs.

By choosing a traditional bank with a competitive savings account, you can take advantage of a range of benefits and features that can help you reach your financial goals. Remember to always read the fine print and understand the terms and conditions of the account before opening.

Online Banks and Credit Unions: A Viable Alternative

For those looking for alternatives to traditional brick-and-mortar banks, online banks and credit unions can be an attractive option for savings accounts. These institutions often offer competitive interest rates, lower fees, and innovative features that can help savers reach their financial goals. When considering online banks and credit unions for a savings account, it’s essential to weigh the benefits and drawbacks of these institutions.

One of the primary advantages of online banks and credit unions is their ability to offer higher interest rates compared to traditional banks. Since they don’t have the same overhead costs as brick-and-mortar banks, they can pass the savings on to customers in the form of higher interest rates. For example, Alliant Credit Union offers a high-yield savings account with an APY of 2.10%, while Navy Federal Credit Union offers a savings account with an APY of 2.05%.

Another benefit of online banks and credit unions is their low or no-fee structure. Many of these institutions don’t charge monthly maintenance fees, overdraft fees, or ATM fees, which can save customers a significant amount of money over time. Additionally, online banks and credit unions often have more flexible minimum balance requirements, making it easier for customers to open and maintain a savings account.

However, online banks and credit unions may have some drawbacks. For example, they often have limited branch and ATM networks, which can make it difficult for customers to access their money in person. Additionally, some online banks and credit unions may have more restrictive customer service hours or limited support options.

Despite these potential drawbacks, online banks and credit unions can be a viable alternative for those looking for a competitive savings account. By doing research and comparing rates, fees, and features, customers can find an online bank or credit union that meets their needs and helps them achieve their financial goals. Some popular online banks and credit unions for savings accounts include:

- Alliant Credit Union

- Navy Federal Credit Union

- Discover Bank

- Capital One 360

- Ally Bank

When searching for the best banks for savings accounts, it’s essential to consider online banks and credit unions as part of the equation. By weighing the benefits and drawbacks of these institutions, customers can make an informed decision and find a savings account that helps them maximize their savings and reach their financial goals.

Conclusion: Finding the Best Savings Account for Your Financial Future

When it comes to selecting a savings account, there are numerous options available, each with its unique features, benefits, and drawbacks. To find the best savings account for your financial future, it’s essential to consider your individual needs and goals. By evaluating factors such as interest rates, fees, and mobile banking capabilities, you can make an informed decision and choose a savings account that aligns with your financial objectives.

Throughout this guide, we’ve explored various types of savings accounts, including high-yield savings accounts, low-fee savings accounts, and savings accounts with innovative features and technology. We’ve also discussed the benefits and drawbacks of online banks and credit unions, as well as traditional banks with competitive savings accounts.

When searching for the best banks for savings accounts, it’s crucial to consider your financial goals and needs. Are you looking for a high-yield savings account to maximize your savings? Or perhaps a low-fee savings account to minimize your expenses? Whatever your goals, there’s a savings account out there that can help you achieve them.

Some final tips to keep in mind when selecting a savings account include:

- Evaluate the interest rate and fees associated with the account

- Consider the minimum balance requirements and any potential penalties

- Look for mobile banking capabilities and online banking features

- Research the bank’s reputation and customer service

- Compare rates and features across multiple banks and credit unions

By following these tips and considering your individual needs and goals, you can find the best savings account for your financial future. Remember to always read the fine print, ask questions, and seek advice from a financial expert if needed. With the right savings account, you can achieve your financial goals and secure a brighter financial future.