Why Accurate Bookkeeping is Crucial for Small Business Success

Accurate bookkeeping is the backbone of any successful small business. It provides financial transparency, ensuring that business owners have a clear understanding of their company’s financial health. This, in turn, enables informed decision-making, allowing entrepreneurs to make strategic choices that drive growth and profitability. Moreover, accurate bookkeeping is essential for tax compliance, helping small businesses avoid costly penalties and fines. By implementing a robust bookkeeping system, small businesses can also identify areas for cost reduction, optimize cash flow, and improve their overall financial management.

In today’s competitive business landscape, small businesses need to be agile and responsive to changing market conditions. Accurate bookkeeping provides the financial insights necessary to make quick and informed decisions, helping small businesses stay ahead of the curve. Furthermore, accurate bookkeeping helps small businesses build credibility with stakeholders, including investors, lenders, and suppliers. By demonstrating a commitment to financial transparency and accountability, small businesses can establish trust and strengthen their relationships with key partners.

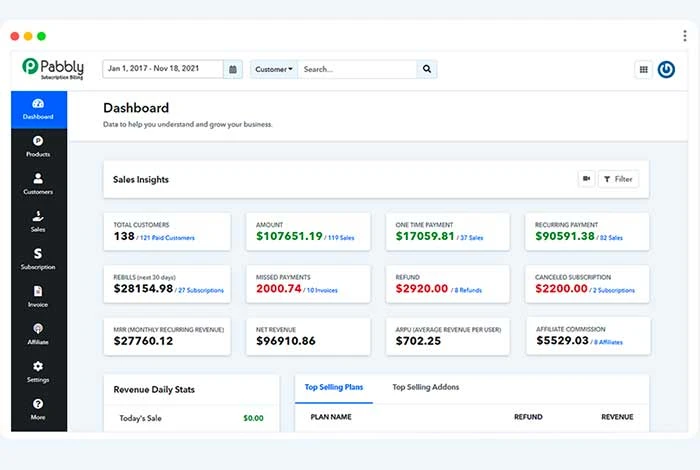

When it comes to selecting the best bookkeeping software for small business, accuracy and reliability are paramount. Look for software that offers automated data entry, real-time financial reporting, and robust security features. Cloud-based bookkeeping software, such as QuickBooks and Xero, offer the added benefits of accessibility, scalability, and collaboration. By leveraging these tools, small businesses can streamline their financial management, reduce errors, and improve their overall financial performance.

According to a recent survey, small businesses that use cloud-based bookkeeping software are more likely to experience increased productivity, improved cash flow, and enhanced financial visibility. By adopting a cloud-based bookkeeping solution, small businesses can also reduce their reliance on manual data entry, minimize errors, and free up more time to focus on high-value activities, such as strategy and growth.

In conclusion, accurate bookkeeping is essential for small business success. By implementing a robust bookkeeping system and selecting the best bookkeeping software for their needs, small businesses can improve their financial management, reduce errors, and drive growth and profitability. Whether you’re a startup or an established business, investing in accurate bookkeeping is a smart decision that will pay dividends for years to come.

Key Features to Look for in Bookkeeping Software for Small Business

When selecting the best bookkeeping software for small business, it’s essential to consider the features that will help streamline financial management and support business growth. The ideal bookkeeping software should be user-friendly, scalable, and offer a range of tools to manage financial transactions, track expenses, and generate reports. Here are the key features to look for in bookkeeping software for small business:

Ease of Use: The software should have an intuitive interface that makes it easy to navigate and use, even for those without extensive accounting experience. Look for software with a user-friendly dashboard, clear menus, and minimal setup requirements.

Scalability: As the business grows, the bookkeeping software should be able to adapt to increasing financial complexity. Opt for software that offers flexible pricing plans, customizable features, and seamless integration with other business applications.

Invoicing and Billing: The software should enable easy creation and management of invoices, quotes, and bills. Look for features like automated payment reminders, online payment gateways, and customizable invoice templates.

Expense Tracking: Accurate expense tracking is crucial for small businesses. The software should allow for easy categorization, tagging, and tracking of expenses, as well as automated expense reporting and reimbursement management.

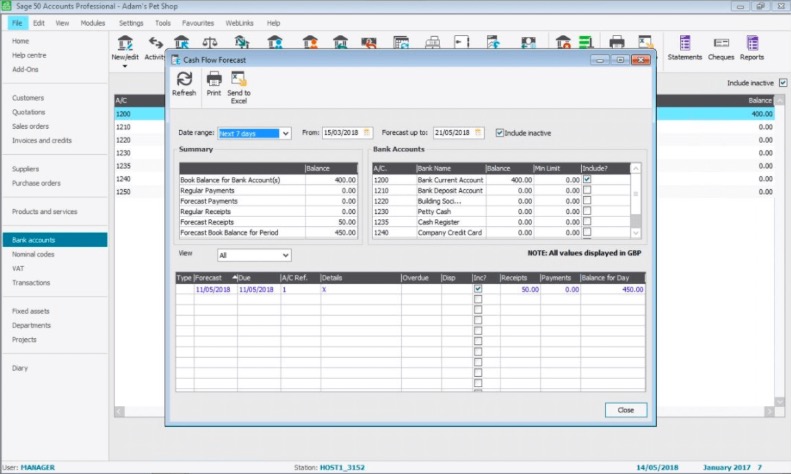

Financial Reporting: The software should provide real-time financial reporting and analytics, enabling business owners to make informed decisions. Look for features like balance sheets, income statements, and cash flow statements, as well as customizable reporting templates.

Security and Compliance: The software should ensure the security and integrity of financial data, complying with relevant regulations and standards. Look for software with robust security measures, such as data encryption, two-factor authentication, and regular backups.

Integration and Compatibility: The software should integrate seamlessly with other business applications, such as payment gateways, accounting software, and e-commerce platforms. Ensure the software is compatible with various operating systems, devices, and browsers.

By considering these key features, small business owners can find the best bookkeeping software for their needs, streamlining financial management and supporting business growth.

How to Choose the Best Bookkeeping Software for Your Small Business

Selecting the best bookkeeping software for small business can be a daunting task, given the numerous options available. However, by following a step-by-step approach, business owners can make an informed decision that meets their financial management needs. Here’s a comprehensive guide to help small businesses choose the best bookkeeping software:

Step 1: Assess Business Needs

Before starting the search for bookkeeping software, it’s essential to assess the business’s financial management needs. Consider the number of employees, revenue, and financial transactions. Identify the specific features required, such as invoicing, expense tracking, and financial reporting.

Step 2: Evaluate Software Options

Research and evaluate different bookkeeping software options, including cloud-based and desktop applications. Consider the software’s scalability, ease of use, and compatibility with other business applications. Look for software that offers a free trial or demo to test its features and functionality.

Step 3: Read Reviews and Ask for Referrals

Read reviews from reputable sources, such as accounting professionals, business owners, and industry experts. Ask for referrals from colleagues, friends, or mentors who have experience with bookkeeping software. Pay attention to the pros and cons of each software option and evaluate their overall satisfaction.

Step 4: Compare Features and Pricing

Compare the features and pricing of different bookkeeping software options. Consider the cost of implementation, training, and ongoing support. Evaluate the software’s flexibility and customization options to ensure they meet the business’s specific needs.

Step 5: Check Security and Compliance

Ensure the bookkeeping software meets the necessary security and compliance standards, such as data encryption, two-factor authentication, and regular backups. Verify the software’s compliance with relevant regulations, such as GDPR and HIPAA.

Step 6: Test and Implement

Test the selected bookkeeping software to ensure it meets the business’s needs and expectations. Implement the software, and provide training to employees who will be using it. Monitor the software’s performance and make adjustments as necessary.

By following these steps, small businesses can choose the best bookkeeping software that meets their financial management needs, streamlines their operations, and supports their growth. Remember to consider the main keyword “best bookkeeping software for small business” when evaluating options to ensure the chosen software meets the specific needs of the business.

Top Bookkeeping Software for Small Business: A Review of QuickBooks, Xero, and Wave

When it comes to selecting the best bookkeeping software for small business, there are several options to consider. In this review, we’ll examine three popular bookkeeping software options: QuickBooks, Xero, and Wave. We’ll highlight their features, pricing, and user reviews to help small business owners make an informed decision.

QuickBooks

QuickBooks is a well-established bookkeeping software that offers a range of features, including invoicing, expense tracking, and financial reporting. It’s user-friendly and scalable, making it suitable for small businesses of all sizes. QuickBooks offers a cloud-based version, QuickBooks Online, which provides real-time access to financial data and automatic backups.

Features:

- Invoicing and billing

- Expense tracking and management

- Financial reporting and analytics

- Inventory management

- Payroll processing

Pricing:

- Simple Start: $10/month (1 user)

- Essentials: $17/month (3 users)

- Plus: $25/month (5 users)

User Reviews:

QuickBooks has a 4.5-star rating on Capterra, with users praising its ease of use and comprehensive features.

Xero

Xero is a cloud-based bookkeeping software that offers a range of features, including invoicing, expense tracking, and financial reporting. It’s known for its user-friendly interface and scalability, making it suitable for small businesses of all sizes. Xero offers automatic bank reconciliation, inventory management, and payroll processing.

Features:

- Invoicing and billing

- Expense tracking and management

- Financial reporting and analytics

- Inventory management

- Payroll processing

- Automatic bank reconciliation

Pricing:

- Early: $9/month (1 user)

- Growing: $30/month (3 users)

- Established: $40/month (5 users)

User Reviews:

Xero has a 4.5-star rating on Capterra, with users praising its ease of use and comprehensive features.

Wave

Wave is a cloud-based bookkeeping software that offers a range of features, including invoicing, expense tracking, and financial reporting. It’s known for its user-friendly interface and scalability, making it suitable for small businesses of all sizes. Wave offers automatic bank reconciliation, inventory management, and payroll processing.

Features:

- Invoicing and billing

- Expense tracking and management

- Financial reporting and analytics

- Inventory management

- Payroll processing

- Automatic bank reconciliation

Pricing:

Wave offers a free plan, as well as several paid plans, including:

- Wave Plus: $19/month (1 user)

- Wave Advisor: $29/month (3 users)

User Reviews:

Wave has a 4.5-star rating on Capterra, with users praising its ease of use and comprehensive features.

Ultimately, the best bookkeeping software for small business will depend on the specific needs and requirements of the business. By considering the features, pricing, and user reviews of QuickBooks, Xero, and Wave, small business owners can make an informed decision and choose the best bookkeeping software for their needs.

Cloud-Based Bookkeeping Software: The Benefits and Drawbacks

Cloud-based bookkeeping software has revolutionized the way small businesses manage their finances. By storing financial data in the cloud, businesses can access their accounts from anywhere, at any time, and collaborate with accountants and bookkeepers in real-time. However, like any technology, cloud-based bookkeeping software has its benefits and drawbacks.

Benefits of Cloud-Based Bookkeeping Software

Cloud-based bookkeeping software offers several benefits, including:

- Accessibility: Cloud-based bookkeeping software can be accessed from anywhere, at any time, using any device with an internet connection.

- Collaboration: Cloud-based bookkeeping software allows multiple users to access and work on financial data simultaneously, making it easier to collaborate with accountants and bookkeepers.

- Automatic Backups: Cloud-based bookkeeping software automatically backs up financial data, ensuring that it is safe and secure in case of a disaster or technical issue.

- Scalability: Cloud-based bookkeeping software can scale to meet the needs of growing businesses, without the need for expensive hardware upgrades.

- Cost-Effective: Cloud-based bookkeeping software is often more cost-effective than traditional on-premise bookkeeping software, with lower upfront costs and no maintenance fees.

Drawbacks of Cloud-Based Bookkeeping Software

While cloud-based bookkeeping software offers many benefits, it also has some drawbacks, including:

- Security Risks: Cloud-based bookkeeping software is vulnerable to security risks, such as data breaches and cyber attacks.

- Dependence on Internet Connection: Cloud-based bookkeeping software requires a stable internet connection to function, which can be a problem for businesses with poor internet connectivity.

- Vendor Lock-In: Cloud-based bookkeeping software can make it difficult to switch to a different vendor, due to the complexity of migrating financial data.

- Compliance Issues: Cloud-based bookkeeping software may not meet the compliance requirements of certain industries, such as finance and healthcare.

Best Practices for Using Cloud-Based Bookkeeping Software

To get the most out of cloud-based bookkeeping software, businesses should follow best practices, such as:

- Choose a Reputable Vendor: Choose a reputable vendor with a proven track record of security and reliability.

- Use Strong Passwords: Use strong passwords and enable two-factor authentication to protect financial data.

- Regularly Back Up Data: Regularly back up financial data to ensure that it is safe and secure.

- Monitor Activity: Monitor activity and transactions to detect any suspicious activity.

By understanding the benefits and drawbacks of cloud-based bookkeeping software, businesses can make informed decisions about their financial management needs. By following best practices, businesses can ensure that their financial data is safe, secure, and accessible from anywhere.

Bookkeeping Software for Specific Industries: A Closer Look

While bookkeeping software can be used by businesses across various industries, some industries have unique requirements that necessitate specialized bookkeeping software. In this article, we’ll examine bookkeeping software options for specific industries, including retail, construction, and non-profit, highlighting their unique features and requirements.

Retail Bookkeeping Software

Retail businesses require bookkeeping software that can handle high-volume transactions, track inventory, and manage multiple locations. Some popular bookkeeping software options for retail businesses include:

- QuickBooks: Offers advanced inventory management features, including tracking and reporting.

- Xero: Provides real-time inventory tracking and automated reporting.

- TradeGecko: Offers a cloud-based inventory management system that integrates with popular e-commerce platforms.

Construction Bookkeeping Software

Construction businesses require bookkeeping software that can handle complex project accounting, track labor costs, and manage multiple projects. Some popular bookkeeping software options for construction businesses include:

- QuickBooks: Offers advanced project accounting features, including tracking and reporting.

- Procore: Provides a cloud-based construction management platform that includes bookkeeping and accounting features.

- Jonas Construction Software: Offers a comprehensive construction management system that includes bookkeeping and accounting features.

Non-Profit Bookkeeping Software

Non-profit organizations require bookkeeping software that can handle grant tracking, donor management, and fundraising campaigns. Some popular bookkeeping software options for non-profit organizations include:

- QuickBooks: Offers advanced non-profit accounting features, including grant tracking and donor management.

- Aplos: Provides a cloud-based non-profit accounting system that includes grant tracking and donor management features.

- Nonprofit Treasurer: Offers a comprehensive non-profit accounting system that includes grant tracking and donor management features.

Key Features to Consider

When selecting bookkeeping software for a specific industry, it’s essential to consider the unique features and requirements of that industry. Some key features to consider include:

- Industry-specific reporting and tracking

- Integration with industry-specific software and systems

- Compliance with industry-specific regulations and standards

- Scalability and flexibility to meet the needs of growing businesses

By selecting bookkeeping software that meets the unique needs of a specific industry, businesses can streamline their financial management, improve accuracy and compliance, and make informed decisions to drive growth and success.

Common Bookkeeping Mistakes Small Businesses Make (And How to Avoid Them)

Bookkeeping is a crucial aspect of small business management, but it can be prone to errors and mistakes. Inaccurate bookkeeping can lead to financial mismanagement, tax compliance issues, and poor decision-making. In this article, we’ll identify common bookkeeping mistakes small businesses make and provide tips on how to avoid them.

Inaccurate Expense Tracking

One of the most common bookkeeping mistakes small businesses make is inaccurate expense tracking. This can lead to incorrect financial reporting, tax compliance issues, and poor decision-making. To avoid this mistake, small businesses should:

- Implement a robust expense tracking system

- Use a cloud-based bookkeeping software that automates expense tracking

- Regularly review and reconcile expense accounts

Poor Financial Reporting

Poor financial reporting is another common bookkeeping mistake small businesses make. This can lead to poor decision-making, financial mismanagement, and tax compliance issues. To avoid this mistake, small businesses should:

- Implement a robust financial reporting system

- Use a cloud-based bookkeeping software that provides real-time financial reporting

- Regularly review and analyze financial reports

Insufficient Cash Flow Management

Insufficient cash flow management is a common bookkeeping mistake small businesses make. This can lead to financial mismanagement, poor decision-making, and even business failure. To avoid this mistake, small businesses should:

- Implement a robust cash flow management system

- Use a cloud-based bookkeeping software that provides real-time cash flow tracking

- Regularly review and analyze cash flow reports

Failure to Reconcile Accounts

Failure to reconcile accounts is a common bookkeeping mistake small businesses make. This can lead to financial mismanagement, poor decision-making, and tax compliance issues. To avoid this mistake, small businesses should:

- Regularly reconcile accounts

- Use a cloud-based bookkeeping software that automates account reconciliation

- Review and analyze account reconciliation reports

Tips for Avoiding Bookkeeping Mistakes

To avoid bookkeeping mistakes, small businesses should:

- Implement a robust bookkeeping system

- Use a cloud-based bookkeeping software that automates bookkeeping tasks

- Regularly review and analyze financial reports

- Seek professional advice from a certified accountant or bookkeeper

By avoiding common bookkeeping mistakes, small businesses can ensure accurate financial management, tax compliance, and informed decision-making. By implementing a robust bookkeeping system, using cloud-based bookkeeping software, and seeking professional advice, small businesses can maximize the benefits of bookkeeping and achieve long-term success.

Getting the Most Out of Your Bookkeeping Software: Tips and Best Practices

Once you’ve selected the best bookkeeping software for your small business, it’s essential to use it effectively to maximize its benefits. In this article, we’ll provide expert advice on how to get the most out of your bookkeeping software, including setting up a chart of accounts, tracking expenses, and generating financial reports.

Setting Up a Chart of Accounts

A chart of accounts is a fundamental component of bookkeeping software, as it helps you organize and categorize your financial transactions. To set up a chart of accounts, follow these steps:

- Identify your business’s financial accounts, such as cash, accounts payable, and accounts receivable.

- Categorize your accounts into different types, such as assets, liabilities, and equity.

- Set up a chart of accounts in your bookkeeping software, using the categories and accounts you’ve identified.

Tracking Expenses

Tracking expenses is a critical aspect of bookkeeping, as it helps you understand where your money is going and make informed decisions about your business. To track expenses effectively, follow these steps:

- Set up an expense tracking system in your bookkeeping software, using categories and accounts to categorize your expenses.

- Use a cloud-based bookkeeping software that allows you to track expenses on-the-go, using mobile apps or online portals.

- Regularly review and reconcile your expense accounts to ensure accuracy and completeness.

Generating Financial Reports

Financial reports are essential for understanding your business’s financial performance and making informed decisions. To generate financial reports effectively, follow these steps:

- Use a cloud-based bookkeeping software that provides real-time financial reporting, such as balance sheets, income statements, and cash flow statements.

- Customize your financial reports to meet your business’s specific needs, using filters and parameters to drill down into specific data.

- Regularly review and analyze your financial reports to identify trends, opportunities, and challenges.

Additional Tips and Best Practices

To get the most out of your bookkeeping software, follow these additional tips and best practices:

- Regularly back up your financial data to ensure security and integrity.

- Use a cloud-based bookkeeping software that provides automatic updates and maintenance.

- Seek professional advice from a certified accountant or bookkeeper to ensure you’re using your bookkeeping software effectively.

By following these tips and best practices, you can maximize the benefits of your bookkeeping software and achieve financial success for your small business.