How to Choose the Perfect Credit Card for Your Lifestyle

Selecting a credit card that aligns with your spending habits and financial goals is crucial for maximizing rewards and minimizing costs. With numerous credit card options available, it’s essential to understand the different types of cards and their features. Cashback credit cards, rewards credit cards, and travel credit cards are popular options, each offering unique benefits and drawbacks.

Cashback credit cards, such as the Citi Double Cash Card, provide a percentage of your purchases back as a reward. Rewards credit cards, like the Chase Sapphire Preferred, offer points or miles that can be redeemed for travel, merchandise, or other rewards. Travel credit cards, such as the Capital One Venture, offer benefits like travel insurance, airport lounge access, and no foreign transaction fees.

When evaluating credit cards, consider the interest rate, fees, and rewards structure. Look for cards with low or no annual fees, and be aware of any foreign transaction fees that may apply. If you plan to carry a balance, look for cards with low interest rates or 0% introductory APRs. Some of the best credit cards of 2024 offer sign-up bonuses, so be sure to take advantage of these offers if you’re eligible.

Ultimately, the key to choosing the perfect credit card is to understand your financial needs and goals. By considering your lifestyle and spending habits, you can select a card that provides the rewards and benefits you need to maximize your financial potential. Whether you’re looking for cashback, rewards, or travel benefits, there’s a credit card out there that’s right for you.

Uncovering the Best Cashback Credit Cards on the Market

Cashback credit cards are a popular choice among consumers, offering a percentage of purchases back as a reward. Among the best credit cards of 2024, cashback cards stand out for their simplicity and flexibility. Two top contenders in this category are the Citi Double Cash Card and the Chase Freedom Unlimited.

The Citi Double Cash Card offers an impressive 2% cashback on all purchases, with no rotating categories or spending limits. This card is ideal for those who want a hassle-free cashback experience. Additionally, the Citi Double Cash Card has no annual fee, making it an attractive option for those who want to earn rewards without incurring extra costs.

The Chase Freedom Unlimited, on the other hand, offers 3% cashback on all purchases in your first year up to $20,000 spent, and 1.5% cashback on all other purchases. This card also has no annual fee and offers a 0% introductory APR for 15 months on purchases and balance transfers.

Both cards have their strengths and weaknesses, but they share a common trait: they offer a straightforward cashback rewards structure that’s easy to understand and maximize. When choosing between these cards, consider your spending habits and financial goals. If you want a simple, no-fuss cashback experience, the Citi Double Cash Card may be the better choice. If you’re willing to navigate rotating categories and spending limits, the Chase Freedom Unlimited may offer more rewards potential.

Ultimately, the best cashback credit card for you will depend on your individual needs and preferences. By considering your options and choosing a card that aligns with your spending habits, you can earn significant rewards and make the most of your credit card.

Earning Rewards with Top Travel Credit Cards

Travel credit cards are a great way to earn rewards on flights, hotels, and other travel expenses. Among the best credit cards of 2024, travel cards offer a range of benefits and rewards that can help you maximize your travel budget. Two top contenders in this category are the Chase Sapphire Preferred and the Capital One Venture.

The Chase Sapphire Preferred offers 2X points on travel and dining purchases and a 60,000-point bonus after spending $4,000 in the first 3 months. This card also offers a 25% points bonus when redeemed for travel through Chase Ultimate Rewards. Additionally, the Chase Sapphire Preferred has a $95 annual fee and no foreign transaction fees.

The Capital One Venture, on the other hand, offers 2X miles on all purchases and miles can be redeemed for travel purchases with no blackout dates or restrictions. This card also offers a 50,000-mile bonus after spending $3,000 in the first 3 months and has a $0 annual fee for the first year, then $95.

Both cards offer a range of travel benefits, including travel insurance, trip cancellation insurance, and concierge services. However, the Chase Sapphire Preferred offers more premium benefits, such as airport lounge access and a higher points bonus. The Capital One Venture, on the other hand, offers more flexibility in redeeming miles for travel purchases.

When choosing a travel credit card, consider your travel habits and preferences. If you’re a frequent traveler, the Chase Sapphire Preferred may be the better choice. If you’re looking for more flexibility in redeeming miles, the Capital One Venture may be the way to go.

Ultimately, the best travel credit card for you will depend on your individual needs and preferences. By considering your options and choosing a card that aligns with your travel habits, you can earn significant rewards and make the most of your credit card.

Low-Interest Credit Cards for Savvy Borrowers

Low-interest credit cards are a great option for those who need to carry a balance or want to save money on interest charges. Among the best credit cards of 2024, low-interest cards offer a range of benefits and features that can help you manage your debt and reduce your interest payments. Two top contenders in this category are the Citi Simplicity Card and the Discover it Balance Transfer.

The Citi Simplicity Card offers a 0% introductory APR for 21 months on balance transfers, with a 3% balance transfer fee. This card also has no late fees, no penalty APR, and no annual fee. Additionally, the Citi Simplicity Card offers a 14.74% – 24.74% (Variable) APR after the introductory period.

The Discover it Balance Transfer, on the other hand, offers a 0% introductory APR for 18 months on balance transfers, with a 3% balance transfer fee. This card also has no annual fee, no foreign transaction fees, and free FICO credit scores. Additionally, the Discover it Balance Transfer offers a 11.99% – 22.99% Variable APR after the introductory period.

Both cards offer a range of benefits for those who need to carry a balance or want to save money on interest charges. However, the Citi Simplicity Card offers a longer introductory APR period, while the Discover it Balance Transfer offers more rewards and benefits, such as cashback on purchases and free FICO credit scores.

When choosing a low-interest credit card, consider your financial situation and goals. If you need to carry a balance, look for cards with long introductory APR periods and low balance transfer fees. If you want to save money on interest charges, look for cards with low ongoing APRs and no annual fees.

Ultimately, the best low-interest credit card for you will depend on your individual needs and preferences. By considering your options and choosing a card that aligns with your financial goals, you can save money on interest charges and manage your debt more effectively.

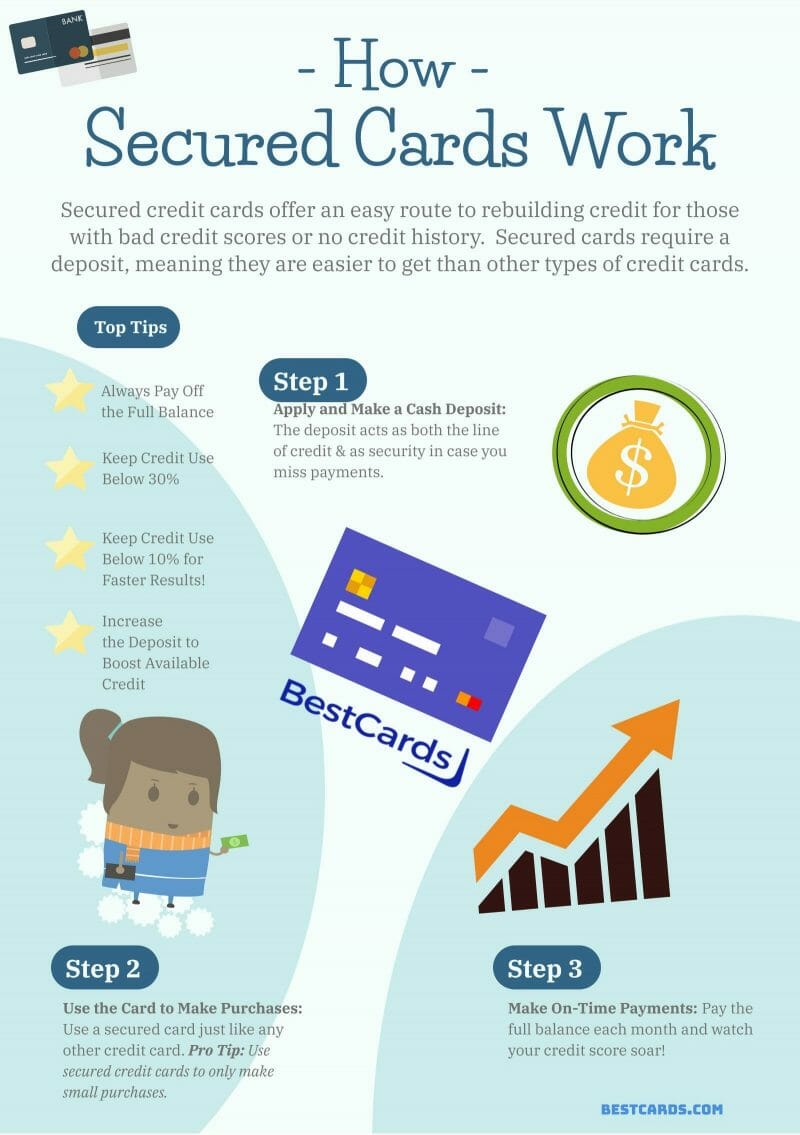

Secured Credit Cards for Building Credit

Secured credit cards are a great option for those who are looking to establish or rebuild their credit. These cards require a security deposit, which becomes the credit limit, and are designed for individuals with poor or no credit. Among the best credit cards of 2024, secured credit cards offer a range of benefits and features that can help you build credit and improve your financial health. Two top contenders in this category are the Discover it Secured and the Capital One Secured Mastercard.

The Discover it Secured offers a cashback rewards program, with 1% – 2% cashback on purchases, and a free FICO credit score. This card also has no annual fee and no foreign transaction fees. Additionally, the Discover it Secured offers a credit limit increase with no additional deposit required.

The Capital One Secured Mastercard, on the other hand, offers a lower security deposit requirement and a credit limit increase with a deposit. This card also has no annual fee and no foreign transaction fees. Additionally, the Capital One Secured Mastercard offers access to a higher credit limit with a deposit.

Both cards offer a range of benefits for those who are looking to build credit. However, the Discover it Secured offers a more comprehensive rewards program

Secured Credit Cards for Building Credit

Secured credit cards are a great option for those who are looking to establish or rebuild their credit. These cards require a security deposit, which becomes the credit limit, and are designed for individuals with poor or no credit. Among the best credit cards of 2024, secured credit cards offer a range of benefits and features that can help you build credit and improve your financial health. Two top contenders in this category are the Discover it Secured and the Capital One Secured Mastercard.

The Discover it Secured offers a cashback rewards program, with 1% – 2% cashback on purchases, and a free FICO credit score. This card also has no annual fee and no foreign transaction fees. Additionally, the Discover it Secured offers a credit limit increase with no additional deposit required.

The Capital One Secured Mastercard, on the other hand, offers a lower security deposit requirement and a credit limit increase with a deposit. This card also has no annual fee and no foreign transaction fees. Additionally, the Capital One Secured Mastercard offers access to a higher credit limit with a deposit.

Both cards offer a range of benefits for those who are looking to build credit. However, the Discover it Secured offers a more comprehensive rewards program

Secured Credit Cards for Building Credit

Secured credit cards are a great option for those who are looking to establish or rebuild their credit. These cards require a security deposit, which becomes the credit limit, and are designed for individuals with poor or no credit. Among the best credit cards of 2024, secured credit cards offer a range of benefits and features that can help you build credit and improve your financial health. Two top contenders in this category are the Discover it Secured and the Capital One Secured Mastercard.

The Discover it Secured offers a cashback rewards program, with 1% – 2% cashback on purchases, and a free FICO credit score. This card also has no annual fee and no foreign transaction fees. Additionally, the Discover it Secured offers a credit limit increase with no additional deposit required.

The Capital One Secured Mastercard, on the other hand, offers a lower security deposit requirement and a credit limit increase with a deposit. This card also has no annual fee and no foreign transaction fees. Additionally, the Capital One Secured Mastercard offers access to a higher credit limit with a deposit.

Both cards offer a range of benefits for those who are looking to build credit. However, the Discover it Secured offers a more comprehensive rewards program

Secured Credit Cards for Building Credit

Secured credit cards are a great option for those who are looking to establish or rebuild their credit. These cards require a security deposit, which becomes the credit limit, and are designed for individuals with poor or no credit. Among the best credit cards of 2024, secured credit cards offer a range of benefits and features that can help you build credit and improve your financial health. Two top contenders in this category are the Discover it Secured and the Capital One Secured Mastercard.

The Discover it Secured offers a cashback rewards program, with 1% – 2% cashback on purchases, and a free FICO credit score. This card also has no annual fee and no foreign transaction fees. Additionally, the Discover it Secured offers a credit limit increase with no additional deposit required.

The Capital One Secured Mastercard, on the other hand, offers a lower security deposit requirement and a credit limit increase with a deposit. This card also has no annual fee and no foreign transaction fees. Additionally, the Capital One Secured Mastercard offers access to a higher credit limit with a deposit.

Both cards offer a range of benefits for those who are looking to build credit. However, the Discover it Secured offers a more comprehensive rewards program