What is a Hands-Off Roth IRA and How Does it Work?

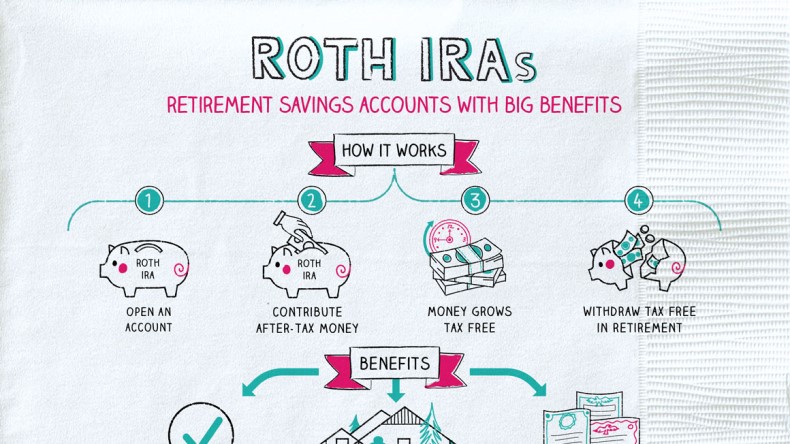

A hands-off Roth IRA is a type of retirement account that allows individuals to contribute after-tax dollars, which then grow tax-free over time. The main benefit of a hands-off Roth IRA is its minimal maintenance requirements, making it an attractive option for those who want to save for retirement without actively managing their investments. Unlike traditional IRAs, Roth IRAs do not require individuals to take required minimum distributions (RMDs) in retirement, providing more flexibility in terms of withdrawals. Additionally, hands-off Roth IRAs often have lower fees compared to actively managed accounts, which can help reduce costs and increase returns over the long term.

When considering a hands-off Roth IRA, it’s essential to understand how it differs from other retirement accounts. For instance, traditional IRAs require individuals to pay taxes on withdrawals in retirement, whereas Roth IRAs allow tax-free withdrawals if certain conditions are met. Furthermore, hands-off Roth IRAs often have more investment options compared to traditional employer-sponsored retirement plans, such as 401(k)s or 403(b)s.

To get the most out of a hands-off Roth IRA, it’s crucial to choose the best provider for your needs. Look for providers that offer low fees, a range of investment options, and excellent customer service. Some popular providers of hands-off Roth IRAs include Fidelity, Vanguard, and Charles Schwab. By selecting the right provider and taking advantage of the benefits of a hands-off Roth IRA, individuals can create a retirement savings plan that is both efficient and effective.

When searching for the best hands-off Roth IRA, consider the following factors: investment options, fees, and customer service. A good provider should offer a range of investment options, including index funds, ETFs, and target date funds. Fees should be low, with no hidden costs or surprises. Finally, customer service should be excellent, with representatives available to answer questions and provide guidance when needed.

By understanding how a hands-off Roth IRA works and choosing the right provider, individuals can create a retirement savings plan that is both hands-off and effective. With its minimal maintenance requirements and potential for long-term growth, a hands-off Roth IRA is an attractive option for those who want to save for retirement without actively managing their investments.

How to Choose the Best Hands-Off Roth IRA for Your Needs

When selecting a hands-off Roth IRA provider, it’s essential to consider several factors to ensure you find the best option for your needs. One of the most critical factors is fees. Look for providers that offer low or no fees for account maintenance, management, and transactions. Some popular providers, such as Fidelity, Vanguard, and Charles Schwab, offer competitive fee structures that can help you save money over time.

Another crucial factor to consider is investment options. A good hands-off Roth IRA provider should offer a range of investment options, including index funds, ETFs, and target date funds. These options can help you diversify your portfolio and reduce risk. For example, Fidelity’s ZERO Large Cap Index Fund (FNILX) and Vanguard’s Total Stock Market Index Fund (VTSAX) are popular options for hands-off investors.

Customer service is also an essential factor to consider when choosing a hands-off Roth IRA provider. Look for providers that offer excellent customer service, including online support, phone support, and in-person support. This can help you get the assistance you need when you need it, and ensure that your investments are on track to meet your goals.

When evaluating hands-off Roth IRA providers, consider the following factors: fees, investment options, and customer service. By carefully evaluating these factors, you can find the best hands-off Roth IRA provider for your needs and create a retirement savings plan that is both efficient and effective.

Some popular hands-off Roth IRA providers to consider include:

- Fidelity: Known for its low fees and wide range of investment options, Fidelity is a popular choice for hands-off investors.

- Vanguard: With its low-cost index funds and ETFs, Vanguard is a great option for investors who want to keep costs low and returns high.

- Charles Schwab: Schwab offers a range of investment options and low fees, making it a popular choice for hands-off investors.

By considering these factors and evaluating popular providers, you can find the best hands-off Roth IRA for your needs and create a retirement savings plan that is both efficient and effective.

Automating Your Investments for Long-Term Success

Automating your investments in a hands-off Roth IRA is a crucial step in achieving long-term success. By setting up regular contributions and taking advantage of dollar-cost averaging, you can reduce emotional decision-making and increase returns over time. This approach allows you to invest a fixed amount of money at regular intervals, regardless of the market’s performance, which can help you avoid making impulsive decisions based on short-term market fluctuations.

Dollar-cost averaging is a powerful investment strategy that can help you reduce the impact of market volatility on your investments. By investing a fixed amount of money at regular intervals, you’ll be buying more shares when prices are low and fewer shares when prices are high. This can help you smooth out the ups and downs of the market and reduce your overall cost per share.

Another benefit of automating your investments in a hands-off Roth IRA is that it can help you avoid emotional decision-making. When you’re not actively involved in the day-to-day management of your investments, you’re less likely to make impulsive decisions based on short-term market fluctuations. This can help you stay focused on your long-term goals and avoid making costly mistakes.

To automate your investments in a hands-off Roth IRA, you can set up a systematic investment plan. This involves setting up a regular investment schedule, where a fixed amount of money is invested at regular intervals. You can also take advantage of dollar-cost averaging by investing a fixed amount of money at regular intervals, regardless of the market’s performance.

Some popular investment options for automating your investments in a hands-off Roth IRA include:

- Index funds: These funds track a specific market index, such as the S&P 500, and provide broad diversification and low fees.

- ETFs: These funds are similar to index funds but trade on an exchange like stocks, providing flexibility and diversification.

- Target date funds: These funds automatically adjust their asset allocation based on your retirement date, providing a hands-off approach to investing.

By automating your investments in a hands-off Roth IRA, you can take advantage of dollar-cost averaging, reduce emotional decision-making, and increase returns over time. This approach can help you achieve your long-term goals and create a secure financial future.

Investment Options for a Hands-Off Roth IRA: A Review of Popular Choices

When it comes to investing in a hands-off Roth IRA, there are several popular options to consider. These options can help you achieve your long-term financial goals while minimizing the need for active management. In this section, we’ll review some of the most popular investment options for a hands-off Roth IRA, including index funds, ETFs, and target date funds.

Index funds are a popular choice for hands-off investors because they offer broad diversification and low fees. These funds track a specific market index, such as the S&P 500, and provide exposure to a wide range of stocks or bonds. Some popular index funds for a hands-off Roth IRA include:

- VTSAX (Vanguard Total Stock Market Index Fund): This fund tracks the CRSP US Total Market Index and provides exposure to nearly all publicly traded US companies.

- SWTSX (Schwab US Broad Market ETF): This fund tracks the Dow Jones US Broad Stock Market Index and provides exposure to a wide range of US stocks.

ETFs (Exchange-Traded Funds) are another popular option for hands-off investors. These funds are similar to index funds but trade on an exchange like stocks, providing flexibility and diversification. Some popular ETFs for a hands-off Roth IRA include:

- SPDR S&P 500 ETF Trust (SPY): This fund tracks the S&P 500 Index and provides exposure to a wide range of US stocks.

- iShares Core US Aggregate Bond ETF (AGG): This fund tracks the Bloomberg Barclays US Aggregate Bond Index and provides exposure to a wide range of US bonds.

Target date funds are a type of investment option that automatically adjusts their asset allocation based on your retirement date. These funds are designed to provide a hands-off approach to investing and can help you achieve your long-term financial goals. Some popular target date funds for a hands-off Roth IRA include:

- Vanguard Target Retirement 2060 Fund (VTTSX): This fund is designed for investors who plan to retire in 2060 or later and provides a diversified portfolio of stocks and bonds.

- Fidelity Freedom 2060 Fund (FFIVX): This fund is designed for investors who plan to retire in 2060 or later and provides a diversified portfolio of stocks and bonds.

When selecting investment options for a hands-off Roth IRA, it’s essential to consider your individual financial goals and risk tolerance. You may also want to consider consulting with a financial advisor or conducting your own research to determine the best investment options for your needs.

Managing Risk and Volatility in a Hands-Off Roth IRA

Managing risk and volatility is a crucial aspect of investing in a hands-off Roth IRA. By implementing strategies such as diversification, asset allocation, and regular portfolio rebalancing, you can reduce losses during market downturns and increase returns over time. In this section, we’ll discuss these strategies in more detail and provide tips for managing risk and volatility in a hands-off Roth IRA.

Diversification is a key strategy for managing risk and volatility in a hands-off Roth IRA. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce your exposure to any one particular market or sector. This can help you ride out market fluctuations and reduce losses during downturns.

Asset allocation is another important strategy for managing risk and volatility in a hands-off Roth IRA. By allocating your investments across different asset classes, you can create a balanced portfolio that is tailored to your individual risk tolerance and financial goals. For example, if you’re a conservative investor, you may want to allocate a larger portion of your portfolio to bonds and a smaller portion to stocks.

Regular portfolio rebalancing is also essential for managing risk and volatility in a hands-off Roth IRA. By rebalancing your portfolio on a regular basis, you can ensure that your investments remain aligned with your target asset allocation and risk tolerance. This can help you avoid taking on too much risk and reduce losses during market downturns.

Some popular strategies for managing risk and volatility in a hands-off Roth IRA include:

- Core-satellite investing: This involves investing a core portion of your portfolio in a diversified index fund or ETF and a satellite portion in a more aggressive or specialized fund.

- Risk parity: This involves allocating your investments across different asset classes based on their risk profile, rather than their expected return.

- Dynamic asset allocation: This involves adjusting your asset allocation based on changes in market conditions or your individual financial goals.

By implementing these strategies, you can manage risk and volatility in a hands-off Roth IRA and increase your chances of achieving your long-term financial goals.

Some popular investment options for managing risk and volatility in a hands-off Roth IRA include:

- Vanguard Total Stock Market Index Fund (VTSAX): This fund provides broad diversification and low fees, making it a popular choice for hands-off investors.

- iShares Core US Aggregate Bond ETF (AGG): This fund provides exposure to a wide range of US bonds and can help reduce risk and volatility in a hands-off Roth IRA.

- BlackRock Global Allocation Fund (MALOX): This fund provides a diversified portfolio of stocks, bonds, and alternative investments and can help manage risk and volatility in a hands-off Roth IRA.

Tax Benefits and Rules for Hands-Off Roth IRAs

Hands-off Roth IRAs offer several tax benefits and advantages that can help you save for retirement. One of the main benefits is tax-free growth and withdrawals. This means that your investments can grow and compound over time without being subject to taxes, and you can withdraw your money tax-free in retirement.

Another benefit of hands-off Roth IRAs is that they are not subject to required minimum distributions (RMDs). This means that you are not required to take withdrawals from your account at a certain age, which can help you keep your money in the account for longer and potentially earn more interest.

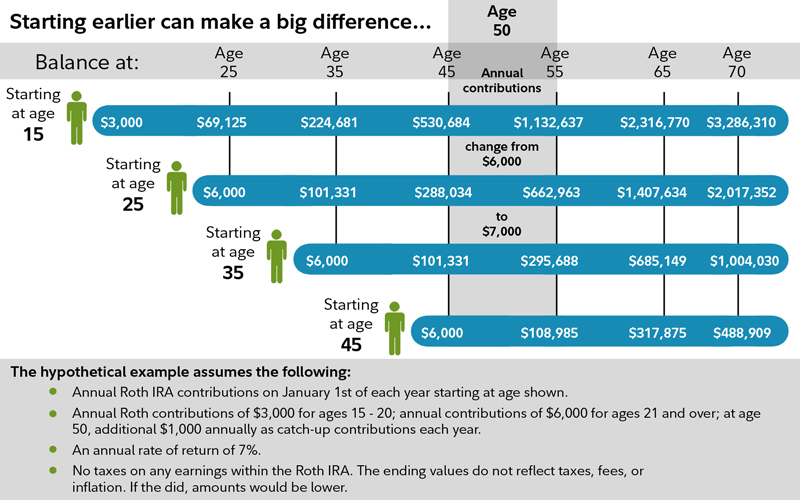

However, there are some income limits and contribution limits to be aware of when it comes to hands-off Roth IRAs. For example, in 2022, the income limit for contributing to a Roth IRA is $137,500 for single filers and $208,500 for joint filers. Additionally, the annual contribution limit for Roth IRAs is $6,000 in 2022, or $7,000 if you are 50 or older.

It’s also important to note that hands-off Roth IRAs are subject to certain rules and regulations. For example, you must have earned income to contribute to a Roth IRA, and you cannot contribute more than your earned income. Additionally, you must wait at least five years from the date of your first contribution to withdraw your earnings tax-free and penalty-free.

Some popular tax benefits and rules for hands-off Roth IRAs include:

- Tax-free growth and withdrawals: Your investments can grow and compound over time without being subject to taxes, and you can withdraw your money tax-free in retirement.

- No RMDs: You are not required to take withdrawals from your account at a certain age, which can help you keep your money in the account for longer and potentially earn more interest.

- Income limits: There are income limits for contributing to a Roth IRA, which vary based on your filing status and income level.

- Contribution limits: There are annual contribution limits for Roth IRAs, which vary based on your age and income level.

By understanding the tax benefits and rules for hands-off Roth IRAs, you can make informed decisions about your retirement savings and potentially maximize your returns.

Common Mistakes to Avoid with a Hands-Off Roth IRA

When it comes to managing a hands-off Roth IRA, it’s essential to be aware of common mistakes that can hinder the growth of your retirement savings. By avoiding these pitfalls, you can ensure that your best hands-off Roth IRA strategy remains on track and continues to work in your favor over the long term.

One of the most significant mistakes to avoid is inadequate diversification. Failing to spread your investments across various asset classes can leave your portfolio vulnerable to market fluctuations. To mitigate this risk, consider allocating your investments across a range of low-cost index funds or ETFs that cover different sectors, such as domestic and international stocks, bonds, and real estate.

Excessive fees are another common mistake that can erode your retirement savings over time. Be mindful of the fees associated with your hands-off Roth IRA provider, as well as the expense ratios of the investment options you choose. Look for providers that offer low or no fees for maintenance, management, and transactions. Similarly, opt for index funds or ETFs with low expense ratios, as these can help minimize the impact of fees on your returns.

Failure to monitor and adjust your portfolio over time is another mistake to avoid. While a hands-off approach is designed to be low-maintenance, it’s still essential to periodically review your portfolio to ensure it remains aligned with your investment objectives and risk tolerance. Rebalance your portfolio as needed to maintain an optimal asset allocation, and consider adjusting your investment options if your goals or risk tolerance change over time.

Not taking advantage of tax benefits is another mistake that can cost you in the long run. With a hands-off Roth IRA, you’ve already made a smart decision by choosing a tax-free growth and withdrawal option. However, be sure to maximize your contributions each year, as this can help you build a larger nest egg over time. Additionally, consider converting other retirement accounts to a Roth IRA to take advantage of tax-free growth and withdrawals.

Finally, be cautious of emotional decision-making, which can lead to impulsive decisions that can harm your long-term investment strategy. Avoid making changes to your portfolio based on short-term market fluctuations or emotional reactions to market volatility. Instead, stick to your investment plan and let time work in your favor.

By avoiding these common mistakes, you can help ensure that your best hands-off Roth IRA strategy remains on track and continues to work in your favor over the long term. Remember to stay informed, stay disciplined, and let time work in your favor to achieve your retirement goals.

Getting Started with a Hands-Off Roth IRA: A Step-by-Step Guide

Opening a hands-off Roth IRA is a straightforward process that can be completed in a few steps. By following this guide, you can start building a tax-free retirement nest egg with minimal maintenance and long-term growth potential.

Step 1: Choose the Best Hands-Off Roth IRA Provider

Select a reputable provider that offers low fees, a range of investment options, and excellent customer service. Consider providers like Fidelity, Vanguard, or Charles Schwab, which are known for their low-cost index funds and ETFs. Look for providers that offer a user-friendly online platform and mobile app to manage your account on the go.

Step 2: Open a Hands-Off Roth IRA Account

Visit the website of your chosen provider and click on the “Open an Account” button. Fill out the online application, providing personal and financial information as required. You will need to provide identification, social security number, and employment information. Once your account is approved, you can fund it with an initial deposit.

Step 3: Set Up Automatic Contributions

Set up automatic contributions to your hands-off Roth IRA account to make regular deposits. You can choose to contribute a fixed amount monthly or quarterly, or set up a payroll deduction. This will help you build a consistent investment habit and take advantage of dollar-cost averaging.

Step 4: Select Your Investment Options

Choose from a range of investment options, including index funds, ETFs, and target date funds. Consider a diversified portfolio that aligns with your investment objectives and risk tolerance. Look for low-cost index funds or ETFs that track a specific market index, such as the S&P 500 or the Total Stock Market.

Step 5: Monitor and Adjust Your Portfolio

While a hands-off approach is designed to be low-maintenance, it’s essential to periodically review your portfolio to ensure it remains aligned with your investment objectives and risk tolerance. Rebalance your portfolio as needed to maintain an optimal asset allocation, and consider adjusting your investment options if your goals or risk tolerance change over time.

Tips for Maintaining a Long-Term Perspective

To get the most out of your hands-off Roth IRA, maintain a long-term perspective and avoid common pitfalls. Avoid making emotional decisions based on short-term market fluctuations, and stay focused on your long-term goals. Consider setting a reminder to review your portfolio annually or semi-annually to ensure it remains on track.

By following these steps and tips, you can get started with a hands-off Roth IRA and build a tax-free retirement nest egg with minimal maintenance and long-term growth potential. Remember to choose the best hands-off Roth IRA provider for your needs, set up automatic contributions, and select a diversified portfolio that aligns with your investment objectives and risk tolerance.