What is No Medical Exam Life Insurance and How Does it Work?

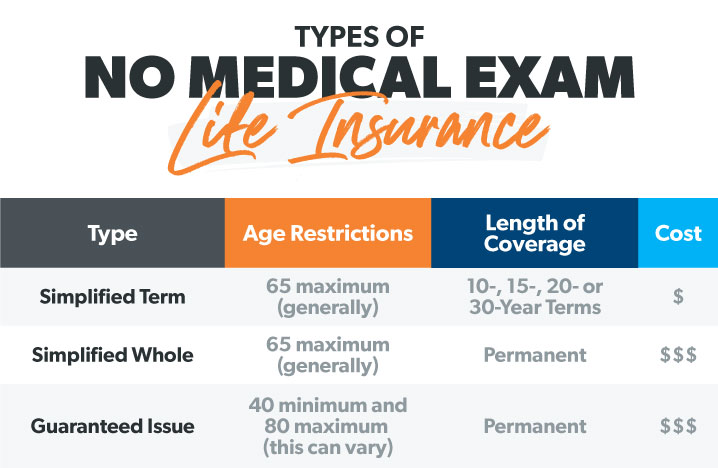

No medical exam life insurance is a type of life insurance policy that does not require a medical examination as part of the application process. This type of insurance is designed to provide coverage to individuals who may not qualify for traditional life insurance or who prefer not to undergo a medical exam. There are two main types of no medical exam life insurance policies: simplified issue and guaranteed issue life insurance.

Simplified issue life insurance policies do not require a medical exam, but may ask a series of health-related questions as part of the application process. These policies are often faster to approve than traditional life insurance policies and may offer more competitive premiums. Guaranteed issue life insurance policies, on the other hand, do not require a medical exam or ask any health-related questions. These policies are often more expensive than simplified issue policies and may have a graded death benefit, which means that the full death benefit is not paid out until a certain period of time has passed.

The benefits of no medical exam life insurance include faster approval times and increased accessibility. Without the need for a medical exam, the application process is often faster and more convenient. Additionally, no medical exam life insurance policies can provide coverage to individuals who may not qualify for traditional life insurance due to health issues or other factors. When searching for the best life insurance without medical exam, it’s essential to consider your individual needs and circumstances to find the right policy for you.

No medical exam life insurance policies can be an excellent option for individuals who want to avoid the hassle of a medical exam or who need coverage quickly. However, it’s crucial to carefully review the policy terms and conditions to ensure that you understand what is covered and what is not. By doing your research and comparing different policies, you can find the best no medical exam life insurance policy to meet your needs and provide peace of mind for you and your loved ones.

How to Choose the Best No Medical Exam Life Insurance Policy for Your Needs

When selecting a no medical exam life insurance policy, there are several factors to consider to ensure you find the best coverage for your needs. One of the most critical aspects to evaluate is the coverage amount. Consider your income, debts, and financial obligations to determine how much coverage you need to protect your loved ones. A general rule of thumb is to choose a coverage amount that is 5-10 times your annual income.

Another essential factor to consider is the term length of the policy. No medical exam life insurance policies are often available in term lengths of 10, 20, or 30 years. Consider your financial goals and obligations to determine which term length is best for you. For example, if you have young children, a 20- or 30-year term may be more suitable to ensure they are protected until they are financially independent.

Premium costs are also a crucial consideration when choosing a no medical exam life insurance policy. Compare the premiums of different policies to ensure you are getting the best value for your money. Keep in mind that premiums may vary depending on your age, health, and other factors, even if you don’t have to take a medical exam.

In addition to evaluating coverage amounts, term lengths, and premium costs, it’s also essential to research the insurance company itself. Look for companies with high ratings from independent rating agencies, such as A.M. Best or Moody’s. You should also read customer reviews to get a sense of the company’s customer service and claims process.

When searching for the best life insurance without medical exam, it’s also important to consider the company’s financial strength and stability. A company with a strong financial foundation is more likely to be able to pay out claims in the future. You can check the company’s financial ratings and reviews from independent agencies to get a sense of their financial stability.

By carefully evaluating these factors, you can find the best no medical exam life insurance policy for your needs and budget. Remember to always read the policy terms and conditions carefully and ask questions if you’re unsure about anything. With the right policy, you can have peace of mind knowing that your loved ones are protected, even if you don’t have to take a medical exam.

Top No Medical Exam Life Insurance Companies: A Review of the Best Options

When it comes to no medical exam life insurance, there are several top companies that offer competitive policies. Here are a few of the best options to consider:

Ladder Life is a popular choice for no medical exam life insurance. They offer a range of policies with coverage amounts from $100,000 to $8 million, and term lengths from 10 to 30 years. Ladder Life’s policies are known for their flexibility, with the option to adjust coverage amounts and term lengths as needed.

Haven Life is another top company for no medical exam life insurance. They offer a range of policies with coverage amounts from $25,000 to $1 million, and term lengths from 10 to 30 years. Haven Life’s policies are known for their simplicity, with a streamlined application process and competitive premiums.

Ethos Life is a newer company that has quickly become a top choice for no medical exam life insurance. They offer a range of policies with coverage amounts from $25,000 to $1 million, and term lengths from 10 to 30 years. Ethos Life’s policies are known for their affordability, with competitive premiums and a range of discounts available.

Other top companies for no medical exam life insurance include Lincoln National Life Insurance Company, Transamerica Life Insurance Company, and Principal Life Insurance Company. Each of these companies offers a range of policies with competitive coverage amounts, term lengths, and premiums.

When choosing a no medical exam life insurance company, it’s essential to consider several factors, including the company’s financial strength, customer service, and claims process. Look for companies with high ratings from independent rating agencies, such as A.M. Best or Moody’s. You should also read customer reviews to get a sense of the company’s reputation and level of service.

By considering these top companies and factors, you can find the best life insurance without medical exam for your needs and budget. Remember to always read the policy terms and conditions carefully and ask questions if you’re unsure about anything. With the right policy, you can have peace of mind knowing that your loved ones are protected.

The Application Process: What to Expect When Applying for No Medical Exam Life Insurance

Applying for no medical exam life insurance is a relatively straightforward process that can be completed online or over the phone. The application process typically involves answering a series of health-related questions, providing personal and financial information, and submitting documentation to support your application.

The types of questions asked during the application process may include:

- Medical history: You may be asked about your medical history, including any pre-existing conditions, surgeries, or hospitalizations.

- Lifestyle habits: You may be asked about your lifestyle habits, including your smoking status, exercise routine, and diet.

- Family medical history: You may be asked about your family medical history, including any genetic conditions or diseases that run in your family.

- Financial information: You may be asked to provide financial information, including your income, assets, and debts.

In addition to answering questions, you may also be required to provide documentation to support your application. This may include:

- Identification: You may be required to provide identification, such as a driver’s license or passport.

- Proof of income: You may be required to provide proof of income, such as a pay stub or W-2 form.

- Medical records: You may be required to provide medical records, such as doctor’s notes or test results.

The typical approval timeline for no medical exam life insurance is relatively fast, with many applications being approved within 24-48 hours. However, the approval timeline may vary depending on the complexity of your application and the speed at which you provide required documentation.

Once your application is approved, you will be issued a policy and will begin making premium payments. It’s essential to carefully review your policy terms and conditions to ensure that you understand what is covered and what is not.

By understanding the application process for no medical exam life insurance, you can be better prepared to find the best life insurance without medical exam for your needs and budget. Remember to always read the policy terms and conditions carefully and ask questions if you’re unsure about anything.

No Medical Exam Life Insurance vs. Traditional Life Insurance: Which is Right for You?

No medical exam life insurance and traditional life insurance are two different types of life insurance policies that cater to different needs and circumstances. While both types of policies provide a death benefit to beneficiaries, they differ in their underwriting processes, premium costs, and coverage options.

Traditional life insurance policies require a medical exam as part of the underwriting process. This exam is used to assess the applicant’s health and determine their risk level. Based on the exam results, the insurance company may offer a policy with a higher or lower premium cost. Traditional life insurance policies often offer more comprehensive coverage options and lower premium costs for healthy applicants.

No medical exam life insurance policies, on the other hand, do not require a medical exam as part of the underwriting process. Instead, applicants are asked to answer a series of health-related questions, and the insurance company may review their medical history and other records to determine their risk level. No medical exam life insurance policies often offer faster approval times and more flexible coverage options, but may have higher premium costs.

So, which type of policy is right for you? If you are healthy and want to save money on premiums, traditional life insurance may be the better option. However, if you have health issues or prefer not to take a medical exam, no medical exam life insurance may be the better choice.

It’s also worth considering the following scenarios:

- If you have a pre-existing medical condition, no medical exam life insurance may be a better option.

- If you are a smoker or have a high-risk occupation, traditional life insurance may be a better option.

- If you need coverage quickly, no medical exam life insurance may be a better option.

Ultimately, the choice between no medical exam life insurance and traditional life insurance depends on your individual needs and circumstances. By understanding the pros and cons of each type of policy, you can make an informed decision and find the best life insurance without medical exam for your needs and budget.

Common Misconceptions About No Medical Exam Life Insurance: Separating Fact from Fiction

No medical exam life insurance is often misunderstood, and many people have misconceptions about this type of insurance. In this section, we will address some of the most common misconceptions and provide accurate information to help you make an informed decision.

Misconception #1: No medical exam life insurance is only for people with health issues.

Reality: No medical exam life insurance is available to anyone who wants to avoid the hassle of a medical exam. While it’s true that people with health issues may be more likely to choose no medical exam life insurance, it’s not the only option for them. In fact, many healthy individuals choose no medical exam life insurance because it’s faster and more convenient.

Misconception #2: No medical exam life insurance is more expensive than traditional life insurance.

Reality: The cost of no medical exam life insurance varies depending on the insurance company, coverage amount, and term length. While it’s true that some no medical exam life insurance policies may be more expensive than traditional life insurance, others may be more affordable. It’s essential to shop around and compare quotes to find the best option for your needs and budget.

Misconception #3: No medical exam life insurance doesn’t provide adequate coverage.

Reality: No medical exam life insurance policies can provide adequate coverage for your loved ones. In fact, many no medical exam life insurance policies offer coverage amounts up to $1 million or more. However, it’s crucial to carefully review the policy terms and conditions to ensure that you understand what is covered and what is not.

By understanding the facts about no medical exam life insurance, you can make an informed decision and find the best life insurance without medical exam for your needs and budget. Remember to always read the policy terms and conditions carefully and ask questions if you’re unsure about anything.

No Medical Exam Life Insurance Riders and Add-ons: Customizing Your Policy

No medical exam life insurance policies can be customized to meet your individual needs and circumstances. Riders and add-ons are additional features that can be added to your policy to provide extra protection and benefits. In this section, we will discuss some of the most common riders and add-ons available for no medical exam life insurance policies.

Waiver of Premium Rider:

This rider waives the premium payments if the policyholder becomes disabled or critically ill. This rider can provide financial protection and peace of mind, knowing that your loved ones will be taken care of even if you are unable to work.

Accidental Death Benefit Rider:

This rider provides an additional death benefit if the policyholder dies as a result of an accident. This rider can provide extra financial protection for your loved ones in the event of an unexpected death.

Long-term Care Rider:

This rider provides coverage for long-term care expenses, such as nursing home care or home health care. This rider can provide financial protection and peace of mind, knowing that your loved ones will be taken care of if you need long-term care.

Other Riders and Add-ons:

Other riders and add-ons that may be available for no medical exam life insurance policies include:

- Child protection rider: Provides coverage for your children until they reach a certain age.

- Spousal protection rider: Provides coverage for your spouse until they reach a certain age.

- Disability income rider: Provides a monthly income benefit if the policyholder becomes disabled.

When selecting a no medical exam life insurance policy, it’s essential to consider the riders and add-ons that are available. By customizing your policy with the right riders and add-ons, you can provide extra protection and benefits for your loved ones.

By understanding the various riders and add-ons available for no medical exam life insurance policies, you can make an informed decision and find the best life insurance without medical exam for your needs and budget. Remember to always read the policy terms and conditions carefully and ask questions if you’re unsure about anything.

Conclusion: Finding the Best No Medical Exam Life Insurance Policy for Your Peace of Mind

No medical exam life insurance can provide the protection and peace of mind you need without the hassle of a medical exam. By understanding the different types of policies available, the benefits of skipping the medical exam, and the various riders and add-ons that can be added to your policy, you can make an informed decision and find the best life insurance without medical exam for your needs and budget.

When selecting a no medical exam life insurance policy, it’s essential to consider your individual needs and circumstances. Think about your coverage goals, term length, and premium costs. Evaluate insurance company ratings and customer reviews to ensure you’re working with a reputable and reliable company.

By following the tips and considerations outlined in this article, you can find the best no medical exam life insurance policy for your peace of mind. Remember to always read the policy terms and conditions carefully and ask questions if you’re unsure about anything.

No medical exam life insurance can provide the protection and peace of mind you need without the hassle of a medical exam. By understanding the different types of policies available and the various riders and add-ons that can be added to your policy, you can make an informed decision and find the best life insurance without medical exam for your needs and budget.

Don’t wait any longer to get the protection you need. Start exploring your options for no medical exam life insurance today and find the best policy for your peace of mind.