Unlocking the Power of Index Fund Investing

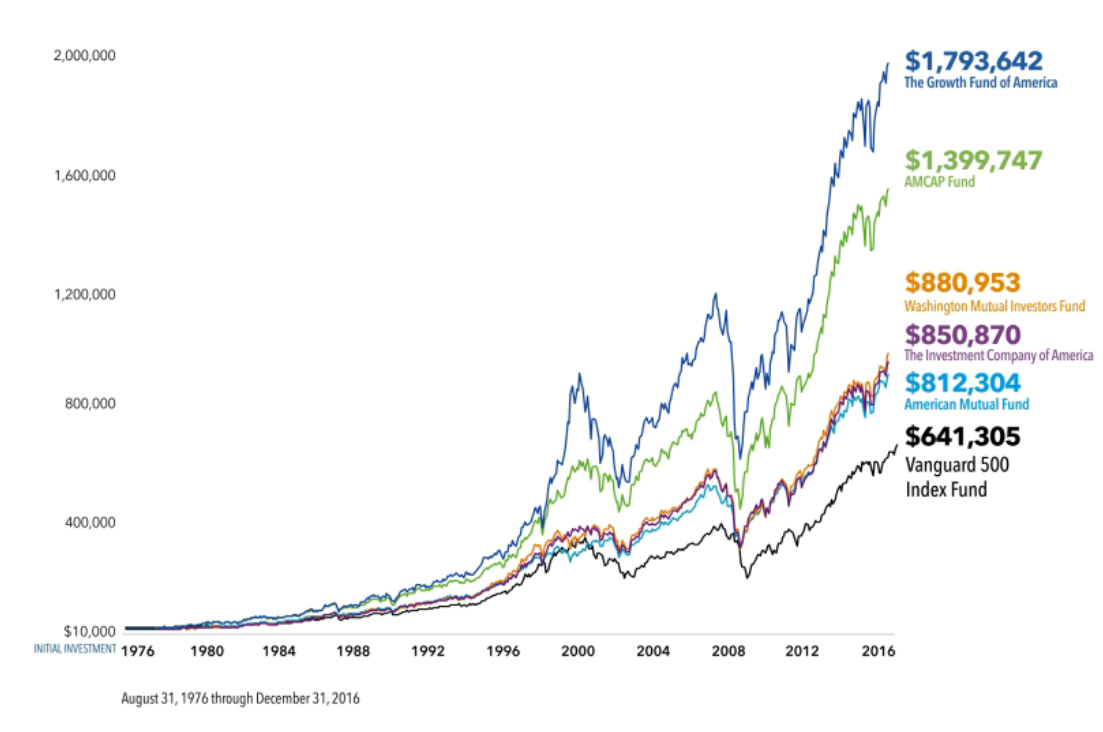

Index fund investing has revolutionized the way individuals approach the stock market. By providing broad diversification, low costs, and long-term growth potential, index funds have become a staple in many investment portfolios. Vanguard, a pioneer in the index fund space, offers a range of top-performing index funds that cater to various investment goals and risk tolerance. The best performing Vanguard index funds have consistently outperformed actively managed funds, making them an attractive option for investors seeking long-term growth.

One of the primary benefits of index fund investing is its ability to reduce costs. Actively managed funds often come with high expense ratios, which can eat into investors’ returns. In contrast, index funds typically have lower expense ratios, allowing investors to retain more of their earnings. Additionally, index funds provide broad diversification, which can help reduce risk and increase potential returns.

Vanguard’s commitment to low-cost investing has made it a leader in the index fund space. The company’s range of index funds tracks various market indices, including the S&P 500, the Total Stock Market, and international markets. By investing in Vanguard index funds, individuals can gain exposure to a broad range of assets, reducing their reliance on individual stocks or sectors.

For investors seeking to maximize their returns, the best performing Vanguard index funds offer a compelling option. These funds have consistently demonstrated long-term growth potential, making them an attractive choice for those with a time horizon of five years or more. By incorporating Vanguard index funds into their portfolios, investors can benefit from the expertise of professional managers while minimizing costs.

As the investment landscape continues to evolve, index fund investing is likely to remain a popular choice among investors. With its range of top-performing index funds, Vanguard is well-positioned to meet the needs of investors seeking long-term growth and low costs. Whether you’re a seasoned investor or just starting out, the best performing Vanguard index funds offer a valuable addition to any investment portfolio.

How to Choose the Best Vanguard Index Funds for Your Portfolio

Selecting the best Vanguard index funds for your portfolio requires careful consideration of several factors. With a wide range of funds available, it’s essential to evaluate your investment goals, risk tolerance, and time horizon to determine the most suitable options. One of the key factors to consider is the expense ratio, which can significantly impact your returns over time. Vanguard index funds are known for their low expense ratios, but it’s still crucial to compare the costs of different funds to ensure you’re getting the best value.

Another critical factor to consider is the tracking error, which measures the fund’s ability to replicate the performance of the underlying index. A lower tracking error indicates that the fund is more effective at tracking the index, which can result in better returns. Additionally, investment minimums should also be taken into account, as some funds may have higher minimums than others.

When evaluating the best performing Vanguard index funds, it’s also essential to consider the fund’s investment objective and strategy. For example, some funds may focus on specific sectors or geographic regions, while others may provide broad diversification across the entire market. By understanding the fund’s investment objective and strategy, you can make more informed decisions about which funds to include in your portfolio.

Furthermore, it’s crucial to assess your risk tolerance and time horizon when selecting Vanguard index funds. If you’re a conservative investor with a short time horizon, you may prefer funds with lower volatility and more stable returns. On the other hand, if you’re a more aggressive investor with a longer time horizon, you may be willing to take on more risk in pursuit of higher returns.

Ultimately, the key to choosing the best Vanguard index funds for your portfolio is to carefully evaluate your investment goals, risk tolerance, and time horizon. By considering factors such as expense ratios, tracking errors, and investment minimums, you can make informed decisions about which funds to include in your portfolio. With a well-diversified portfolio of top-performing Vanguard index funds, you can increase your potential for long-term growth and success.

Vanguard 500 Index Fund: A Core Holding for Any Portfolio

The Vanguard 500 Index Fund (VFIAX) is a top-performing fund that tracks the S&P 500 Index, providing investors with broad diversification and exposure to the US stock market. With a low expense ratio of 0.04%, this fund is an attractive option for investors seeking to minimize costs while maximizing returns. The Vanguard 500 Index Fund has consistently demonstrated long-term growth potential, making it a core holding for any portfolio.

One of the key benefits of the Vanguard 500 Index Fund is its ability to track the S&P 500 Index, which is widely considered a benchmark for the US stock market. By investing in this fund, investors can gain exposure to 500 of the largest and most stable companies in the US, including Apple, Microsoft, and Johnson & Johnson. This broad diversification can help reduce risk and increase potential returns over the long term.

In addition to its low expense ratio and broad diversification, the Vanguard 500 Index Fund also offers tax efficiency. The fund’s tax-loss harvesting strategy helps to minimize capital gains distributions, which can reduce the tax burden on investors. This makes the Vanguard 500 Index Fund an attractive option for investors seeking to minimize taxes while maximizing returns.

As one of the best performing Vanguard index funds, the Vanguard 500 Index Fund is a popular choice among investors. Its low costs, broad diversification, and tax efficiency make it an attractive option for investors seeking to build a long-term investment portfolio. Whether you’re a seasoned investor or just starting out, the Vanguard 500 Index Fund is a core holding that can provide a solid foundation for your portfolio.

When combined with other Vanguard index funds, the Vanguard 500 Index Fund can provide a comprehensive investment portfolio that is diversified across asset classes and geographic regions. By investing in a range of Vanguard index funds, investors can increase their potential for long-term growth while minimizing risk. With its low costs and broad diversification, the Vanguard 500 Index Fund is an excellent choice for investors seeking to build a long-term investment portfolio.

Vanguard Total Stock Market Index Fund: A Comprehensive Market Tracker

The Vanguard Total Stock Market Index Fund (VTSAX) is a popular choice among investors seeking to track the entire US stock market. This fund provides broad diversification by investing in a wide range of stocks, including small-cap, mid-cap, and large-cap companies. With a low expense ratio of 0.04%, the Vanguard Total Stock Market Index Fund is an attractive option for investors seeking to minimize costs while maximizing returns.

One of the key benefits of the Vanguard Total Stock Market Index Fund is its ability to track the CRSP US Total Market Index, which is a comprehensive benchmark of the US stock market. By investing in this fund, investors can gain exposure to nearly 100% of the US stock market, including companies of all sizes and styles. This broad diversification can help reduce risk and increase potential returns over the long term.

In addition to its low costs and broad diversification, the Vanguard Total Stock Market Index Fund also offers tax efficiency. The fund’s tax-loss harvesting strategy helps to minimize capital gains distributions, which can reduce the tax burden on investors. This makes the Vanguard Total Stock Market Index Fund an attractive option for investors seeking to minimize taxes while maximizing returns.

As one of the best performing Vanguard index funds, the Vanguard Total Stock Market Index Fund is a popular choice among investors. Its low costs, broad diversification, and tax efficiency make it an attractive option for investors seeking to build a long-term investment portfolio. Whether you’re a seasoned investor or just starting out, the Vanguard Total Stock Market Index Fund is a comprehensive market tracker that can provide a solid foundation for your portfolio.

When combined with other Vanguard index funds, the Vanguard Total Stock Market Index Fund can provide a diversified investment portfolio that is well-positioned for long-term growth. By investing in a range of Vanguard index funds, investors can increase their potential for long-term success while minimizing risk. With its low costs and broad diversification, the Vanguard Total Stock Market Index Fund is an excellent choice for investors seeking to build a long-term investment portfolio.

Vanguard International Index Funds: Diversifying Your Portfolio Abroad

Investing in international markets can be a great way to diversify your portfolio and potentially increase returns. Vanguard’s international index funds offer a convenient and cost-effective way to gain exposure to markets outside of the US. The Vanguard FTSE Developed Markets ETF (VEA) and the Vanguard FTSE Emerging Markets ETF (VWO) are two popular options for investors seeking to diversify their portfolios abroad.

The Vanguard FTSE Developed Markets ETF (VEA) tracks the FTSE Developed All Cap ex US Index, which includes developed markets such as the UK, Japan, and Canada. This fund provides broad diversification and exposure to some of the world’s largest and most stable economies. With a low expense ratio of 0.05%, the VEA is an attractive option for investors seeking to minimize costs while maximizing returns.

The Vanguard FTSE Emerging Markets ETF (VWO) tracks the FTSE Emerging Markets All Cap China A Inclusion Index, which includes emerging markets such as China, India, and Brazil. This fund provides exposure to some of the world’s fastest-growing economies and can potentially offer higher returns over the long term. With a low expense ratio of 0.10%, the VWO is an attractive option for investors seeking to diversify their portfolios and potentially increase returns.

Both the VEA and VWO offer a range of benefits, including broad diversification, low costs, and tax efficiency. By investing in these funds, investors can gain exposure to international markets and potentially increase returns over the long term. As part of a diversified portfolio, Vanguard’s international index funds can help investors achieve their long-term investment goals.

When investing in international markets, it’s essential to consider the risks and potential benefits. Vanguard’s international index funds offer a convenient and cost-effective way to gain exposure to markets outside of the US. By diversifying your portfolio abroad, you can potentially increase returns and reduce risk over the long term.

As one of the best performing Vanguard index funds, the VEA and VWO are popular choices among investors. Their low costs, broad diversification, and tax efficiency make them attractive options for investors seeking to build a long-term investment portfolio. Whether you’re a seasoned investor or just starting out, Vanguard’s international index funds can provide a solid foundation for your portfolio.

Vanguard Bond Index Funds: Generating Income and Reducing Risk

Vanguard’s bond index funds offer a convenient and cost-effective way to generate income and reduce risk in your investment portfolio. The Vanguard Total Bond Market Index Fund (VBTLX) and the Vanguard Short-Term Bond Index Fund (VBIRX) are two popular options for investors seeking to diversify their portfolios and potentially increase returns.

The Vanguard Total Bond Market Index Fund (VBTLX) tracks the Bloomberg Barclays US Aggregate Float-Adjusted Index, which includes a wide range of investment-grade bonds. This fund provides broad diversification and exposure to the US bond market, making it an attractive option for investors seeking to generate income and reduce risk. With a low expense ratio of 0.05%, the VBTLX is an excellent choice for investors seeking to minimize costs while maximizing returns.

The Vanguard Short-Term Bond Index Fund (VBIRX) tracks the Bloomberg Barclays US 1-5 Year Government/Credit Float-Adjusted Index, which includes short-term investment-grade bonds. This fund provides a low-risk option for investors seeking to generate income and preserve capital. With a low expense ratio of 0.07%, the VBIRX is an attractive option for investors seeking to minimize costs while maximizing returns.

Both the VBTLX and VBIRX offer a range of benefits, including regular income, reduced risk, and low costs. By investing in these funds, investors can potentially increase returns and reduce risk over the long term. As part of a diversified portfolio, Vanguard’s bond index funds can help investors achieve their long-term investment goals.

When investing in bond index funds, it’s essential to consider the risks and potential benefits. Vanguard’s bond index funds offer a convenient and cost-effective way to generate income and reduce risk. By diversifying your portfolio with bond index funds, you can potentially increase returns and reduce risk over the long term.

As one of the best performing Vanguard index funds, the VBTLX and VBIRX are popular choices among investors. Their low costs, broad diversification, and tax efficiency make them attractive options for investors seeking to build a long-term investment portfolio. Whether you’re a seasoned investor or just starting out, Vanguard’s bond index funds can provide a solid foundation for your portfolio.

Building a Long-Term Investment Strategy with Vanguard Index Funds

Building a long-term investment strategy with Vanguard index funds requires careful consideration of several factors. One of the most important factors is asset allocation, which involves dividing your portfolio among different asset classes, such as stocks, bonds, and cash. By allocating your assets effectively, you can potentially increase returns and reduce risk over the long term.

Another key factor to consider is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This strategy can help you smooth out market fluctuations and avoid trying to time the market. By investing regularly, you can potentially reduce the impact of market volatility and increase your chances of long-term success.

Regular portfolio rebalancing is also essential for maintaining a long-term investment strategy. This involves periodically reviewing your portfolio and adjusting your asset allocation to ensure that it remains aligned with your investment goals and risk tolerance. By rebalancing your portfolio regularly, you can potentially reduce risk and increase returns over the long term.

Vanguard index funds offer a range of benefits that can help you build a long-term investment strategy. Their low costs, broad diversification, and tax efficiency make them an attractive option for investors seeking to maximize returns and minimize risk. By investing in Vanguard index funds, you can potentially increase your chances of long-term success and achieve your investment goals.

When building a long-term investment strategy with Vanguard index funds, it’s essential to consider your investment goals, risk tolerance, and time horizon. By understanding your investment objectives and constraints, you can create a portfolio that is tailored to your needs and goals. By investing regularly and rebalancing your portfolio periodically, you can potentially increase returns and reduce risk over the long term.

As one of the best performing Vanguard index funds, the Vanguard Total Stock Market Index Fund (VTSAX) and the Vanguard Total Bond Market Index Fund (VBTLX) are popular choices among investors. Their low costs, broad diversification, and tax efficiency make them attractive options for investors seeking to build a long-term investment portfolio. Whether you’re a seasoned investor or just starting out, Vanguard index funds can provide a solid foundation for your portfolio.

Monitoring and Adjusting Your Vanguard Index Fund Portfolio

Monitoring and adjusting your Vanguard index fund portfolio is crucial to ensuring that it remains aligned with your investment goals and risk tolerance. Regular portfolio rebalancing can help you maintain an optimal asset allocation and reduce risk over time. By reviewing your portfolio periodically, you can identify areas that require adjustments and make changes as needed.

When monitoring your portfolio, it’s essential to consider your investment goals, risk tolerance, and time horizon. By understanding your investment objectives and constraints, you can make informed decisions about your portfolio and ensure that it remains on track to meet your goals. Regular portfolio rebalancing can help you maintain an optimal asset allocation and reduce risk over time.

One of the key benefits of Vanguard index funds is their low costs and broad diversification. By investing in a range of Vanguard index funds, you can potentially increase returns and reduce risk over the long term. However, it’s essential to regularly review your portfolio and make adjustments as needed to ensure that it remains aligned with your investment goals and risk tolerance.

As one of the best performing Vanguard index funds, the Vanguard Total Stock Market Index Fund (VTSAX) and the Vanguard Total Bond Market Index Fund (VBTLX) are popular choices among investors. Their low costs, broad diversification, and tax efficiency make them attractive options for investors seeking to build a long-term investment portfolio. By regularly monitoring and adjusting your portfolio, you can potentially increase returns and reduce risk over the long term.

When adjusting your portfolio, it’s essential to consider the impact of fees and taxes on your returns. By minimizing fees and taxes, you can potentially increase your returns and achieve your investment goals more efficiently. Regular portfolio rebalancing can help you maintain an optimal asset allocation and reduce risk over time.

By following these tips and strategies, you can potentially increase returns and reduce risk over the long term. Vanguard index funds offer a range of benefits, including low costs, broad diversification, and tax efficiency. By regularly monitoring and adjusting your portfolio, you can ensure that it remains aligned with your investment goals and risk tolerance.